A few years ago, I learned about a very clever strategy... one that allows you to protect the value of your current savings during a currency crisis like the one we are experiencing today...

It's a strategy that enables you to benefit from a unique set of assets that will do spectacularly well as the U.S. government continues printing and borrowing money. Now, this has nothing to do with gold or silver or any other type of precious metals investment. Also, you don't have to open up a foreign bank account, or speculate in foreign currencies. In fact, this strategy is extremely safe, and the investments are very easy to buy and sell from any regular broker.

What's more, some of the world's best investors and money managers have taken advantage of similar strategies to grow their own fortunes. They include Ken Fisher, Chris Davis, Ron Baron, and Monish Pabrai, to name a few. Perhaps you've never heard of these guys, but they are some of the richest and most powerful men in the financial sector.

Monish Pabrai, for example, is typically referred to as the "next Warren Buffett." He manages more than $500 million. After starting his fund in 1999, he earned 600%-plus gains for his investors (after fees and expenses) in just his first eight years in the business. Ron Barron is one of the 300 richest men in America according to Forbes. Chris Davis' business manages more than $93 billion.

In this report, I'm going to show you how to make a simple investment – right alongside some of these investors – that will help to protect and grow your savings during a currency crisis. Before I explain our strategy... I want to be clear about one thing...

The U.S. Is Facing an Imminent Currency Crisis.

This crisis will manifest itself as a period of blistering inflation and have a long-lasting impact on our standard of living. How did this happen?

President Richard Nixon set this con in motion in 1971, when he severed the U.S. dollar's last tie to gold. Ever since Nixon officially took America off the gold standard, the dollar has lost its anchor. Prior to 1971, dollars represented a claim on some portion of the Treasury's gold. That capped how many new dollars the government could circulate. Freed of that limit, politicians can now create new dollars whenever they want.

Let me be clear upfront... We can't escape the fact that macroeconomic trends like inflation and international monetary policies will cause huge swings in the price of resources like gold... I'm a geologist by trade. Analyzing geologic data, staying connected to industry insiders, and vetting management teams are my specialties.

However, no one speaks more clearly and eloquently about the threat of inflation and the value of gold than Stansberry & Associates founder Porter Stansberry. He describes the advent of the "paper dollar" – backed not by gold, but simply the "full faith and credit of the United States government" – as the most powerful factor in our economy...

The power to use this debt and to control the creation of new money is the most powerful factor in our economy. The government can now create unlimited amounts of credit to control the U.S. economy...

Without the tie to gold, the amount of economic mischief our government could engineer became practically limitless. No social goal was too absurd... no war too expensive... and no government insurance scheme too patently self-serving not to finance.

Today, when the government needs more money, it cranks up the printing presses and creates more. And every time the feds print a new dollar, the value of the dollars already in your bank account declines just a little bit. You can think of your wealth as a fraction of all the dollars in the world... like a piece of a giant pie. This creation of new dollars means your slice of pie becomes smaller.

And the problem of inflation has only just begun... America faces an enormous debt problem... Again, let me quote my publisher, Porter Stansberry (from the March 2011 issue of his Investment Advisory newsletter)...

Today, total debt in the United States stands at $56 trillion – 3.8 times GDP.

That's $180,000 in debt for every man, woman, and child in the United States. That's nearly $700,000 in debt per family in the United States. The interest on these debts is more than $3.5 trillion per year. To give you some idea how much money we're spending on interest alone... just consider the total budget of the U.S. federal government is also $3.5 trillion. Again, $3.5 trillion just covers the interest!

These debts are completely unaffordable. How many families in America do you know that can afford to finance and repay $700,000 in debt? Not many... certainly not the "average" family.

The U.S. government simply has no other way out. It has taken on too much debt... and made too many open-ended promises to too many people.

If it openly defaults... it risks collapsing the economy. The only way it can pay for these promises – and its incredible debts – is to print more and more dollars... debasing an already devalued currency.

The key to protecting yourself from this currency crisis is to keep your wealth in real, tangible assets that hold their value... the things that are going to require more and more dollars to purchase. That means gold and silver bullion...

It also means keeping a good portion of your wealth in shares of world-class resource deposits. I'm talking about giant gold deposits... billion-barrel crude oil deposits... large tracks of agricultural land... and vast stores of natural gas. These deposits often go by the nickname "trophies."

It's a strategy used by generations of rich investors... as well as some of the most successful Wall Street money managers... to protect wealth from the slow, invisible threat of inflation.

You see, when paper currencies lose value, as the U.S. dollar has done since 2001, the value of "trophy" resource deposits tends to skyrocket. These vital resources – including copper, crude oil, natural gas, gold, silver, and farmland – will rise in value by hundreds of percent over the coming years.

I realize many investors believe it's extremely difficult – if not impossible – to make money in natural resource stocks. I can't say I blame them... The resource sector is one of the most volatile areas of the market. During the 2008 credit crisis, many of the world's best resource stocks fell more than 80%. The "not so best" resource stocks fell by 90%... even 99%.

There's also the fact that many resource stocks simply aren't worth the time it takes to investigate them. Out of the thousands of mining stocks out there, maybe 50 are worth knowing about. Plus, "knowing" these stocks well enough to trade them successfully requires extensive knowledge and industry contacts. Most people don't have the time for any of this. With such extreme volatility and work staring at you in the face, it's easy to "write off" the natural resource sector.

But what most people don't know is that buying trophies is an easy, safe method to making money in natural resource stocks. It's a clever strategy that allows you to protect the value of your current savings – and even see gains triple-digit gains – as the U.S. government digs itself deeper into a currency crisis.

Right now, you can make a simple investment in two stocks that are sitting on world-class trophy deposits. Investing in these companies today could set you up for hundreds of percent gains over the next few years.

Let's take a look at the first trophy stock...

Trophy No. 1:

Buying Two of the World's Best Trophy Assets

As legendary investor Warren Buffett said, "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

The next trophy stock we're buying is a wonderful company at a better-than-fair price – $30 billion copper, gold, and molybdenum producer Freeport-McMoRan (NYSE: FCX). Freeport was the world's second-largest copper producer in 2011, at 3.66 billion pounds of copper. It owns two of the world's best trophy assets: Grasberg and Tenke Fungurume.

Grasberg is a giant copper and gold deposit in Indonesia. It is the world's largest gold mine and third-largest copper mine. Tenke Fungurume is one of the world's largest copper and cobalt deposits. It covers nearly 580 square miles in the Democratic Republic of Congo.

Freeport also owns a large portfolio of copper mines in North and South America – three in Chile and one in Peru. And it owns another nine operations in the U.S. – two in Colorado, two in New Mexico, and five in Arizona. Freeport is also the world's largest molybdenum producer.

In 2012, it made about 32% of its operating income from its mines in North America, 20% from Grasberg, 36% from its mines in South America, and 9% from Tenke Fungurume. It generated 2% of operating income from molybdenum sales.

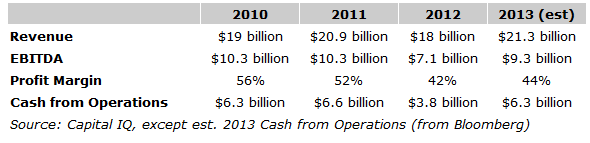

These mines are good businesses... Freeport had a 52% profit margin in 2011. It was 42% in 2012, due to lower metal prices and an 18% production decline at Grasberg. But that is still good for a mining company. And if the price of copper rises in 2013 – as I suspect it will – we could see big profit margins like this again.

The average copper price was about 5% lower in 2012 than it was in 2011. And that pushed Freeport's share price down along with the rest of the sector. But a recent acquisition sent its shares falling even farther.

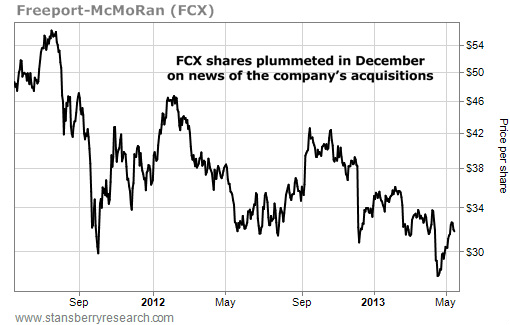

On December 5, FCX announced the acquisition of oil and natural gas explorers McMoRan Exploration (MMR) and Plains Exploration (PXP) for a total of $9 billion. Both companies work as partners on an "ultradeep gas" discovery in the shallow Gulf of Mexico. The market reacted poorly to the news. And as you can see in the chart below, shares fell 21% over the next two days.

That – and the general downtrend in mining stocks over the last year – has created a fantastic opportunity for folks like us... who understand both Freeport's copper business and its acquisition. And I think we have a fantastic entry price right now.

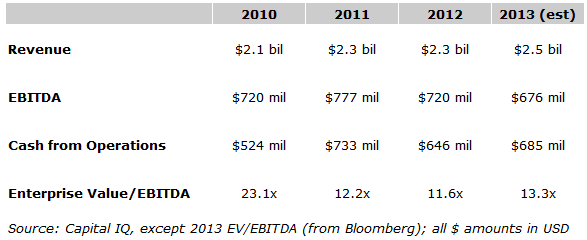

As you can see in the table below, 2012 was a tough year for Freeport. The company's earnings dropped substantially from the levels of 2010 and 2011. That's a big part of why the company's shares fell so far from their 2011 peak of $58 to the recent close of $32.

Why the Market Is Wrong about Freeport?

Many investors think Freeport's acquisitions of McMoRan Exploration and Plains Exploration was a bailout.

In December, Freeport bought Plains for $6.9 billion in cash and stock and McMoRan for $3.4 billion in cash and stock. Once you factor in the debt Freeport also took on as part of the acquisitions, its total cost comes to $14 billion. In total, it paid about 6.6 times 2012 earnings estimates for Plains Exploration and about 21 times 2012 earnings estimates for McMoRan.

That seems like a fat premium to pay for such a deal. You can think of it as the number of years that the earnings would take to repay the acquisition costs. Obviously, 21 years (for McMoRan) is too long. But Freeport – and specifically its Chairman, James R. Moffett – is known for big mergers... and if McMoRan's exploration wells succeed, profits will soar.

"Jim Bob," as he's known, has a history of huge acquisitions. In 1981, he spearheaded one of the largest corporate mergers ever (at the time)... between his McMoRan Oil & Gas and Freeport Minerals Company. The merger created Freeport-McMoRan, which has grown into one of the world's largest natural resource companies. Then in 2007, he again led the company into a merger with Phelps Dodge. At $27 billion, it was the largest mining company takeover in history.

In addition to his role at Freeport, Jim Bob is a founder and co-chairman of McMoRan Exploration. He and two partners founded the company in 1967. He currently owns 3% of McMoRan's shares and is an intimate player in its business. That's why many investors viewed this deal as a bailout. Jim Bob and several other board members made a lot of money in the deal. Since Freeport paid a high price for the company its chairman founded, this looks like a serious conflict.

As I said before... McMoRan and Plains are exploring a major new series of "ultradeep natural gas" fields in the Gulf of Mexico. The targets are the same giant sand bodies found in the deep offshore fields. These fields are prolific oil and gas producers in deep water, and McMoRan's geologists believe they extend up close to land, as well.

Exploring for gas in wells nearly five miles underground is difficult, costly, and risky. But the area McMoRan is targeting is large, it has four operating wells – and if it makes a discovery, it will be a huge success... According to preliminary economic calculations, the finding and development cost for the ultra-deep gas is about $1.50 per thousand cubic feet (MCF). So McMoRan only needs a natural gas price of $2.20 per MCF to make 15% profit. (Right now, natural gas is around $4 per MCF.)

There's big potential here... But it was clear from the company's filings that McMoRan was going to be strapped for cash as it first took on these deep wells. Since natural gas exploration is far from Freeport's expertise, some investors felt the deal was simply Jim Bob's way of saving his original company. But I'm not so sure.

Jim Bob has been in the business for many decades, and he has intimate knowledge of the assets he buys. It's more likely (in my opinion) that he knows something about this area and the companies Freeport bought.

Plus... the single largest expense for a miner is energy costs. A miner is at the mercy of energy prices. If costs rise, it loses money. But if that miner also owns oil and gas production, it will make money as prices rise... offsetting rising costs at the mine. So you can look at Freeport's acquisition as a hedge against a rising energy cost for its mining business.

I'm not alone in this support. Billionaire Leon Cooperman, founder of Omega Fund, made a lot of money in 2012 buying undervalued stocks. In a recent interview on CNBC, he voiced his support for Jim Bob, and said that he is buying Freeport.

There certainly is risk in this investment. The copper price could fall, some unseen bump in the road could derail the U.S. economic recovery, or McMoRan could go 0-for-4 on its wells. But we're mitigating that risk by buying shares cheaply and putting in a hard stop. We're going to put in a hard stop at $28 per share. If shares fall below $28, that would be the lowest price since 2009. Such a fall is unlikely.

If we are correct... if copper prices continue to rise, and if crafty old Jim Bob knows what he's doing... we could easily make 80% or more in the next 18 months.

Action to take: Buy Freeport-McMoRan (NYSE: FCX) up to $39 per share. Sell those shares if they fall below $28.

Trophy No. 2:

The Only Uranium Miner Worth Owning

When it comes to investing in energy, the most important number you need to know is: 5.3.

That's the number of Chinese people who live on the electricity you or I consume in a year. In other words, China consumes just 20% of our electrical supply. India uses even less per capita. Nearly 30 Indians live on the electricity of a single American.

This is a startling gap... And it's going to close over the coming decades. China and India are the world's largest populations. And they are growing wealthier and wealthier. Energy consumption is a direct result of increased wealth. True Western wealth is a climate-controlled home with cold beer, a big TV, and fast Internet. All that requires energy.

The people in India and China want that kind of Western wealth. More important, they have the money to buy it. You can see the shift happening already... China's energy consumption grew by an average 7% per year from 2003 to 2010. That rate should continue through 2020.

This is a new phenomenon for us. In the past, we in the West only competed among ourselves for resources. Now, we're going to compete with 2.5 billion people eager to enjoy a cold beer in their air-conditioned living rooms.

That's going to drive the real price of energy resources higher... China and India are going to make our lives a lot more expensive. Now imagine combining the real price of energy with homegrown inflation. We're talking about a major spike in price. That's why the first resource hoard we want to secure is a critical fuel for generating electricity – uranium...

Uranium's Role in the Future

Despite the factors that clearly show uranium is now in line for a long move higher... the post-Fukushima revulsion directed at nuclear power hurt the uranium market.

As ultra-successful resource investor Rick Rule, founder of Sprott Global Resource Investments, pointed out in a recent interview... When the Japanese shut down their nuclear power plants, they took 20 million pounds of demand off the market. And the decision added 15 million pounds of supply, as the country's power companies sold off their surplus fuel to generate revenue that wasn't coming from electricity.

So that short-term drop in demand and spike in surplus supplies dumped on the market killed uranium prices over the past year. That's why we have the opportunity we do today.

The chart below is of Cameco (NYSE: CCJ), the world's largest uranium miner. As you can see, its share price fell 60% from its February 2011 high to its November 2012 low. After a brief rally at the start of 2012, Cameco's shares fell another 38% from February to November. Every publicly traded uranium producer sports a nearly identical stock chart.

Investors have not always hated uranium... In 2006, it was all the rage. After spending most of the 1990s trading for less than $15 per pound, it finally began to rise. From January 2005, when uranium traded for $20.50 per pound, the resource shot up to about $135 a pound in mid-2007... a more than 550% run-up.

In the early 2000s, before the uranium's big swing higher, Rick was talking up the nuclear fuel's potential. He told anyone who would listen to him that uranium was far too cheap. Miners were losing money, and that the situation had to change. And it did.

Now, Rick is back talking about uranium again. And his story is the same as it was in the early 2000s. The cost of mining is much higher, than it was a decade ago. Uranium prices are not keeping up. Miners are losing money again.

According to Rick, the "term price" of uranium, which is the price paid for long-term sources of supply contracts, is $65-$70 per pound. The spot price is nearly $40 per pound. He and his analysts came up with a production cost of $85 per pound for miners. In other words, miners are losing nearly $50 per pound selling at the spot price today.

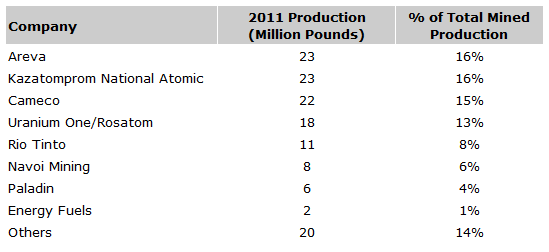

Things have to change. To see if I could find the same value Rick quoted... I took a closer look at the largest uranium producers. The table below is a list of all the significant uranium miners in the world.

While all these companies publish mining costs, I wanted a more inclusive figure... So instead, I used the "cost of revenue," which includes all the business' costs, instead of just the mining costs. Areva produced 23 million pounds of uranium and spent almost $163 per pound doing so. And it was by far the most expensive. Paladin Resources mined 5.7 million pounds of uranium at a cost of almost $90 per pound. Cameco produced more than 22 million pounds of uranium last year at a cost of almost $73 per pound. Uranium One was the most efficient producer. It mined over 10 million pounds of uranium in 2011 at a cost of $58 per pound.

The volume-weighted average cost of uranium for this group – which represents 43% of the uranium mined in 2011 – came to nearly $106 per pound. Even though my number is larger than Rick's, it tells the same story... producers cannot sell to the spot market without losing money. At $40 per pound, they are losing $66 on every pound they sell. That is a great way to go bankrupt. The spot price simply has to rise... eventually.

That is why we're going to take a hard look at the universe of uranium companies. This month, we'll focus on those companies that are either in production, or close to production. They are the ones that will benefit most from a rise in the spot price.

The opportunity in uranium is so promising right now that we are going to put a slate of them in the model portfolio. These companies are so beaten-down that we won't risk more than 12.5% on any of them... and our potential gains are as much as 300% if they simply recover to their pre-Fukushima prices.

The Trophy Uranium Company

The trophy investment in uranium mining is Cameco (NYSE: CCJ) – an $8 billion miner that accounts for 14% of the world's uranium production.

This giant miner has a great balance sheet, excellent assets, and owns shares of junior miners in the sector. Its mines account for 16% of the world's mine production of uranium. It owns 465 million pounds of uranium reserves. It controls some of the world's best uranium mines. This is the ExxonMobil of uranium.

When we bought Cameco back in October 2011, it appeared that the industry was recovering from Fukushima. Unfortunately, the European debt crisis arose... Panicked investors dumped all assets that seemed risky and sent all resource stocks (including uranium) into a tailspin. We held the stock until June 2012, when we stopped out for a 21% loss.

We're going to buy Cameco again today. But this time we're going to protect our investment with a hard stop. You see, Cameco has never fallen to less than $16 per share since March 2009. If we're wrong about the direction of uranium stocks and Cameco hits that level again... we'll sell. That's about $4.80 per share less (or 23%) than its current price. That's all the capital we're going to risk here.

If we're right and uranium rallies, we could easily see shares of Cameco trading for more than $40 again... That would be a gain of 100%. So we'll risk 23% to potentially make 100% (or more).

Action to take: Buy Cameco (NYSE: CCJ) up to $20 per share. If shares fall below $16, we will sell. Don't overpay for shares. If they rise above the price of our recommendation, be patient. They should eventually come back down into buy range.

Trophies: Where to Put Your Paper Dollars While There's Still Time

In summary, we're buying some of the world's biggest and best collections of resources. These companies are all globally recognized blue-chip resource stocks.

Additionally, this set of "low-risk/high-potential reward" trophy trades is much more about finding tangible assets that hold their value. Remember, in today's world of giant government malinvestment and currency crises, you should keep a good portion of your wealth in the things that are going to require more and more dollars to purchase.

Again, we're risking a little to make a lot, which is the hallmark of successful trading.

RSS Feed

RSS Feed