Hong Kong’s Chinese Gold & Silver Exchange Society has been in operations for over a century, and it’s President Haywood Cheung was interviewed by Bloomberg news earlier today.

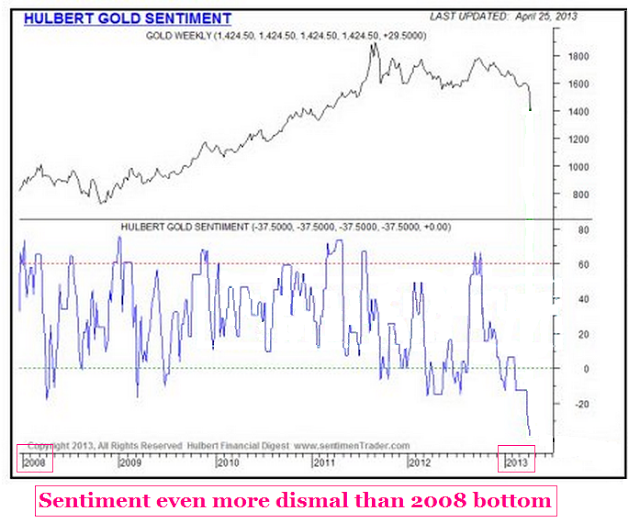

Whoever orchestrated the attack on gold and silver in the last week or so has gravely miscalculated, since the response to the drop has been surging demand for physical gold and silver. While I tend to be skeptical when I hear about silver shortages since these reports have been so exaggerated in the past, the lack of silver coin availability and premiums are the most extreme I have seen since the financial and economic meltdown of 2008.

Now we discover that the Chinese Gold & Silver Exchange Society has essentially sold out of gold bullion, and must wait until Wednesday for shipments to arrive from Switzerland and London.

Click link below for Bloomberg News Video:

http://libertyblitzkrieg.com/2013/04/19/chinese-gold-silver-exchange-society-runs-out-of-gold-importing-from-switzerland-and-london/

Whoever orchestrated the attack on gold and silver in the last week or so has gravely miscalculated, since the response to the drop has been surging demand for physical gold and silver. While I tend to be skeptical when I hear about silver shortages since these reports have been so exaggerated in the past, the lack of silver coin availability and premiums are the most extreme I have seen since the financial and economic meltdown of 2008.

Now we discover that the Chinese Gold & Silver Exchange Society has essentially sold out of gold bullion, and must wait until Wednesday for shipments to arrive from Switzerland and London.

Click link below for Bloomberg News Video:

http://libertyblitzkrieg.com/2013/04/19/chinese-gold-silver-exchange-society-runs-out-of-gold-importing-from-switzerland-and-london/

RSS Feed

RSS Feed