Bulls and bears are always fighting it out in the stock market. In today's battle, though, three of the market's leading sectors are running in different directions. So the fight is tougher than usual to score.

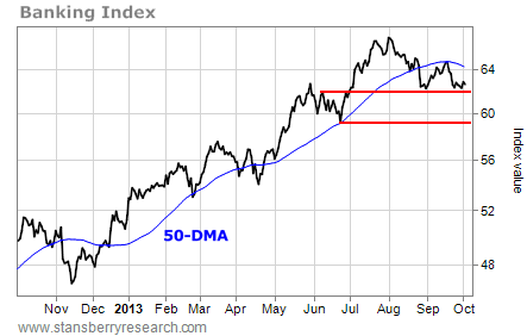

In the bearish corner, we have the banking index (the "BKX").

In the bearish corner, we have the banking index (the "BKX").

The bank sector has been lagging the market for the past month. In September, the BKX rallied back up and "kissed" its 50-day moving average (DMA) from below. That was an ideal spot for traders to make a short trade on the sector. The BKX has been moving lower ever since. If it loses support at $62, it could be a quick trip down to the next support line at $59. Retail stocks, on the other hand, are undecided and could go either way.

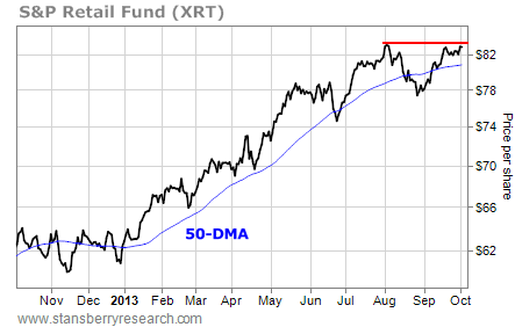

Retailers have been strong over the past month. Retail fund XRT rallied back up and nearly made a new all-time high following the Federal Open Market Committee announcement. But the chart now has a potential "double top" pattern in place.

Bearish traders can look at this as a low-risk area for a short sale. There's plenty of room for the sector to fall. And traders can stop out of the position for a small loss if XRT breaks above the red resistance line and makes a new high.

Meanwhile, bullish traders can buy the sector here in anticipation of a breakout above resistance. They can stop out of the trade for a small loss if XRT falls back below its 50-DMA line. Finally, semiconductor stocks are in the bullish camp.

Bearish traders can look at this as a low-risk area for a short sale. There's plenty of room for the sector to fall. And traders can stop out of the position for a small loss if XRT breaks above the red resistance line and makes a new high.

Meanwhile, bullish traders can buy the sector here in anticipation of a breakout above resistance. They can stop out of the trade for a small loss if XRT falls back below its 50-DMA line. Finally, semiconductor stocks are in the bullish camp.

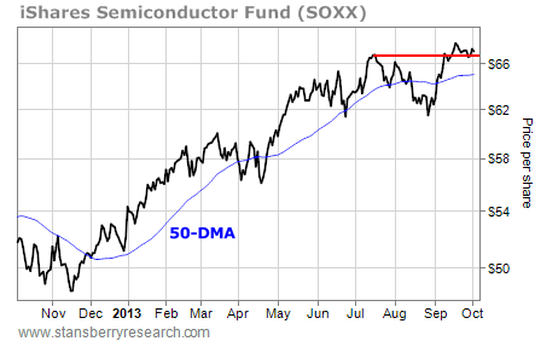

The semiconductor sector broke out to a new high last month. And the sector is holding up well during the market's recent weakness. It doesn't look bearish like it did last month. Instead, the momentum has shifted to bullish. Traders can buy the semiconductor sector here and keep a tight stop just below the red support line at $66.

RSS Feed

RSS Feed