| I think I am finally joining Marc Faber and Warren Buffet's stance on precious metals; although platinum and palladium are still great buys and far below the cost of extraction. | COMMODITIES CORNER I'm still tasting the sour results from the obviously manipulated gold market debacle. I had to maintenance over $80 grand on margin not to mention holding the bag on hundreds of shares of various gold royalty companies. I liquidated most of the dead weight but held onto three companies. I finally shed Harmony Gold (ADR) and rid myself of Seabridge Gold (SEA.TSE) prematurely. I recaptured 44% and made up the difference in Lionbridge Technologies (LIOX) and Diebold (DBD); two securities I have discussed and recommended before. LIOX is up 58% since my recommendation and DBD is up 15.7%. |

It's either a massively stupid idea, or it's brilliant. Buying gold looks like a good trade right here, right now.

I'm still wearing a black eye from my call for a huge gold-stock rally earlier this month. But that's not going to stop me from jumping back in the ring and taking a few more punches. The potential prize money is too big to ignore. Stop rolling your eyes and stay with me here for a minute while I explain the thinking...

There's an obvious contrarian trade here. Gold has underperformed the market this year. It has disappointed investors for so long that only the most diehard gold bugs are still onboard. Most investors have jumped ship and are sailing away with the stock market instead. Nearly every article I read this past weekend on gold predicted the metal would soon be trading at $1,000 or even $800 per ounce.

Sentiment just doesn't get much more bearish than that. So anyone looking to "buy low" has to be looking at gold right now.

There's also a "reversion to the mean" trade developing. After falling for 11 of the past 12 trading days, gold's proverbial rubber band is stretched far to the downside. Even a quick bounce just to alleviate the extreme oversold condition could be good for a fast move up toward $1,300 or so. That's a good trade.

But what I like best right now is the setup on the weekly chart.

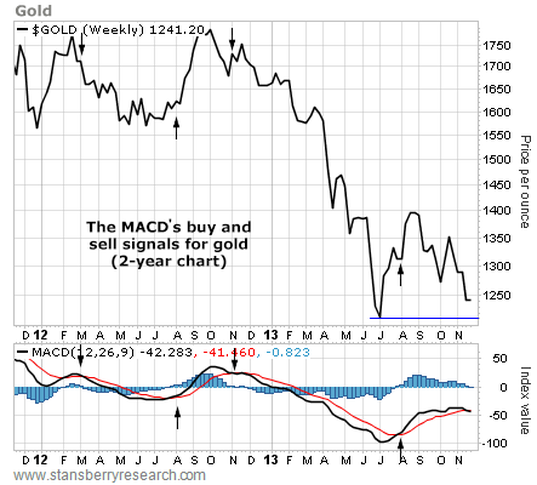

Take a look... Gold has support at the point of its late-June low at about $1,210 per ounce. Yes, gold dipped as low as about $1,170 in June. But this is a weekly chart. The data points are plotted based on the price at the end of the week. So $1,210 is our support level.

The red arrows on the chart below show the MACD indicator buy and sell signalsover the past two years. There's no need to get too complicated here. MACD is a simple momentum indicator. Buy signals occur when the black line crosses over the red line. Sell signals happen when the black line crosses beneath the red line.

As you can see, the weekly MACD indicator gave three signals last year. While they didn't pick the exact turning points in the price of gold, all the signals were profitable.

So far, that signal is unprofitable. Gold is trading lower today than it was back then. But that's what gives us a favorable setup for a long trade in gold.

There's support at $1,210 per ounce. So traders buying here around $1,240 can stop out of the trade on a break of that support. That'll limit the risk to just over $30 per ounce. But we can use the MACD indicator to give us an even tighter stop loss on the trade.

Notice how the black line on the MACD indicator is just barely holding above the red line. The black line is either going to curl up from here – which can only happen if the price of gold rises – or it's going to immediately drop below the red line and generate a sell signal.

Traders can buy gold here in anticipation of higher prices. And they can stop out of the trade for a small loss if – at the end of the week – the black line on the MACD indicator is below the red line.

No matter what you may think of gold at the moment in terms of risk versus reward, this is one of the best-looking trades in the market right now.

Best regards and good trading,

RSS Feed

RSS Feed