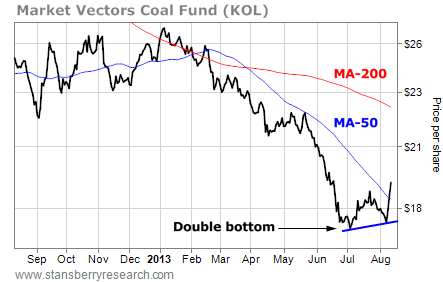

The Market Vectors Gold Miners Fund (GDX) is up 16% in just the past three trading days. It's trading above its 50-day moving average (DMA). Over time, GDX should move up toward its 200-DMA, near $35. But it's not just the stocks of companies mining the shiny yellow metal that are on a tear. Coal stocks are rallying, too. Take a look at this chart of the Market Vectors Coal Fund (KOL).

Just like the gold sector, coal stocks have been under heavy selling pressure all year. KOL bottomed six weeks ago, down about 35% for 2013. But now the chart has formed a double bottom (or "W" pattern) – a bullish sign. A "W" pattern is the opposite of the "M" pattern I showed you last week.

It occurs at the end of a downtrend and often signals the beginning of a longer-term uptrend. KOL has also popped above its 50-DMA (the down-sloping blue line) which had been resistance for the stock all year.

Remember, most technical analysts view the 50-DMA as the line in the sand separating intermediate-term uptrends from intermediate-term downtrends. So stocks trading above the 50-DMA are considered to be in bull mode. KOL should be able to work its way up toward its 200-DMA, near $22, over time.

The sector is a bit extended in the short term. That's normal, given the 10% rally over the past three trading days. So traders can look to buy into the coal sector on any pullback toward the 50-DMA , which should now serve as support.

It occurs at the end of a downtrend and often signals the beginning of a longer-term uptrend. KOL has also popped above its 50-DMA (the down-sloping blue line) which had been resistance for the stock all year.

Remember, most technical analysts view the 50-DMA as the line in the sand separating intermediate-term uptrends from intermediate-term downtrends. So stocks trading above the 50-DMA are considered to be in bull mode. KOL should be able to work its way up toward its 200-DMA, near $22, over time.

The sector is a bit extended in the short term. That's normal, given the 10% rally over the past three trading days. So traders can look to buy into the coal sector on any pullback toward the 50-DMA , which should now serve as support.

RSS Feed

RSS Feed