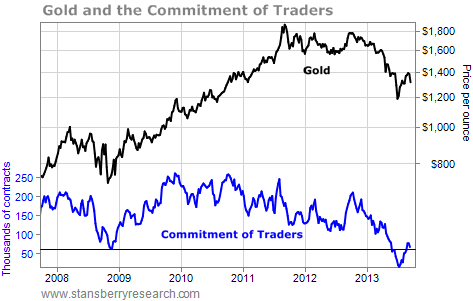

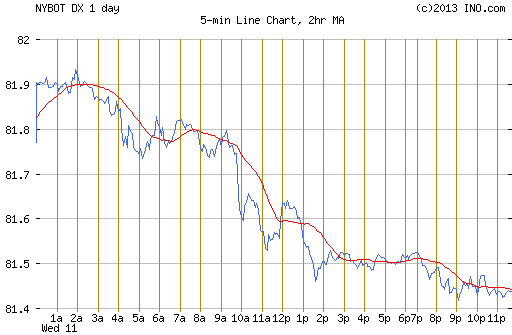

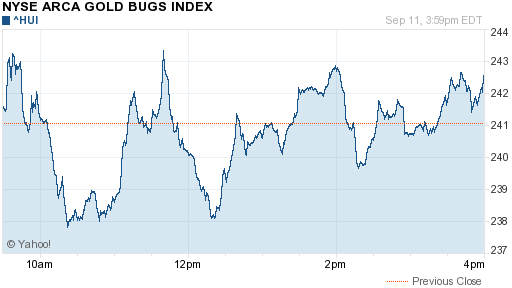

It's last week all over again. The gold sector was at an important decision point last week. The Market Vectors Gold Miners Fund (GDX) was sitting right on support. A bounce higher would likely kick off the start of a new intermediate-term rally for the gold sector. A break below support would cause a retest of the June lows.

One way or another, gold stocks were set up for a big move. And the Federal Open Market Committee (FOMC) meeting was the catalyst. GDX exploded higher last Wednesday after the Fed announced it would continue its quantitative easing program. The decision to keep throwing $85 billion worth of freshly printed bills into the financial markets every month was enough to boost the gold sector by 9%. GDX bounced solidly off support. It closed back above its 50-day moving average (DMA) and the pattern remained consistent with the action we saw as gold stocks bottomed in 2008.

All the sector had to do to confirm its new uptrend was to avoid giving back too large a chunk of those gains over the next few days. We could then pile into the gold sector aggressively, with complete confidence that the intermediate-term rally we've been looking for over the past few weeks was finally underway.

But gold stocks never make it that easy. By the close of trading on Monday, GDX had given back all of last Wednesday's gains and then some. So we're back to the same conditions we had just before the FOMC announcement last week. GDX is sitting on an important support level. It either bounces from here, rallies back above the 50-DMA, and kicks off a strong rally similar to what happened in late 2008 or it breaks below the recent low around $25 and heads back down to retest the June low at about $22. Here's the updated chart.

One way or another, gold stocks were set up for a big move. And the Federal Open Market Committee (FOMC) meeting was the catalyst. GDX exploded higher last Wednesday after the Fed announced it would continue its quantitative easing program. The decision to keep throwing $85 billion worth of freshly printed bills into the financial markets every month was enough to boost the gold sector by 9%. GDX bounced solidly off support. It closed back above its 50-day moving average (DMA) and the pattern remained consistent with the action we saw as gold stocks bottomed in 2008.

All the sector had to do to confirm its new uptrend was to avoid giving back too large a chunk of those gains over the next few days. We could then pile into the gold sector aggressively, with complete confidence that the intermediate-term rally we've been looking for over the past few weeks was finally underway.

But gold stocks never make it that easy. By the close of trading on Monday, GDX had given back all of last Wednesday's gains and then some. So we're back to the same conditions we had just before the FOMC announcement last week. GDX is sitting on an important support level. It either bounces from here, rallies back above the 50-DMA, and kicks off a strong rally similar to what happened in late 2008 or it breaks below the recent low around $25 and heads back down to retest the June low at about $22. Here's the updated chart.

It's decision time for gold stocks. GDX either holds support right here and bounces, or it fails. Either way, the move is going to happen within the next few days.

RSS Feed

RSS Feed