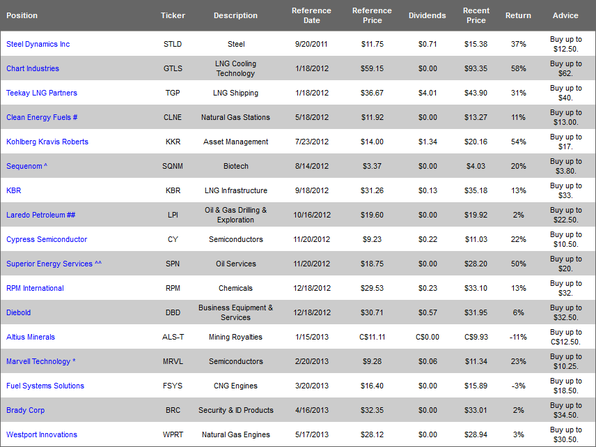

Makes the parts that allow medium-sized trucks and cars to run on natural gas – has had a rough couple of months. After trading below $13.50 in early March, shares rocketed near the $18 level before falling back below $14 last month.

The stock fell this morning after the company reported earnings below Wall Street expectations. Fuel Systems posted an earnings loss of $0.04-per-share in the first quarter. Analysts were expecting a $0.04-per-share profit.

The company is doing much better than the headline suggests. Fuel Systems has spent the past two years coping with tough conditions in Europe. At one point, FSYS shares were down 40%-plus over the previous 12 months. A closer look at the company's report reveals it is starting to turn things around. Sales were actually up 1% versus the same quarter last year. To put this in perspective, sales were down more than 10% in each of the previous two quarters.

Fuel Systems is growing its sales in North America and Asia. More important, the company is just starting to recover from a tough 12-month period. I expect earnings to stabilize in the coming quarters, and shares should soar as a result. Buy shares on this pullback. FSYS is a buy up to $18.50.

Brady Corp. (NYSE: BRC)

It's an elite, small-cap, dividend-paying stock. Most investors have never heard of Brady. It makes things like signs, labels, and name-tags. Even though few people pay attention to the company's products, they're everywhere; in store windows, on boxes, even inside cars and electronics.

Brady is the kind of business that will never disappear. More important, the company gives shareholders a big piece of its profits. It has raised its dividend every year for 27 straight years.

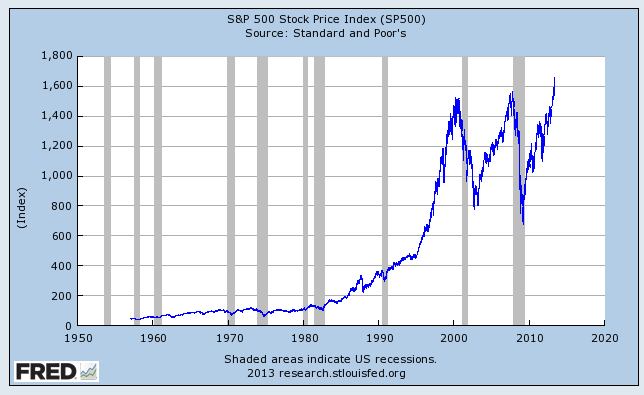

But shares have trailed the market badly over the past couple years. While the S&P 500 soared more than 20%, shares of Brady fell about 10%. In other words, the market forgot what a great business Brady is. That's good news for investors. We get to buy one of the best businesses in the world for a super-cheap 12 times forward earnings.

It looks like the market is starting to realize its mistake. Within the last several weeks, shares of Brady are up 7%-plus. Keep in mind, the company's business didn't suddenly improve in the last few weeks. The market is simply coming around to the fact that Brady will keep churning out profits and raising its dividends years into the future. It also means the company fits the criteria we need in an investment to successfully compound returns over the long term.

Brady shares are now trading above our buy-up-to price. If you haven't bought the stock yet, wait for a pullback below $34.50 before you buy. Remember, Brady is the kind of stock that will generate huge returns over years... not weeks. Being disciplined about the price you pay is an important part of a successful strategy. Brady Corp. is a buy up to $34.50.

RPM International (NYSE: RPM) and natural-gas equipment stock Chart Industries (Nasdaq: GTLS), both small-cap dividend-payers, jumped to new 52-week highs last week. Both stocks are up 10%-plus over the past month.

RPM sells specialty coatings, sealants, and building materials under a variety of brand names, including Rust-Oleum. Like Brady Corp., the company is the kind of steady business that rewards us with the chance to compound our wealth over the long term. RPM pays a safe, high yield – and it has raised its dividend for 38 straight years.

Chart Industries provides products and systems for liquefied-natural-gas (LNG) storage and transmission. You can find its tanks at natural-gas-fueling stations. Two weeks ago, Chart posted positive first-quarter earnings. Sales grew 27% versus the same period last year. More important, earnings are on track to grow 30%-plus this year. These results indicate the company is benefiting from the expanding role of natural gas around the world.

Chart Industries is up nearly 50% since last January. RPM is up 14% in less than five months. Both stocks are trading above their buy-up-to prices. For now, RPM and GTLS are "holds."

RSS Feed

RSS Feed