The gold price didn't do much in Far East trading, but tried to rally around noon in London...and then again once the London p.m. gold fix was in at 10:00 a.m. EDT...but both rallies met with the same fate...a seller of last report. After the second rally got capped, the gold price didn't do much for the remainder of the trading day in New York. Gold's high price tick of $1,261.00 spot came shortly after 10:00 a.m. EDT.

The gold price closed the Wednesday session at $1,252.50 spot...up $10.10 on the day. Not surprisingly, with everyone in New York heading out early, the net volume was a smallish 117,000 contracts.

The gold price closed the Wednesday session at $1,252.50 spot...up $10.10 on the day. Not surprisingly, with everyone in New York heading out early, the net volume was a smallish 117,000 contracts.

The silver price followed a similar path...and the blast off after the noon London silver fix probably made it past the $20 spot price mark for a moment...and a not-for-profit seller had a throw a fair amount of paper silver at it before the rally collapsed. The rally at the 3 p.m. BST gold fix met the same fate...and after that, the price traded flat for the remainder of the New York session. Kitco recorded the New York high tick as $19.97 spot.

Silver finished the day at $19.72 spot...up 34 cents from Tuesday. Not surprisingly, with both rallies getting hit hard, net volume was pretty hefty...around 38,000 contracts.

Silver finished the day at $19.72 spot...up 34 cents from Tuesday. Not surprisingly, with both rallies getting hit hard, net volume was pretty hefty...around 38,000 contracts.

Platinum got sold down a bit yesterday...and palladium traded sideways. Here are the charts...

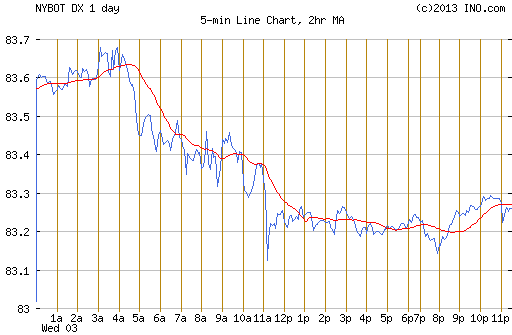

The dollar index closed late Tuesday afternoon in New York at 83.54. Once trading began in the Far East on their Wednesday, the dollar rallied a hair...up to 83.68...by 9:00 a.m. BST in London. It was all down hill from there, with the spike low of 83.12 coming a few minutes after 11:00 a.m. in New York. The index recovered a handful of basis points from there...and closed at 83.24...down 30 basis points on the day.

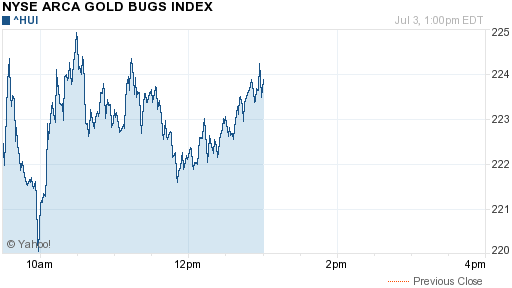

The gold stocks chopped around in positive territory yesterday on Wednesday...and even though the gold price gained back every dollar it lost during the Tuesday trading session, the HUI was only up 1.68 percent by the early 1:00 p.m. EDT close.

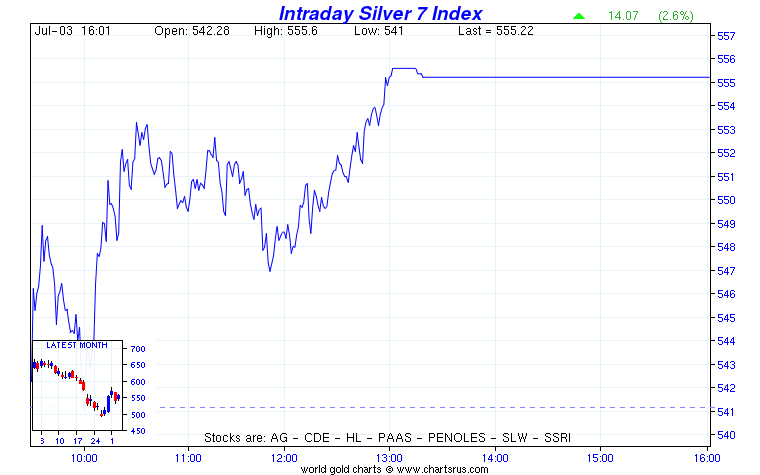

It was the same story with the silver stocks. Even though the silver price gained back more than it lost on Tuesday, Nick Laird's Intraday Silver Sentiment Index gained back only 2.60%. It was down 5.01% on Tuesday, in case you'd forgotten.

The CME's Daily Delivery Report showed that Wednesday was another JPMorgan/Bank of Nova Scotia duet in both metals. There were 10 gold and 221 silver contracts posted for delivery within the Comex-approved depositories next Tuesday. In silver, Canada's Bank of Nova Scotia was the short/issuer on 202 contracts and JPMorgan Chase was the only long/stopper of note, with 192 contracts in its proprietary trading account and 22 contracts for its client account. There were no reported changes in either GLD or SLV yesterday...and no sales report from the U.S. Mint, either.

Over at the Comex-approved depositories on Tuesday, they didn't report receiving any silver...but they did ship 428,838 troy ounces out the door for parts unknown. They didn't report receiving any gold but Canada's Bank of Nova Scotia reported shipping out a couple of kilo bars (64.30 troy ounces).

Over at the Comex-approved depositories on Tuesday, they didn't report receiving any silver...but they did ship 428,838 troy ounces out the door for parts unknown. They didn't report receiving any gold but Canada's Bank of Nova Scotia reported shipping out a couple of kilo bars (64.30 troy ounces).

RSS Feed

RSS Feed