The days right before and after Independence Day tend to lean bullish. So lots of folks are expecting this to be a good week for the stock market. And following yesterday's big gain, we're off to a good start so far. But there are a couple reasons to be cautious. In fact, any gains this week may lead to weakness next week. Let me explain...

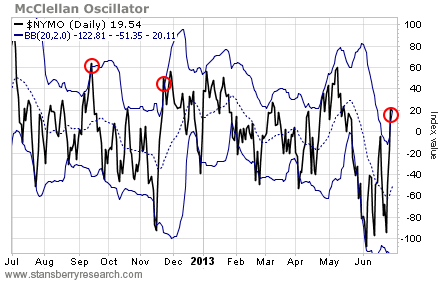

The two indicators we use to call for a short-term rally in stocks are now neutral. Any further progress this week is likely to have them pointing to a short-term decline. Take a look at this chart of the McClellan Oscillator plotted alongside its Bollinger Bands.

The two indicators we use to call for a short-term rally in stocks are now neutral. Any further progress this week is likely to have them pointing to a short-term decline. Take a look at this chart of the McClellan Oscillator plotted alongside its Bollinger Bands.

Last Thursday, the McClellan Oscillator closed above its upper Bollinger Band – which indicates an extreme move. This is an early warning sign that any additional gains in stock prices in the days ahead are likely to be given back.

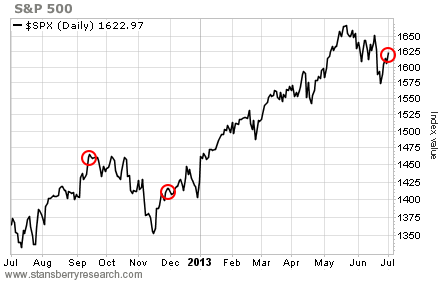

Here's how the S&P 500 traded after the McClellan Oscillator popped above its upper Bollinger Band last September and November.

Here's how the S&P 500 traded after the McClellan Oscillator popped above its upper Bollinger Band last September and November.

Stocks didn't fall right away. In fact, in December, the market actually posted solid gains. But those gains were short-lived as stocks relented to the overbought conditions. Here's another reason to be cautious of a rally this week.

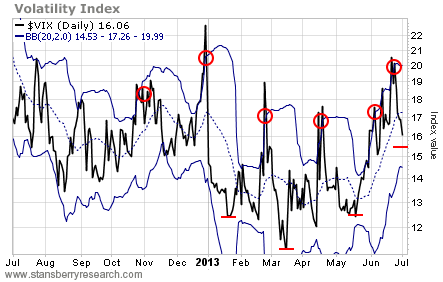

The Volatility Index (the "VIX") triggered a buy signal in stocks two weeks ago by closing above its upper Bollinger Band and then dropping back below it. This confirmed our buy signal.

The VIX dropped rapidly following the three previous buy signals this year. But it never reached its lower Bollinger Band before reversing and heading higher again. A rising VIX typically coincides with a falling stock market.

Any additional gains in the market this week are likely to push the VIX down toward the 15 level. That move would match the action following previous signals. It would likely mark at least a short-term bottom for the Volatility Index and a short-term top for stock prices.

The VIX dropped rapidly following the three previous buy signals this year. But it never reached its lower Bollinger Band before reversing and heading higher again. A rising VIX typically coincides with a falling stock market.

Any additional gains in the market this week are likely to push the VIX down toward the 15 level. That move would match the action following previous signals. It would likely mark at least a short-term bottom for the Volatility Index and a short-term top for stock prices.

RSS Feed

RSS Feed