UNDERSTANDING THE MARKETS

When most people think of investment markets, an image respective of the New York Stock Exchange (NYSE) comes to thought. Visions of anxious traders screaming orders from the pit and the hustling on the floor. Beyond stocks and bonds, most people don't really know how an exchange works or the different markets traded daily. Hopefully, this section will shed some light on the subject as well as examine the different markets and some of the people involved in the process.

|

|

THE STOCK EXCHANGE This video looks at the inner workings of the New York Stock Exchange (NYSE) and the tasks of some of the people on the floor. This film was done in 1958 but it is the same process. I couldn't find contemporary footage detailing the different processes and individuals of the exchange. An oldie but goodie. |

|

|

STOCKS EXPLAINED |

|

|

STOCK OPTIONS EXPLAINED SA Guide to Options - A handbook for quickly understanding options. Note: The hyperlinks in the document are disabled.

|

|

|

BONDS EXPLAINED |

|

|

BEARER BOND EXPLAINED IN DETAIL . |

|

|

MUTUAL FUNDS EXPLAINED |

|

|

EXCHANGE TRADED FUNDS (ETFs) EXPLAINED |

|

|

COMMODITIES TRADING SIMPLIFIED |

|

|

|

|

ANATOMY OF A COMMODITIES TRADE |

|

|

FOREIGN EXCHANGE TRADING (FOREX) Foreign exchange is the world's largest trading market. FX trading was once only the domain of major banks and corporations, but over the last fifteen years has increasingly grown in popularity with individual traders. There are some differences between trading currencies and other assets such as stocks or commodities. The video shall demystify some of these differences including pricing and trading in FX markets, explain some of the more popular currencies and examine what role gold and silver play in currency trading. |

|

|

STOCK MARKET TUTORIAL This guy explains and simplifies things very well. |

|

|

HOW TO READ A STOCK TABLE |

|

|

WHAT IS MARKET CAPITALIZATION? |

|

|

TOUR OF THE NEW YORK STOCK EXCHANGE |

|

|

TOUR OF THE EXCHANGE 2 |

|

|

A DANGEROUS EXPERIMENT Million Dollar Traders is the first of a three part series that aired on the BBC about hedge fund manager Lex Van Dam who tries to teach ordinary people to become successful traders. The series is particularly interesting because none of the traders understand what they are doing, but they all trade as though they did and the results were terrifying, both financially and emotionally. Many great trading lessons here. |

|

|

Floored: Into The Pit - Epic Trader Movie! |

|

|

BILLIONAIRE WALL STREETERS |

|

|

WARREN BUFFETT: THE WORLD'S GREATEST INVESTOR Documentary on Billionaire Warren Buffett. |

|

The Magic Words Every Trader Says Over and Over

By Brian Hunt,

Interviewer: Brian, you claim "five magic words" are the secret to getting rich in the markets and through investments. You claim every rich investor or trader says these words over and over. Can you share those magic words?

Brian Hunt: Sure... The five magic words – and this works with real estate investing, small business investing, blue-chip stock investing, or even short-term trading – are: "How much can I lose?" The rich, successful investor is always focused on how he can lose money on a deal, a stock, or an option position. He is always focused on risk. Once he has the risk taken care of, he can move on to the fun stuff... making money.

Almost everyone who is new to the markets or new to making investments is 100% about making money... the upside. They're always thinking about the big gains they'll make in the next Big Tech stock or currency trade or their uncle's new restaurant business. They don't give a thought to how much they can lose if things don't work out as planned... if the best-case scenario doesn't play out. And the best-case scenario usually doesn't play out.

Since the novice investor never plans for this situation, he gets killed. I've found, through years of investing and trading my own money – and through years of hanging out with very successful businesspeople and great investors – that when presented with an idea, the great investor or trader reflexively asks early in the discussion, "How much can I lose?" Like I say, this can be a real estate deal, a small business investment, a quick trade, a stock position, or a commodity investment. The concern is always, "How much can I lose? What happens if the best-case scenario doesn't pan out?"

Interviewer: It's along the lines of Warren Buffett's famous rules of successful investment. Rule one: Never lose money. Rule two: Never forget rule one.

Hunt: Right. Buffett is probably the greatest business analyst to ever live... the greatest capital allocator to ever live. He's worth over $50 billion because of his ability to analyze investments. When they ask the old man his secret, he doesn't talk about the intricacies of balance sheets or cash flow analysis.

The first thing he recommends to folks who want to make money in the market is to not lose money in the market. He's obsessed with finding out how much he could potentially lose on a stake. Once he's satisfied with that, he looks at what the upside is. So Buffett is your great investor. Now take Paul Tudor Jones, an incredible trader with a net worth in the billions. His interview in the trading bible Market Wizards is the most important thing any new trader can read.

His interview is filled with how he's obsessed with not losing money... with playing defense. Tudor's famous quote is the trader's version of Buffett's investment quote. Tudor says the most important rule of trading is playing great defense, not offense. If a new investor or trader taped Buffett's quote in a place he'd see it every day... and if he read Tudor Jones' interview once per month... and if he reflexively asks himself, "How much can I lose?" before investing a penny in anything, he'd be worlds ahead of most people out there. He'd set himself up for a lifetime of wealth.

Interviewer: OK, that covers the theory. How can we put "how much can I lose" into everyday practice?

Hunt: Well, if you're putting money into a startup business, a speculative stock, an option position, or anything else that is on the riskier end of the spectrum, the answer to "how much can I lose?" is usually, "Every last dollar." While speculative situations can be tremendous wealth-generators, they're best played with small amounts of your overall portfolio.

Or if you're a conservative investor, not played at all. Let's say you're buying a speculative gold-mining stock or a speculative tech company with just one potential "big hit" product. With speculative positions, there is always the possibility that your money could evaporate. This is where the concept of position sizing comes into play. In a speculative situation, you're going to want to put just 0.5% or just 1% of your overall portfolio into that idea. That way, if the situation works out badly, you only lose a little bit of money. You certainly don't want to put 5% or 10% of your portfolio into a speculative position. That's way too big.

Interviewer: How about advice for conservative investors?

Hunt: I think conservative investors should stick to Warren Buffett-type investments... owning incredible companies with great brand names, like Johnson & Johnson or Coca-Cola. These are the safest, most stable companies in the world. When you buy companies like this at cheap prices, when they are out of favor for some reason, it's very hard to lose money on them. They are such incredible profit generators that their share prices eventually rise and rise.

My friend and colleague Dan Ferris, who writes our Extreme Value advisory, provides advice on how and when to buy these dominant companies better than anyone in the business. He knows exactly what they are worth... and he watches them like a hawk to find the right buy-points for his readers. If a conservative investor can buy a super world-dominating company like Johnson & Johnson or Coca-Cola or Intel for less than eight or 10 times its annual cash flow, it's very hard to lose money in them. Eight to 10 times cash flow is often a hard floor for share prices of elite businesses. They don't go down past that.

Interviewer: How about the concept of "replacement cost"? Do you think that's important in the quest to not lose money?

Hunt: A while back, I had lunch with a successful professional real-estate investor who raved about some of the values he found on the east coast of Florida. The market was wrecked there. There are a lot of sellers who needed to dump right then and ask questions later... So he's found tons of properties that are selling for less than the cost it would take to build the structures if they weren't there in the first place. He's bought properties for less than that rock-bottom value... for less than replacement cost.

Since he is focusing on not losing money... and buying below replacement cost... it's going to be easy for him to make money on his properties. Mind you, he's not raving about price-appreciation potential. His eyes lit up because his downside was so well-protected. That's the mindset the new investor needs to cultivate. He needs to realize the time to start raving is when he's found a situation where it's going to be difficult for him to lose a lot of money. The upside will take care of itself.

Interviewer: How about commodities? I know you like to trade commodity stocks.

Hunt: Oh, I love to trade commodity-related stocks... copper producers, oil-service companies, uranium, gold, silver, agriculture. They boom and bust like crazy. And you can make money both ways. I like to say they are "well behaved." The key to not losing money – which leads to making terrific money – in commodity stocks is to focus your buying interest in commodities that have been blown out... that are down 60% or 80% from their high. Find commodities that have suffered brutal bear markets. The longer the bear market, the better. This is the time that the risk has been wrung out of them.

Every commodity has what's called a "production cost." This is how much it costs to produce a given unit of that commodity. It's similar to the concept of "replacement cost." After a big bear market in a commodity, you'll often find it trading for below its replacement cost. Sentiment toward the asset will be so bad that nobody wants it. So producers get out of the business... and demand for that commodity increases because it is so cheap. This sows the seeds of a big bull market. But to get back to covering your downside in commodities, focus on markets that have suffered a terrible selloff or bear market. In these situations, the answer to "how much can I lose?" is often, "Not much... It's already selling at rock-bottom levels."

You can certainly make money in commodities that have been trending higher for a long time, but the sure way to not lose money is to focus on the commodities that have absolutely been blown out. Gold and gold stocks were a classic case of this in 2001. Gold and gold stocks were such bad investments for so long that everyone who bought in the 1980s or '90s had sold their holdings in disgust. They finally got so cheap and hated that they couldn't go any lower. Then they skyrocketed.

Interviewer: Good advice... Any parting shots?

Hunt: When you start out in this game, you're as bad as you're going to get. So take supertrader Bruce Kovner's advice and "undertrade." Make really small bets to get the hang of things... to get the hang of handling your emotions. If you have $10,000 to get started, set aside $7,000 and trade with $3,000 for the first six or 12 months. But even after going through a training period like this, it's tough to learn not to lose money unless you actually feel the pain of losing a lot of money. It took me touching several very hot stoves and suffering several big losses early on in my career before I learned this.

If I am a skilled trader and investor nowadays, it is only because I have made every boneheaded mistake you can think of and learned not to repeat it. I've learned that you can make great money in the market simply by not making stupid mistakes... by playing great defense.

Interviewer: Winning by not losing. It works for Buffett and Paul Tudor Jones... So it's probably worth focusing on. Thanks for your time.

Hunt: My pleasure.

By Brian Hunt,

Interviewer: Brian, you claim "five magic words" are the secret to getting rich in the markets and through investments. You claim every rich investor or trader says these words over and over. Can you share those magic words?

Brian Hunt: Sure... The five magic words – and this works with real estate investing, small business investing, blue-chip stock investing, or even short-term trading – are: "How much can I lose?" The rich, successful investor is always focused on how he can lose money on a deal, a stock, or an option position. He is always focused on risk. Once he has the risk taken care of, he can move on to the fun stuff... making money.

Almost everyone who is new to the markets or new to making investments is 100% about making money... the upside. They're always thinking about the big gains they'll make in the next Big Tech stock or currency trade or their uncle's new restaurant business. They don't give a thought to how much they can lose if things don't work out as planned... if the best-case scenario doesn't play out. And the best-case scenario usually doesn't play out.

Since the novice investor never plans for this situation, he gets killed. I've found, through years of investing and trading my own money – and through years of hanging out with very successful businesspeople and great investors – that when presented with an idea, the great investor or trader reflexively asks early in the discussion, "How much can I lose?" Like I say, this can be a real estate deal, a small business investment, a quick trade, a stock position, or a commodity investment. The concern is always, "How much can I lose? What happens if the best-case scenario doesn't pan out?"

Interviewer: It's along the lines of Warren Buffett's famous rules of successful investment. Rule one: Never lose money. Rule two: Never forget rule one.

Hunt: Right. Buffett is probably the greatest business analyst to ever live... the greatest capital allocator to ever live. He's worth over $50 billion because of his ability to analyze investments. When they ask the old man his secret, he doesn't talk about the intricacies of balance sheets or cash flow analysis.

The first thing he recommends to folks who want to make money in the market is to not lose money in the market. He's obsessed with finding out how much he could potentially lose on a stake. Once he's satisfied with that, he looks at what the upside is. So Buffett is your great investor. Now take Paul Tudor Jones, an incredible trader with a net worth in the billions. His interview in the trading bible Market Wizards is the most important thing any new trader can read.

His interview is filled with how he's obsessed with not losing money... with playing defense. Tudor's famous quote is the trader's version of Buffett's investment quote. Tudor says the most important rule of trading is playing great defense, not offense. If a new investor or trader taped Buffett's quote in a place he'd see it every day... and if he read Tudor Jones' interview once per month... and if he reflexively asks himself, "How much can I lose?" before investing a penny in anything, he'd be worlds ahead of most people out there. He'd set himself up for a lifetime of wealth.

Interviewer: OK, that covers the theory. How can we put "how much can I lose" into everyday practice?

Hunt: Well, if you're putting money into a startup business, a speculative stock, an option position, or anything else that is on the riskier end of the spectrum, the answer to "how much can I lose?" is usually, "Every last dollar." While speculative situations can be tremendous wealth-generators, they're best played with small amounts of your overall portfolio.

Or if you're a conservative investor, not played at all. Let's say you're buying a speculative gold-mining stock or a speculative tech company with just one potential "big hit" product. With speculative positions, there is always the possibility that your money could evaporate. This is where the concept of position sizing comes into play. In a speculative situation, you're going to want to put just 0.5% or just 1% of your overall portfolio into that idea. That way, if the situation works out badly, you only lose a little bit of money. You certainly don't want to put 5% or 10% of your portfolio into a speculative position. That's way too big.

Interviewer: How about advice for conservative investors?

Hunt: I think conservative investors should stick to Warren Buffett-type investments... owning incredible companies with great brand names, like Johnson & Johnson or Coca-Cola. These are the safest, most stable companies in the world. When you buy companies like this at cheap prices, when they are out of favor for some reason, it's very hard to lose money on them. They are such incredible profit generators that their share prices eventually rise and rise.

My friend and colleague Dan Ferris, who writes our Extreme Value advisory, provides advice on how and when to buy these dominant companies better than anyone in the business. He knows exactly what they are worth... and he watches them like a hawk to find the right buy-points for his readers. If a conservative investor can buy a super world-dominating company like Johnson & Johnson or Coca-Cola or Intel for less than eight or 10 times its annual cash flow, it's very hard to lose money in them. Eight to 10 times cash flow is often a hard floor for share prices of elite businesses. They don't go down past that.

Interviewer: How about the concept of "replacement cost"? Do you think that's important in the quest to not lose money?

Hunt: A while back, I had lunch with a successful professional real-estate investor who raved about some of the values he found on the east coast of Florida. The market was wrecked there. There are a lot of sellers who needed to dump right then and ask questions later... So he's found tons of properties that are selling for less than the cost it would take to build the structures if they weren't there in the first place. He's bought properties for less than that rock-bottom value... for less than replacement cost.

Since he is focusing on not losing money... and buying below replacement cost... it's going to be easy for him to make money on his properties. Mind you, he's not raving about price-appreciation potential. His eyes lit up because his downside was so well-protected. That's the mindset the new investor needs to cultivate. He needs to realize the time to start raving is when he's found a situation where it's going to be difficult for him to lose a lot of money. The upside will take care of itself.

Interviewer: How about commodities? I know you like to trade commodity stocks.

Hunt: Oh, I love to trade commodity-related stocks... copper producers, oil-service companies, uranium, gold, silver, agriculture. They boom and bust like crazy. And you can make money both ways. I like to say they are "well behaved." The key to not losing money – which leads to making terrific money – in commodity stocks is to focus your buying interest in commodities that have been blown out... that are down 60% or 80% from their high. Find commodities that have suffered brutal bear markets. The longer the bear market, the better. This is the time that the risk has been wrung out of them.

Every commodity has what's called a "production cost." This is how much it costs to produce a given unit of that commodity. It's similar to the concept of "replacement cost." After a big bear market in a commodity, you'll often find it trading for below its replacement cost. Sentiment toward the asset will be so bad that nobody wants it. So producers get out of the business... and demand for that commodity increases because it is so cheap. This sows the seeds of a big bull market. But to get back to covering your downside in commodities, focus on markets that have suffered a terrible selloff or bear market. In these situations, the answer to "how much can I lose?" is often, "Not much... It's already selling at rock-bottom levels."

You can certainly make money in commodities that have been trending higher for a long time, but the sure way to not lose money is to focus on the commodities that have absolutely been blown out. Gold and gold stocks were a classic case of this in 2001. Gold and gold stocks were such bad investments for so long that everyone who bought in the 1980s or '90s had sold their holdings in disgust. They finally got so cheap and hated that they couldn't go any lower. Then they skyrocketed.

Interviewer: Good advice... Any parting shots?

Hunt: When you start out in this game, you're as bad as you're going to get. So take supertrader Bruce Kovner's advice and "undertrade." Make really small bets to get the hang of things... to get the hang of handling your emotions. If you have $10,000 to get started, set aside $7,000 and trade with $3,000 for the first six or 12 months. But even after going through a training period like this, it's tough to learn not to lose money unless you actually feel the pain of losing a lot of money. It took me touching several very hot stoves and suffering several big losses early on in my career before I learned this.

If I am a skilled trader and investor nowadays, it is only because I have made every boneheaded mistake you can think of and learned not to repeat it. I've learned that you can make great money in the market simply by not making stupid mistakes... by playing great defense.

Interviewer: Winning by not losing. It works for Buffett and Paul Tudor Jones... So it's probably worth focusing on. Thanks for your time.

Hunt: My pleasure.

My Strategy for Successful Short-Selling

By Jeff Clark, editor, S&A Short Report

About The Author

Jeff is a master trader. Before joining Stansberry & Associates, he spent more than 20 years managing money for some of California's wealthiest people. Now, Jeff shows subscribers the options-trading techniques he used to help build these people's fortunes. In today's edition of our weekend Masters Series… Jeff shares his secret for shorting stocks. Many investors are reluctant to try shorting… They worry that it's complicated or just "not for them." But short-selling is simply a transaction that profits when a stock's price falls. And it's an important tool for a balanced portfolio. In the following piece – originally published in a 2009 edition of our daily e-letter Growth Stock Wire – Jeff describes three key factors he looks for in a short-sale candidate.

When I first started trading stocks, I did so almost exclusively from the long side... only buying stocks. Through a series of trials and errors, I developed a three-pronged approach for what constituted a good stock to buy:

1. Ridiculously cheap valuation.

2. High degree of pessimism surrounding the shares.

3. Price action that had just turned up following a long decline.

As simple as this buying strategy might seem, it has produced superior returns. Logically, then, it makes sense to use a similar three-pronged approach to betting on a stock falling – called shorting.

1. Ridiculously high valuation.

2. High degree of optimism surrounding the shares.

3. Price action that has just turned down following a steady incline or parabolic rise.

Let's look at each element individually.

1. Ridiculously high valuation.

We all understand that, ultimately, earnings drive stock prices. Consequently, the price-to-earnings (P/E) ratio is the best gauge with which to measure the ridiculousness of a stock's valuation. If you've found a stock with a P/E ratio 50% higher than the industry average, or more than 50% higher than the company's historic P/E ratio, then you might have a good short sale on your hands.

2. High degree of optimism surrounding the shares.

If every analyst on Wall Street loves the stock... if the anchors on CNBC seem to be mentioning the stock every hour... if all of your friends are talking about the fortunes to be made by owning the stock... it's probably on my list of short-sale candidates. This concept is easy to understand. If the whole world is in love with a stock, and if everyone who wants to own the stock already does, who is left to push the price higher? If there's no one left to buy and to push the stock higher, it only takes one seller to shift the momentum in the other direction.

3. Price action that has just turned down following a steady incline or parabolic rise.

Just as it doesn't make much sense to jump in front of a moving train, it doesn't make much sense to short a stock as it's moving higher. Rather than trying to pick a top in a stock, it makes far more sense to wait until the price action has turned lower – and is in the early stages of a downtrend. For me, that confirmation occurs when the stock trades below its 50-day moving average.

Stocks in which the upside momentum is strong will hold above their 50-day moving average lines. Failing to hold above that line is an excellent early indication the momentum is shifting to the bearish camp. You see, all of the Wall Street hype, all of the CNBC promotion, and all of the persuasive opinions of friends at cocktail parties creates big opportunities for us to bet against over-hyped stocks.

If you stick with these three guidelines, you'll have all the tools you need to make money on the short side of the stock market.

By Jeff Clark, editor, S&A Short Report

About The Author

Jeff is a master trader. Before joining Stansberry & Associates, he spent more than 20 years managing money for some of California's wealthiest people. Now, Jeff shows subscribers the options-trading techniques he used to help build these people's fortunes. In today's edition of our weekend Masters Series… Jeff shares his secret for shorting stocks. Many investors are reluctant to try shorting… They worry that it's complicated or just "not for them." But short-selling is simply a transaction that profits when a stock's price falls. And it's an important tool for a balanced portfolio. In the following piece – originally published in a 2009 edition of our daily e-letter Growth Stock Wire – Jeff describes three key factors he looks for in a short-sale candidate.

When I first started trading stocks, I did so almost exclusively from the long side... only buying stocks. Through a series of trials and errors, I developed a three-pronged approach for what constituted a good stock to buy:

1. Ridiculously cheap valuation.

2. High degree of pessimism surrounding the shares.

3. Price action that had just turned up following a long decline.

As simple as this buying strategy might seem, it has produced superior returns. Logically, then, it makes sense to use a similar three-pronged approach to betting on a stock falling – called shorting.

1. Ridiculously high valuation.

2. High degree of optimism surrounding the shares.

3. Price action that has just turned down following a steady incline or parabolic rise.

Let's look at each element individually.

1. Ridiculously high valuation.

We all understand that, ultimately, earnings drive stock prices. Consequently, the price-to-earnings (P/E) ratio is the best gauge with which to measure the ridiculousness of a stock's valuation. If you've found a stock with a P/E ratio 50% higher than the industry average, or more than 50% higher than the company's historic P/E ratio, then you might have a good short sale on your hands.

2. High degree of optimism surrounding the shares.

If every analyst on Wall Street loves the stock... if the anchors on CNBC seem to be mentioning the stock every hour... if all of your friends are talking about the fortunes to be made by owning the stock... it's probably on my list of short-sale candidates. This concept is easy to understand. If the whole world is in love with a stock, and if everyone who wants to own the stock already does, who is left to push the price higher? If there's no one left to buy and to push the stock higher, it only takes one seller to shift the momentum in the other direction.

3. Price action that has just turned down following a steady incline or parabolic rise.

Just as it doesn't make much sense to jump in front of a moving train, it doesn't make much sense to short a stock as it's moving higher. Rather than trying to pick a top in a stock, it makes far more sense to wait until the price action has turned lower – and is in the early stages of a downtrend. For me, that confirmation occurs when the stock trades below its 50-day moving average.

Stocks in which the upside momentum is strong will hold above their 50-day moving average lines. Failing to hold above that line is an excellent early indication the momentum is shifting to the bearish camp. You see, all of the Wall Street hype, all of the CNBC promotion, and all of the persuasive opinions of friends at cocktail parties creates big opportunities for us to bet against over-hyped stocks.

If you stick with these three guidelines, you'll have all the tools you need to make money on the short side of the stock market.

Short-Sellers Beware: This Could Happen to You

By Jeff Clark, editor, S&A Short Report

Although many people are reluctant to try short-selling – an investment that profits as a stock price falls – it's a valuable technique in most investors' "tool box." Jeff highlights one pitfall that can undermine a short position... even one placed on a vulnerable stock. And more important, he tells you how to avoid it.

As any elementary school nerd or frat-house pledge will tell you, there are few things in life that are more painful than having someone grab your shorts from behind and yank them as far up your backside as possible. In the world of YouTube pranks, it's called a "wedgie." In the stock market, we call it a short squeeze. And – like a wedgie – if you're on the wrong side of one, it hurts...

A short squeeze happens when a heavily shorted stock rockets higher overnight – usually as the result of a favorable news announcement or corporate press release. The gains are unusually large as traders rush to buy as much as possible and press the share price high enough to force short-sellers to capitulate, buy back their shares, and push the stock even higher. In the long run, stocks with a large short interest – say, 30% of the outstanding float or more – run into trouble over time. The best short-sellers – like Jim Chanos (who famously shorted Enron before the company's demise) and David Einhorn (who made a fortune shorting Lehman Brothers) – perform extensive research... and they're right about their calls much more often than they're wrong. But in the short term, stocks with a large short interest can see tremendous moves higher.

Here's a look at a few stocks that got squeezed yesterday.

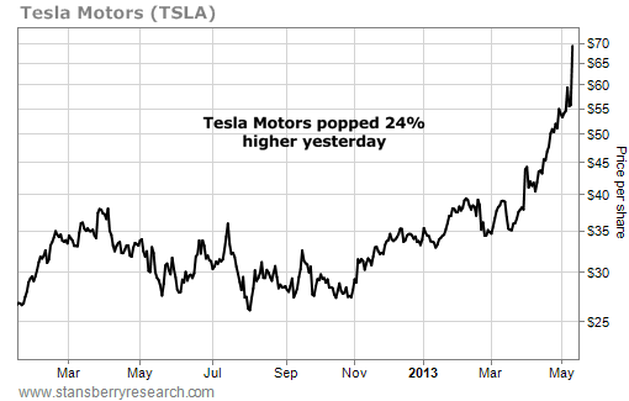

Electric carmaker Tesla Motors (TSLA) popped 24% higher yesterday on the heels of a stronger-than-expected earnings report. Nearly 50% of TSLA shares are sold short. The stock has doubled in the past five months.

By Jeff Clark, editor, S&A Short Report

Although many people are reluctant to try short-selling – an investment that profits as a stock price falls – it's a valuable technique in most investors' "tool box." Jeff highlights one pitfall that can undermine a short position... even one placed on a vulnerable stock. And more important, he tells you how to avoid it.

As any elementary school nerd or frat-house pledge will tell you, there are few things in life that are more painful than having someone grab your shorts from behind and yank them as far up your backside as possible. In the world of YouTube pranks, it's called a "wedgie." In the stock market, we call it a short squeeze. And – like a wedgie – if you're on the wrong side of one, it hurts...

A short squeeze happens when a heavily shorted stock rockets higher overnight – usually as the result of a favorable news announcement or corporate press release. The gains are unusually large as traders rush to buy as much as possible and press the share price high enough to force short-sellers to capitulate, buy back their shares, and push the stock even higher. In the long run, stocks with a large short interest – say, 30% of the outstanding float or more – run into trouble over time. The best short-sellers – like Jim Chanos (who famously shorted Enron before the company's demise) and David Einhorn (who made a fortune shorting Lehman Brothers) – perform extensive research... and they're right about their calls much more often than they're wrong. But in the short term, stocks with a large short interest can see tremendous moves higher.

Here's a look at a few stocks that got squeezed yesterday.

Electric carmaker Tesla Motors (TSLA) popped 24% higher yesterday on the heels of a stronger-than-expected earnings report. Nearly 50% of TSLA shares are sold short. The stock has doubled in the past five months.

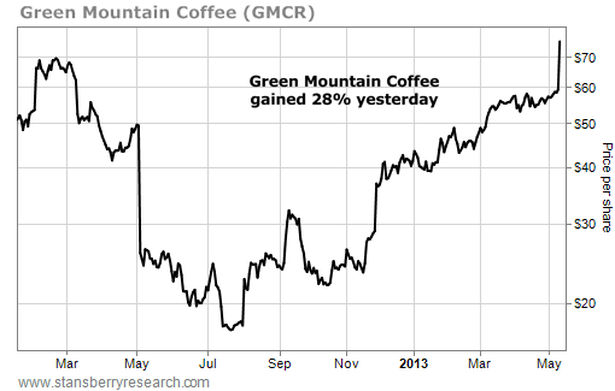

Coffee company Green Mountain Coffee (GMCR) also surged higher after reporting earnings yesterday. Thirty-eight percent of the stock is sold short. That helped propel a 28% gain yesterday.

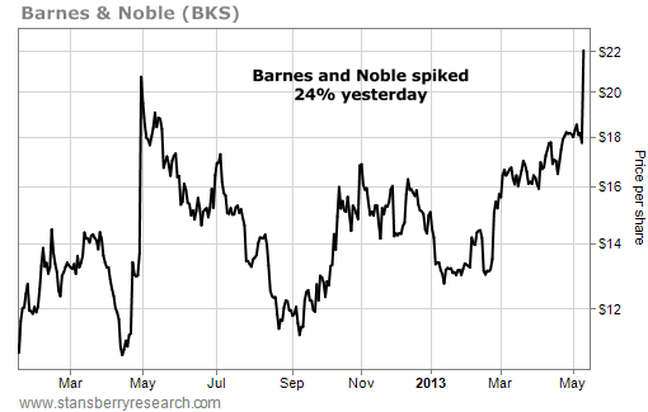

Thirty-six percent of bookseller Barnes & Noble (BKS) shares are sold short. Short-sellers suffered an "atomic wedgie" yesterday following reports that Microsoft would pay $1 billion for the company's Nook division. BKS shares spiked 24% on the news. (Editor's note: Since Jeff originally published this essay, BKS shares have fallen back to around $20.)

As I said earlier, stocks with more than 30% short interest often turn out to be excellent longer-term short sales. But those are the exact same stocks that are most prone to getting squeezed in the short term. It's often a good idea for traders to watch these stocks. When you see a short squeeze, let it run its course, and then enter a short position once the stock starts to trend lower.