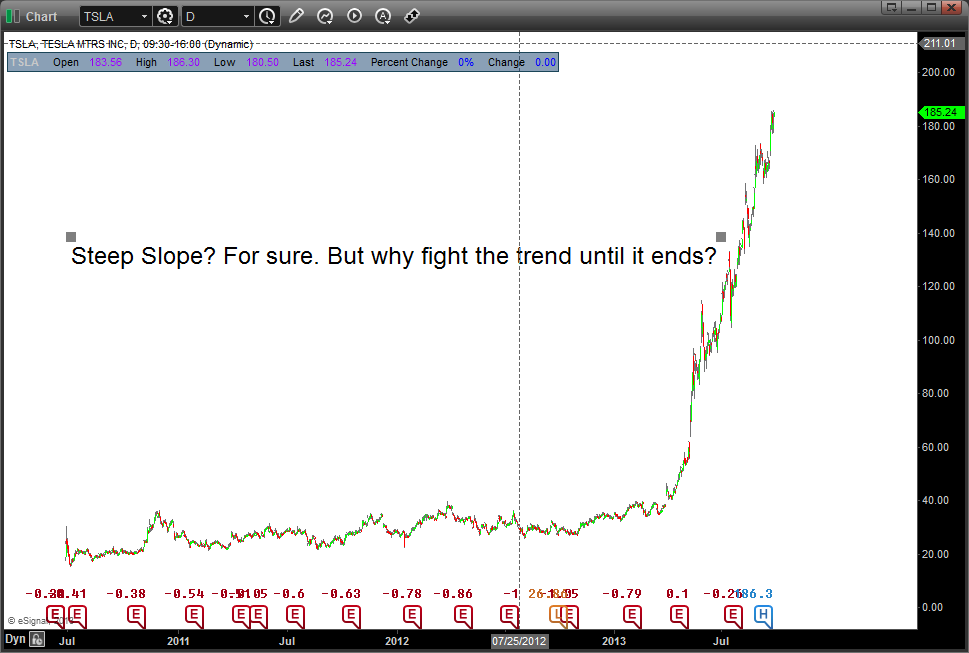

Such is the game with growth stocks-turned-cult stocks supported by a strong base of trend-followers — the trend doesn't end until it does. On that front, I wrote the following:

“The issue with trend-follower stocks such as TSLA is that a defined top first must be in place for the bears to get their days, and once the bears have the ball, they dare not blink or risk giving the game right back to the bulls.” The point where bears take control of Tesla stock clearly has not yet occurred, but when it does, it could smack TSLA a good 20% to 30% lower in a quick fashion.

Important to note, however, is that such a correction initially would not be much of a statement about the underlying fundamentals of the business, but rather a healthy mean-reversion move of the stock price. This would ultimately allow longer-term investors to consider the stock again, thus making it stronger. But for now … why fight the trend?

Should the stock fall meaningfully below the 21-day moving average, bulls might want to take a step back.

RSS Feed

RSS Feed