| MARKET CONDITIONS Steel is an interesting sector. Over the years its volatility has wrecked portfolios if you didn't hedge with options. There is lot's of opportunity in the "building boom". The building boom isn't in constructing new skyscrapers and city infrastructure but LNG pipelines and the tankers to ship it. |

By Brian Hunt

Last week, I covered a crazy idea that is making people a lot of money right now. It's the idea that despite all the negative press it's getting, the economy is somehow "not falling apart." It's slowly getting better. This means growing demand for things like cars and shipping services. As I noted, shares of Ford Motor are up more than 30% this year. Plus, shipping stocks are in a big "stealth" bull market.

As this economic trend plays out, these sectors should keep winning. And the next sector that will follow will be steel. My investor following know we always look to trade the market's "boom and bust" sectors. These sectors include steelmakers, coal producers, gold miners, and airlines. They're all prone to wild swings up and down. If you get into the upswings early and avoid the downswings, you can make huge returns.

It all sounds easy but executing these trades is actually very difficult. The right time to buy into a "boom and bust" sector is after it has suffered a huge bear market. You want to buy when the news coverage of the sector is terrible. You want to buy when nobody else will buy. These trades have the potential to double, triple, even quadruple your money in a short time.

It takes a contrarian "iron stomach" to initiate these trades. You'll need to fight your natural crowd-following instincts. But as one of the ultimate trading truisms goes, the hard trade to make is the right trade to make. Right now, the "hard trade to make" is buying the steelmaking sector. And that's why it makes sense to buy shares of steelmakers like AK Steel (AKS), ArcelorMital (MT), and U.S. Steel (X) .

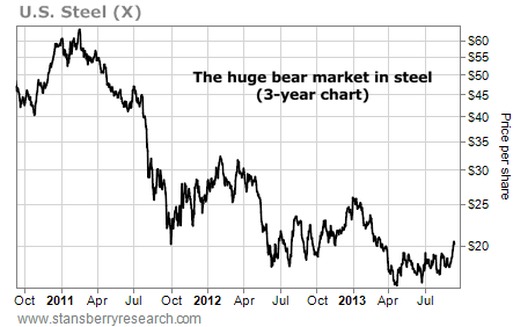

I introduced the idea of buying U.S. Steel to investors about a month ago. The company is America's largest steelmaker. It makes steel that goes into automobiles, structures, appliances, and containers. Because of industry overcapacity and a sluggish global economy, U.S. Steel and its fellow steelmakers have been crushed in the past two years. Shares of U.S. Steel fell more than 70% from their 2011 high to their 2013 bottom. You can see this horrible bear market in the three-year chart below:

Last week, I covered a crazy idea that is making people a lot of money right now. It's the idea that despite all the negative press it's getting, the economy is somehow "not falling apart." It's slowly getting better. This means growing demand for things like cars and shipping services. As I noted, shares of Ford Motor are up more than 30% this year. Plus, shipping stocks are in a big "stealth" bull market.

As this economic trend plays out, these sectors should keep winning. And the next sector that will follow will be steel. My investor following know we always look to trade the market's "boom and bust" sectors. These sectors include steelmakers, coal producers, gold miners, and airlines. They're all prone to wild swings up and down. If you get into the upswings early and avoid the downswings, you can make huge returns.

It all sounds easy but executing these trades is actually very difficult. The right time to buy into a "boom and bust" sector is after it has suffered a huge bear market. You want to buy when the news coverage of the sector is terrible. You want to buy when nobody else will buy. These trades have the potential to double, triple, even quadruple your money in a short time.

It takes a contrarian "iron stomach" to initiate these trades. You'll need to fight your natural crowd-following instincts. But as one of the ultimate trading truisms goes, the hard trade to make is the right trade to make. Right now, the "hard trade to make" is buying the steelmaking sector. And that's why it makes sense to buy shares of steelmakers like AK Steel (AKS), ArcelorMital (MT), and U.S. Steel (X) .

I introduced the idea of buying U.S. Steel to investors about a month ago. The company is America's largest steelmaker. It makes steel that goes into automobiles, structures, appliances, and containers. Because of industry overcapacity and a sluggish global economy, U.S. Steel and its fellow steelmakers have been crushed in the past two years. Shares of U.S. Steel fell more than 70% from their 2011 high to their 2013 bottom. You can see this horrible bear market in the three-year chart below:

Because of this bear market, sentiment toward the steel sector is terrible. Anyone who has bought steel stocks in the past few years has lost big. Nobody is bragging at cocktail parties about "being long steel." Few Wall Street analysts would dream of urging clients to "buy steel." But this is precisely the time to buy steel... when nobody can stand the thought of owning it... when the investment public thinks you're insane for buying... when it's the hard trade to make.

Just like winter is followed by spring, big steel busts are followed by big steel rallies. And a gradually improving U.S. economy should help power U.S. Steel's earnings and share price higher. It makes sense.

The improving economy has caused housing stocks to gain 135% in the past two years. It's driving a boom in auto sales (and Ford Motor shares)... And it's driving a rally in shipping stocks. I expect steel will be the next train to leave the station. The one-year chart of U.S. Steel below shows how the train is starting to move.

Note the right-hand side of the chart. You'll see how U.S. Steel just broke out to its highest level in five months.

Just like winter is followed by spring, big steel busts are followed by big steel rallies. And a gradually improving U.S. economy should help power U.S. Steel's earnings and share price higher. It makes sense.

The improving economy has caused housing stocks to gain 135% in the past two years. It's driving a boom in auto sales (and Ford Motor shares)... And it's driving a rally in shipping stocks. I expect steel will be the next train to leave the station. The one-year chart of U.S. Steel below shows how the train is starting to move.

Note the right-hand side of the chart. You'll see how U.S. Steel just broke out to its highest level in five months.

Keep in mind: Buying steel stocks here is a speculative trade. It's not like buying a blue-chip stock.

My stance toward speculative "boom and bust" stocks like U.S. Steel is "rent, don't buy." Steel has gone through a terrible bear market. And while the crowd likes the idea of owning glamorous stocks like Facebook and Netflix, it can't stand the thought of owning steel.

Buying steel is the hard trade to make... That's why it's the right trade to make.

My stance toward speculative "boom and bust" stocks like U.S. Steel is "rent, don't buy." Steel has gone through a terrible bear market. And while the crowd likes the idea of owning glamorous stocks like Facebook and Netflix, it can't stand the thought of owning steel.

Buying steel is the hard trade to make... That's why it's the right trade to make.

RSS Feed

RSS Feed