The proximity of resource-rich Australia to China makes it an important barometer for the strength of the Chinese economy. Australian dollars were even held as a bullish play on China until the renminbi was liberalized.

The Aussie dollar just hit a fresh two-month low on Monday following Federal Reserve taper talk, but the currency has been sliding for the past week after reports that Chinese manufacturing expanded at a slower pace.

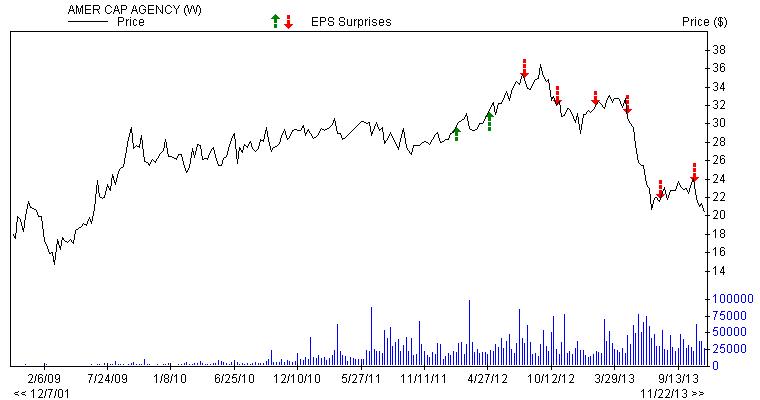

The very strong correlation between the CurrencyShares Australian Dollar Trust (NYSE: FXA) and iShares China Large-Cap (NYSE: FXI) over the past five years has weakened recently. In the past 52 weeks, FXA is off 11% with FXI up 8%.

But with all of the potential strike and expiration combinations, choosing an option can be a daunting task.

You want to buy a high-probability option that has enough time to be right, so there are two rules traders should follow:

Rule One: Choose a call option with a delta of 70 or above.

An option’s strike price is the level at which the options buyer has the right to purchase the underlying stock or ETF without any obligation to do so.

(In reality, you rarely convert the option into shares, but rather simply sell back the option you bought to exit the trade for a gain or loss.)

It is important to buy options that pay off from a modest price move in the underlying stock or ETF rather than those that only make money on the infrequent price explosion. In-the-money options are more expensive, but they’re worth it, as your chances of success are mathematically superior to buying cheap, out-of-the-money options that rarely pay off.

The options Greek delta approximates the odds that an option will be in the money at expiration. It is a measurement of how well an option follows the movement in the underlying security. You can find an option’s delta using an options calculator, such as the one offered by the CBOE.

With FXA trading near $91.75 at the time of this writing, an in-the-money $85 strike call option currently has about $6.75 in real or intrinsic value. The remainder of the premium is the time value of the option. And this call option currently has a delta of about 76.

Rule Two: Buy more time until expiration than you may need — at least three to six months — for the trade to develop.

Time is an investor’s greatest asset when you have completely limited the exposure risks. Traders often do not buy enough time for the trade to achieve profitable results. Nothing is more frustrating than being right about a move only after the option has expired.

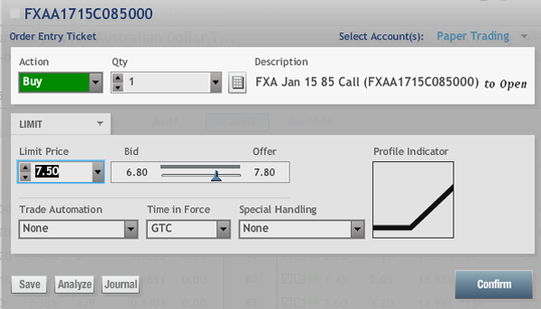

With these rules in mind, I would recommend the FXA Jan 2015 85 Calls at $7.50 or less.

This trade breaks even at $92.50 ($85 strike plus $7.50 options premium). That is less than $1 away from FXA’s recent price. If shares hit the $110 target, then the call option would have $25 of intrinsic value and deliver a gain of more than 200%.

Recommended Trade Setup:

– Buy CurrencyShares Australian Dollar Trust (NYSE: FXA) Jan 2015 85 Calls at $7.50 or less

– Set stop-loss at $3.75

– Set initial price target at $25 for a potential 233% gain in 14 months

RSS Feed

RSS Feed