| MARKET CONDITIONS Contrary to what you might see in the mainstream media, the world’s largest stocks are still cheap. That might surprise you… A lot of the biggest blue chips have delivered tremendous gains over the last two years. Home Depot, for example, is up 136%. Visa is up 118%. But the 189 companies with a market value of $50 billion or more trade at a median 12.9 times forward earnings. That’s not expensive. And there’s one group of mega-cap stocks that’s dramatically cheaper than the rest of the pack |

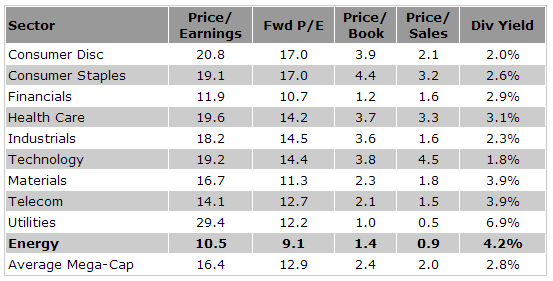

As you dig into the value in large-cap stocks, one sector jumps out… energy companies. Of the 10 major sectors, energy stocks are the cheapest by nearly every measure. Take a look…

The world’s largest energy stocks trade for just 9.1 times next year’s earnings estimates. That’s a 29% discount to the entire group… and a 28% discount to the 10-year average price-to-earnings ratio (P/E) on U.S. energy companies. They also pay hefty 4.2% dividends. That’s well above the 2.8% average and second only to utility stocks (which most investors buy solely for income).

If you look to energy stocks located in emerging markets, the value gets even better… particularly in Russia.

Russia’s three mega-cap oil companies are Gazprom, Lukoil, and Rosneft. It’s hard for U.S. investors to buy Rosneft. But Gazprom and Lukoil trade “over the counter.” In other words, they don’t trade on the NYSE or Nasdaq… But you should be able to buy them through your broker. And they’re trading at just 2.8 and 4.4 times earnings, respectively.

That’s as cheap as any stocks on the planet.

I know that the idea of putting money in Russia is scary. But at those prices, nearly everything can go wrong and investors can still make money.

In short, energy stocks are now the cheapest group of large-cap stocks on the planet. And Russian energy companies are the cheapest energy companies. They’re the cheapest of the cheap.

Investors looking for value should consider energy stocks in general… and Russian energy stocks specifically. These stocks could rise 50% if oil prices go nowhere… and they’d still be cheap.

Good investing,

If you look to energy stocks located in emerging markets, the value gets even better… particularly in Russia.

Russia’s three mega-cap oil companies are Gazprom, Lukoil, and Rosneft. It’s hard for U.S. investors to buy Rosneft. But Gazprom and Lukoil trade “over the counter.” In other words, they don’t trade on the NYSE or Nasdaq… But you should be able to buy them through your broker. And they’re trading at just 2.8 and 4.4 times earnings, respectively.

That’s as cheap as any stocks on the planet.

I know that the idea of putting money in Russia is scary. But at those prices, nearly everything can go wrong and investors can still make money.

In short, energy stocks are now the cheapest group of large-cap stocks on the planet. And Russian energy companies are the cheapest energy companies. They’re the cheapest of the cheap.

Investors looking for value should consider energy stocks in general… and Russian energy stocks specifically. These stocks could rise 50% if oil prices go nowhere… and they’d still be cheap.

Good investing,

RSS Feed

RSS Feed