THE MARKET IS BULLISH ON ROBOTS

America's urge to speculate in high-growth "story stocks" is alive and well. For proof, all we need to do is look at shares of iRobot. There aren't many "slam dunk" guarantees one can make about technology investment. It's a sector that changes monthly. One year's big success story is another year's big bankruptcy. However, one trend we can count on is the increasing use of robots to manufacture cars, work in labs, and perform heavy military duties.

As machines get lighter, faster, stronger, and smarter, the robotics market will mushroom in size. One of the few "pure plays" on robots is iRobot (IRBT). Although most folks have never heard of it, the $1 billion market cap company is one of the world's largest robot-makers. Some analysts even call the company "the GM of robots."

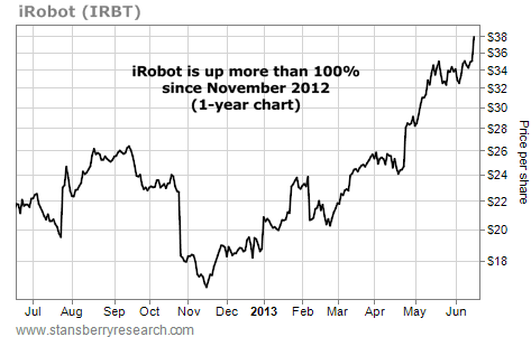

It has a huge potential market to grow into over the coming decade. As you can see in the chart below, investors are piling into this great "story stock." Shares of iRobot have climbed from $18 in late 2011 to $37. Yesterday, they surged more than 7% to reach a new 52-week high. With a rich price-to-earnings ratio of 37, iRobot is not cheap but the market is willing to "pay up" for good growth stocks right now.

America's urge to speculate in high-growth "story stocks" is alive and well. For proof, all we need to do is look at shares of iRobot. There aren't many "slam dunk" guarantees one can make about technology investment. It's a sector that changes monthly. One year's big success story is another year's big bankruptcy. However, one trend we can count on is the increasing use of robots to manufacture cars, work in labs, and perform heavy military duties.

As machines get lighter, faster, stronger, and smarter, the robotics market will mushroom in size. One of the few "pure plays" on robots is iRobot (IRBT). Although most folks have never heard of it, the $1 billion market cap company is one of the world's largest robot-makers. Some analysts even call the company "the GM of robots."

It has a huge potential market to grow into over the coming decade. As you can see in the chart below, investors are piling into this great "story stock." Shares of iRobot have climbed from $18 in late 2011 to $37. Yesterday, they surged more than 7% to reach a new 52-week high. With a rich price-to-earnings ratio of 37, iRobot is not cheap but the market is willing to "pay up" for good growth stocks right now.

RSS Feed

RSS Feed