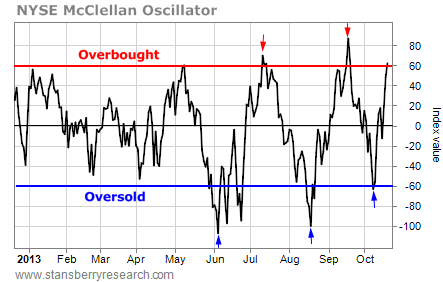

We've used the NYMO to trigger several profitable short-term trades. Right now, it's triggering another one. The NYMO warned us stocks were overbought in mid-July and mid-September. That gave aggressive traders the chance to profit from a couple short trades as the S&P 500 fell more than 60 points within just a few weeks of each trigger.

The NYMO also warned us when stocks were oversold and primed for a rally. We got "buy" signals in early June and late August. Each of these signals led to big rallies and profits for traders who jumped onboard. Just two weeks ago, the NYMO triggered another "buy" signal. And the S&P 500 is up nearly 100 points since then.

There's no doubt that the NYSE McClellan Oscillator has been one of the best timing indicators of the year. So it pays to follow it and right now, this indicator says it's time to sell. Take a look.

Traders who bet on a reversal made fast profits. Today, with the S&P 500 trading at all-time highs, the NYSE McClellan Oscillator is back in overbought territory. So traders should be on the lookout for a reversal and a chance to profit on a short-term decline in the market. Best regards and good trading,

RSS Feed

RSS Feed