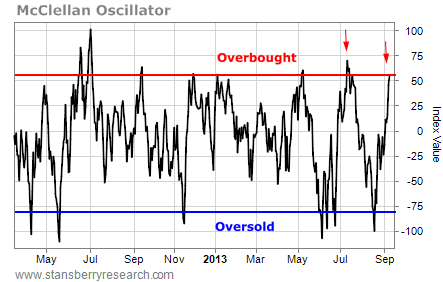

It has been a marvelous week for stocks. By the end of the day Wednesday, the S&P 500 had rallied from 1,635 to 1,689 in seven trading days. That's a gain of over 3%. Not bad for one week. There are signs, though, that this bounce is nearing an end. The same signs that had us looking for a bounce a few weeks ago are now warning of a potential decline. The McClellan Oscillator is approaching overbought levels. Take a look...

This measure of overbought and oversold conditions has been especially volatile lately. The recent action looks similar to what happened following the June bottom in stock prices and leading up to the August decline. At the very least, the McClellan Oscillator suggests stock prices are extended to the upside right now. Stocks will have a tough time holding onto any further gains, and there's a strong possibility of a pullback. The Volatility Index (the "VIX") is also sending a warning sign...

This 60-minute chart of the VIX shows a bullish falling-wedge pattern. Most of the time, charts break this pattern to the upside. This should lead to a sharp move higher for the VIX. Since a rising VIX usually happens with a falling stock market, this is another sign stocks may be heading for a rough patch.

Finally, let's take another look at the Banking Index (the "BKX")...

Finally, let's take another look at the Banking Index (the "BKX")...

Bank stocks tend to lead the stock market. A strong market needs a strong banking sector. As you can see from the chart, though, the Banking Index broke down from its uptrend a few weeks ago. The recent move down has pushed the index back up toward its breakdown point and the natural resistance of its 50-day moving average.

With the broad stock market already extended and approaching overbought conditions, there's probably not enough energy left to power the BKX above this resistance level. If the Banking Index pulls back from here, look for the broad stock market to follow.

With the broad stock market already extended and approaching overbought conditions, there's probably not enough energy left to power the BKX above this resistance level. If the Banking Index pulls back from here, look for the broad stock market to follow.

RSS Feed

RSS Feed