Investors relying only to future growth in stock prices for their returns were badly burned as they saw their portfolios decimated by the dot-com bust and the Great Recession. Those investors holding portfolios with an even mix of dividends and growth were certainly not immune, but they could at least look to past cash returns for overall performance.

On average since 1962, the market has suffered crashes of more than 20% in a year once every seven and a half years. Still, investing is about long-term returns, and even the best dividend stocks may not get your portfolio to its goal. So what's an investor to do?

The answer lies in a group of stocks that Financial Analyst Paul Tracy calls "Forever Stocks." These are the stocks that you can confidently hold forever, collecting your dividend checks and banking the higher share price when you need it. These are the companies with strong cash flows that support a current cash return but can increase the share price over time.

Problem is, these stocks don't come around often. Most companies with stocks yielding around 3% or higher often do not keep enough cash to reinvest into their business. Utilities and telecoms are good examples. Both industries are heavily regulated, and these companies pay out much of their free cash flow, leaving only enough for maintenance capital expenditures. In fact, only about 3% of companies with shares trading in U.S. markets pay better than a 3% dividend and still enjoy a return on equity of 15% or higher. For some "Forever" equities, you have to look beyond the U.S.' borders.

Despite the recent sell-off in emerging-market shares, this is really where investors will find future growth. Europe might eke out growth in the fourth quarter, if it's lucky, while the U.S. and Japan are doing everything they can for a target of just 2% growth on the year. Down from the decade average around 7%, emerging markets are still forecast to post 5.5% growth this year.

Though the emerging-market space has underperformed this year, it should be a fairly short-lived weakness. One of the biggest culprits to the underperformance in emerging-market stocks has been a decrease in profitability with higher labor costs. Increases in minimum wage rates across the group have brought return on equity from a peak of 15.7% in 2011 to 12.9% this year. Even at this lower level, the group still outperforms others like Europe (10.9%) and Japan (6%). As the developed economies recover to normalized levels and exports pick up, the emerging markets will see a faster rebound.

The problem is that many emerging-market indexes, and the funds that follow, are constructed according to the market capitalization of the constituent countries, so larger markets make up a bigger weight. This means that markets that have been successful in development and may be on the verge of developed-nation status will hold bigger weights. The solution... An emerging-market fund that weights countries by fundamentals and dividends rather than market capitalization.

The WisdomTree Emerging Markets Equity Income Fund (NYSE: DEM) rebalances each year based on dividends and earnings of the universe of tradable emerging-market stocks. Companies must have a dividend yield in the top 30% of those in the WisdomTree Dividend Index (WTDI) and trade at least a quarter-million shares per month to be considered for inclusion. The fund of 350 companies pays a 3.3% dividend yield and has beaten 98% of its peers over the past six years.

The weighting on fundamentals gives the fund a value tilt since higher price-to-earnings stocks are dropped in favor of those with high dividends and lower prices. The fund, at $5.5 billion, is the largest of the WisdomTree emerging-markets lineup with overweight exposure to energy, materials and telecom.

The biggest difference between the fund and others in the emerging-markets space is its huge underweight exposure to South Korea, which makes up just 2.9% of the index, compared with 14.3% in the MSCI Emerging Markets Index.

The value tilt and focus on dividends has worked. Since its inception in 2007, the fund has beaten the MSCI Emerging Markets Index by an average of more than 5% a year. Even more impressive is the fact that volatility in the shares is lower at 23% versus 28% in the popular emerging-markets index.

Most of the fund's holdings are not directly available to U.S. investors, making the exposure even more valuable in my opinion, but some -- such as Chunghwa Telecom (NYSE: CHT), a $25 billion integrated telecommunications company in Taiwan -- are traded as American depositary receipt (ADR) shares. CHT pays a 3.6% dividend yield and has returned a compound rate of 14% annually over the past five years. Another standout of the fund, Banco de Chile (NYSE: BCH), is a $13.8 billion financial institution in Chile with a 4% dividend yield and a compound return of 22% annually over the past five years.

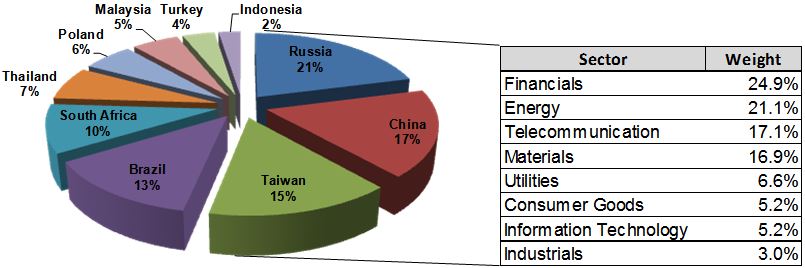

This graphic shows the relative country and sector weightings in the fund. As with most emerging-market funds, Russia, China and Brazil make up a large portion of holdings, but the fund underweights other markets like South Korea with its questionable emerging-markets credentials.

On average since 1962, the market has suffered crashes of more than 20% in a year once every seven and a half years. Still, investing is about long-term returns, and even the best dividend stocks may not get your portfolio to its goal. So what's an investor to do?

The answer lies in a group of stocks that Financial Analyst Paul Tracy calls "Forever Stocks." These are the stocks that you can confidently hold forever, collecting your dividend checks and banking the higher share price when you need it. These are the companies with strong cash flows that support a current cash return but can increase the share price over time.

Problem is, these stocks don't come around often. Most companies with stocks yielding around 3% or higher often do not keep enough cash to reinvest into their business. Utilities and telecoms are good examples. Both industries are heavily regulated, and these companies pay out much of their free cash flow, leaving only enough for maintenance capital expenditures. In fact, only about 3% of companies with shares trading in U.S. markets pay better than a 3% dividend and still enjoy a return on equity of 15% or higher. For some "Forever" equities, you have to look beyond the U.S.' borders.

Despite the recent sell-off in emerging-market shares, this is really where investors will find future growth. Europe might eke out growth in the fourth quarter, if it's lucky, while the U.S. and Japan are doing everything they can for a target of just 2% growth on the year. Down from the decade average around 7%, emerging markets are still forecast to post 5.5% growth this year.

Though the emerging-market space has underperformed this year, it should be a fairly short-lived weakness. One of the biggest culprits to the underperformance in emerging-market stocks has been a decrease in profitability with higher labor costs. Increases in minimum wage rates across the group have brought return on equity from a peak of 15.7% in 2011 to 12.9% this year. Even at this lower level, the group still outperforms others like Europe (10.9%) and Japan (6%). As the developed economies recover to normalized levels and exports pick up, the emerging markets will see a faster rebound.

The problem is that many emerging-market indexes, and the funds that follow, are constructed according to the market capitalization of the constituent countries, so larger markets make up a bigger weight. This means that markets that have been successful in development and may be on the verge of developed-nation status will hold bigger weights. The solution... An emerging-market fund that weights countries by fundamentals and dividends rather than market capitalization.

The WisdomTree Emerging Markets Equity Income Fund (NYSE: DEM) rebalances each year based on dividends and earnings of the universe of tradable emerging-market stocks. Companies must have a dividend yield in the top 30% of those in the WisdomTree Dividend Index (WTDI) and trade at least a quarter-million shares per month to be considered for inclusion. The fund of 350 companies pays a 3.3% dividend yield and has beaten 98% of its peers over the past six years.

The weighting on fundamentals gives the fund a value tilt since higher price-to-earnings stocks are dropped in favor of those with high dividends and lower prices. The fund, at $5.5 billion, is the largest of the WisdomTree emerging-markets lineup with overweight exposure to energy, materials and telecom.

The biggest difference between the fund and others in the emerging-markets space is its huge underweight exposure to South Korea, which makes up just 2.9% of the index, compared with 14.3% in the MSCI Emerging Markets Index.

The value tilt and focus on dividends has worked. Since its inception in 2007, the fund has beaten the MSCI Emerging Markets Index by an average of more than 5% a year. Even more impressive is the fact that volatility in the shares is lower at 23% versus 28% in the popular emerging-markets index.

Most of the fund's holdings are not directly available to U.S. investors, making the exposure even more valuable in my opinion, but some -- such as Chunghwa Telecom (NYSE: CHT), a $25 billion integrated telecommunications company in Taiwan -- are traded as American depositary receipt (ADR) shares. CHT pays a 3.6% dividend yield and has returned a compound rate of 14% annually over the past five years. Another standout of the fund, Banco de Chile (NYSE: BCH), is a $13.8 billion financial institution in Chile with a 4% dividend yield and a compound return of 22% annually over the past five years.

This graphic shows the relative country and sector weightings in the fund. As with most emerging-market funds, Russia, China and Brazil make up a large portion of holdings, but the fund underweights other markets like South Korea with its questionable emerging-markets credentials.

Outlook

The recent talk of tapering massive liquidity programs by the Federal Reserve has seen a rebound in the dollar and added to emerging market weakness. Still, debt levels topping 100% of GDP in the United States and other developed nations means that long-term growth may never return to its past levels.

Return on equity is what drives long-term performance in shares and the emerging world is the only place to provide the kind of returns you need to meet your financial goals.

The fund trades for just 10 times the underlying earnings of the companies held, compared with 11 times for the iShares MSCI Emerging Markets (NYSE: EEM) and 16 times for companies in the S&P 500. If valuations rebound closer to their 20-year median of 15 times trailing earnings, the shares could bounce 50% off of current levels.

Even if a return to historical levels is not in the cards, GDP growth in emerging markets of 5.5% should yield earnings growth of around 7.5% and $5.13 per share for companies in the fund. A price multiple of 12 times earnings puts the fair value at $61.56 per share, a gain of 23% on top of the 3.3% dividend yield.

Risks to Consider: Weakness in the global macroeconomic environment as well as strength in the dollar could hold shares down in the short term. The real risk is getting anxious during periods of higher volatility and selling out of a "Forever" investment at low prices.

Action to Take --> The U.S. faces a few years of very good growth relative to other developed markets, but emerging markets may be a better investment for the long term. The WisdomTree Emerging Markets Equity Income Fund provides exposure to this growth while generating a stable dividend stream. The fund breaks the mold with its re-balancing on fundamentals and should continue to outperform other emerging markets options.

The recent talk of tapering massive liquidity programs by the Federal Reserve has seen a rebound in the dollar and added to emerging market weakness. Still, debt levels topping 100% of GDP in the United States and other developed nations means that long-term growth may never return to its past levels.

Return on equity is what drives long-term performance in shares and the emerging world is the only place to provide the kind of returns you need to meet your financial goals.

The fund trades for just 10 times the underlying earnings of the companies held, compared with 11 times for the iShares MSCI Emerging Markets (NYSE: EEM) and 16 times for companies in the S&P 500. If valuations rebound closer to their 20-year median of 15 times trailing earnings, the shares could bounce 50% off of current levels.

Even if a return to historical levels is not in the cards, GDP growth in emerging markets of 5.5% should yield earnings growth of around 7.5% and $5.13 per share for companies in the fund. A price multiple of 12 times earnings puts the fair value at $61.56 per share, a gain of 23% on top of the 3.3% dividend yield.

Risks to Consider: Weakness in the global macroeconomic environment as well as strength in the dollar could hold shares down in the short term. The real risk is getting anxious during periods of higher volatility and selling out of a "Forever" investment at low prices.

Action to Take --> The U.S. faces a few years of very good growth relative to other developed markets, but emerging markets may be a better investment for the long term. The WisdomTree Emerging Markets Equity Income Fund provides exposure to this growth while generating a stable dividend stream. The fund breaks the mold with its re-balancing on fundamentals and should continue to outperform other emerging markets options.

RSS Feed

RSS Feed