There are quarterly irregulars, which pay a modest dividend in three out of four quarters. One quarterly payment, however, is quite significant. There are also semi-annual irregulars, which pay one large and one small dividend each year.

Most brokerage and investment websites take a stock's most recent dividend payment and multiply it times the payment frequency to get a stock's annual dividend. These websites then use the computed annual dividend to calculate the yield.

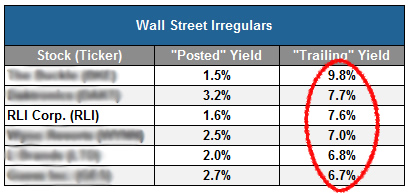

For the Wall Street Irregulars, the yield investors see often underestimates the true annual yield of the stock. Below I've listed some irregulars, showing the "posted" yield -- the yield you'll see listed on a financial website -- versus the trailing yield -- the yield based on the company's actual dividend payments over the last 12 months.

Most brokerage and investment websites take a stock's most recent dividend payment and multiply it times the payment frequency to get a stock's annual dividend. These websites then use the computed annual dividend to calculate the yield.

For the Wall Street Irregulars, the yield investors see often underestimates the true annual yield of the stock. Below I've listed some irregulars, showing the "posted" yield -- the yield you'll see listed on a financial website -- versus the trailing yield -- the yield based on the company's actual dividend payments over the last 12 months.

As this table shows, "posted yields" can be deceiving. In fact, these stocks have actually been paying dividend yields that are three or four times higher than what financial websites are reporting.

When I search for a potential holding, I normally look for a security with a predictable and frequent dividend stream. But if you have some flexibility, there are some advantages to owning an "irregular."

Take RLI Corp (NYSE: RLI) for example. RLI is a specialty insurance company with a stellar track record, delivering profits for the past 17 consecutive years and paying a dividend for 148 consecutive quarters. RLI has been paying an irregular dividend payment for the past three years.

The latest irregular dividend was $5.32 per share, up a smidge from the $5.30 it paid the previous year. If RLI maintains both its regular and irregular distributions, shareholders will see a yield of 7.6% at today's prices.

There is no guarantee that RLI will pay as generous an "irregular" dividend as it did last year. But the last three years have set a precedent that I believe management would like to maintain.

Most of the irregulars, like RLI, pay their large dividend near the end of the year. Predictably, investors flock to these stocks when the size of the large dividend is declared, driving up the share price. Investors can get a better price -- and a better yield -- by getting a jump on the crowd. So this is an especially good time of year to shop for irregulars.

More than ever, there are scores of new investors flooding into traditional dividend-paying stocks. Who can blame them, when a savings account is yielding less than 0.5%?

As a result, however, the prices of traditional dividend stocks have risen -- and the yields have fallen. In many cases, these stocks have been priced for perfection and there can be downside risk when these companies deliver less than perfect results. For instance, shares of consumer staples company Procter & Gamble (NYSE: PG) tumbled 6.6% on April 24, after the company projected lower profits than Wall Street expected for the quarter ending June 30.

When traditional income investments get crowded, there is an advantage in looking beyond what everyone else is looking at. For example, the technology sector, which had been all but ignored in this year's market rally.

Now, I'm looking at dividend stocks that aren't normally noticed for their income potential. They represent diverse businesses that pay much higher dividend yields than what's posted on mainstream financial websites. The one thing they have in common is their rising "irregular" dividend payments -- which gives them "hidden" yields of 6.1%, 7.7%, 10% or higher.

When I search for a potential holding, I normally look for a security with a predictable and frequent dividend stream. But if you have some flexibility, there are some advantages to owning an "irregular."

Take RLI Corp (NYSE: RLI) for example. RLI is a specialty insurance company with a stellar track record, delivering profits for the past 17 consecutive years and paying a dividend for 148 consecutive quarters. RLI has been paying an irregular dividend payment for the past three years.

The latest irregular dividend was $5.32 per share, up a smidge from the $5.30 it paid the previous year. If RLI maintains both its regular and irregular distributions, shareholders will see a yield of 7.6% at today's prices.

There is no guarantee that RLI will pay as generous an "irregular" dividend as it did last year. But the last three years have set a precedent that I believe management would like to maintain.

Most of the irregulars, like RLI, pay their large dividend near the end of the year. Predictably, investors flock to these stocks when the size of the large dividend is declared, driving up the share price. Investors can get a better price -- and a better yield -- by getting a jump on the crowd. So this is an especially good time of year to shop for irregulars.

More than ever, there are scores of new investors flooding into traditional dividend-paying stocks. Who can blame them, when a savings account is yielding less than 0.5%?

As a result, however, the prices of traditional dividend stocks have risen -- and the yields have fallen. In many cases, these stocks have been priced for perfection and there can be downside risk when these companies deliver less than perfect results. For instance, shares of consumer staples company Procter & Gamble (NYSE: PG) tumbled 6.6% on April 24, after the company projected lower profits than Wall Street expected for the quarter ending June 30.

When traditional income investments get crowded, there is an advantage in looking beyond what everyone else is looking at. For example, the technology sector, which had been all but ignored in this year's market rally.

Now, I'm looking at dividend stocks that aren't normally noticed for their income potential. They represent diverse businesses that pay much higher dividend yields than what's posted on mainstream financial websites. The one thing they have in common is their rising "irregular" dividend payments -- which gives them "hidden" yields of 6.1%, 7.7%, 10% or higher.

RSS Feed

RSS Feed