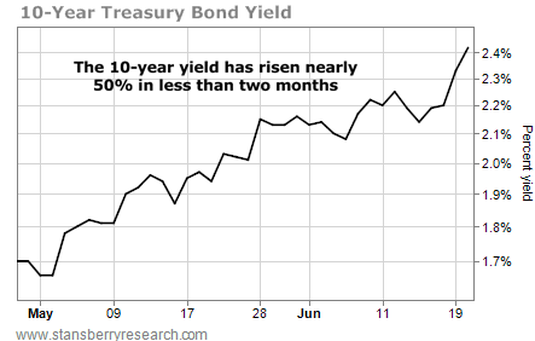

The Volatility Index ("VIX") has popped higher. Last Thursday, it broke out to more than 20% for the first time since December.

Only one of our stocks – Intel – has fallen more than the S&P 500. And while we don't like to see our portfolio positions go down, we're prepared for the worst. We've loaded the portfolio with industry-leading, blue-chip stocks that boast shareholder-friendly policies. We know that even when we end up owning shares of these companies, we can hold onto these stocks and ride out the downturn. These companies will last for years to come, eventually, their stock prices will stabilize. In the meantime, we can book consistent income through dividend payments and covered-call premiums.

How To Take Advantage of Investor Fear

EMC Corp. (NYSE: EMC) is one such company. Since it was founded in Massachusetts in 1979, EMC has become the world's largest provider of computer-storage systems. EMC works with a wide range of companies from startup tech companies to industry leaders like Microsoft. Its clients operate in a diverse array of sectors, like health care, airlines, and banking.

EMC is well situated to take part in the cloud-computer boom that's begun in recent years. Cloud-computing is when individuals or organizations store their data and software with a third party and access them over the Internet. In principle, cloud-computing has been around for decades. If you have an e-mail account from web providers like Google and Yahoo, you've used a form of cloud-computing.

In recent years, the idea of cloud-computing has taken off. Microsoft offers its SkyDrive service to allow users to access files on different computers. Google has its own storage system. I use a service called DropBox to store documents, and I'm experimenting with SkyDrive. So no matter where I am in the world, I can reach files I need.

Regardless of whose service ends up being the No. 1 choice of users, EMC will be a big winner. Its massive storage systems are exactly the infrastructure needed by all the service providers. In 2012, EMC had record revenues of $21.7 billion. That's up more than $4 billion from 2010 – nearly 22.5%.

One of the things I like best is that EMC spends a good percentage of its revenues on research and development (R&D) – just like another of my favorite tech giants, microchip maker Intel (NYSE: INTC). In just the past three years, EMC has spent more than $6.5 billion in R&D. This commitment to new discoveries will keep it a global leader in its industry.

Let's take a look at EMC's financials:

For its size and industry, EMC has a high free cash flow. Part of the reason for this is its low capital expenditure (capex). Capex is the money a company uses for its physical assets – like buildings and equipment. In 2012, EMC only spent $819 million on capital expenditures. That's only about 5% of its cash flow, which allows EMC to use so much for R&D.

EMC is increasingly shareholder-friendly. In the past three years, it's bought back $3 billion in stock. And the company plans to buy back $6 billion in shares through December 2015. Furthermore, just last month, the company announced it would start paying a quarterly dividend of $0.10 per share. That's a yield of about 1.6%. I expect EMC to continue this shareholder-friendly trend as revenues keep increasing.

Right now, the stock is trading for about $4 less than its 52-week high. (It hit $28.18 per share in September.) But you can see in the chart below that the good news has started to bring investors back into this industry leader.

Here's How the Safe Money Option for EMC Works

Sell, to open, EMC Corp. (EMC) August $23 puts for around $0.50 with the stock trading around $23.75.

The puts obligate you to buy EMC at $23 a share if the stock falls to less than that by option-expiration day (August 16). Selling these puts gives you about $50 in your account per option contract. (Remember, one option contract equals 100 shares of stock.)

Buying 100 shares at $23 each represents a potential obligation of $2,300. To put on this trade, you will have to deposit a "margin requirement" – essentially a security deposit that reassures the broker that you can cover your potential obligation. It usually runs about 20% for put sales. (In this case, 20% of $2,300 is $460)

Here's the math.

Sell one EMC August $23 put for $50.

Place 20% of the capital at risk in your option account, $460.

Total outlay: $410.

If the markets remain unchanged and EMC trades for more than $23 on August 16, you won't have to buy the stock. You keep the $50 premium (and the $460 margin). That's a simple 10.9% return on margin in less than two months. If we put this trade on every two months – assuming all prices remain the same – this could return 65% a year on the margin amount.

If EMC trades for less than $23 on August 16, you'll keep the $50. But you'll have to buy EMC stock at $23 per share. So you'll own EMC at $22.50 (the $23 strike minus the $0.50-per-share premium). Here's how that scenario works out for each option contract you sell.

Initial income from sold put premium of $50.

Purchase of 100 shares of EMC at $23 is $2,300.

Total outlay: $2,250.

The cost ($22.50) is roughly 5.3% less than EMC's current market price. This gives a little downside protection. Plus, if you become a shareholder, you'll also receive the company's $0.40-per-share annual dividend. If EMC pays its expected dividend over the next 12 months, you'll receive a total of $90 ($50 plus $40 in dividends) on a $2,300 investment... 3.9% cash on your investment. And we'll likely sell call options against the stock to further boost our returns.

***Note: The prices in this example reflect trading on May 27.

IRA Alternative for EMC

If you're using an IRA or Roth IRA that bars you from selling puts, there's an alternative covered-call trade you can make. (These alternative trades can also be done in your regular brokerage accounts.)

This is the same strategy we use to generate income on stocks that are put to us, but if you prefer to start by owning shares and selling calls, the trading strategy works just as well.

The math is nearly identical and the returns are similar when you sell puts versus covered calls (in terms of your potential obligation, the so-called "capital at risk"). As always... for each trade, execute either the call or put trade, but not both.

Remember... with covered-call selling, you are selling a call option and simultaneously buying stock. Thus, the option is "covered" with stock. When you enter the trade in your trading platform, you should do it as a combination buy/write, or covered call.

This means you will be paying for the stock minus the premium you receive for selling the option – what's called a "net debit."

Here is how the EMC trade works as a covered call.

Buy 100 shares of EMC Corp. for about $23.75, and

Sell, to open, the EMC August $24 calls for about $0.95.

This represents a total outlay (or "net debit") of $22.80 ($23.75 stock price minus the $0.95 we receive from the call premium). Remember... you are buying 100 shares of the stock for every call option you sell against it.

Here's how the math works.

Income from sold call premium of $0.95 is $95.

Purchase of 100 shares of EMC at $23.75 is $2,375.

Initial outlay: $2,280.

If EMC shares sell for $24 or more on August 16, the stock will be "called" away from you at $24 a share. This gives you a net gain of $1.20 per share on the position (the difference between our initial outlay and the price at which you sold your shares). This is about 5% in less than two months, for an annualized return of about 30%.

Of course, if the stock trades for less than $24, your calls will expire worthless and you'll still own the stock, uncovered. You can keep the $95 premium and the future dividend stream from 100 shares of EMC. That should amount to $40 a year per 100 shares. This is a total of $135 (the $95 premium plus the $40 dividend) on a $2,400 investment, or about 5.6% a year.

The prices we've used in describing the trade are based on May 27 trading. Anyone who is familiar with options trading knows options prices can move around a lot, based on changes in the underlying stock's share price and the time to expiration.

Is it Too Late to Get into That Trade?

People often wonder what to do if the trade moves a little bit and the prices don't quite match what I've written up. The important thing is to understand that options prices move along with the underlying stock.

An assumption I make is that the "implied volatility" doesn't change much from day to day. (This may or may not turn out to be true. But it's a reasonable assumption over short periods of time.)

The prices people pay for options represent ("imply") the future variability in the price of the underlying stock. If people expect prices to rise or fall quickly, they will bid up option prices. And thus, the implied volatility increases. When people are comfortable and fearless about stocks, they won't pay much for calls or puts. Thus, the implied volatility decreases.

So... how does this influence our EMC trade and what are good prices to accept if the stock shifts around?

Below I've created a table that shows how EMC options prices should move over the next week (assuming implied volatility for the options between 25%-27%). When you go to open a position, compare the date and share price with the table. If you can sell the options near the listed price, that represents a good opportunity to open a position. So for example, if by Tuesday, EMC shares are trading for $23.25, you can safely sell the put for around $0.76 each.

Note that in the case of calls, if the stock price drops a quarter, then we will get about $0.10 per share less. Similarly, the more time passes the less value the call has. So even if nothing else changes by Tuesday, we can expect to receive less for the call.

The same thing happens with put options except in reverse. That is, the higher the stock price goes, the more the value of the option decreases. The passage of time also causes the put's value to decrease.

Again, please use this table as a guide to help gauge acceptable prices for opening today's trade. (Please note, "DTE" refers to "days to expiration.")

Q: In an IRA account, we have had three different covered call trades assigned early in recent months, the latest being XLK just a day or so before expiration. I realize the person on the other side of the trade is doing this to collect the dividends, but wonder if this is happening to most of us, or if there is anything one can do to decrease the risk of early assignment.

A: When you get "assigned" on a covered call, the option buyer buys your shares for the highest price you could possibly get and your shares get "called away." So don't worry about getting assigned early... It's actually a good thing.

And you're correct. Some traders do this to capture a dividend, like in the case of XLK. But these traders will be shocked come tax time when they have to pay income tax on the dividends at the earned income rate rather than the much lower 15% dividend rate.

Here's why we're not worried about getting assigned early. If you were exercised and called away in less time, you got your money that much sooner. You can put your capital to work that much quicker.

Plus, the dividend is already factored into the formula for calculating option prices and volatility. So when we sell calls and puts, the dividend is part of the price. Think of it this way... We already earned the dividends – they're included in the option premium. Having someone give us that dividend sooner than they should is simply an early birthday present. We'll gladly take it and make even more money.

Q: Could you please explain the consequences of, and best response to being put a stock prior to expiration? I've heard that if my put is in the money, I could be put the stock at any time. On a different note, which are the most profitable options strategies in a down and volatile market a) where you own the underlying security, and b) where you don't own the underlying security?

A: You can be "put" the stock at any time. The holder of a put could exercise the option and thus make you buy the stock for more than the current "open market" price but if time remains before expiration, he likely won't. After all, the stock is moving down. People think, "Let's wait and see if I can make even more money from it moving down." Sometimes it works, and sometimes it doesn't. If you are put the stock, you can continue to earn income through the dividend on the stock (if there is one) and selling covered calls.

Regarding your second question; If you know the market is going down, you can put on what we call a "cap and collar." It's basically selling a call against your stock position to pay for a put that you purchase to protect your downside. It's not usually a good way to open a position but it's an excellent way to preserve capital and protect gains on stocks you've held for a while. It's ideal for a market correction like we experienced last month. I hope some of you were able to use it to protect your portfolios.

RSS Feed

RSS Feed