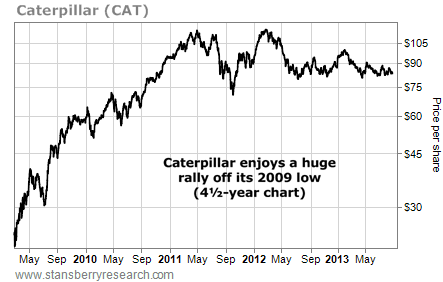

| MARKET CONDITIONS This wonderful article appeared recently and if you have been reading my recommendations, you will see why I posted it here. My consistent message along with supporting posts say the same thing...invest in stable, blue chips with a steady growth rate and dividend yield. I've told you how to pick 'em. I've posted videos on how to price 'em. In order to build wealth in a low risk way, you must buy at the right price and reinvest those dividends. |

Investors define income stocks in different ways. We target those with dividend yields higher than the interest rate of the 10-year Treasury note, which is currently at about 2.7%.

Safety can also be defined in different ways. We tackled the definition from two perspectives: Both the company and the income it pays should be safe.

A dividend is safe, in our opinion, when it is likely to continue being paid at the same rate as it was paid in the past. To find stocks with safe dividends, we looked for companies that have paid investors in each of the past five years. The dividend payment also has to account for less than 50% of its earnings.

If a company passes these tests, they have demonstrated a commitment to providing shareholders with income and should be able to continue paying the dividend even if earnings decline. There is no guarantee they will, but the data says it is likely.

We also excluded American depositary receipts (ADRs) in our effort to find safe income. ADRs are issued to track the stocks of companies listed on foreign exchanges. The dividend policy of companies in foreign countries is often different than U.S.-listed companies. Rather than paying a steady quarterly dividend, many foreign companies make a payment once or twice a year in an amount that varies with earnings. There is nothing wrong with buying ADRs, but they will not necessarily provide regular and steady income.

To find safe companies, we limited our search to large-cap stocks. These companies are more likely to withstand an economic slowdown than small-cap stocks.

Finally, we excluded companies with dividend yields greater than 7%, because unusually high dividends are often a sign of problems.

The top five companies on our list are:

-- ConocoPhillips (NYSE: COP), 4.1% dividend yield

-- Cracker Barrel Old Country Store (Nasdaq: CBRL), 3% dividend yield

-- DuPont (NYSE: DD), 3.1% dividend yield

-- Gannett (NYSE: GCI), 3.3% dividend yield

-- Lockheed Martin (NYSE: LMT), 3.8% dividend yield

These stocks are all buys at their current prices, but we could also wait for a pullback and earn a higher yield. Selling put options could allow us to get paid while waiting for a pullback and increase our returns.

A put option gives the buyer the right to sell 100 shares of stock at a certain price, known as the exercise or strike price, at any time before the option expires. Put sellers agree to buy those shares if the put buyer chooses to sell.

When selling a put, you are paid a premium that provides immediate income. If the option expires worthless because the stock remains above the exercise price, you keep the premium as your gain on the trade. If the stock falls below the exercise price, you will be able to buy the stock at a reduced price.

The specific trades we like for each of those five stocks are:

-- Sell COP Nov 60 Puts at 30 to 65 cents with shares trading near $66.40

-- Sell CBRL Dec 85 Puts at $1 to $1.60 with shares trading near $103.40

-- Sell DD Jan 48 Puts at 30 to 70 cents with shares trading near $57.85

-- Sell GCI Jan 20 Puts at 30 to 55 cents with shares trading near $25

-- Sell LMT Dec 100 Puts at 30 to 80 cents with shares trading near $125.50

For Conoco, for example, you could sell a put that expires in November at an exercise price of $60 for about 60 cents. Since each contract covers 100 shares of stock, you would immediately receive $60. COP is trading at about $66.40 a share. If it is trading below $60 when the option expires, you would get the stock at a 10% discount to its recent price, paying $59.40 a share ($60 strike price minus 60-cent premium collected for selling the option).

If COP is above $60 at expiration, you would keep the premium as your profit. Brokers generally require a 20% margin deposit when selling a put, which can be thought of as a down payment on the possible purchase price. In this example, the margin would be $1,200 (20% of $6,000), making the return on investment 5% if the option is not exercised.

Selling options is a great income strategy to increase your gains and allow you to buy stocks on price dips.

This article was originally published at ProfitableTrading.com

The Top 5 Income Stocks for Uneasy Investors

RSS Feed

RSS Feed