| MARKET CONDITIONS Although the XRT is performing, the reality is that it paints a very distorted picture. Americans are notorious for accumulating debt at a time when they should be worried about their future savings, residual income and retirement. With the new unemployment numbers at over 15%, I doubt the increase in the XRT is due to economic growth. It's due to joblessness and depression. |

Another week goes by and the American consumer still lives. Makes you wonder if the U.S. economy is doing better than the pessimists would have you believe. We've pointed out the soaring profits and share prices of hotel and home improvement chains as evidence.

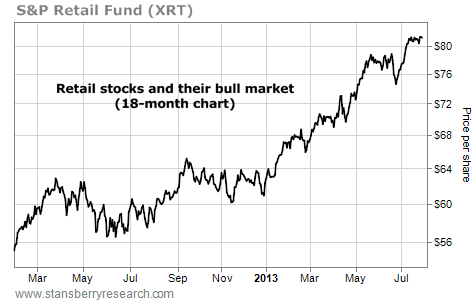

Today, we provide an update on another key idea... retail. A useful way to track retail stocks is with the S&P Retail Fund (XRT). This fund is comprised of consumer stocks, like Netflix, J.C. Penney, Best Buy, Whole Foods, Tiffany, Macy's, Saks, and Men's Wearhouse. It rises and falls with America's shopping habits. As you can see from the chart below, America is still shopping. Last summer, this fund traded for $57 per share. Over the past 12 months, shares have climbed past $80 to reach a multiyear high. Sure, the American economy has problems, but as long as XRT is soaring, we have to say things aren't all that bad.

Today, we provide an update on another key idea... retail. A useful way to track retail stocks is with the S&P Retail Fund (XRT). This fund is comprised of consumer stocks, like Netflix, J.C. Penney, Best Buy, Whole Foods, Tiffany, Macy's, Saks, and Men's Wearhouse. It rises and falls with America's shopping habits. As you can see from the chart below, America is still shopping. Last summer, this fund traded for $57 per share. Over the past 12 months, shares have climbed past $80 to reach a multiyear high. Sure, the American economy has problems, but as long as XRT is soaring, we have to say things aren't all that bad.

RSS Feed

RSS Feed