| MARKET CONDITIONS I personally don't share the opinion that this artificial "Bull Market" will last to 2015. I think the Fed's objectives will have been met by mid-year 2014. That doesn't mean we shouldn't enjoy the ride while it lasts. Tech is going to go through the ceiling this summer and may not peter off until the end of the first quarter 2014. My Intel and Microsoft Calls are showing 300% + returns so far. |

By Dr. Steve Sjuggerud

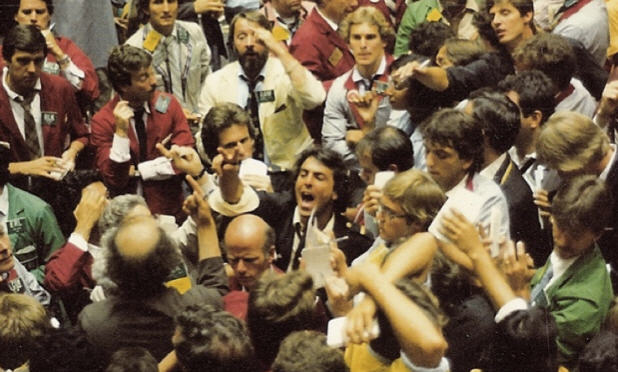

The stock market boom so far has been incredible... And it isn't ending anytime soon.

The Dow Jones stock index is up 22% since November. It's hitting new all-time highs. And most people are worried that a bust is just around the corner. But those people don't get why the market is going up.

This stock market boom is not about an improving economy, improving home sales, or improving corporate revenues. It is about stimulus from the Federal Reserve. So the question becomes, when will the Fed's stimulus end? Here's what you need to know. The "Bernanke Asset Bubble" is shorthand for my long-term thesis that asset prices – namely U.S. stocks and U.S. housing prices – can and will soar to unimaginable heights, thanks to the Fed's commitment to keeping interest rates low.

You see, low interest rates force investors out of bonds and into stocks and real estate. And the Fed isn't going to let interest rates rise anytime soon. The Federal Reserve has a "dual mandate" – it's trying to accomplish two things. It wants to 1) keep prices stable and 2) keep people employed. The Fed has laid out its specific targets... It wants to see the unemployment rate below 6.5%. And it wants inflation to get up to 2%. It will keep stimulating the economy until its objectives are met.

Today, the unemployment rate is 7.7%. A survey of 75 economists forecast that the unemployment rate will fall gradually to 6.9% in the fourth quarter of 2014. This works out to unemployment going down by roughly 0.1% a quarter. And today, the inflation rate (as measured with the Fed's favorite inflation measure, the "core PCE") is 1.1% – well below the Fed's target of 2%.

Bloomberg's survey of Wall Street economists says that the inflation rate will still fall short of the Fed's target... with estimates of 1.5% for the fourth quarter of 2013 and 1.85% for the fourth quarter of 2014. Unless something drastic happens, unemployment is not going to fall fast enough and inflation is not going to rise fast enough to cause the Fed to stop stimulating the economy anytime soon. The simple conclusion here is that the Fed will continue "juicing" the U.S. stock market at least through the end of 2014.

It will not get in the way of this boom. Don't over-think it. The message is simple: Own U.S. stocks. This is a 100% Fed-driven stock market. And the Fed stimulus will continue for a while. Low interest rates and low inflation will help "propel stocks to levels higher than anyone can imagine. I believe the stock market could rise 95% in the next three years. But if you position yourself correctly, you could make much more than that.

The stock market boom so far has been incredible... And it isn't ending anytime soon.

The Dow Jones stock index is up 22% since November. It's hitting new all-time highs. And most people are worried that a bust is just around the corner. But those people don't get why the market is going up.

This stock market boom is not about an improving economy, improving home sales, or improving corporate revenues. It is about stimulus from the Federal Reserve. So the question becomes, when will the Fed's stimulus end? Here's what you need to know. The "Bernanke Asset Bubble" is shorthand for my long-term thesis that asset prices – namely U.S. stocks and U.S. housing prices – can and will soar to unimaginable heights, thanks to the Fed's commitment to keeping interest rates low.

You see, low interest rates force investors out of bonds and into stocks and real estate. And the Fed isn't going to let interest rates rise anytime soon. The Federal Reserve has a "dual mandate" – it's trying to accomplish two things. It wants to 1) keep prices stable and 2) keep people employed. The Fed has laid out its specific targets... It wants to see the unemployment rate below 6.5%. And it wants inflation to get up to 2%. It will keep stimulating the economy until its objectives are met.

Today, the unemployment rate is 7.7%. A survey of 75 economists forecast that the unemployment rate will fall gradually to 6.9% in the fourth quarter of 2014. This works out to unemployment going down by roughly 0.1% a quarter. And today, the inflation rate (as measured with the Fed's favorite inflation measure, the "core PCE") is 1.1% – well below the Fed's target of 2%.

Bloomberg's survey of Wall Street economists says that the inflation rate will still fall short of the Fed's target... with estimates of 1.5% for the fourth quarter of 2013 and 1.85% for the fourth quarter of 2014. Unless something drastic happens, unemployment is not going to fall fast enough and inflation is not going to rise fast enough to cause the Fed to stop stimulating the economy anytime soon. The simple conclusion here is that the Fed will continue "juicing" the U.S. stock market at least through the end of 2014.

It will not get in the way of this boom. Don't over-think it. The message is simple: Own U.S. stocks. This is a 100% Fed-driven stock market. And the Fed stimulus will continue for a while. Low interest rates and low inflation will help "propel stocks to levels higher than anyone can imagine. I believe the stock market could rise 95% in the next three years. But if you position yourself correctly, you could make much more than that.

RSS Feed

RSS Feed