Chipotle Mexican Grill (CMG), the operator of fast-casual Mexican restaurants, has over the years been one of America’s prime trend-follower stocks. Despite a rough six months in 2012, trend-followers quickly rekindled their love for Chipotle stock early this year as CMG again began to march higher.

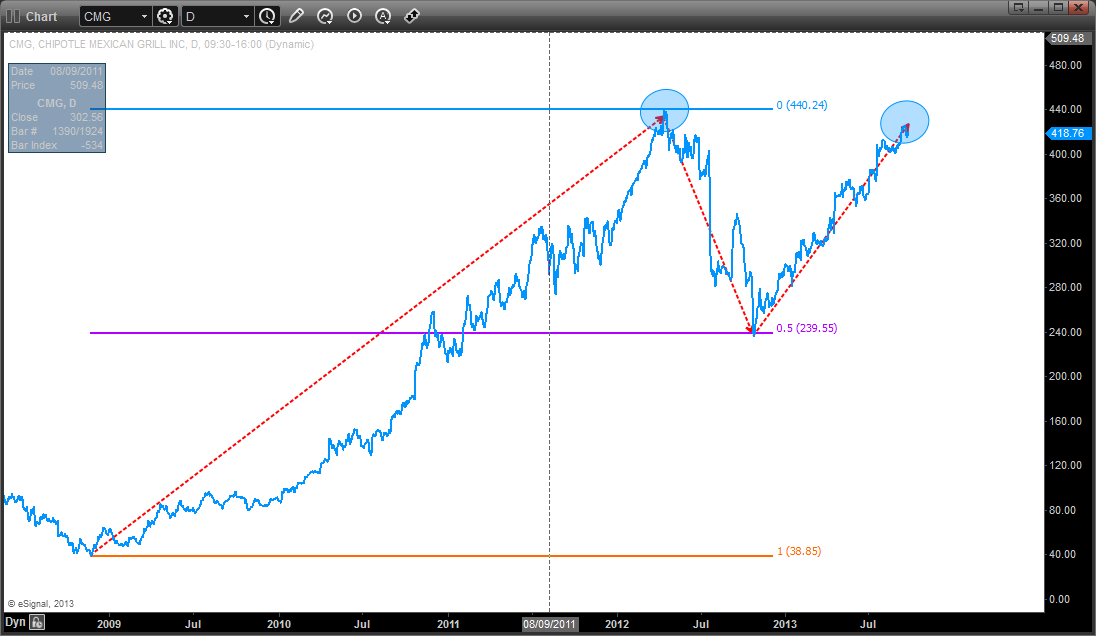

For a little perspective on all of this, see the below chart of CMG, which looks all the way back to the late-2008 bottom.

For a little perspective on all of this, see the below chart of CMG, which looks all the way back to the late-2008 bottom.

After a massive three-and-a-half year rally, Chipotle stock topped in April 2012 (which remains the all-time high) and proceeded to correct sharply until CMG found a bottom and higher low vs. the late 2008 lows in October 2012.

The October 2012 lows, not entirely by chance, coincided with an exact 50% retracement of the entire 2008-12 rally. The rally off the 2012 lows once again has the character of a strong stock, and one that is supported by both the institutional as well as the trend-following crowds.

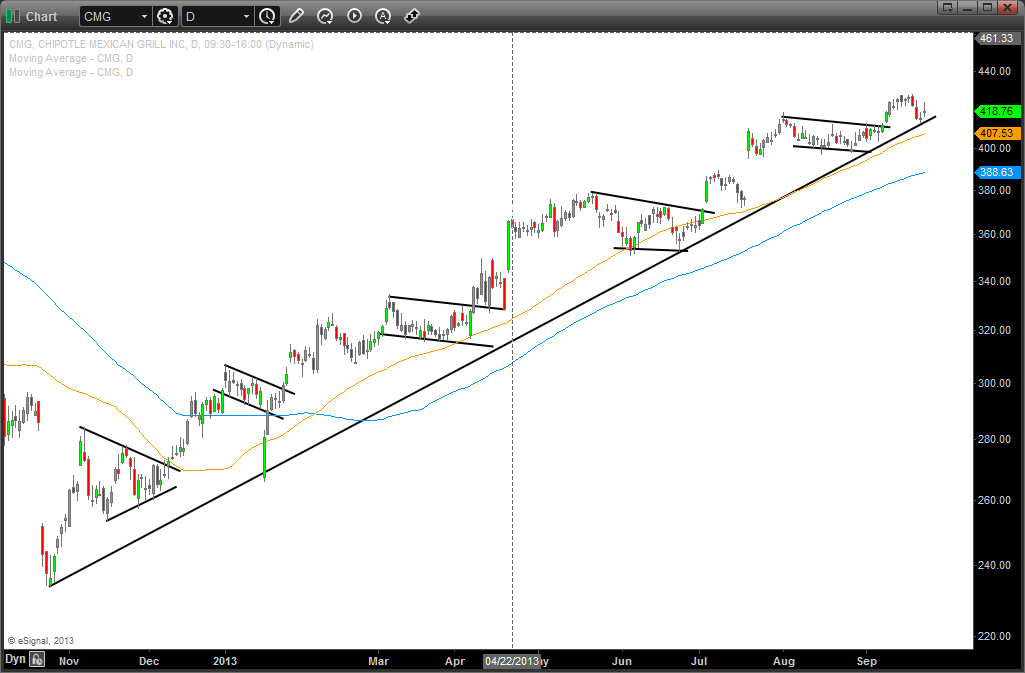

Closer up on the daily chart, see how orderly the ascent off the 2012 lows has been. Chipotle stock continues to respect its October 2012 uptrend as well as the area around the 50-day simple moving average (yellow line).

Furthermore — and as I often point out on strongly trending stocks — note the series of consolidation patterns (black parallels), followed by breakouts and retracements back to the 2012 uptrend line.

The October 2012 lows, not entirely by chance, coincided with an exact 50% retracement of the entire 2008-12 rally. The rally off the 2012 lows once again has the character of a strong stock, and one that is supported by both the institutional as well as the trend-following crowds.

Closer up on the daily chart, see how orderly the ascent off the 2012 lows has been. Chipotle stock continues to respect its October 2012 uptrend as well as the area around the 50-day simple moving average (yellow line).

Furthermore — and as I often point out on strongly trending stocks — note the series of consolidation patterns (black parallels), followed by breakouts and retracements back to the 2012 uptrend line.

Most recently, CMG found resistance along with the broader market on Sept. 18 at the highs of the post-FOMC announcement rally.

Thus far, Chipotle has simply retraced back to the 2012 uptrend line and, given its strong construct, I am willing to give it room toward its 50-day moving average around $407 as first support. Should CMG fall through there, next support would be its 100-day moving average (blue line), which has not been tested since January.

In summary, Chipotle stock so far has only managed to form a lower high vs. its April 2012 highs, but barring any snapping of its 100-day moving average, CMG looks poised to take out the 2012 highs in coming months.

Thus far, Chipotle has simply retraced back to the 2012 uptrend line and, given its strong construct, I am willing to give it room toward its 50-day moving average around $407 as first support. Should CMG fall through there, next support would be its 100-day moving average (blue line), which has not been tested since January.

In summary, Chipotle stock so far has only managed to form a lower high vs. its April 2012 highs, but barring any snapping of its 100-day moving average, CMG looks poised to take out the 2012 highs in coming months.

RSS Feed

RSS Feed