By Frank Curzio, editor, Small Stock Specialist

Friday, May 17, 2013

One of my favorite sectors is just starting to make gains... I expect much more to come...

These companies make the "chips" that go into computers, smartphones, video-game consoles, and other electronic devices. They were one of the few great "bargains" left in the stock market. And they had a big-picture tailwind working in their favor. This sector is still cheap and has huge upside potential. Let me explain...

Chip stocks have spent the past two years drastically underperforming the S&P 500. Most of the weakness was due to a massive drop in personal computer (PC) sales. Despite the growth in sales of tablets – like Apple's iPad and Microsoft's Surface – the PC slowdown left most chip companies stuck with inflated inventory levels.

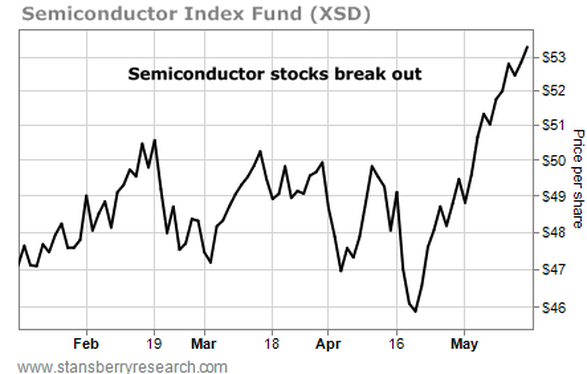

Also, investors were terrified things would get worse for the global economy. If the economy is slow and folks aren't buying electronics, semiconductor makers suffer. So the market dumped chip stocks. The big semiconductor fund (NYSE: XSD) fell 25% in five months. The sell off left the sector full of cheap, low-risk, high-reward opportunities. And now, the market is starting to turn around. As you can see in the chart below, chip stocks are finally breaking out.

Since March, the sector is up 12%. And this move higher is just beginning...

Chip companies have been cutting inventory levels over the past 12 months. According to investment firm Goldman Sachs, inventory is down 17% for the sector. This means supplies are shrinking and chip companies can ramp up production.

Plus, according to consulting firm Infonetics Research, global telecom companies like AT&T, Verizon, and China Mobile will spend more than $300 billion this year to upgrade equipment and improve wireless infrastructure. In fact, telecom spending is expected to surpass $1 trillion over the next three years. Telecom companies are some of chip stocks' biggest customers.

A few companies that will benefit from this tailwind are Altera, Xilinx, and LSI. These chip stocks are cheap based on conservative earnings estimates. They have strong balance sheets and just bounced off their recent lows. But my favorite play on the sector is Cypress Semiconductor (NASDAQ: CY).

Cypress is a leader in touchscreen-chip technology. The company is well-positioned to benefit from telecom's massive spending spree. It has contracts with 80% of the companies in the telecom industry, including AT&T, Verizon, and T-Mobile. It also supplies international telecom companies, including China Mobile.

The stock is dirt-cheap, trading at 13 times forward earnings. Plus, Cypress pays a 4% yield. This dividend is safe thanks to the company's ability to generate huge cash flow. Chip stocks like Cypress still have a big picture tailwind working in their favor. If you haven't already, I recommend taking a position today.

Friday, May 17, 2013

One of my favorite sectors is just starting to make gains... I expect much more to come...

These companies make the "chips" that go into computers, smartphones, video-game consoles, and other electronic devices. They were one of the few great "bargains" left in the stock market. And they had a big-picture tailwind working in their favor. This sector is still cheap and has huge upside potential. Let me explain...

Chip stocks have spent the past two years drastically underperforming the S&P 500. Most of the weakness was due to a massive drop in personal computer (PC) sales. Despite the growth in sales of tablets – like Apple's iPad and Microsoft's Surface – the PC slowdown left most chip companies stuck with inflated inventory levels.

Also, investors were terrified things would get worse for the global economy. If the economy is slow and folks aren't buying electronics, semiconductor makers suffer. So the market dumped chip stocks. The big semiconductor fund (NYSE: XSD) fell 25% in five months. The sell off left the sector full of cheap, low-risk, high-reward opportunities. And now, the market is starting to turn around. As you can see in the chart below, chip stocks are finally breaking out.

Since March, the sector is up 12%. And this move higher is just beginning...

Chip companies have been cutting inventory levels over the past 12 months. According to investment firm Goldman Sachs, inventory is down 17% for the sector. This means supplies are shrinking and chip companies can ramp up production.

Plus, according to consulting firm Infonetics Research, global telecom companies like AT&T, Verizon, and China Mobile will spend more than $300 billion this year to upgrade equipment and improve wireless infrastructure. In fact, telecom spending is expected to surpass $1 trillion over the next three years. Telecom companies are some of chip stocks' biggest customers.

A few companies that will benefit from this tailwind are Altera, Xilinx, and LSI. These chip stocks are cheap based on conservative earnings estimates. They have strong balance sheets and just bounced off their recent lows. But my favorite play on the sector is Cypress Semiconductor (NASDAQ: CY).

Cypress is a leader in touchscreen-chip technology. The company is well-positioned to benefit from telecom's massive spending spree. It has contracts with 80% of the companies in the telecom industry, including AT&T, Verizon, and T-Mobile. It also supplies international telecom companies, including China Mobile.

The stock is dirt-cheap, trading at 13 times forward earnings. Plus, Cypress pays a 4% yield. This dividend is safe thanks to the company's ability to generate huge cash flow. Chip stocks like Cypress still have a big picture tailwind working in their favor. If you haven't already, I recommend taking a position today.

RSS Feed

RSS Feed