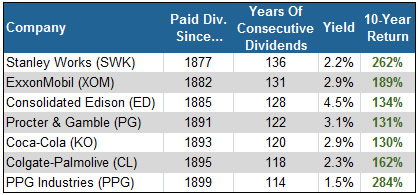

| MARKET CONDITIONS These seven stocks have done the impossible. Each one of them has paid a dividend like clockwork for over a century. In fact, the longest-standing dividend payer on the list hasn't missed a payment since 1877 — when Rutherford B. Hayes was president. Think of everything that has happened to our financial system since that time…World War I and II… The Great Depression, the dot-com bubble, government shutdowns… the list goes on. |

For the seven stocks I’m about to show you though, it didn't matter. These companies breezed through every economic downturn America has ever faced without so much as a hiccup in their dividend payments. In fact, most of them were able to increase their payouts during those periods…

That’s pretty remarkable considering that in 2009 alone over 800 American companies had to cut their dividends because of the fallout from the subprime crisis. Now, to be fair, there is nothing secret about these stocks. You’ve probably heard of all these companies before. But to me, that’s not a deterrent. In fact, it’s part of what makes these seven stocks so attractive.

That’s because in all my years of investing, I’ve found that it’s not the high-flying tech startups or the risky biotech plays that make investors the most money.

Instead, from what I’ve seen, the most successful companies are the ones that we see every day… The ones that are so integral to our way of life, that if they disappeared tomorrow, it would have a direct impact on how we live.

Take one of the stocks on the list, Coca-Cola (NYSE: KO), for example. Ask anyone in the world for a Coke, and chances are that 99% of them will know what you’re talking about. Coca-Cola is such a dominant company that one of its biggest competitors — Dr Pepper Snapple (NYSE: DPS) — actually pays to use Coke’s distribution network.

Given that kind of market dominance, is there any question as to how Coca-Cola has been able pay an uninterrupted dividend since 1893… AND increase its payout by over 1,393% in the last 25 years alone?

Nothing is guaranteed, in my experience I've found that it’s companies like Coca-Cola, and the rest of the companies below – the ones that dominate their markets AND reward shareholders with steady (and increasing) dividends — that can make investors the most money in the market.

That’s pretty remarkable considering that in 2009 alone over 800 American companies had to cut their dividends because of the fallout from the subprime crisis. Now, to be fair, there is nothing secret about these stocks. You’ve probably heard of all these companies before. But to me, that’s not a deterrent. In fact, it’s part of what makes these seven stocks so attractive.

That’s because in all my years of investing, I’ve found that it’s not the high-flying tech startups or the risky biotech plays that make investors the most money.

Instead, from what I’ve seen, the most successful companies are the ones that we see every day… The ones that are so integral to our way of life, that if they disappeared tomorrow, it would have a direct impact on how we live.

Take one of the stocks on the list, Coca-Cola (NYSE: KO), for example. Ask anyone in the world for a Coke, and chances are that 99% of them will know what you’re talking about. Coca-Cola is such a dominant company that one of its biggest competitors — Dr Pepper Snapple (NYSE: DPS) — actually pays to use Coke’s distribution network.

Given that kind of market dominance, is there any question as to how Coca-Cola has been able pay an uninterrupted dividend since 1893… AND increase its payout by over 1,393% in the last 25 years alone?

Nothing is guaranteed, in my experience I've found that it’s companies like Coca-Cola, and the rest of the companies below – the ones that dominate their markets AND reward shareholders with steady (and increasing) dividends — that can make investors the most money in the market.

Every stock on the list above is one of the most dominant companies in the world. If any of these businesses were to suddenly go under, it would have a direct impact on the way we live of our daily lives.

That’s why when you own stocks like this in your portfolio, you don’t have to worry much about bear markets… recessions… government shutdowns… or rising interest rates. If history is any indicator, you just simply let their steady dividend payments grow your wealth year in and year out.

And those dividends have been good to the companies’ share prices as well. Despite being over 100 years old, each of these stocks has handily beaten the market in the last 10 years. The average total return for the seven stocks in this list is 185%, including dividends — significantly higher than the 99% total return for the S&P 500 over the same period.

Don’t get me wrong, past performance is never an assurance of future success. Just because these stocks have paid consecutive dividends for over a century, it doesn’t guarantee that they’ll continue to do it for another 100 years.

And in fact, as much as I like Coca-Cola, it does seem a bit expensive right now. It’s currently trading at a P/E ratio of about 20 — significantly higher than the S&P’s long-term average of 15.

But it just goes to show you that when you buy the market’s most dominant companies — the ones that have a competitive advantage in their industry and show a commitment to their shareholders — you’re buying companies whose dividend can withstand nearly anything… including the current economic environment.

That’s why when you own stocks like this in your portfolio, you don’t have to worry much about bear markets… recessions… government shutdowns… or rising interest rates. If history is any indicator, you just simply let their steady dividend payments grow your wealth year in and year out.

And those dividends have been good to the companies’ share prices as well. Despite being over 100 years old, each of these stocks has handily beaten the market in the last 10 years. The average total return for the seven stocks in this list is 185%, including dividends — significantly higher than the 99% total return for the S&P 500 over the same period.

Don’t get me wrong, past performance is never an assurance of future success. Just because these stocks have paid consecutive dividends for over a century, it doesn’t guarantee that they’ll continue to do it for another 100 years.

And in fact, as much as I like Coca-Cola, it does seem a bit expensive right now. It’s currently trading at a P/E ratio of about 20 — significantly higher than the S&P’s long-term average of 15.

But it just goes to show you that when you buy the market’s most dominant companies — the ones that have a competitive advantage in their industry and show a commitment to their shareholders — you’re buying companies whose dividend can withstand nearly anything… including the current economic environment.

RSS Feed

RSS Feed