| MARKET CONDITIONS Emerging markets are pushing higher and this could be the start of a 50%-plus move. While U.S. stocks soared over the last few years, emerging-market stocks were on a one-way course downward. Since early 2012, the largest emerging markets (Brazil, Russia, India, and China) all saw their stock markets decline. Brazil, for example, fell nearly 30% while U.S. stocks soared over 30%. But I think a new uptrend just got started. We have a safe opportunity to make big gains over the next 12 months. |

For the better part of four years, Brazilian stocks have been "dead money." The iShares MSCI Brazil Fund (EWZ) holds a basket of Brazil's largest stocks, including oil giant Petrobras and mining giant Vale. If you bought EWZ in 2009, you'd be sitting on a 16% loss today. (If you'd bought the U.S.-based S&P 500, you'd be up 77%.)

Earlier this year, Brazil's bear market reached its "puke point." EWZ lost 25% in a six-week stretch from late May to early June. That kind of irrational blow-out often happens at market bottoms. Everyone rushes out. The price doesn't matter and when there's no one left to sell, that's when prices can rise.

After the crash, EWZ moved sideways for a couple months. Then in late August, the fund moved up 20%. There's a lot more potential upside here. The Ibovespa Index (the Brazilian S&P 500) trades for around book value today. That's half what it was trading for in 2010. And it's 35% below its 10-year average.

The chart below shows just how cheap Brazilian stocks have gotten and the uptrend that's currently taking place. Take a look:

Earlier this year, Brazil's bear market reached its "puke point." EWZ lost 25% in a six-week stretch from late May to early June. That kind of irrational blow-out often happens at market bottoms. Everyone rushes out. The price doesn't matter and when there's no one left to sell, that's when prices can rise.

After the crash, EWZ moved sideways for a couple months. Then in late August, the fund moved up 20%. There's a lot more potential upside here. The Ibovespa Index (the Brazilian S&P 500) trades for around book value today. That's half what it was trading for in 2010. And it's 35% below its 10-year average.

The chart below shows just how cheap Brazilian stocks have gotten and the uptrend that's currently taking place. Take a look:

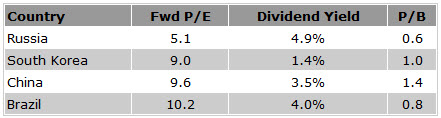

This makes me think we've seen the bottom and there's still a ton of upside potential here for one simple reason... emerging markets are crazy-cheap. Just take a look just how cheap the major emerging markets are today.

RSS Feed

RSS Feed