One quarter of the Baby Boom generation expects to work until they die. For Americans ages 46-55,

having enough money to retire is among their most pressing worries. Nearly half (44%) have little or no

faith that they are financially secure enough to retire, according to a recent Associated Press survey.

And 25% say they simply can’t retire. (Unsurprisingly, a similar number say they have no retirement savings.).

Thankfully, the good people at CNN and Money magazine have put a “calculator” on the Internet to

tell you exactly what you’ll need. Just plug in your age, current salary, and total savings… and voila…

the site spits out a number it says you need to sock away each year to retire on 85% of your current

salary. Problem solved, right?

With all due respect to the good intentions of the folks at CNN/Money…It’s bunk. As a medical doctor,

I can tell you that if you’re relatively healthy right now and a nonsmoker, you could live a lot longer than

the averages. How long? It’s impossible to say. There are just too many variables.

How do you ensure you won’t run out of money if you don’t know how long you’ll need it? Stocks have

returned little over the past 10 years, and your pension plan might not meet your needs. If you’re a

homeowner, you’ve probably seen your house value plummet, too. And bonds barely pay a few

percentage points of interest. Can you really trust Social Security to make your retirement pleasant

and worry-free? I doubt it.

How can you be certain you’ll have enough money to last for your retirement? Today, I’ll show you

how. I’m going to introduce you to a potential retirement solution only a handful of Americans

ever consider.

I’m going to lift the veil on one of the most misunderstood secrets of the wealthy... annuities. If you

combine the benefits of an annuity with the strategies we’ve outlined in our report called “Trade

Non productive Assets for a Huge Cash Reward,” you’ll be able to retire free of the money worries

dogging most Americans.

As I’ll explain, the money you receive via annuity is guaranteed by a company that is required by law to have enough cash on hand to meet future obligations (unlike a bank or brokerage firm). Your money is also guaranteed (up to $100,000 or as high as $500,000) by an insurance fund regulated

by your state government.

Another thing that makes this investment unique is that you can set up your contract so the monthly payouts you receive can go up in value but never down, even if stocks, bonds, and real estate stay in a bear market for another 20 years. So it’s almost impossible to lose money. It gets even better.

Unlike any other investment vehicle I know, the money you receive from an annuity could be sent

to you for the rest of your life and can even be passed on to your heirs. But before I go any further,

I have to warn you... these insurance products are not right for everyone, and you must meet several requirements before you can begin collecting payouts. The good news is, most Americans near

retirement age qualify. Let’s take a closer look...

Will You Have Enough Cash in Retirement?

If you are nearing retirement, you can drive yourself crazy trying to figure out how much money

you’re going to need. How long will you live? How high will inflation be? What will happen to the

stock market and the economy? All these things affect your retirement income and it’s impossible to know the answers.

That’s why you should consider making sure you’ve got at least a certain level of guaranteed

income. Even in the worst-case scenario, you’ll know that you’ve got enough money to meet your

basic expenses. Remember, Social Security was only meant to be a safety net. I don’t have the time

in this report to detail how untenable the current program is (although if you plug “Social Security

outlook” into an Internet search engine, you can read plenty on the topic). Just trust me…

If you’re 55 today, you won’t be collecting what you think you will be from Social Security

in 10 years.

One way to be prepared is with these annuities. The products are designed to pay retirees

guaranteed income and are created by the insurance industry. Over the years, annuities have

gotten a bad name. But according to several folk I’ve spoken with in the business, when used

properly, annuities can be a vital tool in ensuring you have the income you need to retire.

The problem is you can find thousands of annuity options on the market. You can invest in an

annuity that pays you for the next five or 10 years... or one that pays you for as long as you live.

You can find ones that pay you immediately or defer your payments for 10 years or more. You can

buy an annuity that increases your payouts when inflation rises or when stocks go up, or one in

which the payouts stay the same for the rest of your life.

I’ll spell out the basics of annuities, some of the options, and how they work. We’ll tell you the

eight things to think about when investing in an annuity. And show you a real-world example and

how the process might work for you. Then I’ll explain my favorite type of annuity, which I think

offers the best options for most retirement-age Americans.

How These Investments Work

An annuity is part investment and part insurance. It’s an investment in the sense that you put

money in and hope to get back more later, depending on how the investment performs. It’s

insurance in the sense that you pay a premium to make sure your money will never lose value

and you will collect a worst-case gain.

It’s like a mutual fund that offers you insurance. No matter what happens in stocks, bonds, real

estate, or the rest of the economy, your income will never go down. Remember, it’s the only

investment in the world besides Social Security and a pension that guarantees you a certain

amount of income, for as long as you live. And again, you shouldn’t count on Social Security’s

longtime viability.

Here’s another way to think about it: You pay to insure your home against damage. You pay to

insure your car against collision. When you buy an annuity, you’re insuring your future income

stream until you and your spouse die.

Dozens of U.S. insurance companies offer annuities. (We’re even researching a few overseas.)

When you buy an annuity, you enter into a contract with the insurance company. You give either a

lump sum (my preference) or several payments over time; the company guarantees you income

according to the terms of the contract.

There are several basic differences in annuities:

· Fixed Rate vs. Variable. Fixed-rate annuities give you the same payout every month. Variable

annuities, on the other hand, typically have a guaranteed minimum payout, but the payout can

go up depending on how your investments do.

We prefer variable annuities, because your payment can go up, but won’t ever go down.

Those are the annuities we’ll be talking about.

· Immediate vs. Deferred. Immediate annuities begin paying you, as the name indicates, pretty

much immediately. Deferred annuities pay at some point down the road.

Whether you’re interested in an immediate or deferred annuity depends on whether you’re

looking for income now, or are preparing for retirement down the road. Generally, the older

you are when you start receiving payouts, the larger the payouts will be. The deferred annuity

is my preference.

· Single Premium vs. Flexible Premium. When you start an annuity, you can make one single

principal payment, or you might have the option of making multiple payments in the amount

and the time of your choosing.

If this all sounds confusing, don’t worry... It’s easier than it seems at first. And we’ve prepared a

checklist of things to keep in mind when you’re shopping for the perfect annuity.

Annuity Checklist: Eight Things to Look for in Your Guaranteed Retirement Contract

1) Is the company secure?

An insurance company guarantees your annuity. So you want to know that the insurance

company is going to be around in 20 years. One corporation, A.M. Best, “rates” the insurance

company’s ability to pay claims now and in the future.

We recommend buying annuities from insurance companies with a rating of A-plus or better.

The higher the rating, the safer the company. You can simply ask your broker for the rating of

the insurance company that’s offering the annuity.

All insurance companies submit to regulation by the government of the state where they

operate. Part of what these state agencies do is run a “guaranty fund” to which every local

insurance company must contribute. If the insurance company that issued your annuity goes

out of business, the money from this fund will be used to pay back some or all of your principal.

You can check with the insurance commission in the company’s home state for more details.

2) Can you invest for the long term?

If you are looking for a highly liquid investment that you can buy one day and cash out the

next, annuities are NOT for you. You must be committed to using them for the long term.

The issuer will only let you withdraw a certain amount of your principal per year during the

“surrender period.” The surrender period typically lasts four to seven years.

So for example, you may be able to take out as much as 10% of your initial investment per

year without penalty for the first four years. After that, you can take out as much as you

want or liquidate your investment entirely.

3) Is the tax situation right for you?

Because the IRS treats annuities as an insurance product, your money grows tax-free. And

annuities aren’t subject to annual contribution limits like with IRAs and 401(k)s.

If you withdraw your money before you’re 59 and a half, you’ll pay income taxes plus a 10%

penalty tax. Otherwise, you only pay taxes on the payouts you receive that are over and above

the amounts you initially put in.

4) Are the costs worth it?

For years, one of the big criticisms of annuities is the expenses that the stock market

“generally” always goes up, so you don’t need to pay for protection. That may be the case

“generally,” but what about now?

Guaranteed income does not come free of charge. Because annuities can offer more benefits,

they have more expenses than mutual funds. You can expect to pay about 1% more than the

costs of your typical mutual fund. And you can shop for annuities on a “cafeteria plan.”

It’s simple: You only pay for the benefits you want. You don’t pay for the benefits you don’t want.

5) Are your heirs taken care of?

If you die before you receive your full principal back in monthly payouts, your spouse or heirs

can continue to receive payouts or a lump sum until the principal (at least) has been returned

in full.

Let’s say you are 65 years old, and you would like to put $100,000 of your savings into an

annuity to guarantee some income for the rest of your life. And let’s say you’ve found an annuity that will pay you $5,000 a year for as long as you live. If you live another 25 years, you’ll receive

$125,000, no matter what happens in the stock market even if we’re in a terrible bear market for

the next 25 years. (As I’ll explain, you could receive a lot more if the market goes up.)

But what if you live just five more years? You’ll have received just $25,000 from your $100,000

investment. Doesn’t sound like a very good deal. That’s why we recommend you opt for a

“death benefit.” If you live a long time, you make out great. But if you don’t, you still won’t lose a penny of your initial investment.

If you die before the original investment has been paid, your heirs will continue to receive

payments until your money has been paid back in full. That’s in the worst-case scenario. If

your investment has gone up in value (see below for more details), your heirs can receive at

least the cash value of your investment, if not more. Opting for a death benefit will increase

your costs slightly, but it guarantees you can’t lose money, no matter what.

6) Will you benefit from a bull market?

Some annuities allow you to invest your principal in “sub accounts,” which are like mutual

funds. The more choices the annuity offers, the more control you have over your investment.

But that’s not even the best part: If your chosen investments go up in value, your payouts

increase. But even if your investments go down in value, your payouts will never decrease.

So your downside is limited to zero. And your upside is unlimited. If your chosen investments

skyrocket, you’ll see your monthly payouts balloon. Your monthly payouts can only increase.

They can never go down. Let’s look at an example...

Say you’re 65 and you’ve got $100,000 to put in an annuity. You’ve found one that will pay out

about $5,000 a year. Now if you spread that out among sub accounts that end up losing value, your payments will stay the same. They’ll never go down. But if your investments double over

four years, your payout could grow to $10,000. This higher payout is now locked in.

So now let’s say in Year 5, your sub accounts lose all of their gains and drop down to $100,000 or even down to $50,000. For most investors, that kind of loss would be devastating. But with the “lock-in” benefit, you will still receive at least $10,000 every year for life, guaranteed. It’s as if your principal is still worth $200,000 and didn’t lose a penny.

Given the market’s volatility skyrocketing one year, plummeting the next this benefit can

be unbelievably valuable. Imagine if you could get all of the gains of the stock market and

none of the losses. That’s what happens when you lock in your gains.

7) Will you benefit in a bear market?

Many annuities will guarantee you annual compounding growth of 5% as long as you’re not

taking payouts. This means that even if your chosen investments lose money, your income

stream is growing. Let’s look at our example again...

You invest $100,000. But you start right at the beginning of a horrible bear market. Five years

later, your investments haven’t grown a penny. In fact, they’ve lost money. Your $100,000 has

turned into $80,000.

As I said above, your payments will never go down. So you’ll never receive less than $5,000 a

year once you start taking payouts. But with guaranteed growth, your future income can

increase even if your investments lose money. So with 5% guaranteed annual growth, five years later, it’s as though your principal is worth about $128,000. It’s as though you’re up more than 25% instead of down 20%.

In other words, your future income will grow if the markets do absolutely nothing and even if

they tank. So by locking in your gains, you get all the benefits of a bull market, but none of

the volatility. And by getting guaranteed growth, you never have to suffer in a bear market

again. But the best part is, you can combine these two features.

8) Are you getting the most out of the bull and the bear market?

Nowadays, some annuities can “stack” your worst-case bear-market return (the guaranteed

growth) on top of your best-case bull-market return (your locked-in gains). Let me show you...

Start with the same $100,000, and we’re back in the bull market. By Year 4, your $100,000 has

grown to $200,000. But then in Year 5, your investments take a hit and drop back to $100,000.

Remember, your future income doesn’t fall. Your gains are locked in, as though your principal

is still worth $200,000. But if you’ve got 6% guaranteed growth (today’s current rate), it’s

actually more like $212,000 ($200,000 plus 6%).

That 6% will keep compounding every year as long as your principal is less than your locked-

in highest gain and as long as you’re not collecting payouts. This gives you a worst-case return

you can count on, without limiting your gains. Your money can grow in bull and bear

markets. Your income will increase every year, guaranteed.

Let’s Look at a Real-World Annuity...

Here’s an annuity we reviewed with financial planner Jeff Winn. We asked Jeff to show us an

illustration of an annuity, with the following assumptions:

· I was 60 years old when I invested.

· I made a one-time investment of $100,000.

· I started getting paid immediately.

Jeff chose a simple annuity, just for illustration, from an A-plus rated insurance company.

For simplicity’s sake, this annuity was invested in just three “sub accounts.” They were:

1. A growth portfolio (which had holdings in companies like Google, Microsoft, Nokia,

Berkshire Hathaway, and Cisco).

2. A growth income fund (which held income-paying companies like Merck and Exxon Mobil).

3. An intermediate bond portfolio

(which invested mostly in corporate and government bonds).

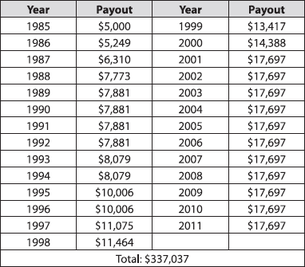

| If you’d bought this annuity with a single $100,000 investment back in 1985, you would have received payouts so far of $337,037 and you’d still be collecting a minimum of $17,697 a year, which you would receive every year for the rest of your life. All of this was on one single investment of $100,000. Here’s what you would have received every year since your purchase: |

investment would still have $140,000 in cash value which you could pull out at any time or pass it

along to your heirs.

Considering the fact that the stock market has basically gone nowhere for the past decade, these

guaranteed payments start to look pretty good. Would you have made more by simply investing your money directly in the stock market in 1985? Perhaps, but what if the stock market had gone

down? You would have had none of the guarantees that these offer, which is what a lot of retirees

need.

How Much Money Do You Want to Collect Every Month?

Here’s one rule of thumb to “guarantee” a comfortable retirement:

Figure out your basic living expenses and subtract any pensions or Social Security payments.

Now you’ve got the minimum income you need to meet your basic expenses in retirement.

That’s the monthly payout you should look for from your annuity.

For example, if you are receiving $1,000 per month from Social Security, and you get a pension

that pays you $700 a month, that’s $20,400 a year. Let’s say you figure your basic living expenses

are around $25,000 a year. You should look for an annuity that pays you at least $5,000 a year

(or about $415 per month).

Beware of anyone who tries to pressure you into more than that. We would never recommend

you put the bulk of your money into an annuity. Stay away from someone who tries to put all or

most of your money into an annuity.

How the Process Will Work for You

So now you know just about everything you need to know to find the best annuity for you and

ensure you collect guaranteed income for life.

Once you’ve figured out all the options you want, when you want to get paid, and how much

you want to collect each month, you’re ready to talk to a professional about which annuities

will best fit your needs.

Many different financial institutions can sell you an annuity, including your bank, your online

broker, your insurance agent, and possibly your financial planner. But they might have a limited

selection and not the right one for you.

With the huge number of options, we suggest dealing with an honest, independent adviser. They

generally have the best selection and can best match a product to your needs. I’ve listed two here

in this report as a place to start. Once you and your adviser have found a suitable annuity, ask to receive an “illustration.” This illustration will include all the details, including fees, benefits,

withdrawal penalties, etc.

Take your time to review it. You’ll then fill out an easy application. It should take about 10 minutes.

You can select your sub accounts then, or wait to choose your investments. After that, you’ll get a “free look.” When you buy an annuity, you have between 10 and 30 days to cancel the contract.

This free look period gives you one last chance to opt out. Ask how long your “free look” lasts,

in case you change your mind. (Just a note: If your sub accounts go down during the free look period, and you decide not to go ahead with the annuity, you will only get back the market value of your

principal.) If you’re happy with your “free look,” you don’t have to do anything. You’ll start receiving monthly payouts as soon as your contract specifies.

What I Recommend

Because of the large number of choices available to you and because each individual’s

circumstances are different, I can’t say for sure what the perfect annuity is for you. But here are some of the options I think will get you the most out of your annuity:

Choose a variable annuity that will guarantee your payouts will never go down in value but

leave plenty of upside for your payouts to increase. Today, I’ve seen quotes for 6% minimum

growth from several A-plus insurance companies.

Look for a good selection of sub accounts to choose from. I’d recommend you put the

sub accounts into funds like emerging markets (i.e. China or India) or Japanese funds.

Look for an option where you can speculate with your choices. After all, you have a minimum

amount guaranteed (6%) and if you do better than that with speculative funds, you could

make even more. And with the markets down right now, it’s a great time to get into some

riskier investments.

Choose an annuity that will give you payouts for life, not over a fixed term. This will give you

maximum peace of mind and money for you and your spouse until you die.

Choose a single payment deferred annuity so your principal can build up over time for your

retirement years. This way, you’ll insure a higher payout amount than if you started collecting

today.

Add a “death benefit,” which will guarantee you and your heirs will get at least what you put

into it.

You should ONLY put as much as you need to cover your basic retirement expenses (after your

existing pension or Social Security) and keep plenty of money outside of your annuity to have liquid

funds on hand.

Guaranteed income-for-life variable annuities are ideal for a small piece of your retirement

money, so that you’ll know, beyond all reasonable doubt, you’ll have at least a certain level of

income for as long as you live. You owe it to yourself to seriously consider them for a portion

of your retirement money.

More Resources

Annuities are a great way to ensure you’ll have some income for as long as you live. You just

have to figure out which options are best for you. Here are a few more sources to help you out:

· Read the SEC’s “Investor Tips” on variable annuities: http://www.sec.gov/answers/varann.htm.

· Fidelity offers annuities... and has good information on annuities on its website: Fidelity Annuities.

· MassMutual, a large life insurance company, has a nice website talking about annuities and

how they might work for you. You can take a look here: MassMutual. I encourage you to

check out several sources to get the best combination of price and lower fees, while

maintaining the quality of the insurer.

· Talk to your financial planner and see if he deals with annuities. It’s important that he works

with lots of different insurance companies so that you can be assured he has an independent

view.

Finally, there are two guys we know who have been working in the insurance and financial planning business for years (decades) and are knowledgeable about annuities. You should

know we have no financial relationship with either one of them. Be sure you’ve read about

annuities online or spoken to a few other insurance agents about the products first so you

can help these guys help you more easily. If you call them up knowing nothing, you’ll

waste their time and yours.

Todd Phillips - You can reach Todd at 888-892-1102 or [email protected]

Jeff Winn - You can reach Jeff at 800-432-4402 or [email protected]

Jeff and Todd can give you a second opinion on anything you’ve gotten from your own financial

or insurance agent, too. They are both easy to talk with and knowledgeable.

Few Americans have considered single premium deferred and variable annuities. But they’re an

incredibly safe solution to ensure yourself and your spouse a lifetime of income. And unlike stocks

or mutual funds, there’s no guessing about how much you’ll have or when you’ll get your money.

You can step up and secure your financial future right now and know exactly when and how

much you’ll be collecting for the rest of your life.

RSS Feed

RSS Feed