Billionaire hedge fund manager David Einhorn has proven his ability to find winners on the short side but he maintains a "net long" position in his funds, which means he has more long positions than shorts. One of his recent winners on the long side was Seagate Technology (NASDAQ: STX), which Einhorn began buying in 2011 and resulted in a 64% average annual return in less than two years.

Einhorn selects investments with a traditional value approach, although he may not be as patient as a typical value investor. Einhorn took Apple (NASDAQ: AAPL) to court in an effort to force the company to return cash to shareholders, and more recently challenged Oil States International (NYSE: OIS) to unlock shareholder value.

Among his current holdings are three stocks that have strong cash flow and high relative strength (RS). Cash flow is more predictive of a company's financial health than earnings, and RS shows how a stock is performing compared to the rest of the market.

Value stocks can trade at low values for years before other investors catch on. Buying only when RS is high helps avoid this problem. RS is shown as a number between 0 and 100, with 100 being the strongest and 0 being the weakest. High RS means a stock is among the best performers in the market.

The Babcock & Wilcox Company (NYSE: BWC) is a leader in the nuclear power industry. The company makes nuclear reactors for submarines and aircraft carriers, and even with cutbacks in defense spending, it reported a $2.8 billion backlog in that sector. The company also has a backlog of $2.3 billion in its power generation business segment.

For 2013, the company expects revenue of $3.4 billion to $3.5 billion and earnings per share (EPS) of $2.25 to $2.45, after adjusting for some accounting charges related to pension obligations and restructuring.

It is unlikely that new competitors will emerge in the near future in the nuclear reactor business. There are engineering and regulatory hurdles in place to ensure safety and the market is fairly limited. The U.S. Navy has plans to buy only two aircraft carriers between now and 2025, and plans to buy no more than two nuclear-powered submarines a year for the next decade.

BWC is also providing alternative energy solutions beyond nuclear power. Last year, the company was awarded more than $900 million in contracts for waste-to-energy projects, including major projects in the U.S. and Denmark.

BWC has been steadily growing revenue, earnings and cash flow since 2009. Analysts expect earnings growth to average almost 20% a year in the next five years. Based on estimated earnings for 2014, BWC is trading with a price-to-earnings (P/E) ratio of about 13.

The PEG ratio compares the P/E ratio to the earnings growth rate and is about 0.65 for BWC. Stocks with PEG ratios below 1 are considered to be bargains.

Finally, BWC has a RS rank of 100, meaning it is one of the absolute strongest stocks in the market right now.

Einhorn selects investments with a traditional value approach, although he may not be as patient as a typical value investor. Einhorn took Apple (NASDAQ: AAPL) to court in an effort to force the company to return cash to shareholders, and more recently challenged Oil States International (NYSE: OIS) to unlock shareholder value.

Among his current holdings are three stocks that have strong cash flow and high relative strength (RS). Cash flow is more predictive of a company's financial health than earnings, and RS shows how a stock is performing compared to the rest of the market.

Value stocks can trade at low values for years before other investors catch on. Buying only when RS is high helps avoid this problem. RS is shown as a number between 0 and 100, with 100 being the strongest and 0 being the weakest. High RS means a stock is among the best performers in the market.

The Babcock & Wilcox Company (NYSE: BWC) is a leader in the nuclear power industry. The company makes nuclear reactors for submarines and aircraft carriers, and even with cutbacks in defense spending, it reported a $2.8 billion backlog in that sector. The company also has a backlog of $2.3 billion in its power generation business segment.

For 2013, the company expects revenue of $3.4 billion to $3.5 billion and earnings per share (EPS) of $2.25 to $2.45, after adjusting for some accounting charges related to pension obligations and restructuring.

It is unlikely that new competitors will emerge in the near future in the nuclear reactor business. There are engineering and regulatory hurdles in place to ensure safety and the market is fairly limited. The U.S. Navy has plans to buy only two aircraft carriers between now and 2025, and plans to buy no more than two nuclear-powered submarines a year for the next decade.

BWC is also providing alternative energy solutions beyond nuclear power. Last year, the company was awarded more than $900 million in contracts for waste-to-energy projects, including major projects in the U.S. and Denmark.

BWC has been steadily growing revenue, earnings and cash flow since 2009. Analysts expect earnings growth to average almost 20% a year in the next five years. Based on estimated earnings for 2014, BWC is trading with a price-to-earnings (P/E) ratio of about 13.

The PEG ratio compares the P/E ratio to the earnings growth rate and is about 0.65 for BWC. Stocks with PEG ratios below 1 are considered to be bargains.

Finally, BWC has a RS rank of 100, meaning it is one of the absolute strongest stocks in the market right now.

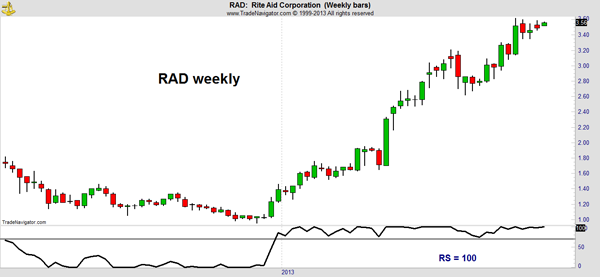

Rite Aid (NYSE: RAD) is not the type of stock usually seen on a list of hedge fund holdings. The stock trades at about $3.60, under the $5 a share price limit set by many large investors. Many brokers will not allow traders to margin positions in stocks that cost less than $5 a share, and that means the funds might have to accept unleveraged returns on their positions in low-priced stocks.

We have no way to know if Einhorn is allowed to margin stocks trading for less than $5 a share (as allowed by some brokers) or if he is convinced the stock can deliver gains without leverage.

RAD operates more than 4,600 drug stores around the country, making it the third largest drug store chain in the country. Revenue topped $25 billion in the past 12 months with RAD reporting a profit of $0.24 per share.

The company's fiscal year ended in March, and RAD reported its first full-year profit since 2007. That makes this a potential turnaround.

Drug stores might benefit from the Affordable Care Act, which will expand access to health care and could increase the number of customers for pharmacies. RAD might also benefit from an aging population since older people tend to use more prescription drugs.

Einhorn is not alone in buying RAD. The stock has an RS of 100 and has more than doubled in price since the beginning of the year.

We have no way to know if Einhorn is allowed to margin stocks trading for less than $5 a share (as allowed by some brokers) or if he is convinced the stock can deliver gains without leverage.

RAD operates more than 4,600 drug stores around the country, making it the third largest drug store chain in the country. Revenue topped $25 billion in the past 12 months with RAD reporting a profit of $0.24 per share.

The company's fiscal year ended in March, and RAD reported its first full-year profit since 2007. That makes this a potential turnaround.

Drug stores might benefit from the Affordable Care Act, which will expand access to health care and could increase the number of customers for pharmacies. RAD might also benefit from an aging population since older people tend to use more prescription drugs.

Einhorn is not alone in buying RAD. The stock has an RS of 100 and has more than doubled in price since the beginning of the year.

Einhorn added RAD to his portfolio in the second quarter of 2013, the last quarter we have a full report of his activity for. During that time, he was also buying Spirit AeroSystems Holdings (NYSE: SPR).

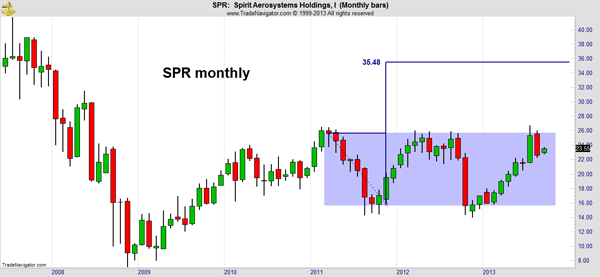

This company supplies aero-structures to airplane manufacturers Boeing (NYSE: BA) and European Aeronautic Defense and Space Company EADS N.V. (OTC: EADSY), the maker of Airbus aircraft.

SPR is expected to see earnings grow at about the same rate as BA, but SPR is significantly cheaper from a value perspective. In 2014, analysts expect SPR to report EPS of $2.59. The stock is currently trading at about 9.2 times that amount. The expected growth rate of 12.75% a year results in a PEG ratio of 0.72.

SPR is also a buy from a technical perspective. The RS rank is 66 and rising, meaning SPR has outperformed 66% of the market in the past six months.

The monthly chart shows that SPR is near the upper limit of a multi-year trading range. A breakout from that range points to a price target of $35.48, which is about 50% above the recent price.

This company supplies aero-structures to airplane manufacturers Boeing (NYSE: BA) and European Aeronautic Defense and Space Company EADS N.V. (OTC: EADSY), the maker of Airbus aircraft.

SPR is expected to see earnings grow at about the same rate as BA, but SPR is significantly cheaper from a value perspective. In 2014, analysts expect SPR to report EPS of $2.59. The stock is currently trading at about 9.2 times that amount. The expected growth rate of 12.75% a year results in a PEG ratio of 0.72.

SPR is also a buy from a technical perspective. The RS rank is 66 and rising, meaning SPR has outperformed 66% of the market in the past six months.

The monthly chart shows that SPR is near the upper limit of a multi-year trading range. A breakout from that range points to a price target of $35.48, which is about 50% above the recent price.

These stocks are market leaders and have been researched by one of the best value investors in the markets right now. David Einhorn rated these stocks as buys when he filed his most recent report of holdings. All three are worth consideration by any investor.

RSS Feed

RSS Feed