There's a way to profit off gold and silver mines without taking on all that risk: royalty stocks. And it's time to start buying. Royalty companies don't actually operate mines. Instead, they own a percentage of a mine's production.

Typically, a mining company sells a royalty to raise cash to build the mine. Once the mine is built, the royalty becomes a revenue stream. After the royalty company makes its first payment, the cost of that revenue is practically zero.

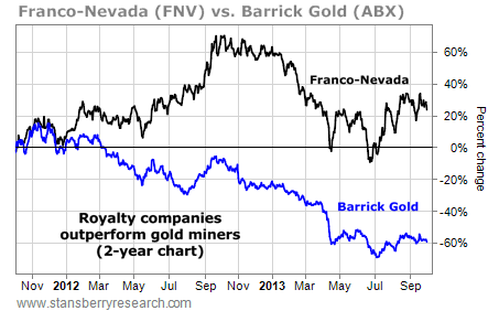

That business model allows royalty companies to generate enormous profit margins of 80% to 90%; a heck of a lot better than the average mining stock. You can see how they weathered the big gold-stock bear market in the chart below.

Franco-Nevada (FNV) is one of the biggest names in the business. It suffered a big drawdown from September 2012 through this summer. But as you can see, it ended the last two years up nearly 30%. Barrick Gold, one of the world's biggest gold producers, is down 60%.

Today, they will get closer to $1,300 per ounce of gold (a 19% decline) and $21 per ounce of silver (a 32% decline). But the stocks are down between 28% and 50% from this time last year. So are they cheap?

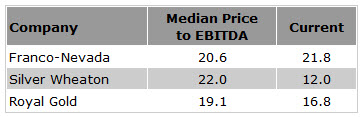

I like to use price to EBITDA (earnings before interest, taxes, depreciation, and amortization) to track how cheap or expensive these companies are. The table below shows each company's median price to EBITDA (over the last seven years for Royal Gold and Silver Wheaton and two years for Franco-Nevada) and the current price.

Royal Gold is cheaper than average and so is Silver Wheaton. Precious metals haven't been this cheap any time in the last eight years. I expect gains of 50%-100% over the next 12 months, just as it returns to a more normal valuation. If you're looking for a diversified way to profit in a precious-metals rebound, start here.

RSS Feed

RSS Feed