Investors already unnerved by the prospect of imminent monetary tightening by the Federal Reserve are now forced to endure the latest performance of political kabuki in the halls of Congress. The persistent dysfunction in Washington, DC reached a nadir last week with the government shutdown, weighing heavily on the stocks of companies that rely on Uncle Sam for revenue.

The defense sector is bearing the brunt of this pessimism. However, investors who fret that budgetary wrangling will significantly hurt military spending are missing the big picture. In recent weeks, one company has flown far above its competitors in the ceaseless dogfight for military spoils: Lockheed Martin (NYSE: LMT). The company's undervalued stock has emerged as the best defense sector play now.

Last Friday, Lockheed announced that it would furlough 3,000 employees because of the government shutdown. Those furloughs were scheduled to start today, but the company indicated yesterday that it might call them off, depending on how shutdown negotiations proceed.

Regardless, the company's pronouncements on furloughs are likely intended as theatrics to get lawmakers' attention. Corporate executives, ever the pragmatists, dislike the shutdown because it's disruptive. And although those Lockheed jobs are very real to the people who depend on them, they barely represent a blip compared to the vast sums that the company is virtually assured of reaping for years to come. It's also a safe bet that those workers will get called back, immediately after the shutdown sideshow reaches its finale.

With a market cap of $39 billion, Lockheed is the largest defense contractor in the world. Based in Bethesda, Maryland, Lockheed manufactures a host of military aerospace products for the Pentagon and international clients. In addition to its core competency of combat fighters, the company makes missiles, satellites and coastal warships.

Lockheed is more than compensating for budgetary uncertainty at home by cutting costs, diversifying into other industries and expanding export sales of its high-tech aircraft.

Because of the automatic budget cuts known as the "sequester,” the US Department of Defense (DoD) is now required to cut more than $40 billion this fiscal year out of its $549 billion budget. Those cuts are indeed taking place, but one program that isn't slated to take a significant hit is the most expensive US weapons program in history: Lockheed's F-35 Lightning II Joint Strike Fighter.

The F-35 is the most advanced combat jet fighter ever built and the Navy, Air Force and Marines are devoted to their respective iterations of the program. More than 2,443 of the planes are on order and about 65 already have been built, at a cost of $84 billion. Lockheed generated about $6.5 billion from the plane in 2012 and expects the F-35 to contribute an even greater amount to annual revenue in 2013 and beyond.

The unit cost for an F-35 currently hovers at around $161 million. According to estimates compiled by Bloomberg, it could cost up to $1.5 trillion to develop, build, fly, and maintain all the F-35s on order for 55 years, the full operational lives of the planes.

The upshot: Lockheed will remain the recipient of an extraordinary amount of federal government spending, far into the future.

September Trifecta

In late September, Lockheed scored three important coups in the competition for defense money:

What's more, the American-produced F-35 is seen as a bulwark against China, a longtime nemesis of both Korea and Japan that is boosting defense outlays and developing an indigenous aerospace industry.

In the wake of these recent successes, Lockheed increased its quarterly dividend by 16 percent to $1.33 per share and boosted its share repurchase plan by $3 billion. These moves will return more cash to Lockheed's shareholders, helping alleviate their concerns over slimmer US defense budgets. The company still had $1.4 billion remaining in its share buyback program at the end of the second quarter.

Lockheed has a larger overseas military aircraft footprint than any of its defense rivals, such as Boeing (NYSE: BA). Boeing enjoys a commanding presence in commercial aircraft sales that Lockheed lacks, but the latter is gaining the edge in defense appropriations. Notably, Boeing's warfighter bid was voted down by South Korea last month.

Lockheed's stock has slumped recently (see graph below), but all of the aforementioned tailwinds suggest plenty of upside ahead.

The defense sector is bearing the brunt of this pessimism. However, investors who fret that budgetary wrangling will significantly hurt military spending are missing the big picture. In recent weeks, one company has flown far above its competitors in the ceaseless dogfight for military spoils: Lockheed Martin (NYSE: LMT). The company's undervalued stock has emerged as the best defense sector play now.

Last Friday, Lockheed announced that it would furlough 3,000 employees because of the government shutdown. Those furloughs were scheduled to start today, but the company indicated yesterday that it might call them off, depending on how shutdown negotiations proceed.

Regardless, the company's pronouncements on furloughs are likely intended as theatrics to get lawmakers' attention. Corporate executives, ever the pragmatists, dislike the shutdown because it's disruptive. And although those Lockheed jobs are very real to the people who depend on them, they barely represent a blip compared to the vast sums that the company is virtually assured of reaping for years to come. It's also a safe bet that those workers will get called back, immediately after the shutdown sideshow reaches its finale.

With a market cap of $39 billion, Lockheed is the largest defense contractor in the world. Based in Bethesda, Maryland, Lockheed manufactures a host of military aerospace products for the Pentagon and international clients. In addition to its core competency of combat fighters, the company makes missiles, satellites and coastal warships.

Lockheed is more than compensating for budgetary uncertainty at home by cutting costs, diversifying into other industries and expanding export sales of its high-tech aircraft.

Because of the automatic budget cuts known as the "sequester,” the US Department of Defense (DoD) is now required to cut more than $40 billion this fiscal year out of its $549 billion budget. Those cuts are indeed taking place, but one program that isn't slated to take a significant hit is the most expensive US weapons program in history: Lockheed's F-35 Lightning II Joint Strike Fighter.

The F-35 is the most advanced combat jet fighter ever built and the Navy, Air Force and Marines are devoted to their respective iterations of the program. More than 2,443 of the planes are on order and about 65 already have been built, at a cost of $84 billion. Lockheed generated about $6.5 billion from the plane in 2012 and expects the F-35 to contribute an even greater amount to annual revenue in 2013 and beyond.

The unit cost for an F-35 currently hovers at around $161 million. According to estimates compiled by Bloomberg, it could cost up to $1.5 trillion to develop, build, fly, and maintain all the F-35s on order for 55 years, the full operational lives of the planes.

The upshot: Lockheed will remain the recipient of an extraordinary amount of federal government spending, far into the future.

September Trifecta

In late September, Lockheed scored three important coups in the competition for defense money:

- Lockheed's F-35 emerged as the likely winner of South Korea's fiercely contested $7.7 billion fighter jet deal.

- Lockheed won two major contracts, worth a combined $7.8 billion, from the DoD for 71 additional units of the F-35. The company will start delivering the first batch of this order in the second quarter of 2014.

- Lockheed scooped up a huge proportion—more than $4 billion—of $10.92 billion worth of DoD contracts awarded on September 27.

What's more, the American-produced F-35 is seen as a bulwark against China, a longtime nemesis of both Korea and Japan that is boosting defense outlays and developing an indigenous aerospace industry.

In the wake of these recent successes, Lockheed increased its quarterly dividend by 16 percent to $1.33 per share and boosted its share repurchase plan by $3 billion. These moves will return more cash to Lockheed's shareholders, helping alleviate their concerns over slimmer US defense budgets. The company still had $1.4 billion remaining in its share buyback program at the end of the second quarter.

Lockheed has a larger overseas military aircraft footprint than any of its defense rivals, such as Boeing (NYSE: BA). Boeing enjoys a commanding presence in commercial aircraft sales that Lockheed lacks, but the latter is gaining the edge in defense appropriations. Notably, Boeing's warfighter bid was voted down by South Korea last month.

Lockheed's stock has slumped recently (see graph below), but all of the aforementioned tailwinds suggest plenty of upside ahead.

Lockheed's trailing 12-month price-to-earnings (P/E) ratio is only 13.7, a bargain compared to the trailing P/E of 22 for the aerospace/defense sector. At a healthy 4.3 percent, the stock's dividend yield outperforms its sector's dividend yield of 2 percent.

In contrast, major rival Boeing has a trailing P/E of 21.4, reflecting high expectations that the Chicago-based manufacturer will benefit from the commercial aerospace resurgence. The stock's dividend yield is 1.4 percent.

Lockheed's big-ticket weapons systems confer much higher margins than commercial airliners and they generate streams of revenue that last longer, especially when upgrades and maintenance are considered.

The fact is, despite the latest round of political brinksmanship on Capitol Hill, Lockheed over the long haul will remain awash in orders for defense items. When the shutdown inevitably ends, the company's stock is likely to get an immediate boost, as partisan rhetoric is drowned out by a tsunami of global defense money.

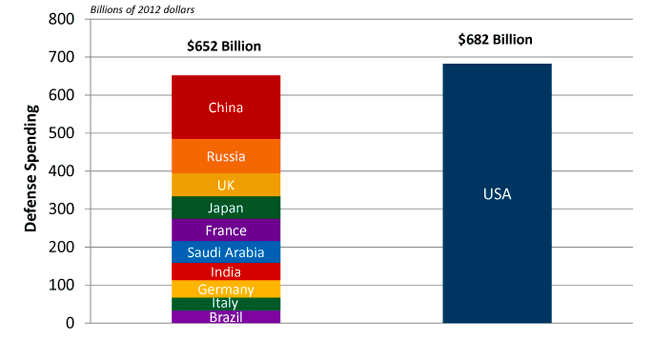

The Stockholm International Peace Research Institute estimates that global military expenditures totaled $1.75 trillion in 2012, an increase of more than 53 percent since 2000.

According to the non-partisan Peter G. Peterson Foundation, the US military remains by far the best funded and largest on the planet (see chart below).

Global Military Largesse

US military expenditures compared to the rest of the world.

In contrast, major rival Boeing has a trailing P/E of 21.4, reflecting high expectations that the Chicago-based manufacturer will benefit from the commercial aerospace resurgence. The stock's dividend yield is 1.4 percent.

Lockheed's big-ticket weapons systems confer much higher margins than commercial airliners and they generate streams of revenue that last longer, especially when upgrades and maintenance are considered.

The fact is, despite the latest round of political brinksmanship on Capitol Hill, Lockheed over the long haul will remain awash in orders for defense items. When the shutdown inevitably ends, the company's stock is likely to get an immediate boost, as partisan rhetoric is drowned out by a tsunami of global defense money.

The Stockholm International Peace Research Institute estimates that global military expenditures totaled $1.75 trillion in 2012, an increase of more than 53 percent since 2000.

According to the non-partisan Peter G. Peterson Foundation, the US military remains by far the best funded and largest on the planet (see chart below).

Global Military Largesse

US military expenditures compared to the rest of the world.

Whether this high level of US defense spending is a justified and efficient use of taxpayers' dollars is beyond the purview of this article. The point is that this gigantic pool of money—and generator of jobs—is woven into the fabric of the national economy and unlikely to ever shrink in any major way, regardless of ephemeral political passions in Washington.

The US also generates more foreign sales of weapons systems than any other nation on earth; one of America's fastest-growing military export niches is aircraft. Fixed-wing combat airplanes account for one third of all global arms transfers, with Lockheed and other US-based manufacturers topping the list of sellers.

Lockheed derives 80 percent of its revenue from the Pentagon, but the company is making a major push for international sales. Emerging nations are clamoring for US-made combat aircraft that feature highly advanced technology. This demand will more than compensate for belt-tightening in America and Europe.

In addition to its advanced F-35, Lockheed also makes the F-16, which is the world's most sought-after combat jet. Countries currently lining up for more F-16s include Turkey, Taiwan and Indonesia, among others.

Land, Sea and Space

Lockheed also is expanding its role in combating the growing global concern of cyber security.

In August, Lockheed was selected by the US Department of Homeland Security to provide cyber security services to defend federal and other government IT networks from threats. In September, the company acquired Amor Group, a cyber security provider based in Scotland.

Lockheed also is making a major push into the booming energy patch. In March, the company launched a program to develop liquefied natural gas (LNG) tanks for transportation and storage.

The company is leveraging its existing technology and long experience making space shuttle tanks for NASA. Lockheed has the means to create cryogenic LNG storage systems that are "intermodal,” the term for containerized freight that's suitable for land, rail and water transportation.

Meanwhile, Lockheed's other non-aerospace business segments continue to reap orders. Notably, the US Navy this year awarded Lockheed a $57 million contract to upgrade the fleet's electronic defenses against anti-ship missiles.

Also this year, the US National Oceanic and Atmospheric Administration (NOAA) awarded Lockheed a $1 billion contract to construct geostationary weather satellites. The satellites are increasingly important for NOAA's storm-watching mandate, as climate change makes weather more volatile and difficult to predict.

Lockheed reported second quarter 2013 revenue of $11.4 billion, compared to $11.9 billion in the second quarter of 2012. Earnings in the second quarter were $859 million, or $2.64 in earnings per share (EPS), compared to $781 million, or $2.38 in EPS, in the same quarter a year ago. Revenue and earnings should pick up in future quarters, as anticipated contracts come to the fore.

This defense contractor has plenty of fight left, making its undervalued stock a rare buying opportunity for investors who aren't distracted by the Washington circus.

The US also generates more foreign sales of weapons systems than any other nation on earth; one of America's fastest-growing military export niches is aircraft. Fixed-wing combat airplanes account for one third of all global arms transfers, with Lockheed and other US-based manufacturers topping the list of sellers.

Lockheed derives 80 percent of its revenue from the Pentagon, but the company is making a major push for international sales. Emerging nations are clamoring for US-made combat aircraft that feature highly advanced technology. This demand will more than compensate for belt-tightening in America and Europe.

In addition to its advanced F-35, Lockheed also makes the F-16, which is the world's most sought-after combat jet. Countries currently lining up for more F-16s include Turkey, Taiwan and Indonesia, among others.

Land, Sea and Space

Lockheed also is expanding its role in combating the growing global concern of cyber security.

In August, Lockheed was selected by the US Department of Homeland Security to provide cyber security services to defend federal and other government IT networks from threats. In September, the company acquired Amor Group, a cyber security provider based in Scotland.

Lockheed also is making a major push into the booming energy patch. In March, the company launched a program to develop liquefied natural gas (LNG) tanks for transportation and storage.

The company is leveraging its existing technology and long experience making space shuttle tanks for NASA. Lockheed has the means to create cryogenic LNG storage systems that are "intermodal,” the term for containerized freight that's suitable for land, rail and water transportation.

Meanwhile, Lockheed's other non-aerospace business segments continue to reap orders. Notably, the US Navy this year awarded Lockheed a $57 million contract to upgrade the fleet's electronic defenses against anti-ship missiles.

Also this year, the US National Oceanic and Atmospheric Administration (NOAA) awarded Lockheed a $1 billion contract to construct geostationary weather satellites. The satellites are increasingly important for NOAA's storm-watching mandate, as climate change makes weather more volatile and difficult to predict.

Lockheed reported second quarter 2013 revenue of $11.4 billion, compared to $11.9 billion in the second quarter of 2012. Earnings in the second quarter were $859 million, or $2.64 in earnings per share (EPS), compared to $781 million, or $2.38 in EPS, in the same quarter a year ago. Revenue and earnings should pick up in future quarters, as anticipated contracts come to the fore.

This defense contractor has plenty of fight left, making its undervalued stock a rare buying opportunity for investors who aren't distracted by the Washington circus.

RSS Feed

RSS Feed