Remember when I recommended Philip Morris (PM) a few weeks ago just before the company raised its dividend? Stockholders got a hefty 10.6 percent raise. But unfortunately, the stock shot up so quickly a lot of people didn’t get a chance to buy.

I don’t want that to happen to you again. Pay close attention to the stocks and buy prices on the list.

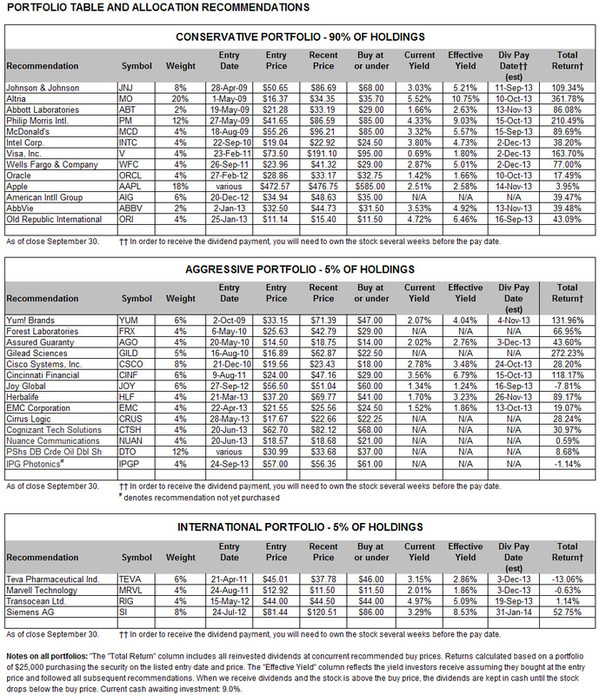

You may not be able to grab Altria (MO) at $16.37 like we did back in 2009, but there’s an excellent chance you can get it under our current buy price of $35.70.

Here’s the full list of stocks that are near or below our “buy prices” as of yesterday’s close:

I don’t want that to happen to you again. Pay close attention to the stocks and buy prices on the list.

You may not be able to grab Altria (MO) at $16.37 like we did back in 2009, but there’s an excellent chance you can get it under our current buy price of $35.70.

Here’s the full list of stocks that are near or below our “buy prices” as of yesterday’s close:

- In the Conservative Portfolio: Altria (MO), Intel Corp (INTC), Oracle (ORCL), and Apple (AAPL);

- In the Aggressive Portfolio: Joy Global (JOY), EMC Corporation (EMC), Cirrus Logic (CRUS), Nuance Communications (NUAN), PowerShares DB Crude Oil Double Short (DTO), and IPG Photonics (IPGP);

- In the International Portfolio: Teva Pharmaceutical Industries (TEVA), Marvell Technology (MRVL) and Transocean (RIG).

RSS Feed

RSS Feed