Jeff Clark

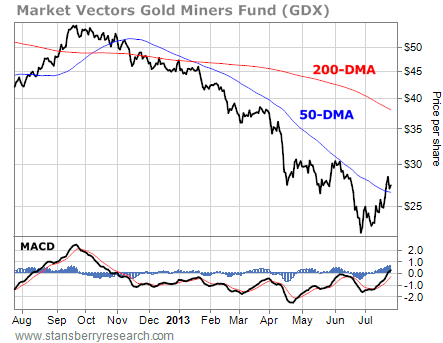

On Monday, the gold sector did something it hasn't done since last November: It traded above its 50-day moving average (DMA) line. Most technical analysts view the 50-DMA as the line in the sand separating intermediate-term uptrends from intermediate-term downtrends. Stocks trading above the 50-DMA are in bull mode, while stocks trading below the line are in bear mode. So Monday's action is a BIG deal. And the rally should have folks looking to buy.

Last month, I explained how the failure of the sector to rally above its 50-DMA – when it was set up almost perfectly to do so – created a firestorm of selling pressure. I also told you that I believed the disappointing action in the gold sector could be setting up for an even more violent rally in the coming months. Here's what I wrote; This is the type of oversold condition you only see once or twice in a generation. Other than the liquidation event of 2008, we haven't seen anything similar to today's conditions since 1976.

Gold stocks, as measured by the Barron's Gold Miners Index (the "BGMI") – the most popular gold index in the 1970s – declined 67% from their 1974 highs to their 1976 lows. The index bottomed 44% below its 200-DMA. Using 1976 as a guide, there's still room for gold stocks to move slightly lower here. But by that same guide, gold stocks rallied more than 600% in the years following the 1976 bottom. So the sector could explode violently higher once the bottom is in.

Of course, it won't be a one-way move higher. The sector will have plenty of selloffs and back-and-forth action as it starts its new uptrend. Traders should look at any declines as buying opportunities – especially any declines that come back down and retest the 50-DMA – like the one we got Wednesday...

On Monday, the gold sector did something it hasn't done since last November: It traded above its 50-day moving average (DMA) line. Most technical analysts view the 50-DMA as the line in the sand separating intermediate-term uptrends from intermediate-term downtrends. Stocks trading above the 50-DMA are in bull mode, while stocks trading below the line are in bear mode. So Monday's action is a BIG deal. And the rally should have folks looking to buy.

Last month, I explained how the failure of the sector to rally above its 50-DMA – when it was set up almost perfectly to do so – created a firestorm of selling pressure. I also told you that I believed the disappointing action in the gold sector could be setting up for an even more violent rally in the coming months. Here's what I wrote; This is the type of oversold condition you only see once or twice in a generation. Other than the liquidation event of 2008, we haven't seen anything similar to today's conditions since 1976.

Gold stocks, as measured by the Barron's Gold Miners Index (the "BGMI") – the most popular gold index in the 1970s – declined 67% from their 1974 highs to their 1976 lows. The index bottomed 44% below its 200-DMA. Using 1976 as a guide, there's still room for gold stocks to move slightly lower here. But by that same guide, gold stocks rallied more than 600% in the years following the 1976 bottom. So the sector could explode violently higher once the bottom is in.

Of course, it won't be a one-way move higher. The sector will have plenty of selloffs and back-and-forth action as it starts its new uptrend. Traders should look at any declines as buying opportunities – especially any declines that come back down and retest the 50-DMA – like the one we got Wednesday...

You can see how the Market Vectors Gold Miners Fund (GDX) broke above its 50-DMA (the blue line) on Monday. It extended that rally on Tuesday. Then Wednesday, it came back down and is now testing the 50-DMA as support.

That support should hold. I don't expect GDX to decline much more than a couple percentage points below its 50-DMA. If that turns out to be the case, Monday's action will prove to be the start of a new intermediate-term uptrend for the mining sector. And GDX should work higher toward its 200-DMA (the red line) over the next several months.

That support should hold. I don't expect GDX to decline much more than a couple percentage points below its 50-DMA. If that turns out to be the case, Monday's action will prove to be the start of a new intermediate-term uptrend for the mining sector. And GDX should work higher toward its 200-DMA (the red line) over the next several months.

RSS Feed

RSS Feed