There was a tiny rally in gold during morning trading in the Far East on their Friday, but starting around 2:00 p.m. in Hong Kong, the gold price began to develop its usual negative bias. That ended at the beginning of Comex trading...and the subsequent rally got cut off at the London p.m. gold fix.

Then at 10:45 a.m. EDT, the high-frequency traders showed up...and fifteen minutes later, the gold price was down another fifteen bucks. The low tick [$1,311.70 spot] came at precisely 11:00 a.m. in New York...and from there the gold price rallied quietly until 3:00 p.m. in the electronic market, when the price popped up over ten bucks in short order before trading quietly into the the close from 3:30 p.m. onwards.

The gold price finished the day at $1,333.80 spot...down 30 cents from Thursday's close. Volume, net of roll-overs was very light...around 88,000 contracts. But gross volume was monstrous.

Then at 10:45 a.m. EDT, the high-frequency traders showed up...and fifteen minutes later, the gold price was down another fifteen bucks. The low tick [$1,311.70 spot] came at precisely 11:00 a.m. in New York...and from there the gold price rallied quietly until 3:00 p.m. in the electronic market, when the price popped up over ten bucks in short order before trading quietly into the the close from 3:30 p.m. onwards.

The gold price finished the day at $1,333.80 spot...down 30 cents from Thursday's close. Volume, net of roll-overs was very light...around 88,000 contracts. But gross volume was monstrous.

Here's the New York Spot Gold [Bid] chart on its own...and the fifteen minutes downward price 'adjustment' between 10:45 and 11:00 a.m. EDT is more than obvious.

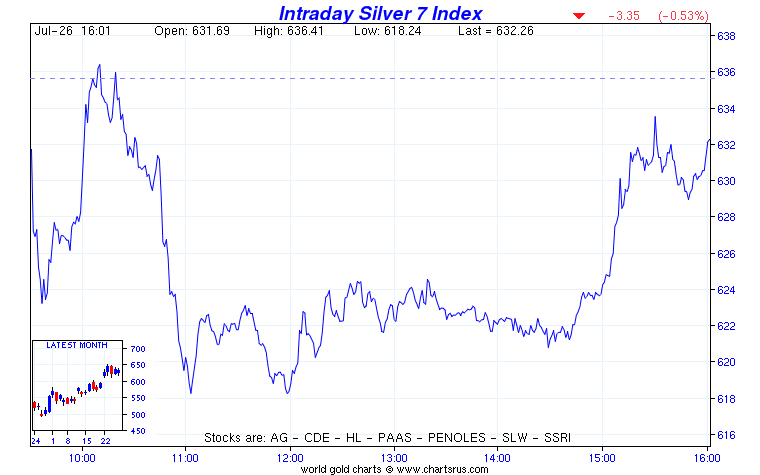

It was very much the same price pattern in silver, except the 10:45 to 11:00 a.m. EDT price adjustment was even more noticeable...and the subsequent rally didn't get silver back to anywhere near it's Thursday closing price.

Silver closed the Friday session at $19.99 spot...down 26 cents on the day. Gross volume was very decent...around 43,000 contracts. Net volume wasn't much below that.

Silver closed the Friday session at $19.99 spot...down 26 cents on the day. Gross volume was very decent...around 43,000 contracts. Net volume wasn't much below that.

Here's the New York Spot Silver [Bid] chart...complete with the fifteen minute price 'adjustment'.

Platinum and palladium did not escape yesterday's sell-off...although their respective price 'adjustments' came at slightly different times.

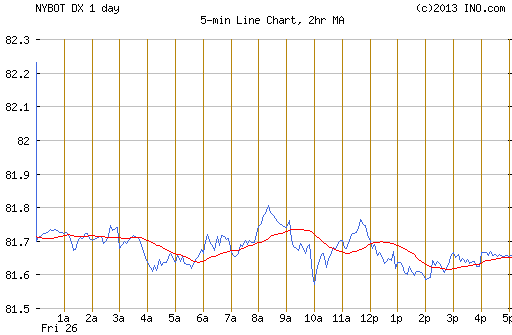

The dollar index closed late on Thursday afternoon in New York at 81.77...and when trading resumed in the Far East on their Friday morning, it spent the rest of the day chopping every-so-slightly lower...closing at 81.66...down 11 basis points. Nothing to see here.

It should be obvious to anyone but the willfully blind, that yesterday's price action in all four precious metals had nothing whatsoever to do with the goings-on inside the currency markets.

It should be obvious to anyone but the willfully blind, that yesterday's price action in all four precious metals had nothing whatsoever to do with the goings-on inside the currency markets.

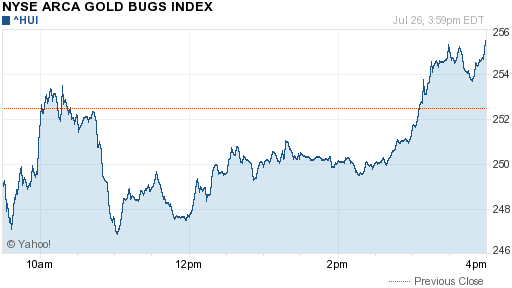

Not surprisingly, the gold stocks spent most of the day in negative territory...but popped into winning territory on the back of the surprise gold price rally late in the electronic trading session. The HUI finished up 1.29%.

The silver stocks weren't as fortunate...and Nick Laird's Intraday Silver Sentiment Index closed down 0.53%.

The CME's Daily Delivery Report showed that 45 gold and 30 silver contracts were posted for delivery on Tuesday. In gold it was Barclays as the only short/issuer...and the Bank of Nova Scotia as the only long stopper. In silver, it was the same story as it has been all month...the short/issuer was JPMorgan out of its client account, with 24 contracts....and JPMorgan was the big long/stopper with 22 contracts out of its in-house [proprietary] trading account.

For a change, nothing happened in the GLD ETF yesterday...and an authorized participant withdrew a smallish 289,388 troy ounces out of SLV.

For the fourth day in a row, there was no sales report from the U.S. Mint.

Over at the Comex-approved depositories in silver on Thursday...nothing was reported received, but 298,624 troy ounces were shipped out the door.

In gold, they reported receiving 32,137 troy ounces...and only shipped out a tiny 230 troy ounces.

The Commitment of Traders Report was a bit of a surprise in silver, as the Commercial net short position in that metal actually declined by 6.04 million ounces....and now sits at 60.7 million ounces in total. Based on the price action during the reporting week, an increase appeared certain. Ted Butler says that although this headline number looks great...under the hood, it wasn't quite as rosy.

In gold, the Commercial net short position increased by a healthy 1.0 million troy ounces...and the total Commercial net short position now stands at 3.47 million ounces. Once again Ted mentioned that digger deeper into the numbers showed that the deterioration was a bit worse than even this number indicates.

So far, this rally off the lows in both metals has been very orderly. I was hoping for disorderly, but up to this point, it hasn't happened.

There was a very interesting Reuters story out yesterday that really caught my eye...and here, in part, is what had to say..."Russia, Ukraine. and Azerbaijan are among eight countries that increased their gold holdings in June, data from the International Monetary Fund shows, reflecting strong interest on the part of emerging economies to own gold as part of their reserves....Data showed Russia's gold reserves climbed 0.3 tonnes to a total of 996.4 tonnes in June for its ninth consecutive monthly increase."

It was such a small increase that it didn't even show up as a rounding error in their June data when they updated their website on July 19th. Both May and June data showed their official reserves as 32.0 million ounces.

Since this is my Saturday column, I always use this occasion to empty out my in-box...and today is no exception.

For a change, nothing happened in the GLD ETF yesterday...and an authorized participant withdrew a smallish 289,388 troy ounces out of SLV.

For the fourth day in a row, there was no sales report from the U.S. Mint.

Over at the Comex-approved depositories in silver on Thursday...nothing was reported received, but 298,624 troy ounces were shipped out the door.

In gold, they reported receiving 32,137 troy ounces...and only shipped out a tiny 230 troy ounces.

The Commitment of Traders Report was a bit of a surprise in silver, as the Commercial net short position in that metal actually declined by 6.04 million ounces....and now sits at 60.7 million ounces in total. Based on the price action during the reporting week, an increase appeared certain. Ted Butler says that although this headline number looks great...under the hood, it wasn't quite as rosy.

In gold, the Commercial net short position increased by a healthy 1.0 million troy ounces...and the total Commercial net short position now stands at 3.47 million ounces. Once again Ted mentioned that digger deeper into the numbers showed that the deterioration was a bit worse than even this number indicates.

So far, this rally off the lows in both metals has been very orderly. I was hoping for disorderly, but up to this point, it hasn't happened.

There was a very interesting Reuters story out yesterday that really caught my eye...and here, in part, is what had to say..."Russia, Ukraine. and Azerbaijan are among eight countries that increased their gold holdings in June, data from the International Monetary Fund shows, reflecting strong interest on the part of emerging economies to own gold as part of their reserves....Data showed Russia's gold reserves climbed 0.3 tonnes to a total of 996.4 tonnes in June for its ninth consecutive monthly increase."

It was such a small increase that it didn't even show up as a rounding error in their June data when they updated their website on July 19th. Both May and June data showed their official reserves as 32.0 million ounces.

Since this is my Saturday column, I always use this occasion to empty out my in-box...and today is no exception.

RSS Feed

RSS Feed