| MARKET CONDITIONS Latin American stocks have taken a beating along with all emerging markets recently. Yesteryear, you could make money in Latin America by simply buying and holding a broad index and letting the rising tide do its thing. That strategy doesn't work anymore. Instead, as Claudio will explain, you must target individual companies with specific qualities that will help them rise above lackluster market performance. He concludes with a checklist of sorts that will help you separate the right companies from the wrong ones. |

By Claudio Maulhardt, World Money Analyst

Not so long ago, Latin American equities were a market darling. Then, the markets viewed signs of an economic recovery in the developed world as good news for Latin American stocks (higher EPS prospects), but signs of stagnation were also considered good news (as a lower discount rate would apply).

Now, the majority of Latin American stock markets have begun to trade as if the opposite were true. With the sole exception of Mexico, whose stock market has traditionally traded closer to the S&P 500, the rest of Latin equities have lost their glow. Latin stocks have registered a seventh consecutive month of investor outflows, and it does not look like the trend is going to reverse any time soon.

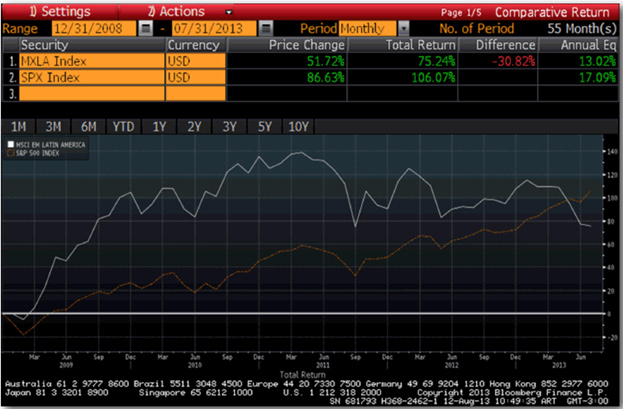

The change from hype to doubt is clearly reflected in the chart below. Latin equities were, incredibly, considered a safe haven after the 2008 financial crisis. From the end of 2008 to the end of 2010, Latin stocks outperformed the S&P 500 by an impressive 90%. Since then, the love affair has come to an end, and Latin equities have underperformed by more than 67%.

Not so long ago, Latin American equities were a market darling. Then, the markets viewed signs of an economic recovery in the developed world as good news for Latin American stocks (higher EPS prospects), but signs of stagnation were also considered good news (as a lower discount rate would apply).

Now, the majority of Latin American stock markets have begun to trade as if the opposite were true. With the sole exception of Mexico, whose stock market has traditionally traded closer to the S&P 500, the rest of Latin equities have lost their glow. Latin stocks have registered a seventh consecutive month of investor outflows, and it does not look like the trend is going to reverse any time soon.

The change from hype to doubt is clearly reflected in the chart below. Latin equities were, incredibly, considered a safe haven after the 2008 financial crisis. From the end of 2008 to the end of 2010, Latin stocks outperformed the S&P 500 by an impressive 90%. Since then, the love affair has come to an end, and Latin equities have underperformed by more than 67%.

This change in the tide may be linked to Wall Street's permanent belief in "next year's" US growth, a story investors seem to like despite the lack of strong empirical support.

However, the main catalyst has undoubtedly been the weakness in China's economic growth and, most important, the shift in China's economic model from investment-driven to consumption-driven growth. There is a direct link between this "remodeling" and the string of monthly outflows that dedicated Latin American fund managers have experienced.

The math is simple: Lower Chinese investment means less demand for industrial commodities, which are produced in Latin America by some of the largest companies in the region, which make up a significant part of the country and regional indices.

The consensus of economists surveyed by Bloomberg was for all Latin American countries to have weaker current account balances in 2013 than in 2012. With interest rates rising and Wall Street expecting them to rise further as the US economy grows, financing the gap may become tougher for Latin economies.

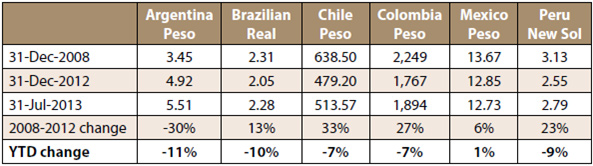

This brings in the linkage to exchange rates, which constitute a not insignificant portion of Latin American equities' underperformance. Exchange rates helped EPS, book values, and leverage ratios look great in US dollar terms for many years. Now that the US dollar has strengthened against Latin American currencies, the opposite trend is under way.

However, the main catalyst has undoubtedly been the weakness in China's economic growth and, most important, the shift in China's economic model from investment-driven to consumption-driven growth. There is a direct link between this "remodeling" and the string of monthly outflows that dedicated Latin American fund managers have experienced.

The math is simple: Lower Chinese investment means less demand for industrial commodities, which are produced in Latin America by some of the largest companies in the region, which make up a significant part of the country and regional indices.

The consensus of economists surveyed by Bloomberg was for all Latin American countries to have weaker current account balances in 2013 than in 2012. With interest rates rising and Wall Street expecting them to rise further as the US economy grows, financing the gap may become tougher for Latin economies.

This brings in the linkage to exchange rates, which constitute a not insignificant portion of Latin American equities' underperformance. Exchange rates helped EPS, book values, and leverage ratios look great in US dollar terms for many years. Now that the US dollar has strengthened against Latin American currencies, the opposite trend is under way.

How to Play the New Scenario

So the trend is not the friend of Latin American equity investors. Is it best to shun them for the time being? It's not that simple.

Latin equities were an easy trade for many years. The fad lifted all boats regardless of their individual merits, which made trading the indices or the associated ETFs the way to go. Now, it's not hard to see that the correction has been exacerbated by the unwinding of the macro trade.

Over the last decade, the weight of Latin American equities in the MSCI World Index has doubled, surging from roughly 2% to 4.4%. The MSCI Emerging Markets Latin American Index has a US$1.5 trillion market cap, which makes simply neglecting it a tough decision for index fund managers.

The problem is that it is hard to trade Latin American equities as if they were a single asset class. Trading ETFs or indices may mean that good opportunities are missed. An index is comprised of a wide array of stocks whose issuers will not necessarily perform similarly in various economic environments.

Appreciating currencies and the wide availability of credit in the last decade has meant that stocks most closely linked to domestic consumption were the winners by far. The new picture of weaker currencies and tougher credit conditions means that the winners of the past may not fare as well in the future.

A New Approach

The next winning theme will be foreign-currency earners (mainly exporters) and, more important, stocks with little or no debt held in a foreign currency—and especially with no debt in foreign currency if it has no foreign currency income to match the servicing of that debt. Those are the characteristics you want to look for in a solid Latin American investment.

It's hard to believe that the cycle of weaker currencies, weaker current accounts, and weaker EPS growth is about to reach its end in the near future. However, this is not the end of the Latin American investment theme; it only means that the approach must change.

There are companies whose business profiles will help them thrive in what may otherwise look like a generally challenging scenario for Latin American stocks. Going with the flow may prevent investors from grabbing the opportunity that these stocks offer.

So the trend is not the friend of Latin American equity investors. Is it best to shun them for the time being? It's not that simple.

Latin equities were an easy trade for many years. The fad lifted all boats regardless of their individual merits, which made trading the indices or the associated ETFs the way to go. Now, it's not hard to see that the correction has been exacerbated by the unwinding of the macro trade.

Over the last decade, the weight of Latin American equities in the MSCI World Index has doubled, surging from roughly 2% to 4.4%. The MSCI Emerging Markets Latin American Index has a US$1.5 trillion market cap, which makes simply neglecting it a tough decision for index fund managers.

The problem is that it is hard to trade Latin American equities as if they were a single asset class. Trading ETFs or indices may mean that good opportunities are missed. An index is comprised of a wide array of stocks whose issuers will not necessarily perform similarly in various economic environments.

Appreciating currencies and the wide availability of credit in the last decade has meant that stocks most closely linked to domestic consumption were the winners by far. The new picture of weaker currencies and tougher credit conditions means that the winners of the past may not fare as well in the future.

A New Approach

The next winning theme will be foreign-currency earners (mainly exporters) and, more important, stocks with little or no debt held in a foreign currency—and especially with no debt in foreign currency if it has no foreign currency income to match the servicing of that debt. Those are the characteristics you want to look for in a solid Latin American investment.

It's hard to believe that the cycle of weaker currencies, weaker current accounts, and weaker EPS growth is about to reach its end in the near future. However, this is not the end of the Latin American investment theme; it only means that the approach must change.

There are companies whose business profiles will help them thrive in what may otherwise look like a generally challenging scenario for Latin American stocks. Going with the flow may prevent investors from grabbing the opportunity that these stocks offer.

RSS Feed

RSS Feed