As we expected, the "gold-to-oil" ratio is working in gold's favor. Back on July 26, we noted how the "gold-to-oil" ratio was ready to snap back in gold's favor. At the time, we reminded you how this kind of "ratio trade" isn't a conventional "buy a stock and hope it goes up" trade.

"Ratio trades" involve trading one asset against another asset. For example, one of the most important ratios in this group is the "gold-to-oil" ratio. Since they are both commodities that have intrinsic value, gold and oil can be affected by the same buying and selling pressure in the market. But their values can get "out of whack."

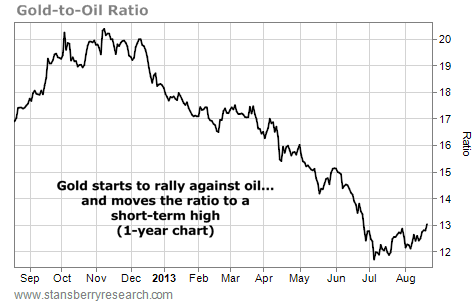

When this happens, traders can step in to sell gold and buy oil. or buy gold and sell oil. The profit on these trades depends on how the two assets move against each other. We used this analysis to time – almost to the day – the epic 2008 bottom in crude oil. From late 2012 through last month, the gold-to-oil ratio fell from 20 to 12.

This means gold collapsed in value relative to oil. In our July note, we pointed out that this decline left gold and oil in an extreme position. Hedge funds held extreme bearish bets on gold and extreme bullish bets on oil. As you can see from the chart below, our note was well-timed. The gold-to-oil ratio has bottomed and just staged a short-term breakout in gold's favor. This rally will continue.

"Ratio trades" involve trading one asset against another asset. For example, one of the most important ratios in this group is the "gold-to-oil" ratio. Since they are both commodities that have intrinsic value, gold and oil can be affected by the same buying and selling pressure in the market. But their values can get "out of whack."

When this happens, traders can step in to sell gold and buy oil. or buy gold and sell oil. The profit on these trades depends on how the two assets move against each other. We used this analysis to time – almost to the day – the epic 2008 bottom in crude oil. From late 2012 through last month, the gold-to-oil ratio fell from 20 to 12.

This means gold collapsed in value relative to oil. In our July note, we pointed out that this decline left gold and oil in an extreme position. Hedge funds held extreme bearish bets on gold and extreme bullish bets on oil. As you can see from the chart below, our note was well-timed. The gold-to-oil ratio has bottomed and just staged a short-term breakout in gold's favor. This rally will continue.

RSS Feed

RSS Feed