Our faithful Washington politicians are causing serious trouble in the stock market and I LOVE it!

Now don't get me wrong, I hate the political theater and endless dysfunction of our Congress.

But as an investor, I couldn't be happier that the benchmark S&P 500 stock index is down about 3% since September 18. This is doubly true as an option-seller. Times like this add a little jet fuel to your option strategy.

Let me explain...

An option trader can't design a better scenario than a short dip in the markets followed by a rally. We enter positions at a lower price, and then ride them up, locking in gains. Plus, the extra volatility means we collect more income upfront for opening our trades. That's exactly the situation we have today. You may be concerned that this dip will turn into a larger bear market. But I'm not concerned yet.

The current government shutdown stems from a disagreement on a short-term budget. It's annoying and troublesome, but history tells us the markets will bounce back. So let's look at the facts. Take a look at the 1995-1996 shutdown.

Now don't get me wrong, I hate the political theater and endless dysfunction of our Congress.

But as an investor, I couldn't be happier that the benchmark S&P 500 stock index is down about 3% since September 18. This is doubly true as an option-seller. Times like this add a little jet fuel to your option strategy.

Let me explain...

An option trader can't design a better scenario than a short dip in the markets followed by a rally. We enter positions at a lower price, and then ride them up, locking in gains. Plus, the extra volatility means we collect more income upfront for opening our trades. That's exactly the situation we have today. You may be concerned that this dip will turn into a larger bear market. But I'm not concerned yet.

The current government shutdown stems from a disagreement on a short-term budget. It's annoying and troublesome, but history tells us the markets will bounce back. So let's look at the facts. Take a look at the 1995-1996 shutdown.

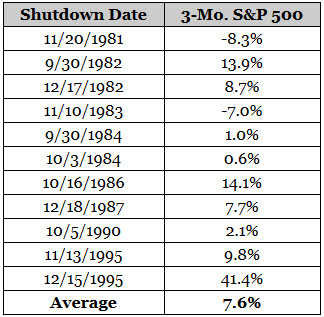

As you can see, government shutdowns can send the market down. But stocks quickly rally. Take a peek at the many other times the crazies in Washington have threatened a shutdown since 1981.

The market reaction varies, but the overall trend is clear. From the start of the shutdown (or threatened shutdown), the S&P 500 rose an average of 7.6% over the next three months – an incredible 30% on an annualized basis.

Wrapped up in the budget debate is whether Congress will raise the self-imposed debt ceiling and allow the government to issue more debt by October 17. If it doesn't, the U.S. would be in jeopardy of missing debt payments and defaulting. That could cause a bigger fall in markets. Just how big, we don't know.

I'm sure Congress will cut a deal to avoid this sort of default. The truth is, plenty of cash is flowing into the Treasury's coffers to keep things going for a while longer; months, even. Ultimately, the consequences of default are just too great. It's the sort of pressure that politicians need to get them working on the country's main problem – spending more than they take in revenues.

The most likely path from here – that this dip turns into a rally – plays perfectly for smart traders. But another kicker makes this even better for option-sellers in particular. It has to do with what happens with option prices when markets drop.

A Quick Reminder on Volatility

One of the things that determines how options are priced is the expected volatility in the markets and individual stocks. When markets are more volatile, skittish investors pay more money for puts. And the more afraid they become, the more they pay.

We don't need to get into the math to understand this. Think of puts like an insurance policy against falling stocks. When things seem scary, people will pay more for their insurance policy. Meanwhile, as option-sellers, we act like the insurance company, collecting the option (insurance) payments.

We measure volatility with things like the CBOE Volatility Index (aka the "VIX").

Wrapped up in the budget debate is whether Congress will raise the self-imposed debt ceiling and allow the government to issue more debt by October 17. If it doesn't, the U.S. would be in jeopardy of missing debt payments and defaulting. That could cause a bigger fall in markets. Just how big, we don't know.

I'm sure Congress will cut a deal to avoid this sort of default. The truth is, plenty of cash is flowing into the Treasury's coffers to keep things going for a while longer; months, even. Ultimately, the consequences of default are just too great. It's the sort of pressure that politicians need to get them working on the country's main problem – spending more than they take in revenues.

The most likely path from here – that this dip turns into a rally – plays perfectly for smart traders. But another kicker makes this even better for option-sellers in particular. It has to do with what happens with option prices when markets drop.

A Quick Reminder on Volatility

One of the things that determines how options are priced is the expected volatility in the markets and individual stocks. When markets are more volatile, skittish investors pay more money for puts. And the more afraid they become, the more they pay.

We don't need to get into the math to understand this. Think of puts like an insurance policy against falling stocks. When things seem scary, people will pay more for their insurance policy. Meanwhile, as option-sellers, we act like the insurance company, collecting the option (insurance) payments.

We measure volatility with things like the CBOE Volatility Index (aka the "VIX").

The higher the VIX goes, the larger the premiums we collect when we sell puts (or covered calls). With that in mind, we're going to make some safe option plays.

An Extra-Safe Pick for Troublesome Times

I always focus on safe, high-quality stocks in Retirement Trader. But given the current conditions, we want to choose an especially safe investment while still collecting the extra income the increasing volatility is giving us.

That's why we're going to add the State Street Global Advisors Technology Select Sector SPDR Fund (NYSE: XLK).

We've traded this exchange-traded fund (ETF) successfully before. It's my favorite way to gain wide exposure to technology markets. The fund is a basket of the world's best-known and relied-upon technology companies. It only holds the truly dominant tech companies that make business happen – Apple, Microsoft, Cisco, IBM, Intel, and Google, for example.

And so rather than picking one technology stock buying this fund gives us a smaller stake in many tech stocks – immediately diversifying our portfolio.

I'm confident these companies are going to be around in another five years. We're increasingly relying on proven technologies and brands. The age of patchwork technology and building things "in-house" will end. But it's harder to say if Apple or Intel or IBM will outshine the others. The best part is that when you bundle all those companies together in an ETF, you end up with stellar fundamentals.

The fund pays a quarterly dividend of 1.9% and has a price-to-earnings (P/E) ratio of 15x. That's below the 16.2x P/E ratio of the S&P 500. The fund's price-to-book ratio is just 3.3x. Its price-to-sales ratio equals 1.7x, and its price-to-cash flow is a reasonable 9.3x.

When you combine the prices the market will pay on options today with the safety and diversification of this ETF, it adds up to a great opportunity. Today, I recommend you...

Sell, to open, the XLK December $32 puts for around $0.83, with the stock trading around $32.20.

The puts obligate you to buy XLK at $32 a share if the stock falls to less than that by option-expiration day on December 21. Selling these puts gives you $83 in your account per option contract. (Remember, one option contract equals 100 shares of stock.)

Buying 100 shares at $32 each represents a potential obligation of $3,200. To put on this trade, you will have to deposit a "margin requirement" – essentially a security deposit that reassures the broker that you can cover your potential obligation. It usually runs about 20% for put sales. (In this case, 20% of $3,200 is just $640.) Here's the math:

Sell one XLK December $32 put for $83.

Place 20% of the capital at risk in your option account, $640.

Total outlay: $557.

If the markets remain unchanged and XLK trades for more than $32 on December 21, you won't have to buy the stock. You keep the $83 premium (and the $640 margin). That's a return on margin of nearly 13% in less than two months. If we put this trade on every two months – assuming all prices remain the same – this could return 77.8% a year on the margin amount.

If XLK trades for less than $32 on December 21, you'll keep the $83. But you'll have to buy XLK stock at $32 per share. So you'll own XLK at a net cost of $31.17 (the $32 strike minus the $0.83-per-share premium). Here's how that scenario works out for each option contract you sell.

Initial income from sold put premium of $83.

Purchase of 100 shares of XLK at $32 is $3,200.

Total outlay: $3,117.

The cost ($31.17) is roughly 3.2% lower than XLK's current market price. This gives a huge amount of downside protection on a basket of companies that mint money. Plus, if you become a shareholder, you'll also receive the $0.60-per-share annual dividend. If XLK pays its expected dividend over the next 12 months, you'll receive a total of $143 ($83 in premium plus $60 in dividends) on a $3,200 investment... 4.5% cash on your investment in the first year. And we'll likely sell call options against the stock to further boost our returns.

Note: The prices in this example reflect morning trading on Friday, October 11.

The IRA Alternative for XLK

If you're using Retirement Trader to trade in an IRA or Roth IRA that bars you from selling puts, you can open an alternative covered-call position. (These alternative trades can also be done in your regular brokerage accounts.)

This is the same strategy we use to generate income on stocks that are put to us. But if you prefer to start by owning shares and selling calls, the trading strategy works just as well.

The math is nearly identical and the returns are similar when you sell puts versus covered calls (in terms of your potential obligation, the so-called "capital at risk"). As always for each trade, execute either the call or put trade, but not both.

Remember, with covered-call selling, you are selling a call option and simultaneously buying stock. Thus, the option is "covered" with stock. When you enter the trade in your trading platform, you should do it as a combination buy/write, or covered call. This means you will be paying for the stock, less the premium you receive for selling the option – what's called a "net debit." Here is how the XLK trade works as a covered call.

Buy 100 shares of XLK for about $31.20, and

Sell, to open, the XLK December $32 calls for about $1.

This represents a total outlay (or "net debit") of $31.20 (the $32.20 stock price minus the $1 we receive from the call premium). Remember, you are buying 100 shares of the stock for every call option you sell against it. Here's how the math works.

Income from sold call premium of $1 is $100.

Purchase of 100 shares of XLK at $32.20 is $3,220.

Initial outlay: $3,120.

If XLK shares sell for $32 or more on option expiration day in December, the stock will be "called" away from you at $32 a share. This gives you a net gain of $0.80 per share on the position. This is about 2.6% in two months, for an annualized return of about 17.3%.

Of course, if the stock trades for less than $32, your calls will expire worthless and you'll still own the stock, uncovered. You can keep the $100 premium and the future dividend stream from 100 shares of XLK. That should amount to $60 a year per 100 shares. This is a total of $160 (the $100 premium plus the $60 dividend) on a $3,120 investment, or about 5.1% this year. As always, put no more than 5% of your portfolio into this position. And hold it with a 20%-25% stop loss.

What to Do if Prices Move

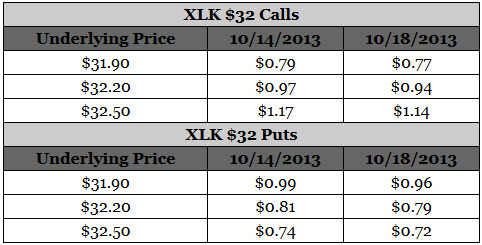

In the example above, we're giving you the most recent prices as of mid-morning October 11. However, we realize prices can change by the time you go to open a position. If there are small price moves, you can still enter the trade. Just pay attention to the initial outlay – the net debits and credits described above.

Try to keep your net debit (in the case of covered calls) at or less than what we recommend. The credit for opening a put sale should equal or exceed what I described above. For example, I recommend selling the XLK December $32 call for around $1 with the stock trading at $32.20. This gives you an initial outlay of $31.20 a share. (The $32.20 stock price minus the $1 premium.)

If on Monday the stock moves up to $32.50, you'd want to receive a premium of about $1.17. This would give you an outlay of $31.33. Keep in mind that as we get closer to option expiration day, the option loses time value, so your outlay may be a bit more than what we recommend.

Similarly, if the stock moves down, you'll pay less for the stock, but also get less for the call option. The following table will give you a rough guide for prices we think represent good opportunities to open the recommended XLK position over the next few trading days.

An Extra-Safe Pick for Troublesome Times

I always focus on safe, high-quality stocks in Retirement Trader. But given the current conditions, we want to choose an especially safe investment while still collecting the extra income the increasing volatility is giving us.

That's why we're going to add the State Street Global Advisors Technology Select Sector SPDR Fund (NYSE: XLK).

We've traded this exchange-traded fund (ETF) successfully before. It's my favorite way to gain wide exposure to technology markets. The fund is a basket of the world's best-known and relied-upon technology companies. It only holds the truly dominant tech companies that make business happen – Apple, Microsoft, Cisco, IBM, Intel, and Google, for example.

And so rather than picking one technology stock buying this fund gives us a smaller stake in many tech stocks – immediately diversifying our portfolio.

I'm confident these companies are going to be around in another five years. We're increasingly relying on proven technologies and brands. The age of patchwork technology and building things "in-house" will end. But it's harder to say if Apple or Intel or IBM will outshine the others. The best part is that when you bundle all those companies together in an ETF, you end up with stellar fundamentals.

The fund pays a quarterly dividend of 1.9% and has a price-to-earnings (P/E) ratio of 15x. That's below the 16.2x P/E ratio of the S&P 500. The fund's price-to-book ratio is just 3.3x. Its price-to-sales ratio equals 1.7x, and its price-to-cash flow is a reasonable 9.3x.

When you combine the prices the market will pay on options today with the safety and diversification of this ETF, it adds up to a great opportunity. Today, I recommend you...

Sell, to open, the XLK December $32 puts for around $0.83, with the stock trading around $32.20.

The puts obligate you to buy XLK at $32 a share if the stock falls to less than that by option-expiration day on December 21. Selling these puts gives you $83 in your account per option contract. (Remember, one option contract equals 100 shares of stock.)

Buying 100 shares at $32 each represents a potential obligation of $3,200. To put on this trade, you will have to deposit a "margin requirement" – essentially a security deposit that reassures the broker that you can cover your potential obligation. It usually runs about 20% for put sales. (In this case, 20% of $3,200 is just $640.) Here's the math:

Sell one XLK December $32 put for $83.

Place 20% of the capital at risk in your option account, $640.

Total outlay: $557.

If the markets remain unchanged and XLK trades for more than $32 on December 21, you won't have to buy the stock. You keep the $83 premium (and the $640 margin). That's a return on margin of nearly 13% in less than two months. If we put this trade on every two months – assuming all prices remain the same – this could return 77.8% a year on the margin amount.

If XLK trades for less than $32 on December 21, you'll keep the $83. But you'll have to buy XLK stock at $32 per share. So you'll own XLK at a net cost of $31.17 (the $32 strike minus the $0.83-per-share premium). Here's how that scenario works out for each option contract you sell.

Initial income from sold put premium of $83.

Purchase of 100 shares of XLK at $32 is $3,200.

Total outlay: $3,117.

The cost ($31.17) is roughly 3.2% lower than XLK's current market price. This gives a huge amount of downside protection on a basket of companies that mint money. Plus, if you become a shareholder, you'll also receive the $0.60-per-share annual dividend. If XLK pays its expected dividend over the next 12 months, you'll receive a total of $143 ($83 in premium plus $60 in dividends) on a $3,200 investment... 4.5% cash on your investment in the first year. And we'll likely sell call options against the stock to further boost our returns.

Note: The prices in this example reflect morning trading on Friday, October 11.

The IRA Alternative for XLK

If you're using Retirement Trader to trade in an IRA or Roth IRA that bars you from selling puts, you can open an alternative covered-call position. (These alternative trades can also be done in your regular brokerage accounts.)

This is the same strategy we use to generate income on stocks that are put to us. But if you prefer to start by owning shares and selling calls, the trading strategy works just as well.

The math is nearly identical and the returns are similar when you sell puts versus covered calls (in terms of your potential obligation, the so-called "capital at risk"). As always for each trade, execute either the call or put trade, but not both.

Remember, with covered-call selling, you are selling a call option and simultaneously buying stock. Thus, the option is "covered" with stock. When you enter the trade in your trading platform, you should do it as a combination buy/write, or covered call. This means you will be paying for the stock, less the premium you receive for selling the option – what's called a "net debit." Here is how the XLK trade works as a covered call.

Buy 100 shares of XLK for about $31.20, and

Sell, to open, the XLK December $32 calls for about $1.

This represents a total outlay (or "net debit") of $31.20 (the $32.20 stock price minus the $1 we receive from the call premium). Remember, you are buying 100 shares of the stock for every call option you sell against it. Here's how the math works.

Income from sold call premium of $1 is $100.

Purchase of 100 shares of XLK at $32.20 is $3,220.

Initial outlay: $3,120.

If XLK shares sell for $32 or more on option expiration day in December, the stock will be "called" away from you at $32 a share. This gives you a net gain of $0.80 per share on the position. This is about 2.6% in two months, for an annualized return of about 17.3%.

Of course, if the stock trades for less than $32, your calls will expire worthless and you'll still own the stock, uncovered. You can keep the $100 premium and the future dividend stream from 100 shares of XLK. That should amount to $60 a year per 100 shares. This is a total of $160 (the $100 premium plus the $60 dividend) on a $3,120 investment, or about 5.1% this year. As always, put no more than 5% of your portfolio into this position. And hold it with a 20%-25% stop loss.

What to Do if Prices Move

In the example above, we're giving you the most recent prices as of mid-morning October 11. However, we realize prices can change by the time you go to open a position. If there are small price moves, you can still enter the trade. Just pay attention to the initial outlay – the net debits and credits described above.

Try to keep your net debit (in the case of covered calls) at or less than what we recommend. The credit for opening a put sale should equal or exceed what I described above. For example, I recommend selling the XLK December $32 call for around $1 with the stock trading at $32.20. This gives you an initial outlay of $31.20 a share. (The $32.20 stock price minus the $1 premium.)

If on Monday the stock moves up to $32.50, you'd want to receive a premium of about $1.17. This would give you an outlay of $31.33. Keep in mind that as we get closer to option expiration day, the option loses time value, so your outlay may be a bit more than what we recommend.

Similarly, if the stock moves down, you'll pay less for the stock, but also get less for the call option. The following table will give you a rough guide for prices we think represent good opportunities to open the recommended XLK position over the next few trading days.

Additional Option Plays

• Exelon (EXC)

Sell the January $32 calls for $0.40 next week.

Buy, to close, the October $33 calls, and

Sell, to open, the January $32 calls for a net credit of $0.40 or more with the stock trading around

$30.40.

• BP (BP)

Buy, to close, the October $44 calls, and

Sell, to open, the January $43 calls for a net credit of $1 or more with the stock trading around $41.90.

• Exelon (EXC)

Sell the January $32 calls for $0.40 next week.

Buy, to close, the October $33 calls, and

Sell, to open, the January $32 calls for a net credit of $0.40 or more with the stock trading around

$30.40.

• BP (BP)

Buy, to close, the October $44 calls, and

Sell, to open, the January $43 calls for a net credit of $1 or more with the stock trading around $41.90.

RSS Feed

RSS Feed