| Sean Hyman is the editor of "The Ultimate Wealth Report" and a regular guest on shows including Fox Business, CNBC, and Bloomberg Television. He is known for his uncanny ability to predict market moves, but what many people don't know is that Sean is a former pastor. Though Sean has years of experience with Charles Swab, he points to the Bible as his secret to investing. | MARKET CONDITIONS He attributes the "Biblical Money Code" found in Scripture for taking him from making only $15,000 a year to now being able to give away up to $50,000 a year. He doesn't share that to brag, but to show that it is possible to change your financial status and to be a blessing to others. Sean has applied ancient biblical principles and radically changed his own life and helped do the same for others. For example, he used these principles to transform his father's $40,000 retirement account into $396,000. He also used the code to help a friend change $2,000 into $10,000 in about a year. Below is a presentation on his analysis of the US dollar and certain investments within his own portfolio. |

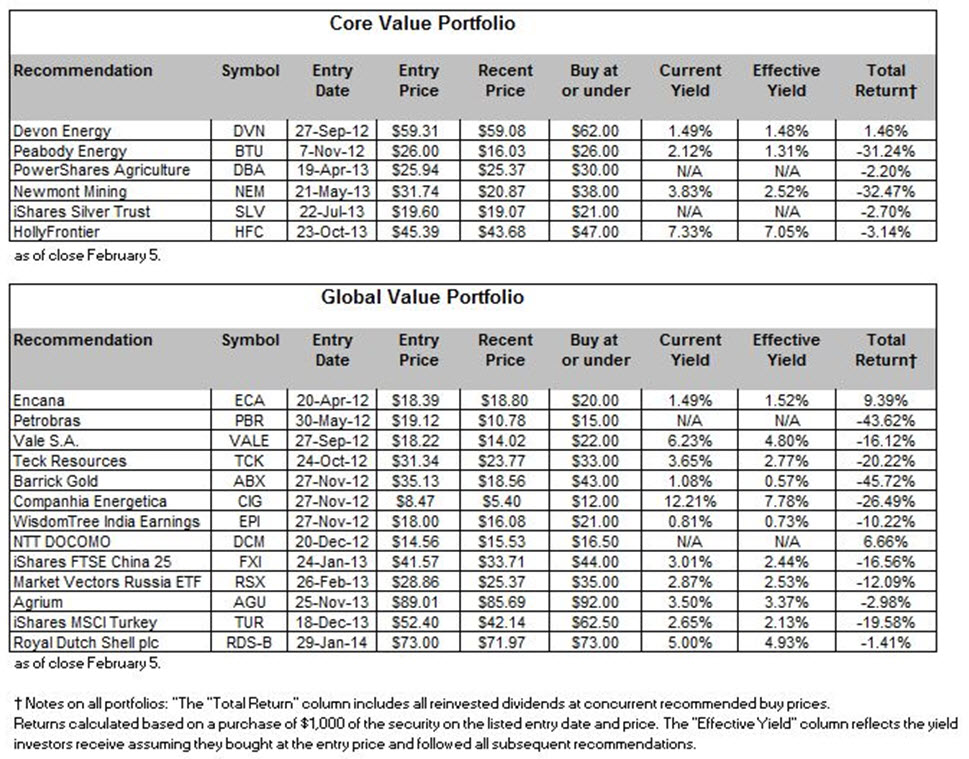

For those of you starting or adding to your own portfolios, the following holdings were at, near, or below Sean's recommended "buy" price as of yesterday's close:

• In the Core Value Portfolio: Devon Energy (DVN), Peabody Energy (BTU), PowerShares Agriculture

(DBA), Newmont Mining (NEM), iShares Silver Trust (SLV) and HollyFrontier (HFC);

• In the Global Value Portfolio: Encana (ECA), Petrobras (PBR), Vale S.A. (VALE), Teck Resources (TCK),

Barrick Gold (ABX), Companhia Energetica (CIG), WisdomTree India Earnings (EPI), NTT DOCOMO

(DCM), iShares FTSE China 25 (FXI), Market Vectors

RSS Feed

RSS Feed