Except for a little price excitement between 9 a.m. and noon in Hong Kong yesterday, it was pretty much a nothing sort of day for gold. The low of the day came just after 12 o'clock noon in London, and the tiny rally going into the Comex open wasn't allowed to get far.

The gold price closed at $1,365.80 spot, up $2.50 from Tuesday's close. Net volume was extremely light, about 104,000 contracts.

The gold price closed at $1,365.80 spot, up $2.50 from Tuesday's close. Net volume was extremely light, about 104,000 contracts.

You can be forgiven if you mistake the silver chart for the gold chart, or vice versa; as they look identical. And, like gold, the tiny rally that began at the noon silver fix in London, didn't get too far once trading began in New York.

Silver finished the Wednesday session at $23.215 spot, up 24.5 cents from Tuesday. Net volume was a very quiet 34,500 contracts.

Silver finished the Wednesday session at $23.215 spot, up 24.5 cents from Tuesday. Net volume was a very quiet 34,500 contracts.

Both platinum and palladium made rally attempts in Far East trading on their Wednesday morning, and neither got far. Platinum then got sold down the moment that Zurich opened, and that continued until late in the Comex trading session in New York. Palladium ran into a price ceiling at the $700 spot price mark, before getting sold down when trading began on the Comex. Here are the charts.

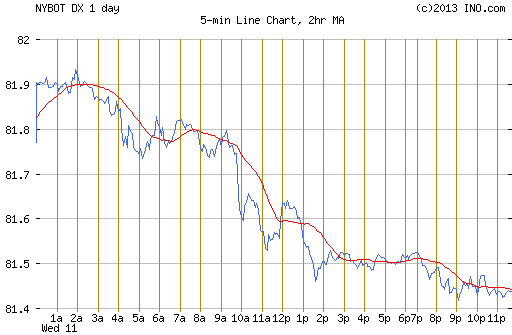

The dollar index closed on Tuesday afternoon in New York at 81.83. When it opened in Far East trading on their Wednesday morning, it rallied up to 81.93 by 2 p.m. local time in Hong Kong, then it was all down hill until the 81.46 low at 1:30 p.m. in New York. After that, the index didn't do much, closing the Wednesday session at 81.53, which was down 30 basis points from Tuesday's close.

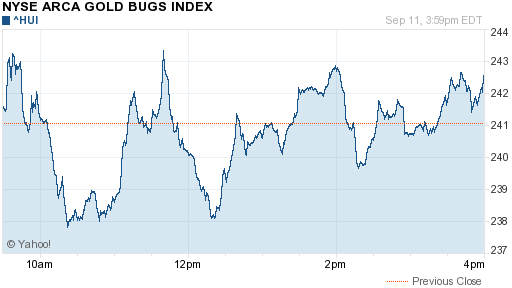

The gold stocks more or less followed the gold price. They opened up about one percent, but immediately got sold down two percent, with every rally attempt after that also meeting with an eager seller. However, the upward bias remained intact into the close, and the HUI finished up 0.67%.

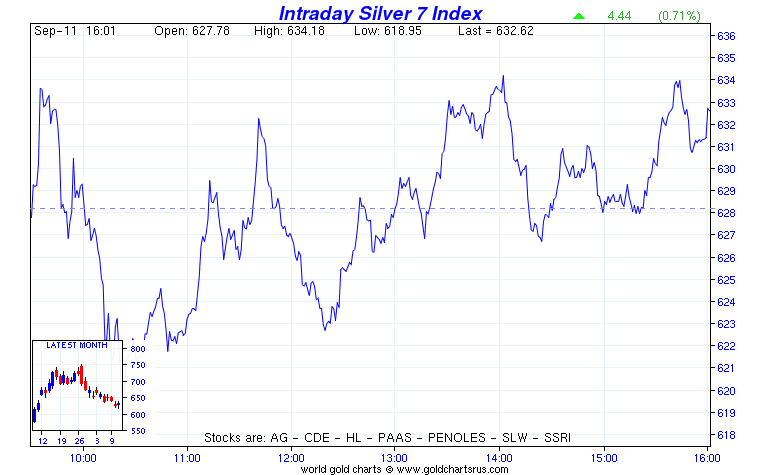

The silver stocks followed a virtually identical chart pattern as gold, and Nick Laird's Intraday Silver Sentiment Index closed up 0.71%.

The CME's Daily Delivery Report showed that 13 gold and 7 silver contracts were posted for delivery on Friday within the Comex-approved depositories. There were no reported changes in GLD, and as of 9:22 p.m. EDT there were no updates posted for SLV.

The good folks over at the shortsqueeze.com Internet site updated the short positions for both GLD and SLV as of 31 August. SLV showed an increase in its short position of 18.94 percent, which translates into an additional 2.53 million shares which were sold short because there was no metal available to deposit when the original transaction[s] was/were done, so the authorized participant was forced to short the shares in lieu of the real deal. I would bet a fair chunk of change that the deposit into SLV that was reported on Tuesday, 964,058 troy ounces, was made by an authorized participant [read JPMorgan Chase] to cover part of that short position.

The 15,880,700 troy ounces/shares currently sold short [in total] in SLV as of this report, represents 4.5 percent of the outstanding shares of SLV, or around 500 metric tonnes. Using past as prologue, this is not an outrageous amount. But the fact of the matter is that there should be zero short position in any hard metal ETF. Can you imagine the hue and cry if CEF or PSLV did an offering, got the cash, and then didn't buy/deposit all the metal they said they would? Shareholders would burn Eric Sprott and Stephan Spicer at the stake; after they got out of jail for fraud, that is. But nobody bats an eyelash when this happens in SLV or GLD. [Now you know why I wouldn't touch either of these ETFs with the proverbial 10-foot cattle prod.]

There was only a tiny increase in the short position over at GLD. This new report showed 2.68 percent. But the total number of GLD shares sold short is about 10 percent of all the outstanding shares issued in GLD, over 3 million troy ounces of gold in total, almost 100 metric tonnes. This is an outrageous amount. Why the GLD fund managers allow this situation to exist is beyond me.

Before laying this issues aside, dear reader, let me ask this question. What would the silver and gold prices be by the end of the trading day today if the authorized participants had to go out and purchase real metal in the open market to cover their portion of the outstanding short positions in both these ETFs, especially silver? And you wonder why Ted Butler is screaming about the permanent short positions in both GLD and SLV. It's out and out fraud. There were no reported sales from the U.S. Mint yesterday.

Over at the Comex-approved depositories on Tuesday, they reported almost no activity in gold. None was reported received, and only 482 troy ounces were shipped out. It was pretty quiet in silver as well on Tuesday. Only 116,244 troy ounces were received, and 40,237 troy ounces were shipped out the door for parts unknown.

The good folks over at the shortsqueeze.com Internet site updated the short positions for both GLD and SLV as of 31 August. SLV showed an increase in its short position of 18.94 percent, which translates into an additional 2.53 million shares which were sold short because there was no metal available to deposit when the original transaction[s] was/were done, so the authorized participant was forced to short the shares in lieu of the real deal. I would bet a fair chunk of change that the deposit into SLV that was reported on Tuesday, 964,058 troy ounces, was made by an authorized participant [read JPMorgan Chase] to cover part of that short position.

The 15,880,700 troy ounces/shares currently sold short [in total] in SLV as of this report, represents 4.5 percent of the outstanding shares of SLV, or around 500 metric tonnes. Using past as prologue, this is not an outrageous amount. But the fact of the matter is that there should be zero short position in any hard metal ETF. Can you imagine the hue and cry if CEF or PSLV did an offering, got the cash, and then didn't buy/deposit all the metal they said they would? Shareholders would burn Eric Sprott and Stephan Spicer at the stake; after they got out of jail for fraud, that is. But nobody bats an eyelash when this happens in SLV or GLD. [Now you know why I wouldn't touch either of these ETFs with the proverbial 10-foot cattle prod.]

There was only a tiny increase in the short position over at GLD. This new report showed 2.68 percent. But the total number of GLD shares sold short is about 10 percent of all the outstanding shares issued in GLD, over 3 million troy ounces of gold in total, almost 100 metric tonnes. This is an outrageous amount. Why the GLD fund managers allow this situation to exist is beyond me.

Before laying this issues aside, dear reader, let me ask this question. What would the silver and gold prices be by the end of the trading day today if the authorized participants had to go out and purchase real metal in the open market to cover their portion of the outstanding short positions in both these ETFs, especially silver? And you wonder why Ted Butler is screaming about the permanent short positions in both GLD and SLV. It's out and out fraud. There were no reported sales from the U.S. Mint yesterday.

Over at the Comex-approved depositories on Tuesday, they reported almost no activity in gold. None was reported received, and only 482 troy ounces were shipped out. It was pretty quiet in silver as well on Tuesday. Only 116,244 troy ounces were received, and 40,237 troy ounces were shipped out the door for parts unknown.

RSS Feed

RSS Feed