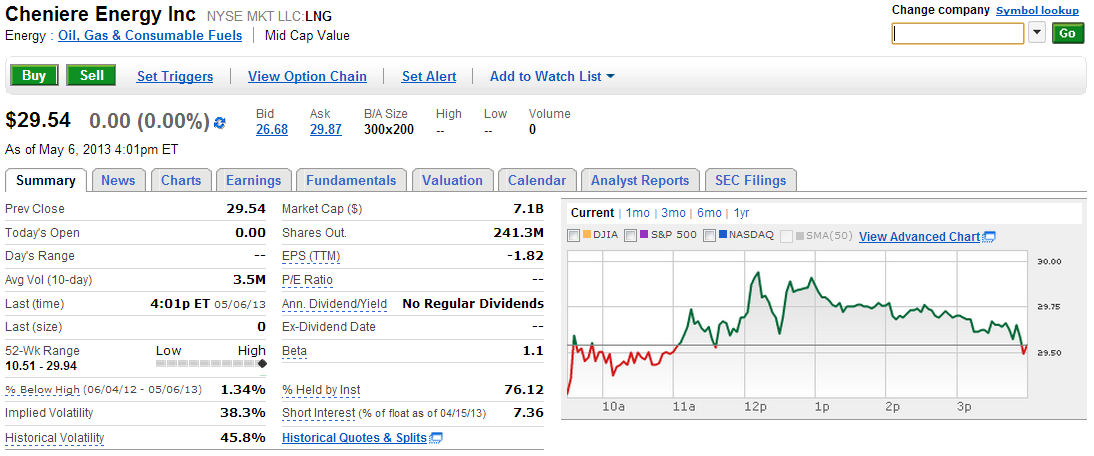

| | COMMODITIES CORNERNatural resources particularly liquid natural gas (LNG) is definitely in a boom state. With industrial usage up 20%, record production increases of 17% and new fracking technologies, LNG is poised to generate healthy gains over time starting this year. I first noticed that the LNG transport providers were making huge gains. If the providers have an increase in revenues then surely the demand for LNG must be increasing as well. Last summer while some providers were still affordable, we took a position in several and hedged it with both puts and calls. I must say aside from the momentary gains before the April correction, those options really kept us afloat during the storm. |

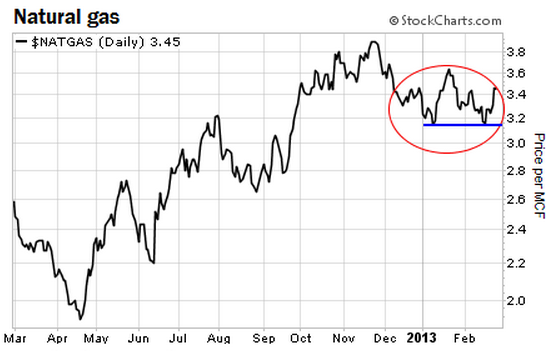

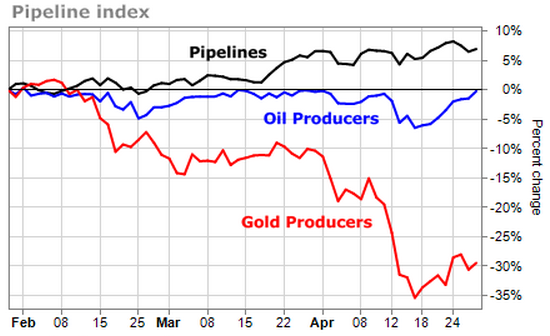

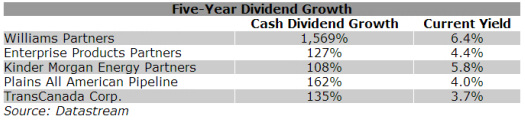

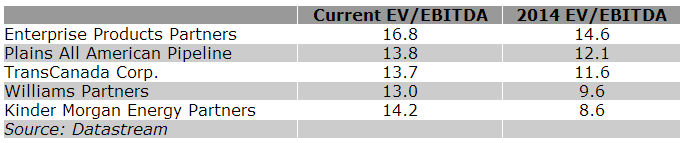

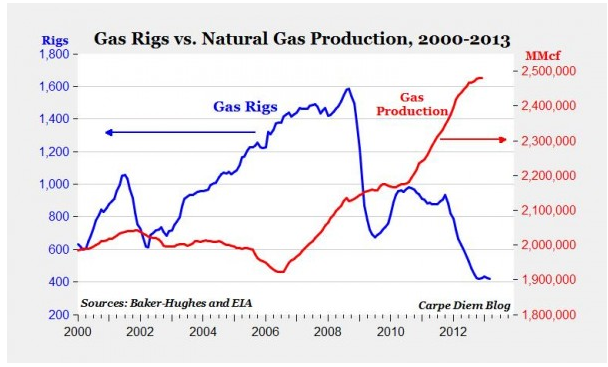

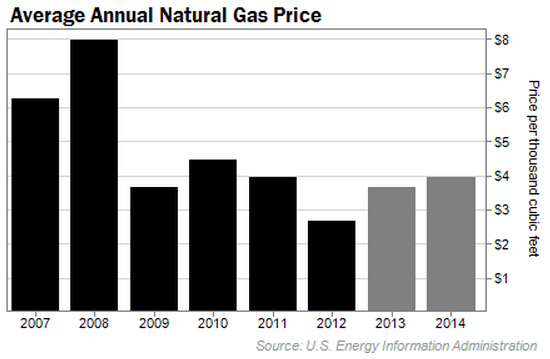

| ALL NEW BENCHMARKS ARE ON THE HORIZON Natural gas prices in the U.S. Northeast are poised to reach five-year seasonal highs this summer because increasing demand from power plants may be too much for pipelines to handle. Kinder Morgan Energy Partners LP (KMP), Spectra Energy Corp. (SE) and Williams Cos., which own the region’s main interstate pipelines, say their systems are running at or near capacity. New England electricity customers were on the verge of rolling blackouts last June and again in February amid equipment failures and limited gas supply during periods of high demand, according to Philip Moeller, a member of the Federal Energy Regulatory Commission. Natural gas now has a double bottom in place just below $3.20 (the blue line). That will provide support on the downside. The chart is also tracing out a potentially bullish "W" pattern (the red circle). This is an intermediate-term bottoming formation... and it could lead to a strong rally if natural gas can break out above $3.60. Seasonal trends are also starting to shift in favor of higher prices. Natural gas tends to reach at least a short-term bottom in the spring. Then it rallies into the early part of summer where it often peaks for the year and provides a better short-selling opportunity. But for now, we're entering the time of year when natural gas prices often bottom. We no longer have the tremendous glut of natural gas we had back in November. In its most recent inventory report, the U.S. Energy Information Administration reported that natural gas inventories had dropped to 2.4 trillion cubic feet. That's slightly above the normal storage amount for this time of year... But it's 30% less than what was in storage in November. And it's down 9% from the same time last year. Lack of adequate infrastructure to meet consumer and regulatory demands will only result in premiums to surge to an all new benchmark toward the end of the year. I recommend the following companies below to take a position in. Since March, we have had an average 83% gain combined with both equities and options. By the time winter rolls around, we all should finish the end of the year out with a warm and cozy feeling...Ahhhh! Hedge Well! By Matt Badiali, editor, S&A Resource Report Wednesday, May 1, 2013 The whole commodity sector just got punched in the gut... Over the last three months, palladium is down 7%, platinum is down 11%, gold is down 12%, copper is down 15%, nickel is down 15%, and silver is down a huge 25%. As regular readers know, commodity producers are leveraged to their commodity prices. As a group, base-metal producers are down around 15%. Gold producers are down 29%. And silver producers are down 29%. What's still standing? I'll show you today... Take a look at the chart below. It's the benchmark pipeline index ($AMZ) plotted against the big oil producer fund ($XOI) and the big gold producer fund ($HUI). Gold producers got crushed, as you know. Oil producers are about breakeven. And pipelines sailed through the trouble. As a group, they're UP more than 5% in the last three months. While precious and base metals were getting destroyed, oil only dropped 5%... and natural gas was up more than 30%. That helped energy producers sidestep the sell off. It also helped the pipelines hold steady... That and a couple other attractive qualities: income and growth. Pipeline companies own the huge transportation network that moves oil and gas around the country. Thanks to the shale revolution, we're tapping huge new supplies of oil and gas. And this pipeline network is seeing huge growth. Since 2008, the industry has seen $50 billion in investment on 11,000 miles of new pipelines. (And those are just the giant main lines. That doesn't include the web of pipes that gather the oil and gas in the fields.) All these new pipes are creating a boom in pipeline company revenues. And since many pipelines are structured to pay out income, growing revenues have translated into growing payouts. As you can see, each of these companies grew dividends by triple digits over the last five years. As my Stansberry & Associates colleagues have pointed out many times, income is the "fashionable trade" these day. And pipelines' high yields have attracted loads of new money. The pipeline index is up 20% since late December, nearly double the broad market's run. So these stocks aren't as cheap as they were last year... Except for TransCanada, they're all yielding less than their five-year average yields. And they have an average EV/EBITDA of 16.8. The five-year average is around 11. (Enterprise value, or EV, takes into account the company's market value, debt, and cash. EBITDA is earnings before interest, taxes, depreciation, and amortization) Once you take growth into account though, these stocks are still near sensible prices. Using forward earnings estimates, here's how they stack up, from most expensive to least... While next year's numbers might not pan out exactly like analysts predict, growth IS coming. According to the Energy Information Administration, almost 2,000 miles of new pipelines that can carry 26 billion cubic feet of natural gas per day will be added by 2017. Kinder Morgan Energy Partners and TransCanada already have major new pipelines under construction. These companies' shares fluctuate with the oil price. And they're more volatile than your standard "safe haven" income-payers. Williams Partners, for example, dropped nearly 30% last year. But most of its peers have held up well over the last few years... and they all held up very well during the recent sell off. They're protected because they get most of their revenue from "tolls" rather than selling oil or natural gas. And in a zero-percent world, investors are desperate for the kind of income they pay. After their big run up, pipelines might be due for a breather. But the trends driving them higher are set to be in place for years to come. |

RSS Feed

RSS Feed