Meanwhile, taking a quick look at the charts, Schaeffer's Senior Trading Analyst Bryan Sapp notes, "The same levels are in play from earlier this week -- specifically, 1,850 on the S&P 500 Index (SPX) and 1,180 on the Russell 2000 Index (RUT). Each has briefly spiked above these key areas, but every rally has been unsustainable. The recent range in the market has likely frustrated both bulls and bears, as there has been no directional lean and very choppy intraday price action."

Market Statistics

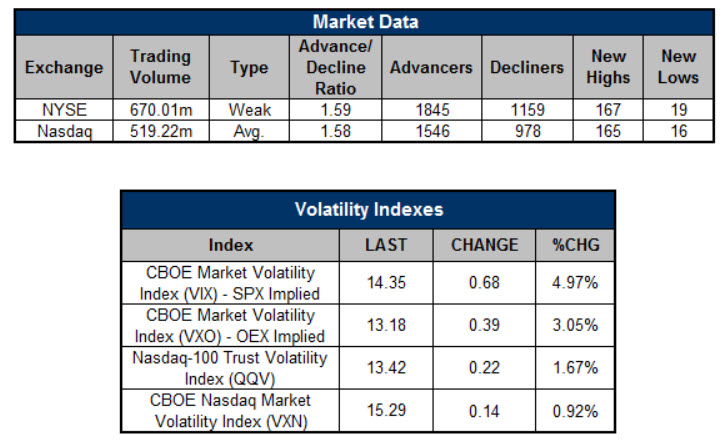

The Chicago Board Options Exchange (CBOE) saw 1,313,950 call contracts traded on Wednesday, compared to 755,043 put contracts. The resultant single-session put/call ratio remained at 0.57, while the 21-day moving average arrived at 0.60.

"The new Investors Intelligence poll surfaced yesterday, and we saw a pretty substantial increase in bulls," continued Sapp. "While this spike represents a one-month high in the reading, we're still below levels seen in December. The amount by which this poll has jumped around in recent weeks shows just how bipolar market participants have been lately. We're seeing many knee-jerk reactions in sentiment, and this leads me to believe that a break of the recent range will lead to an outsized move in stocks once the market shows its hand."

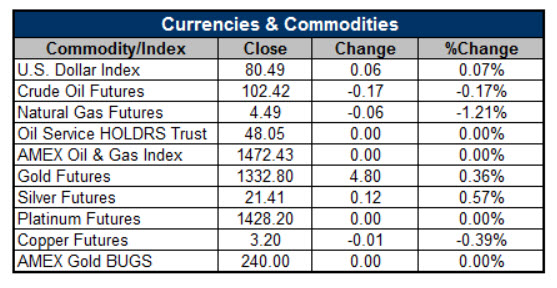

Currencies and Commodities

- The U.S. dollar index is flirting with a 0.1% lead ahead of the bell, with the currency last seen at 80.49.

- Elsewhere, crude oil is looking to pare a portion of yesterday's gains, with crude for April delivery down 0.2% at $102.42 per barrel.

- Gold futures, meanwhile, are on pace to resume their recent uptrend, with the front-month contract 0.4% higher to linger near $1,332.80 an ounce.

Coming out today are durable goods orders for January and weekly jobless claims. In addition, newly minted Fed chief Janet Yellen will testify before the Senate. Stepping up to the earnings plate are AMC Networks (AMCX), Arena Pharmaceuticals (ARNA), Best Buy (BBY), Chico's FAS (CHS), Chiquita Brands (CQB), Clean Energy Fuels (CLNE), Deckers Outdoor (DECK), Gap Inc. (GPS), Halozyme Therapeutics (HALO), Kohl's (KSS), Linn Energy (LINE), Monster Beverage (MNST), OmniVision (OVTI), Salesforce.com (CRM), Sears Holdings (SHLD), Sotheby's (BID), Splunk (SPLK), and Wendy's (WEN).

RSS Feed

RSS Feed