| MARKET CONDITIONS PROFILE: SPDR Financial Sector Fund (NYSE: XLF) The stage is set for a global financial reset. The central bankers in the U.S. and Europe plan to use inflation to wipe away their bad debts. That is their only hope. It will end in crisis, but in the meantime, it's setting up a "nearly risk-free way to make huge gains in bank stocks. Banks today are nearly as strong as they've ever been. |

By Brian Hunt

As we expected, financial-stock investors are enjoying one of the biggest trends in the entire market.

In the June 18, 2012 Growth Stock Wire, analyst Larsen Kusick noted how banking stocks were cheap, hated by most investors, and putting in a tradable bottom.

The fundamental case for owning bank stocks is simple: In its bid to pump up the economy, the Fed is keeping borrowing rates very low. This allows banks to pay just a little to borrow money... and then lend it out at higher rates. In late 2011, the euro debt crisis led investors to dump their bank stocks.

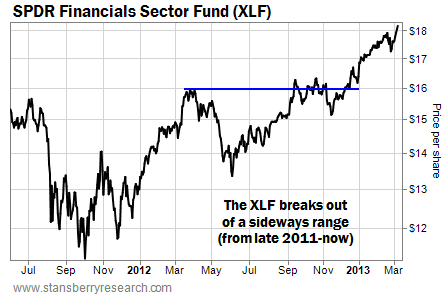

The big financial-stock fund (NYSE: XLF) fell from $15.50 per share to nearly $11 in just a few months (a 28% loss). But the Fed's pro-bank policies helped XLF recover. By the spring of 2012, it had made its way back to the $15-per-share area. As you can see from the chart below, things keep getting better for bank stocks. XLF has "broken out" of a sideways trading range in the $15 area. Shares now change hands for more than $18.

As we expected, financial-stock investors are enjoying one of the biggest trends in the entire market.

In the June 18, 2012 Growth Stock Wire, analyst Larsen Kusick noted how banking stocks were cheap, hated by most investors, and putting in a tradable bottom.

The fundamental case for owning bank stocks is simple: In its bid to pump up the economy, the Fed is keeping borrowing rates very low. This allows banks to pay just a little to borrow money... and then lend it out at higher rates. In late 2011, the euro debt crisis led investors to dump their bank stocks.

The big financial-stock fund (NYSE: XLF) fell from $15.50 per share to nearly $11 in just a few months (a 28% loss). But the Fed's pro-bank policies helped XLF recover. By the spring of 2012, it had made its way back to the $15-per-share area. As you can see from the chart below, things keep getting better for bank stocks. XLF has "broken out" of a sideways trading range in the $15 area. Shares now change hands for more than $18.

Even after the sector's run higher, many bank stocks are cheap. For example, industry giant Bank of America is trading for less than book value. But on a very short-term basis, XLF is a little "overstretched" to the upside. So if you're not long yet, it's best to wait on a 3%-5% pullback before buying.

Overall, though, the "big trend" here is clear. One of our favorite common-sense methods for finding tradable big trends is one introduced by legendary trader Ed Seykota: Post a chart on the wall, go to the other side of the room, and if you can make out the trend from there, you've got a potentially good "trend trade." With bank stocks, you've got such a trend. And the fundamentals point to this trend running higher and higher.

Overall, though, the "big trend" here is clear. One of our favorite common-sense methods for finding tradable big trends is one introduced by legendary trader Ed Seykota: Post a chart on the wall, go to the other side of the room, and if you can make out the trend from there, you've got a potentially good "trend trade." With bank stocks, you've got such a trend. And the fundamentals point to this trend running higher and higher.

RSS Feed

RSS Feed