By John Persinos

Wabash National Corp (NYSE: WNC) is a leading manufacturer of semi-truck trailers that's positioned for market-beating growth. And on this Labor Day, what industry better reflects the quintessential spirit of the American worker than trucking?

Transportation is a classic recovery play, but investors who want to leverage the economic rebound should remain wary of cyclical stocks because many of them could tank if overall growth sputters. The shrewder approach is to find cyclical companies that are undervalued, with unique competitive advantages that allow them to dominate their respective markets and avoid getting clobbered during downturns.

Wabash hits all those criteria. The company designs, manufactures and markets transportation-related products in North America; its core business is standard and customized semi-truck trailers. It also makes equipment that's "intermodal,” which is containerized freight that can travel via truck, rail or ship.

Wabash is enjoying the boost that trucking gets from increased economic activity, while also diversifying into technology solutions that enhance the operational efficiency of its customers. In addition, the company is benefiting from pent-up demand for fleet replacement and enhancement among trucking operators who are only now shaking off the trauma of the most recent recession.

The upshot: Wabash is a cyclical bet with downside protection. Headquartered in Lafayette, Indiana, the company sports a market cap of $726 million and operates in three segments: Commercial Trailer Products, Diversified Products and Retail.

Commercial Trailer Products manufactures truck trailers, dry van trailers, refrigerated trailers, steel and aluminum flatbeds, and drop-deck trailers. Diversified Products provides technology solutions to transportation companies. Retail operates 12 branch locations that sell new and used trailers, aftermarket parts and services.

Wabash's products are sold under well-known brand names that are familiar to any truck driver who makes a living on the road: Wabash National, Transcraft, Benson, DuraPlate, ArcticLite, Brenner Tank, Beall, Garsite, Progress Tank, and many more.

Founded as an entrepreneurial start-up in 1985 and publicly traded since 1991, Wabash is thriving because the trucking industry is a leading indicator for the overall economy. During the early stages of a recovery, customers start to ship more goods in expectation of stronger business conditions.

This year's US Freight Transportation Forecast, compiled by the American Trucking Association (ATA), predicts significant long-term growth in the trucking industry. Released in June, the latest ATA report estimates that overall freight revenue in the US will reach $1.3 trillion annually in 2024, an increase of 63.6 percent from 2012.

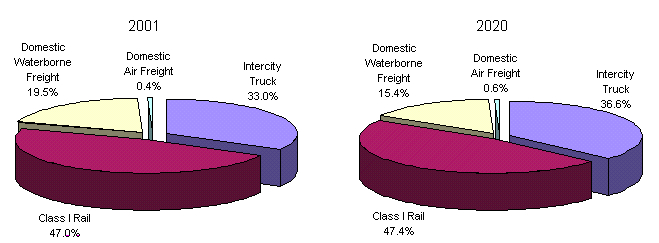

Meanwhile, the US Department of Transportation projects that trucks will carry 36.6 percent of the country's freight by 2020, up from 33 percent in 2001, representing the biggest gain during this period among all freight transportation options (see charts, below).

Trucking's Expanding Role

Wabash National Corp (NYSE: WNC) is a leading manufacturer of semi-truck trailers that's positioned for market-beating growth. And on this Labor Day, what industry better reflects the quintessential spirit of the American worker than trucking?

Transportation is a classic recovery play, but investors who want to leverage the economic rebound should remain wary of cyclical stocks because many of them could tank if overall growth sputters. The shrewder approach is to find cyclical companies that are undervalued, with unique competitive advantages that allow them to dominate their respective markets and avoid getting clobbered during downturns.

Wabash hits all those criteria. The company designs, manufactures and markets transportation-related products in North America; its core business is standard and customized semi-truck trailers. It also makes equipment that's "intermodal,” which is containerized freight that can travel via truck, rail or ship.

Wabash is enjoying the boost that trucking gets from increased economic activity, while also diversifying into technology solutions that enhance the operational efficiency of its customers. In addition, the company is benefiting from pent-up demand for fleet replacement and enhancement among trucking operators who are only now shaking off the trauma of the most recent recession.

The upshot: Wabash is a cyclical bet with downside protection. Headquartered in Lafayette, Indiana, the company sports a market cap of $726 million and operates in three segments: Commercial Trailer Products, Diversified Products and Retail.

Commercial Trailer Products manufactures truck trailers, dry van trailers, refrigerated trailers, steel and aluminum flatbeds, and drop-deck trailers. Diversified Products provides technology solutions to transportation companies. Retail operates 12 branch locations that sell new and used trailers, aftermarket parts and services.

Wabash's products are sold under well-known brand names that are familiar to any truck driver who makes a living on the road: Wabash National, Transcraft, Benson, DuraPlate, ArcticLite, Brenner Tank, Beall, Garsite, Progress Tank, and many more.

Founded as an entrepreneurial start-up in 1985 and publicly traded since 1991, Wabash is thriving because the trucking industry is a leading indicator for the overall economy. During the early stages of a recovery, customers start to ship more goods in expectation of stronger business conditions.

This year's US Freight Transportation Forecast, compiled by the American Trucking Association (ATA), predicts significant long-term growth in the trucking industry. Released in June, the latest ATA report estimates that overall freight revenue in the US will reach $1.3 trillion annually in 2024, an increase of 63.6 percent from 2012.

Meanwhile, the US Department of Transportation projects that trucks will carry 36.6 percent of the country's freight by 2020, up from 33 percent in 2001, representing the biggest gain during this period among all freight transportation options (see charts, below).

Trucking's Expanding Role

Source: The US Dept. of Transportation These trends spell greater demand for Wabash's trucks, products and services. According to the transportation analysis firm ACT Research, shipments of trailers in 2013 will reach an estimated 244,750 units, an increase of 3 percent over 2012. ACT projects that the number of units shipped will be 258,500 in 2014, a 6 percent increase over 2013.

Wabash is gaining even greater leverage from the recovery because of the past reluctance of many trucking operators to replace or even repair aging trailers. Now that the recovery appears real and entrenched, these firms are whittling away at their backlog of deferred repair and replacement work, providing a multi-year stream of work for Wabash that should withstand cyclical volatility.

To further mitigate any vulnerability to economic ups and downs, Wabash also has been diversifying its business. Notably, its Diversified segment offers products that enhance the aerodynamics and fuel performance of semitrailers.

This sort of innovation sets Wabash apart from competitors such as Trinity Industries (NYSE: TRN), a larger company (market cap: $3.3 billion) that caters to several industries and lacks Wabash's tight focus on the development of new trucking technology.

A non-competitor to Wabash that's a major beneficiary of these trends is FleetCor Technologies (NYSE: FLT), the world's leading provider of fleet cards and related payment processes for companies and government entities in 21 countries. I profiled the stock in a May 13 article on Investing Daily and it remains a good long-term play on the trucking renaissance.

Inroads into the Energy Patch

Wabash is an early adopter of advanced composite materials for its manufacture of trucking semi-trailer and truck body components. Composites are polymer materials reinforced with carbon fiber, forming a strengthened combination that's light, flexible and durable.

The next decade will see an explosion in the use of composite materials, in a variety of applications that include cars, planes and trucks. Wabash got ahead of the composite curve and is now a leading provider of these materials for its customers.

Wabash also is a play on the resurgence of the railroad sector, through the offering of its RoadRailer, a lightweight, dual-mode trailer that provides a hybrid of highway and rail transportation. The company has expanded its intermodal offerings to include freight car running boards, crossover platforms and brake steps.

Both the trucking and rail industries are viewed as bellwethers and are closely watched by analysts who seek to divine the direction of the broader economy. Wabash has managed to place a foot into both camps.

According to the ATA report, intermodal rail will continue to be the fastest growing freight mode, growing an average of 5.1 percent a year until 2018. In another major move toward diversification, Wabash last year bought privately held Walker Group Holdings LLC for $360 million in cash.

Walker Group makes engineered products and tanks for transporting liquids. With the addition of Walker Group, Wabash has taken on the manufacture of petroleum tankers and truck-mounted fuel tanks—yet another play on growth, this time on the continuing prosperity of the energy sector.

As oil and gas production soars, especially in the prolific shale plays of North America, energy producers are increasingly in need of transportation options to move their burgeoning volume of product.

The Walker Group acquisition was completed in May 2012 and it has been propelling Wabash's revenue, earnings and stock price ever since (see graph, below).

Wabash is gaining even greater leverage from the recovery because of the past reluctance of many trucking operators to replace or even repair aging trailers. Now that the recovery appears real and entrenched, these firms are whittling away at their backlog of deferred repair and replacement work, providing a multi-year stream of work for Wabash that should withstand cyclical volatility.

To further mitigate any vulnerability to economic ups and downs, Wabash also has been diversifying its business. Notably, its Diversified segment offers products that enhance the aerodynamics and fuel performance of semitrailers.

This sort of innovation sets Wabash apart from competitors such as Trinity Industries (NYSE: TRN), a larger company (market cap: $3.3 billion) that caters to several industries and lacks Wabash's tight focus on the development of new trucking technology.

A non-competitor to Wabash that's a major beneficiary of these trends is FleetCor Technologies (NYSE: FLT), the world's leading provider of fleet cards and related payment processes for companies and government entities in 21 countries. I profiled the stock in a May 13 article on Investing Daily and it remains a good long-term play on the trucking renaissance.

Inroads into the Energy Patch

Wabash is an early adopter of advanced composite materials for its manufacture of trucking semi-trailer and truck body components. Composites are polymer materials reinforced with carbon fiber, forming a strengthened combination that's light, flexible and durable.

The next decade will see an explosion in the use of composite materials, in a variety of applications that include cars, planes and trucks. Wabash got ahead of the composite curve and is now a leading provider of these materials for its customers.

Wabash also is a play on the resurgence of the railroad sector, through the offering of its RoadRailer, a lightweight, dual-mode trailer that provides a hybrid of highway and rail transportation. The company has expanded its intermodal offerings to include freight car running boards, crossover platforms and brake steps.

Both the trucking and rail industries are viewed as bellwethers and are closely watched by analysts who seek to divine the direction of the broader economy. Wabash has managed to place a foot into both camps.

According to the ATA report, intermodal rail will continue to be the fastest growing freight mode, growing an average of 5.1 percent a year until 2018. In another major move toward diversification, Wabash last year bought privately held Walker Group Holdings LLC for $360 million in cash.

Walker Group makes engineered products and tanks for transporting liquids. With the addition of Walker Group, Wabash has taken on the manufacture of petroleum tankers and truck-mounted fuel tanks—yet another play on growth, this time on the continuing prosperity of the energy sector.

As oil and gas production soars, especially in the prolific shale plays of North America, energy producers are increasingly in need of transportation options to move their burgeoning volume of product.

The Walker Group acquisition was completed in May 2012 and it has been propelling Wabash's revenue, earnings and stock price ever since (see graph, below).

Wabash's revenue in the second quarter reached $413 million, an increase of $51 million, or 14 percent compared to the same quarter a year ago. Second quarter revenue was roughly in line with Wall Street's expectations.

Earnings in the quarter came in at $14.1 million, or $0.20 in earnings per share (EPS), compared to second quarter 2012 earnings of $1.9 million, or $0.03 in EPS on revenue of $362 million. Analysts had expected a lower EPS of $0.19.

Operating EBITDA (earnings before interest, taxes, depreciation and amortization) strongly underscored the company's year-over-year improvement in performance, increasing $13 million to $42 million in the second quarter, for a year-over-year jump of 42 percent.

With a 12-month trailing price-to-earnings (P/E) ratio of only 6.1, the stock trades at a hefty discount to the trailing P/E of 23.3 for the trucking industry. Investors can ride this undervalued stock a long way.

Earnings in the quarter came in at $14.1 million, or $0.20 in earnings per share (EPS), compared to second quarter 2012 earnings of $1.9 million, or $0.03 in EPS on revenue of $362 million. Analysts had expected a lower EPS of $0.19.

Operating EBITDA (earnings before interest, taxes, depreciation and amortization) strongly underscored the company's year-over-year improvement in performance, increasing $13 million to $42 million in the second quarter, for a year-over-year jump of 42 percent.

With a 12-month trailing price-to-earnings (P/E) ratio of only 6.1, the stock trades at a hefty discount to the trailing P/E of 23.3 for the trucking industry. Investors can ride this undervalued stock a long way.

RSS Feed

RSS Feed