But income investors, accustomed to staid, low-risk utilities, are at a historical juncture. In the coming year, they may be forced to make some venture capitalist type decisions about which utilities have the best technologies to comply with new Environmental Protection Agency (EPA) emissions standards, should they be enacted.

In early July, we wrote about how the Obama administration was moving to have the EPA enact carbon regulations on existing and future power plants, and how this forever could change the valuations of low-carbon versus high-carbon utilities.

President Obama has said his initiative would seek to reduce US greenhouse gas emissions to 17 percent below 2005 levels (comparable to previous programs) by the end of the decade. And he plans to implement various other policies that would incentivize a doubling of renewables by 2020, as well as new incentives for more transmission, efficiency tech and biofuels, for example.

And so on Sept. 20, EPA Administrator Gina McCarthy proposed a rule for new coal plants that set such a high standard on carbon emissions that it essentially forces utilities to incorporate carbon capture and sequestration technology (CCS) into all future coal plants.

This rule says a new coal plant must be able to emit at a rate of no more than 1,100 pounds of carbon dioxide per megawatt hour (CO2/MWh). That is far below an estimated 1,700 pounds of CO2/MWh to 1,900 pounds of CO2/MWh for the most efficient plants currently in operation anywhere.

A new plant that uses CCS would capture carbon from the smokestack, inject it underground and either store it or use it in an oil-recovery process. The average US coal plant emits 1,768 pounds of CO2/MWh, so coal plants would have to capture and store 20 percent to 40 percent of the CO2 they produce. Cleaner-burning natural gas plants won't be required to capture their emissions.

Power producers had urged the EPA to set the standard at 1,800 pounds or higher. Standards for new power plants will give coal-fired producers an option to meet a "somewhat tighter limit" if they choose to base compliance on an average of their emissions over a multi-year period.

According to the EPA, these rules will ensure new plants are built with "available clean technology to limit carbon pollution," a requirement in line with investment in clean-energy technologies already taking place across the industry.

Technology: Faith vs. Fact

There are a lot of big names that have faith in CCS technology. The question is whether the cost of compliance with new EPA standards by using this technology will significantly reduce earnings in comparison with utilities that have more natural gas, nuclear, renewables and other low-carbon energy resources.

As it stands, according to research completed by your correspondent's predecessor firm, consultancy Green Edison, the value proposition should shift toward low-carbon utilities in the short term.

The Top Low-Carbon Utilities

And we know that even without such technologies, global coal use will be on the rise. But less certain is whether US utility investors will stick around while the domestic coal industry perfects carbon capture.

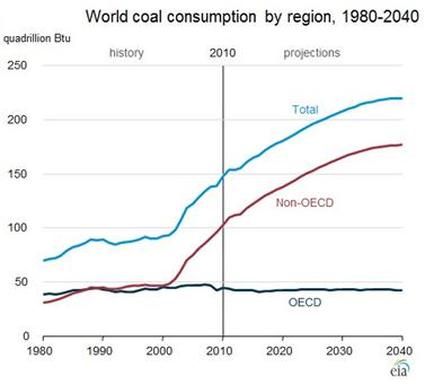

According to the US Energy Information Administration's International Outlook, world coal consumption will rise at an average rate of 1.3 percent per year, from 147 quadrillion British thermal units (Btu) in 2010 to 180 quadrillion Btu in 2020 and 220 quadrillion Btu in 2040.

The forecast for near-term demand reflects significant increases in coal consumption by China, India, and other emerging markets. Over the long term, growth of coal consumption decelerates as policies and regulations encourage the use of cleaner energy sources; natural gas becomes more economically competitive as a result of development in the shale plays; and growth of industrial coal use slows largely due to China's industrial activities (See Chart A).

In early July, we wrote about how the Obama administration was moving to have the EPA enact carbon regulations on existing and future power plants, and how this forever could change the valuations of low-carbon versus high-carbon utilities.

President Obama has said his initiative would seek to reduce US greenhouse gas emissions to 17 percent below 2005 levels (comparable to previous programs) by the end of the decade. And he plans to implement various other policies that would incentivize a doubling of renewables by 2020, as well as new incentives for more transmission, efficiency tech and biofuels, for example.

And so on Sept. 20, EPA Administrator Gina McCarthy proposed a rule for new coal plants that set such a high standard on carbon emissions that it essentially forces utilities to incorporate carbon capture and sequestration technology (CCS) into all future coal plants.

This rule says a new coal plant must be able to emit at a rate of no more than 1,100 pounds of carbon dioxide per megawatt hour (CO2/MWh). That is far below an estimated 1,700 pounds of CO2/MWh to 1,900 pounds of CO2/MWh for the most efficient plants currently in operation anywhere.

A new plant that uses CCS would capture carbon from the smokestack, inject it underground and either store it or use it in an oil-recovery process. The average US coal plant emits 1,768 pounds of CO2/MWh, so coal plants would have to capture and store 20 percent to 40 percent of the CO2 they produce. Cleaner-burning natural gas plants won't be required to capture their emissions.

Power producers had urged the EPA to set the standard at 1,800 pounds or higher. Standards for new power plants will give coal-fired producers an option to meet a "somewhat tighter limit" if they choose to base compliance on an average of their emissions over a multi-year period.

According to the EPA, these rules will ensure new plants are built with "available clean technology to limit carbon pollution," a requirement in line with investment in clean-energy technologies already taking place across the industry.

Technology: Faith vs. Fact

There are a lot of big names that have faith in CCS technology. The question is whether the cost of compliance with new EPA standards by using this technology will significantly reduce earnings in comparison with utilities that have more natural gas, nuclear, renewables and other low-carbon energy resources.

As it stands, according to research completed by your correspondent's predecessor firm, consultancy Green Edison, the value proposition should shift toward low-carbon utilities in the short term.

The Top Low-Carbon Utilities

- PG&E Corp (NYSE: PCG)

- Exelon Corp (NYSE: EXC)

- Entergy Corp (NYSE: ETR)

- Public Service Enterprise Group Inc (NYSE: PEG)

- NextEra Energy Inc (NYSE: NEE)

- Dominion Resources Inc (NYSE: D)

- Sempra Energy (NYSE: SRE)

And we know that even without such technologies, global coal use will be on the rise. But less certain is whether US utility investors will stick around while the domestic coal industry perfects carbon capture.

According to the US Energy Information Administration's International Outlook, world coal consumption will rise at an average rate of 1.3 percent per year, from 147 quadrillion British thermal units (Btu) in 2010 to 180 quadrillion Btu in 2020 and 220 quadrillion Btu in 2040.

The forecast for near-term demand reflects significant increases in coal consumption by China, India, and other emerging markets. Over the long term, growth of coal consumption decelerates as policies and regulations encourage the use of cleaner energy sources; natural gas becomes more economically competitive as a result of development in the shale plays; and growth of industrial coal use slows largely due to China's industrial activities (See Chart A).

In fact, Thomas Fanning, the CEO of Southern Company (NYSE: SO), which is building a CCS plant at its facility in Kemper County, Ga., has warned the EPA that the cost of building this plant should not be used by the agency as indicative that the technology is proven. Southern has argued that even at $4.8 billion, which with cost overruns is now double the project's initial estimate, the Kemper plant would still be cheaper than others proposed, given the location of the plant in proximity to coal reserves and where the CO2 will be used for enhanced oil recovery.

Indeed, one critic of the EPA's proposed rule says that the agency has jumped the gun, at least for coal, arguing that CCS technology has not been adequately demonstrated, and its implementation costs are not reasonable. "The EPA is abusing natural language to suggest projects which have not yet entered into service, some of which are still on the drawing board, somehow prove the technology is viable and can be implemented cost effectively." The Clean Air Act requires the EPA to pay due attention to costs and technical feasibility when it draws up new standards.

But even as the industry argues over the costs, there are also some unresolved issues regarding potential legal liabilities resulting from the storage of carbon in non-oil and gas areas such as aquifers, not to mention the continued debate as to whether storing carbon in the ground is even an ideal approach. And capture and storage is where the greatest amount of emissions reductions can be achieved, so this is a fundamental question with respect to the technology.

There have been concerns raised in the past that cracks or leaks in the underground cavities could lead to dangerous gasses escaping to the surface. That happened in 1986 when a naturally occurring carbon dioxide leak led to the death of 1,700 people at Lake Nyos in Cameroon.

Furthermore, transporting CO2 from factories and other facilities to safer storage units would require long pipelines, and residents in these areas fear that faulty pipes could lead to the uncontrolled release of dangerous fumes. Others have argued that captured carbon emissions from coal plants should be used to grow algae as part of a move to a new biofuel that would support the industrial manufacturing and transportation sectors, eliminating the need for storage.

Income Investor or Venture Capitalist?

This implementation of new environmental rules will be similar to decades past when investors had to choose the winners and losers of electric deregulation, or between A/C or D/C technology, which was known as the War of Currents.

Almost like venture capitalists, investors will have to choose which utilities they believe will be best at commercializing new technologies while being the lowest cost producer.

But never fear if you find this a daunting task. As in previous years, we will be with you every step of the way, advising you on which utilities will provide the best opportunities for both growth and income.

This article originally appeared in the Utility & Income column. Never miss an issue.

Indeed, one critic of the EPA's proposed rule says that the agency has jumped the gun, at least for coal, arguing that CCS technology has not been adequately demonstrated, and its implementation costs are not reasonable. "The EPA is abusing natural language to suggest projects which have not yet entered into service, some of which are still on the drawing board, somehow prove the technology is viable and can be implemented cost effectively." The Clean Air Act requires the EPA to pay due attention to costs and technical feasibility when it draws up new standards.

But even as the industry argues over the costs, there are also some unresolved issues regarding potential legal liabilities resulting from the storage of carbon in non-oil and gas areas such as aquifers, not to mention the continued debate as to whether storing carbon in the ground is even an ideal approach. And capture and storage is where the greatest amount of emissions reductions can be achieved, so this is a fundamental question with respect to the technology.

There have been concerns raised in the past that cracks or leaks in the underground cavities could lead to dangerous gasses escaping to the surface. That happened in 1986 when a naturally occurring carbon dioxide leak led to the death of 1,700 people at Lake Nyos in Cameroon.

Furthermore, transporting CO2 from factories and other facilities to safer storage units would require long pipelines, and residents in these areas fear that faulty pipes could lead to the uncontrolled release of dangerous fumes. Others have argued that captured carbon emissions from coal plants should be used to grow algae as part of a move to a new biofuel that would support the industrial manufacturing and transportation sectors, eliminating the need for storage.

Income Investor or Venture Capitalist?

This implementation of new environmental rules will be similar to decades past when investors had to choose the winners and losers of electric deregulation, or between A/C or D/C technology, which was known as the War of Currents.

Almost like venture capitalists, investors will have to choose which utilities they believe will be best at commercializing new technologies while being the lowest cost producer.

But never fear if you find this a daunting task. As in previous years, we will be with you every step of the way, advising you on which utilities will provide the best opportunities for both growth and income.

This article originally appeared in the Utility & Income column. Never miss an issue.

RSS Feed

RSS Feed