| MARKET CONDITIONS Get ready for a one-day-wonder rally. The S&P 500 is down over 3.6% from its high earlier this month. Most of that decline happened late last week and continued yesterday. As a result, lots of folks are calling this the start of the long-awaited correction; and lots of traders are shorting stocks aggressively into the market's weakness. Those traders are making a mistake. |

Let me be clear, I do think the market is in the process of forming a long-term top. And I think stocks will be lower in the months ahead. But I'm not shorting stocks right now... not after the market has already been smacked down hard over the past week. And not after so many short-term technical indicators are showing extreme oversold conditions. Selling stocks short into extreme oversold conditions is a sure-fire way to lose money... fast.

During bear markets and during correction phases in bull markets, stocks often experience "one-day-wonder"-type rallies. These are the huge, one-day, rocket-shots higher that happen out of nowhere after the market has hit oversold levels, when it looks like it's ready to fall off a cliff, and after traders have loaded up on the short side.

Folks looking to buy stocks rush into the market worried that they've missed the bottom. Traders who bet too heavily on the short side rush to cover to try to minimize their losses. And stocks pop violently higher.

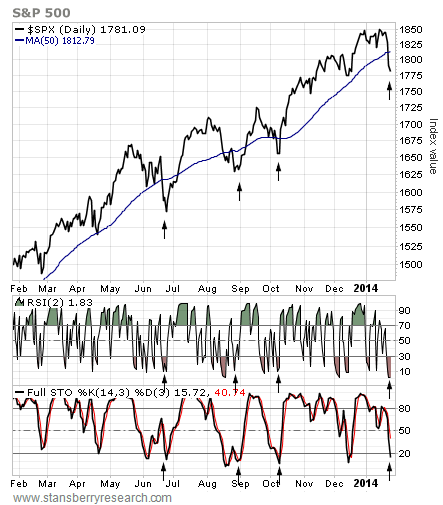

We're set up for one of those one-day-wonder rallies right now. Take a look at this chart of the S&P 500 plotted along with its 50-day moving average (DMA)...

During bear markets and during correction phases in bull markets, stocks often experience "one-day-wonder"-type rallies. These are the huge, one-day, rocket-shots higher that happen out of nowhere after the market has hit oversold levels, when it looks like it's ready to fall off a cliff, and after traders have loaded up on the short side.

Folks looking to buy stocks rush into the market worried that they've missed the bottom. Traders who bet too heavily on the short side rush to cover to try to minimize their losses. And stocks pop violently higher.

We're set up for one of those one-day-wonder rallies right now. Take a look at this chart of the S&P 500 plotted along with its 50-day moving average (DMA)...

This is the fourth time over the past year the S&P 500 has dipped below its 50-DMA and looked like it was ready to collapse. On the three previous occasions, stocks managed to rally and go on to make new highs.

This time may be different, especially if you believe as I do that stocks are forming an important long-term top. The S&P 500 may not rally back and make new highs this time around. But it is due for a rally.

Look at the two-day relative strength index (RSI) and the full stochastics – two measures of overbought and oversold conditions – at the bottom of the chart. Both of those indicators are in "extreme oversold" territory. Stocks have rallied off those conditions each time this happened before. It's likely we'll get a rally this time around, as well. And any sharp rally from this point is going to cause a lot of pain to traders who got aggressively short over the past couple days.

Rather than sell stocks short into extremely oversold conditions, it's better to wait for the inevitable oversold bounce. Traders can then short stocks as they approach obvious resistance areas, like the 50-DMA.

This time may be different, especially if you believe as I do that stocks are forming an important long-term top. The S&P 500 may not rally back and make new highs this time around. But it is due for a rally.

Look at the two-day relative strength index (RSI) and the full stochastics – two measures of overbought and oversold conditions – at the bottom of the chart. Both of those indicators are in "extreme oversold" territory. Stocks have rallied off those conditions each time this happened before. It's likely we'll get a rally this time around, as well. And any sharp rally from this point is going to cause a lot of pain to traders who got aggressively short over the past couple days.

Rather than sell stocks short into extremely oversold conditions, it's better to wait for the inevitable oversold bounce. Traders can then short stocks as they approach obvious resistance areas, like the 50-DMA.

RSS Feed

RSS Feed