| MARKET CONDITIONS Although Medtronic Inc. (MDT) is one pf my favorite medical device manufacturers not to mention a great dividend payer, Covidien has certainly got my attention. Investing in this company is a long-term strategy with minimal downside. For the short term, it is definitely geared for raking in on some option premiums. |

By John Persinos

We won't presume to judge Obamacare's strengths or shortcomings as social policy—we'll leave that to the partisan bloviators on cable news. One aspect of the law, though, seems to be loathed by Republicans and Democrats alike: the medical device tax.

There's scant unanimity in Washington, DC these days, as opponents of the Patient Protection and Affordable Care Act (PPACA) deploy scorched-earth tactics to derail it. However, a consensus is building on both sides of the aisle that a key provision of the PPACA—the medical device tax—needs to go. If the hated tax is lifted, the already thriving device industry will get a big lift as well.

The best play now on these developments is Covidien (NYSE: COV), a designer, manufacturer and marketer of medical devices for use in clinical and home settings. With a market cap of $27.7 billion, the company has 43,000 employees around the world and sells its products in over 140 countries.

Covidien's Medical Devices segment offers laparoscopic instruments, surgical staplers, soft tissue repair products, hernia mechanical devices, and a host of vascular products.

The Medical Supplies segment offers nursing care products for incontinence, wound care, enteral feeding, urology, and suction products, as well as accessories, electrodes, thermometry, chart paper, and syringes.

According to research firm Lucintel, the global medical device industry will post a compound annual growth rate of 6.1 percent from now until 2017, when it's expected to exceed $300 billion in annual sales.

Because of their close interaction with the human body, medical devices also facilitate the collection of copious amounts of patient information. Data management is another significant growth driver in the health care sector.

The 2009 American Recovery and Reinvestment Act, known as "the Stimulus Bill,” includes a total of $19.2 billion that's designated as financial incentives to health care providers to implement electronic medical records.

Companies such as Covidien are becoming adept at collecting and interpreting this data, to create tools that enhance patient care and safety, opening opportunities for new products down the road.

Considering these tailwinds for the industry, it's no surprise that the iShares US Medical Devices ETF (IHI) has been on an upward trajectory, returning 25.48 percent year-to-date and now trading at close to its all-time high. Covidien is one of the exchange-traded fund's top holdings and its stock has trended upward during the past 12 months:

We won't presume to judge Obamacare's strengths or shortcomings as social policy—we'll leave that to the partisan bloviators on cable news. One aspect of the law, though, seems to be loathed by Republicans and Democrats alike: the medical device tax.

There's scant unanimity in Washington, DC these days, as opponents of the Patient Protection and Affordable Care Act (PPACA) deploy scorched-earth tactics to derail it. However, a consensus is building on both sides of the aisle that a key provision of the PPACA—the medical device tax—needs to go. If the hated tax is lifted, the already thriving device industry will get a big lift as well.

The best play now on these developments is Covidien (NYSE: COV), a designer, manufacturer and marketer of medical devices for use in clinical and home settings. With a market cap of $27.7 billion, the company has 43,000 employees around the world and sells its products in over 140 countries.

Covidien's Medical Devices segment offers laparoscopic instruments, surgical staplers, soft tissue repair products, hernia mechanical devices, and a host of vascular products.

The Medical Supplies segment offers nursing care products for incontinence, wound care, enteral feeding, urology, and suction products, as well as accessories, electrodes, thermometry, chart paper, and syringes.

According to research firm Lucintel, the global medical device industry will post a compound annual growth rate of 6.1 percent from now until 2017, when it's expected to exceed $300 billion in annual sales.

Because of their close interaction with the human body, medical devices also facilitate the collection of copious amounts of patient information. Data management is another significant growth driver in the health care sector.

The 2009 American Recovery and Reinvestment Act, known as "the Stimulus Bill,” includes a total of $19.2 billion that's designated as financial incentives to health care providers to implement electronic medical records.

Companies such as Covidien are becoming adept at collecting and interpreting this data, to create tools that enhance patient care and safety, opening opportunities for new products down the road.

Considering these tailwinds for the industry, it's no surprise that the iShares US Medical Devices ETF (IHI) has been on an upward trajectory, returning 25.48 percent year-to-date and now trading at close to its all-time high. Covidien is one of the exchange-traded fund's top holdings and its stock has trended upward during the past 12 months:

Tax Revolt

Device industry executives have derided the 2.3 percent medical device tax as a "jobs killer” ever since Congress in 2009 included it on medical devices in President Obama's health care reform legislation.

Medical device makers have been collecting and remitting this new tax since it went into effect on Jan. 1, 2013, but the industry also has been relentless in its drive to repeal the levy.

The tax is designed to raise about $29 billion over 10 years, to help pay for health coverage of the uninsured. The device industry insists that the tax will dampen demand for its products and many lawmakers are lending a sympathetic ear to this view.

This sympathy is being greased with lots of cash. According to the Center for Responsive Politics, medical device makers have spent more than $150 million on Washington lobbying since 2008. And their efforts are starting to pay off. The US Senate recently voted 79 to 20 to repeal the tax and the House is expected to follow suit.

The tax stands a good chance of getting repealed by the end of this year, in which event Covidien should enjoy a boost in its long-term prospects, as well as an immediate boost in its stock price.

The recent recession did little to discourage hospitals and other health care providers from buying medical devices. Economic recovery, combined with the likely repeal of the widely unpopular device tax, will only help the industry in general and Covidien in particular.

Covidien posted third-quarter fiscal 2013 earnings per share (EPS) of $0.91, flat year over year. However, EPS topped Wall Street estimates by a penny. Third-quarter earnings reached $400 million, an increase of 1.3 percent from $395 million in the same quarter a year ago.

Revenue in the third quarter hit $2.58 billion, a year-over-year increase of 3 percent, propelled by higher sales in the Medical Devices segment. US-generated revenue dropped 3 percent to $1.3 billion, but international sales increased 10 percent.

To better focus on its core competency of medical devices, Covidien divested its pharmaceutical unit in the third quarter, spinning it off into the independent company, Mallinckrodt (NYSE: MNK).

Eyes on the Eastern Prize

Based in Dublin, Ireland, Covidien has made expansion into emerging markets a top priority, especially focusing on China and surrounding Asian countries.

The Middle Kingdom stands out as the biggest prize. McKinsey & Co. recently reported that health care spending in China will nearly triple to $1 trillion annually by 2020, fueled by a graying population and government efforts to expand insurance coverage. China's leaders plan to invest $125 billion in the country's public health care system over the next five years.

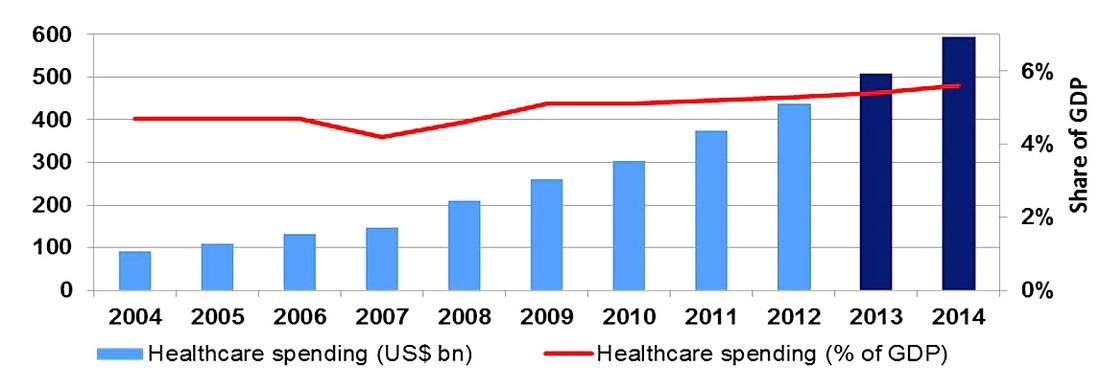

According to the US International Trade Commission, overall health spending in China is on track to reach nearly $500 billion a year by 2014 (see chart below).

The Chinese Clamor for Health Care

Health care expenditures in China, in billions of US dollars and as a percentage of gross domestic product.

Device industry executives have derided the 2.3 percent medical device tax as a "jobs killer” ever since Congress in 2009 included it on medical devices in President Obama's health care reform legislation.

Medical device makers have been collecting and remitting this new tax since it went into effect on Jan. 1, 2013, but the industry also has been relentless in its drive to repeal the levy.

The tax is designed to raise about $29 billion over 10 years, to help pay for health coverage of the uninsured. The device industry insists that the tax will dampen demand for its products and many lawmakers are lending a sympathetic ear to this view.

This sympathy is being greased with lots of cash. According to the Center for Responsive Politics, medical device makers have spent more than $150 million on Washington lobbying since 2008. And their efforts are starting to pay off. The US Senate recently voted 79 to 20 to repeal the tax and the House is expected to follow suit.

The tax stands a good chance of getting repealed by the end of this year, in which event Covidien should enjoy a boost in its long-term prospects, as well as an immediate boost in its stock price.

The recent recession did little to discourage hospitals and other health care providers from buying medical devices. Economic recovery, combined with the likely repeal of the widely unpopular device tax, will only help the industry in general and Covidien in particular.

Covidien posted third-quarter fiscal 2013 earnings per share (EPS) of $0.91, flat year over year. However, EPS topped Wall Street estimates by a penny. Third-quarter earnings reached $400 million, an increase of 1.3 percent from $395 million in the same quarter a year ago.

Revenue in the third quarter hit $2.58 billion, a year-over-year increase of 3 percent, propelled by higher sales in the Medical Devices segment. US-generated revenue dropped 3 percent to $1.3 billion, but international sales increased 10 percent.

To better focus on its core competency of medical devices, Covidien divested its pharmaceutical unit in the third quarter, spinning it off into the independent company, Mallinckrodt (NYSE: MNK).

Eyes on the Eastern Prize

Based in Dublin, Ireland, Covidien has made expansion into emerging markets a top priority, especially focusing on China and surrounding Asian countries.

The Middle Kingdom stands out as the biggest prize. McKinsey & Co. recently reported that health care spending in China will nearly triple to $1 trillion annually by 2020, fueled by a graying population and government efforts to expand insurance coverage. China's leaders plan to invest $125 billion in the country's public health care system over the next five years.

According to the US International Trade Commission, overall health spending in China is on track to reach nearly $500 billion a year by 2014 (see chart below).

The Chinese Clamor for Health Care

Health care expenditures in China, in billions of US dollars and as a percentage of gross domestic product.

Source: The US International Trade Commission

In the context of the recent emerging market slump, Covidien's strong international sales performance is all the more impressive. The company's comparable competitors, such as Medtronic (NYSE: MDT), so far haven't matched Covidien's aggressiveness in courting overseas customers.

In August, Covidien opened its $45 million China Technology Center (CTC) research and development (R&D) facility in Shanghai. The CTC facility encompasses more than 100,000 square feet and 17 laboratories. The CTC is designed to allow health care providers to participate in Covidien's medical device design and development process.

Also in August, the company opened its $21 million Covidien Center of Innovation Korea (CCI Korea), its first R&D center in South Korea. CCI Korea will focus on improving Covidien's range of medical devices and making the local populace aware of them. The facility will include a surgical lab with 11 operating stations and an intensive care unit.

As the emerging markets recover from their recent slump, Covidien should reap the rewards of its expanded sales and marketing footprint in developing markets, where a growing middle class increasingly clamors for Western-quality health care.

Covidien also is in the midst of a major restructuring, by outsourcing generic tasks that can be handled by inexpensive contractors in developing market locations. The company expects the streamlining effort to save up to $300 million annually, starting in fiscal 2014. Meanwhile, management asserts that the medical device tax this year has constituted a 9 percent headwind on EPS growth.

Covidien now spends more than $550 million a year on R&D, at roughly 6 percent of revenue, making the company one of the biggest R&D spenders in its industry. The company owns more than 14,000 patents, with about 12,000 patents pending. The company boasts about 100 new products in the pipeline for launch through 2014.

Covidien's 12-month trailing price-to-earnings (P/E) ratio of 16 compares favorably to the trailing P/E of 21.6 for its industry of medical instruments and supplies. The company estimates that revenue in fiscal 2014 will increase between 2 percent and 5 percent compared to the previous fiscal year.

Covidien faces a bright future, regardless of how the tax repeal effort pans out on Capitol Hill. However, if warring Republicans and Democrats actually succeed in joining hands and repealing the medical device tax, the company's prospects will be even brighter.

John Persinos is managing director of Personal Finance and its parent web site Investing Daily.

In the context of the recent emerging market slump, Covidien's strong international sales performance is all the more impressive. The company's comparable competitors, such as Medtronic (NYSE: MDT), so far haven't matched Covidien's aggressiveness in courting overseas customers.

In August, Covidien opened its $45 million China Technology Center (CTC) research and development (R&D) facility in Shanghai. The CTC facility encompasses more than 100,000 square feet and 17 laboratories. The CTC is designed to allow health care providers to participate in Covidien's medical device design and development process.

Also in August, the company opened its $21 million Covidien Center of Innovation Korea (CCI Korea), its first R&D center in South Korea. CCI Korea will focus on improving Covidien's range of medical devices and making the local populace aware of them. The facility will include a surgical lab with 11 operating stations and an intensive care unit.

As the emerging markets recover from their recent slump, Covidien should reap the rewards of its expanded sales and marketing footprint in developing markets, where a growing middle class increasingly clamors for Western-quality health care.

Covidien also is in the midst of a major restructuring, by outsourcing generic tasks that can be handled by inexpensive contractors in developing market locations. The company expects the streamlining effort to save up to $300 million annually, starting in fiscal 2014. Meanwhile, management asserts that the medical device tax this year has constituted a 9 percent headwind on EPS growth.

Covidien now spends more than $550 million a year on R&D, at roughly 6 percent of revenue, making the company one of the biggest R&D spenders in its industry. The company owns more than 14,000 patents, with about 12,000 patents pending. The company boasts about 100 new products in the pipeline for launch through 2014.

Covidien's 12-month trailing price-to-earnings (P/E) ratio of 16 compares favorably to the trailing P/E of 21.6 for its industry of medical instruments and supplies. The company estimates that revenue in fiscal 2014 will increase between 2 percent and 5 percent compared to the previous fiscal year.

Covidien faces a bright future, regardless of how the tax repeal effort pans out on Capitol Hill. However, if warring Republicans and Democrats actually succeed in joining hands and repealing the medical device tax, the company's prospects will be even brighter.

John Persinos is managing director of Personal Finance and its parent web site Investing Daily.

RSS Feed

RSS Feed