| MARKET CONDITIONS Just last month my step-mother asked her broker at Morgan Stanley about buying Caterpillar. Thank God she took me with her to re-organize her portfolio. I said no way due to the global economic slowdown. That week 60 Minutes aired a report on China's over developed crisis. Talk about timing. |

By Amber Lee Mason and Brian Hunt

Want to hedge your portfolio against a global economic crisis? Supertrader Jim Chanos can help you...

Chanos is one of the world's best short-sellers. Most traders and investors attempt to profit from stocks rising in price. But "short sellers" attempt to profit from stocks falling in price. (Read this educational guide from our colleague Jeff Clark for the details.)

Chanos and his team of forensic accountants blew the whistle on Enron – the big energy-trading firm that went bankrupt in 2001. He's also famous for predicting the big declines in telecom giant WorldCom, PC makers Dell and Hewlett-Packard, and state-owned oil giant Petrobras.

Now, Chanos believes another company is poised to suffer a substantial fall. And shorting this stock happens to be an excellent hedge for folks worried about a big economic decline spurred by rising commodity prices from 2002 to 2008 and from 2009 to 2011, mining companies have plowed hundreds of billions of dollars into new projects.

Many of these projects are geared toward selling output to China, the world's workshop. And Caterpillar (CAT), the world's largest maker of mining and construction equipment, has enjoyed this spending boom, selling more equipment than ever to mining companies... But now it's ending. Chanos believes the Chinese economy is in the midst of a major slowdown. He says the government has encouraged too much investment in real estate and infrastructure.

As China's economy slows (or worse), it will consume less commodities... which will suppress mining investment... and damage Caterpillar's earnings. Over the past year, Caterpillar has earned $6.77 per share. Chanos believes a continued slowdown in China and commodities could drag those earnings down to $5 per share or lower. He also notes that the company's profit margin is near historically high levels. He sees the margin "reverting to the mean" and falling back to a normal range... which will further suppress earnings.

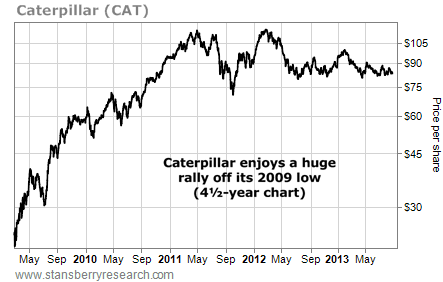

As you can see from the chart below, Caterpillar enjoyed a huge rally off the 2009 bottom. Shares climbed from $20 in early 2009 to $112 in 2012. Since then, shares have declined to $83.

Want to hedge your portfolio against a global economic crisis? Supertrader Jim Chanos can help you...

Chanos is one of the world's best short-sellers. Most traders and investors attempt to profit from stocks rising in price. But "short sellers" attempt to profit from stocks falling in price. (Read this educational guide from our colleague Jeff Clark for the details.)

Chanos and his team of forensic accountants blew the whistle on Enron – the big energy-trading firm that went bankrupt in 2001. He's also famous for predicting the big declines in telecom giant WorldCom, PC makers Dell and Hewlett-Packard, and state-owned oil giant Petrobras.

Now, Chanos believes another company is poised to suffer a substantial fall. And shorting this stock happens to be an excellent hedge for folks worried about a big economic decline spurred by rising commodity prices from 2002 to 2008 and from 2009 to 2011, mining companies have plowed hundreds of billions of dollars into new projects.

Many of these projects are geared toward selling output to China, the world's workshop. And Caterpillar (CAT), the world's largest maker of mining and construction equipment, has enjoyed this spending boom, selling more equipment than ever to mining companies... But now it's ending. Chanos believes the Chinese economy is in the midst of a major slowdown. He says the government has encouraged too much investment in real estate and infrastructure.

As China's economy slows (or worse), it will consume less commodities... which will suppress mining investment... and damage Caterpillar's earnings. Over the past year, Caterpillar has earned $6.77 per share. Chanos believes a continued slowdown in China and commodities could drag those earnings down to $5 per share or lower. He also notes that the company's profit margin is near historically high levels. He sees the margin "reverting to the mean" and falling back to a normal range... which will further suppress earnings.

As you can see from the chart below, Caterpillar enjoyed a huge rally off the 2009 bottom. Shares climbed from $20 in early 2009 to $112 in 2012. Since then, shares have declined to $83.

If the Chinese economy severely weakens over the next year or two, shares of Caterpillar could easily suffer a hit to the $50-$60 range. This would be a drop of 28%-40%.

Some Growth Stock Wire readers are worried a global economic slowdown (or worse) is coming soon. In that scenario, Caterpillar will plummet and bets against it will pay off. So if you're bearish on the economy, you'll find this idea useful. More optimistic readers can simply consider a short position in Caterpillar as a way to hedge their long portfolios.

We know some folks won't short stocks. Some see it as "un-American" to bet against U.S. companies. At the very least, it's a good idea to avoid buying Caterpillar. One of the world's best traders singled it out as very vulnerable. Chanos may be wrong on Caterpillar, but it's not a good idea to bet against him.

Some Growth Stock Wire readers are worried a global economic slowdown (or worse) is coming soon. In that scenario, Caterpillar will plummet and bets against it will pay off. So if you're bearish on the economy, you'll find this idea useful. More optimistic readers can simply consider a short position in Caterpillar as a way to hedge their long portfolios.

We know some folks won't short stocks. Some see it as "un-American" to bet against U.S. companies. At the very least, it's a good idea to avoid buying Caterpillar. One of the world's best traders singled it out as very vulnerable. Chanos may be wrong on Caterpillar, but it's not a good idea to bet against him.

RSS Feed

RSS Feed