| RETIRE RICH I have been trying to unravel this most confusing and complex investment strategy for years and I finally did. This "Income for Life" is a unique savings strategy that uses one of the oldest, most tried-and-true products in existence; whole life insurance. If structured in a specific way that few insurance agents even know about, we can grow our money up to 5% per year tax free, even if the stock market crashes 50% next year. Plus, we have the added peace of mind knowing that our money is with the most conservative investment managers on the planet. |

How to Fund Your Own Worry-Free, 100% Tax-Free Retirement

This super-safe "off the IRS grid" account can't go down in value, has paid uninterrupted dividends for over 100 years, and currently earns five times more than your bank savings account and CDs.

By Tom Dyson

Over the past 10 years, I’ve examined almost every type of safe income investment in existence. So I must admit, when I discovered a secret investment account used by more than 4,000 banks, I was a little shocked.

That’s why top bankers and Fortune 500 executives in the know have quietly been taking advantage of opportunities like these for years now… safely earning generous yields on their money—5.5% on average—while everyone else has been stuck chasing low-paying CDs, bonds, and dividends. (Tax-free returns of 5% may not sound like much, but if you’re in a 35% tax bracket, that’s the equivalent of earning close to 8% in your regular taxable brokerage account).

This Has Become My Single-Largest Investment

We’ve coined a term for this strategy, “Income for Life.” Today, my wife and I have more than 20% of our total net worth allocated to the Income for Life strategy and we’re still adding money to it. We have made it the foundation of our retirement strategy. I’ve even opened up accounts for each of my three children, and because of this decision, they’ll now be financially set for life. (My oldest son, for example, will have about $4 million in his account by the time he retires).

Today, I’m going to share with you everything I know about this strategy... and explain how you can set it up for yourself. With this strategy, there is virtually no risk of principal loss. Like a bank account, your money will never go down in value.

The Safest Place on the Planet for Your Money

We’re putting our money into a special type of dividend-paying company. You’ve probably never heard of these companies, even though they’re among the oldest in America. Most financial professionals haven’t heard of them, either. I made a list of 35 of these special companies doing business in America today. The oldest company on the list is 177 years old.

The average age of these companies is 106 years. Nineteen of them have been in business for more than a century. These companies are rare. No one has formed one in a very long time (worldwide), and no new ones are likely to ever be formed again. These companies do NOT trade on the stock market. Their values don’t fluctuate like traded stocks. They don’t use debt. Acquiring one of these companies is illegal. This is why Wall Street has no business with these companies. And it’s why you’ve probably never heard of them.

And, of course, they generate tons of cash, and they pay large dividends to their owners every year.

The World’s Safest Industry

The companies I’m describing are a special breed of life insurance company. Now, I know what you’re thinking. Most financial gurus say life insurance is a bad place for your money but please bear with me.

What we discovered are not your run-of-the-mill insurance companies. I’ll explain why they’re different from regular life insurance companies in a moment. In fact, these companies behave much more like savings or investment accounts than insurance companies. However, the government restricts the advertising these companies can use.

Okay, so first let me explain why life insurance is such a great industry for safety-conscious investors... Life insurance is one of the oldest financial products in existence. The sale of life insurance in the U.S. began in the late 1760s. Life insurance has proven itself through two world wars, a revolution, a civil war, the Great Depression, and numerous other recessions. There hasn’t been a single life insurance contract default in the last 300 years in America.

Can you think of any other product that has proved itself like this? Popular investment products today include mutual funds, ETFs, 401(k)s, and IRAs. None of these products have been around longer than a few decades. Life insurance is a recession-proof business. People need it regardless of what’s going on in the economy. It’s also a mathematical business, like running a casino, but with even better odds. As long as you price your risk correctly and you don’t do anything stupid with the premiums you collect, you won’t lose money over the long term.

Of all of the different types of insurance companies, life insurance companies are the safest. Consider common insurable events, such as fires, earthquakes, hurricanes. They’re rare, so scientists have fewer examples to study. The damage claims can be astronomical. And you can’t predict when these types of events will occur. Now consider life insurance. A person’s death is certain. Life expectancy is predictable for large groups. There’s plenty of data. And the insurance company knows what the payout for death claims will be.

Demand for life insurance never changes. Even in a Great Depression or an economic boom. This industry doesn’t have a business cycle. Statistics drive profits in this industry. As long as their equations are accurate—which they are, because they’ve been using them successfully for decades—they make predictable profits.

Insurance companies hire data-crunching experts called “actuaries.” Actuaries study this data. Then they create life insurance policies for the insurance company’s customers. As long as the actuaries do their jobs and the insurance company has enough customers, you can virtually guarantee it’ll be profitable. During the Great Depression, more than 9,000 banks went bankrupt. According to a hearing of the Temporary National Economic Committee in 1940, only 2% of the total assets of all life insurance companies in the U.S. became impaired during the Great Depression from 1929 to 1938.

Because the life insurance industry was so strong, it played a big part in keeping the country afloat and helping many troubled businesses get back on their feet. One example is department store mogul James Cash Penney. The great stock market crash of 1929 almost wiped out J.C. Penney. He was able to borrow funds from his life insurance company against his policy to keep his small department store chain in business through the Depression. Today, JCPenney has 1,000 stores and is worth $3.4 billion.

The same pattern appeared after the stock market crash of 2008-2009. We examined several of the safest insurance companies and found that less than 1% of their investments were listed as “nonperforming” during the financial crisis. Not only did the recent financial crisis not affect these insurance companies, but they also continued their century-long track records of paying dividends. If I had to bet on a group of companies being around 100 years from now, I’d choose these.

But, as anyone who invested in MetLife stock knows, not all insurance companies are equal. MetLife’s stock crashed 80% between 2008 and 2009. For our Income for Life strategy, we’re interested in only a tiny, much safer subset of the life insurance industry.

An Elite Subclass of Life Insurance Companies

There are two types of life insurance companies: stock life insurance companies and mutual life insurance companies.

Stock life insurance companies are life insurance companies that trade on the stock market. They issue stock, and they trade like any other public companies. Hartford, MetLife, and Prudential are all examples of stock life insurance companies. So are American National Insurance Company, Kansas City Life Insurance, and National Western Life Insurance.

Mutual life insurance companies do not trade on the stock market. They don’t have shares, and you can’t buy into them through the stock market. They’re like credit unions, except the policyholder is an owner in the insurance company. Mutual life insurance companies are much safer than their “stock-issuing” cousins. For one thing, because mutual companies have no shareholders, Wall Street analysts and money managers cannot pressure management to make short-term decisions. The companies are free to pursue long-term strategies. As a result, these corporations are known to be among the most conservatively managed companies in the world.

Stock life insurance companies have millions of shareholders. Many of these shareholders are powerful money managers. They want higher returns on their investments. It encourages the management of stock life insurance companies to take risks.

Mutual life insurance companies serve only one master... the policyholder. There are no outside shareholders to split profits with. No Wall Street. No quarterly earnings estimates. No conference calls. No insider trading. No takeovers. No message board gossip. No stock options. Think of mutual life insurance companies as cooperatives, or not-for-profit clubs.

A bunch of people have come together and pooled their money to provide life insurance for themselves. Safety, stability, and good service are the only goals of the insurance company. Mutual insurance companies still generate profits. But these get distributed back to all of the members each year as dividends. We’ll get to dividends in a minute.

You’re more likely to see stock insurance companies borrowing money, advertising, and using other aggressive growth strategies. They’ll invest in riskier assets to appease hedge funds or large shareholders with higher returns. They’re also more likely to fudge their quarterly earnings releases to make their results seem better. In sum, mutual insurance companies are one of the safest places on the planet to put your money and one of the highest-paying places too.

In the rest of this report, I’m going to explain how you can use mutuals as “secret savings accounts” that offer the guaranteed growth of our money for the REST OF OUR LIVES. Right now, they’re paying rates of up to 5% tax-free per year. (This would increase, should national interest rates rise.)

Most Life Insurance Is a Bet on Your Life

The life insurance business started as a wager. On June 18, 1583, a London man named Richard Martin placed a bet with a group of merchants. The bet was on the life of another man, named William Gybbon. Martin put up 30 pounds. If Gybbon died within one year, Richard Martin would make 400 pounds. But if Gybbon did not die, Martin would lose his 30-pound stake. Gybbon died just before the end of the year. But the merchants refused to pay Richard Martin his winnings. So Martin took them to court.

The court ruled in favor of Richard Martin. And the merchants’ payment to Richard Martin became the first official life insurance payout. The modern name for this type of life insurance agreement is a “term” policy. Putting the above example into contemporary terms, Richard Martin was the “policyholder” and “beneficiary” of the policy. The 30 pounds he paid was his “premium payment.” The merchants were the insurance company. And we’d call William Gybbon the “insured.”

Term insurance is just a simple bet. It’s the policyholder betting against the insurance company. The policyholder is betting on a death, usually his own. And the insurance company is betting on survival. If the insured person dies in the allotted time or “term,” the policyholder wins the bet (and the beneficiary gets the money). If the insured survives, the insurance company wins the bet and the policyholder loses his stream of payments.

Please note, buying term life insurance is a bet the policyholder expects to lose, but it’s still a bet. But he’s willing to take this bet. That’s because it’s cheap. And he can provide his family with financial protection if he dies. Today, term policies are the most popular type of insurance policy, representing just fewer than 40% of all life insurance premiums paid in America each year. (Today it’s most common to buy 10- or 20-year term policies). Here’s a fact that may shock you... Only 3% of the term insurance contracts conclude with a payout. What that means is the insurance company “wins” the bet 97% of the time!

A Quick Homework Assignment

I want you to figure out how much a $1 million life insurance policy would cost on your life, valid for the next 10 years. It’s important you do this exercise, because it’ll give you a much clearer understanding of how our Income for Life strategy works. To do this, click on this link, enter your state, birthday, coverage amount ($1 million), term amount (10 years), if you smoke, your health class, and gender. Then click on the “Get Instant Quote” button. It’ll take you about 30 seconds.

If you’re younger than 60 and in good health, a 10-year, $1 million life insurance policy will cost you $3,000 per year, or less than $30,000 for the 10 years. It’s cheap because it’s extremely unlikely you’ll die in the next 10 years (3% of the time) and highly likely the insurance company will win the bet (97% of the time).

The Savings Account No One Knows Exists

Early in the 19th century, insurance companies invented a new type of insurance policy. They called it permanent insurance. Permanent insurance is an insurance contract that remains in force until the insured dies. It has no term. It’s permanent. Because there is a 100% chance that the insured will die, permanent life insurance is NOT a gamble; it’s a certainty. You buy $1 million of permanent life insurance. As long as you don’t cancel the policy and you make your premium payments, the insurance company is going to pay out $1 million someday.

To pay out $1 million when you die, the insurance company must accumulate at least $1 million while you’re living in order to make the payout and not go out of business. It accumulates this money by collecting premiums from you each year. These premiums build up over time, and they generate interest—which builds up and compounds too. By the time of your death, you’ve built up plenty of money at the insurance company so it can pay your policy off.

To reinforce this point: In order for the insurance company to pay out your life insurance policy when you die, it must first accumulate this money while you’re alive. It does this by collecting premiums from you each year and investing them.

When you boil permanent life insurance down to its basic cash flows, first you make a series of payments to the insurance company while you’re alive. The insurance company collects these payments, grows them, and then gives them back to you at the end of your life. In other words, permanent life insurance has almost nothing to do with life insurance. It’s a way while you’re alive to save money that you get back when you die. Do you see that?

Permanent life insurance is a certain payment to you from the insurance company in the future. This money exists because you’ve saved it up—and the insurance company has grown it—over many years. In this way, permanent life insurance has nothing to do with life insurance. It’s about saving money. It’s a glorified bank savings account with a much higher interest rate. In contrast, term life insurance is a wager with the insurance company whether or not you’ll die in a given period. Term life insurance is not a vehicle for saving money. It’s a way to protect your family in case you die unexpectedly.

The Opportunity

As you can see, a permanent life insurance contract is really a strategy for saving up money over time so that the insurance company can pay out the full amount when you die. Here’s the beautiful part: While you’re accumulating money with the insurance company, your money earns interest.

Due to special tax provisions for insurance companies, this return is tax-free. When you buy your policy through a mutual life insurance company, you become an owner of the company. As an owner, you receive a share of the profits your company generates via a dividend.

In fact, we studied eight companies that provide these policies, and they have now paid out, on average, for 121 years in a row. When I add it up right now, the money I have in Income for Life is generating a return of 5% per year, tax-free, after dividends and interest. If long-term interest rates rise, my dividend will rise too.

Your Big Objection

I know you have one major objection to this plan. If you’re like me, you’re probably thinking: “Why would I put my money into an investment that pays only when I die?” This is a great question and the answer is very simple. The way permanent life insurance works is that you can use the money you’re accumulating at the life insurance company anytime you want. You can do this through something the experts call a “policy loan.” Not one in 100 people know this, but you can use your Income for Life policies to pay for just about anything.

I’m using these policy loans to pay for all of my vacations, cars, houses, and medical expenses. I’ll also use these loans to finance any future investments I make in stocks, real estate, or small businesses. By running these expenses through my Income for Life policy, I’ll generate an enormous positive cash flow, and no one in my family will ever have to borrow money from a bank or financing firm again. I won’t get into the details of this strategy here. For now, all you need to know is that you can use the money you’ve saved anytime you want. You can do this with no penalty, and no fees, as if it were sitting in a bank account. And even while you’re using it, it keeps growing up to 5% per year.

The Only Life Insurance That’s Worthy

I’m certain complexity is the biggest reason people hate permanent life insurance. Insurance companies have sold permanent life insurance for centuries. But over the last three decades, they’ve made “innovations” to the original model. This has hurt its reputation.

For example, today, insurance companies sell policies in which you can adjust how much money you get when you die. Or when you pay the premiums. You can buy policies that pay interest based on the stock market’s performance or the bond market’s performance. You may have heard of some of these innovations. They have names like universal life, variable life, equity indexed life, etc.

In short, these innovations have introduced hundreds of variables into permanent life insurance policies. The customer can’t understand them. Most agents don’t understand them and most importantly, they have shifted the risk away from the insurance company and back to the policyholder. Plus, the complexity makes it easy for the insurance company to hide the fees and commissions it’s charging.

This was a big reason my wife and I wouldn’t buy life insurance. I couldn’t understand the fees the company wanted to charge me. I’m not saying you couldn’t structure an Income for Life strategy with a universal, variable, or equity indexed life insurance policy. But I’d advise you not to. They’re too complicated. [If you want to learn about the different types of permanent life insurance in more detail, read this article. It’s one of the best we’ve found.]

Our Income for Life strategy uses the most ordinary type of permanent life insurance. It’s the Coca-Cola Classic of the insurance industry. Its design hasn’t changed in over 100 years.

Here’s how it works: First, you agree with the insurance company how much money you want to receive when you die. Then you pay a minimum amount every year into your policy. They call these payments “premiums.” You agree to these amounts upfront with the insurance company. They never change.

While you’re alive, these payments build up a cash value in your policy and you earn interest and dividends, tax-free, on this cash. Meanwhile, you can also use this money whenever you need it. That’s it. There are no fancy customizations and it has nothing to do with the stock market but it’s easy to understand. It’s tried and tested over two centuries and it comes with some of the lowest commissions of any permanent life insurance product on the market.

In the industry, they call it “whole life insurance.” Whole life insurance is a common insurance product. You can buy it from almost any insurance agent in the country or around the world. Our Income for Life strategy uses a “participating” or “dividend-paying” whole life insurance policy.

Becoming a Part Owner to Share in the Profits

When you own a participating whole life insurance policy, you become a part owner of the insurance company. That means you’re entitled to a share of the profits. Profits come from two places, underwriting and investments.

Now, most insurance companies have several lines of business. They’ll issue term policies. Or they’ll offer employee benefit programs that offer medical, dental, and disability insurance.

They might issue auto policies. And most have retirement divisions that offer things such as 401(k)s, annuities, or long-term care solutions.

If insurance companies underwrite and manage these programs the right way, they’ll pour money into the insurance companies’ coffers. And the only customers of the life insurance companies who share in the underwriting profits these multiple lines of businesses generate are the ones with “participating” whole life policies.

The second way insurance companies generate profits is from their investing activities. Think of the hundreds of thousands of customers an insurance company has. All of these customers make annual, quarterly, or monthly payments to the insurance company for all of the policies they have.

That means there’s a steady stream of cash pouring into the company each day. The insurance company won’t need to pay many of its claims immediately. It takes years, sometimes decades, for people to collect.

Instead of sitting on this cash, insurance companies conservatively invest and grow it. They know with exact precision when they’ll need the money to pay claims.

At the end of each year, the insurance company tallies the profits from its investing and underwriting activities. It pays expenses and claims, then sets aside a little into a reserve account for extra safety. What happens to the rest of the profits? They’re dispersed to “participating” policyholders as a dividend each year.

The top mutual insurance companies we recommend are so prudent at managing their investments and insurance businesses that they’ve managed to pay dividends to their participating policyholders for more than 100 years in a row.

There’s one final twist we’ll add to a dividend-paying whole life insurance policy. This twist makes it different from any other type of life insurance policy, including most of the whole life policies the industry sells today.

[When a mutual insurance company issues a whole life policy, it calls it “participating” or “dividend-paying” whole life insurance. It calls it “participating” because policyholders own the mutual company and participate in the profits by earning interest and dividends.]

The Secret Ingredient That Makes Income for Life

Call up your local life insurance agent. Ask him for a whole life insurance policy. He’ll sell you the life insurance coverage that comes with a savings component but we’ve established that Income for Life is NOT about the life insurance coverage. What do I mean by this? Most people think of life insurance as something you buy to protect your family in case you die. It’s a precaution.

But our Income for Life strategy has nothing to do with estate planning, protection, or life insurance. It’s a program to save money and build wealth while you’re still living. We structure our whole life policy to emphasize the savings aspect and minimize the life insurance aspect.

In the insurance industry, they’d say we were trying to “maximize the cash value of the policy and minimize the life insurance coverage.” We do this by stuffing as much money into our whole life policy as we can, as fast as possible, keeping our life insurance coverage as low as possible. For example, a typical term life insurance buyer might pay $1,000 per year for a $2 million policy. But we would prefer to pay $20,000 per year for a $500,000 whole life policy. This way, we get much more money earning interest and dividends in our policy, and we give much less money to the insurance company for life coverage. Do you see this?

Most people want as MUCH life insurance coverage as possible by spending as LITTLE money as possible. With our Income for Life strategy, we want to get as LITTLE life insurance coverage as possible, by putting as MUCH money as possible into our policy. Income for Life uses a special tool to make this happen. It’s called a paid-up additions (PUA) rider. Most life insurance companies offer this rider. But few insurance agents know it exists. A PUA rider is a way to stuff as much money into your policy as legally possible.

This way, you’re earning more interest and more dividends in your account, without increasing the amount you spend on life insurance protection. I’m not going to get into all of the details of the PUA rider just yet. For now, all you need to know is that the PUA rider changes an ordinary whole life insurance policy into a wealth-building machine.

What do I mean by stuffing as much money in your policy as “legally possible?” Insurance policies confer enormous tax benefits. In the ’70s and ’80s, investors and corporations plowed billions into permanent life insurance policies to take advantage of the tax benefits. In 1986, the IRS clamped down. It set a limit on how much cash you could put into permanent life insurance. If you exceed this limit, your life insurance policy turns into what the IRS calls a “modified endowment contract,” or “MEC,” for short and it won’t qualify for the tax benefits.

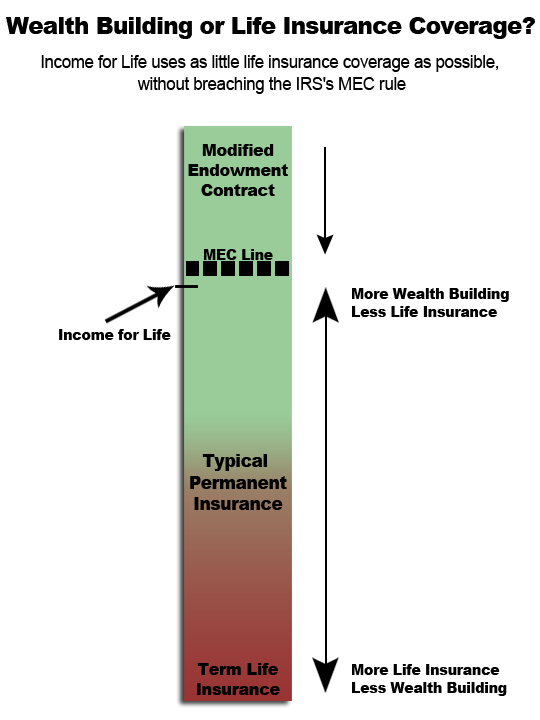

This illustration below shows the relationships of insurance types to this MEC line. At the bottom of the chart, you have term insurance. It offers just insurance, and it’s the cheapest. There is no savings component with term insurance.

This super-safe "off the IRS grid" account can't go down in value, has paid uninterrupted dividends for over 100 years, and currently earns five times more than your bank savings account and CDs.

By Tom Dyson

Over the past 10 years, I’ve examined almost every type of safe income investment in existence. So I must admit, when I discovered a secret investment account used by more than 4,000 banks, I was a little shocked.

That’s why top bankers and Fortune 500 executives in the know have quietly been taking advantage of opportunities like these for years now… safely earning generous yields on their money—5.5% on average—while everyone else has been stuck chasing low-paying CDs, bonds, and dividends. (Tax-free returns of 5% may not sound like much, but if you’re in a 35% tax bracket, that’s the equivalent of earning close to 8% in your regular taxable brokerage account).

This Has Become My Single-Largest Investment

We’ve coined a term for this strategy, “Income for Life.” Today, my wife and I have more than 20% of our total net worth allocated to the Income for Life strategy and we’re still adding money to it. We have made it the foundation of our retirement strategy. I’ve even opened up accounts for each of my three children, and because of this decision, they’ll now be financially set for life. (My oldest son, for example, will have about $4 million in his account by the time he retires).

Today, I’m going to share with you everything I know about this strategy... and explain how you can set it up for yourself. With this strategy, there is virtually no risk of principal loss. Like a bank account, your money will never go down in value.

The Safest Place on the Planet for Your Money

We’re putting our money into a special type of dividend-paying company. You’ve probably never heard of these companies, even though they’re among the oldest in America. Most financial professionals haven’t heard of them, either. I made a list of 35 of these special companies doing business in America today. The oldest company on the list is 177 years old.

The average age of these companies is 106 years. Nineteen of them have been in business for more than a century. These companies are rare. No one has formed one in a very long time (worldwide), and no new ones are likely to ever be formed again. These companies do NOT trade on the stock market. Their values don’t fluctuate like traded stocks. They don’t use debt. Acquiring one of these companies is illegal. This is why Wall Street has no business with these companies. And it’s why you’ve probably never heard of them.

And, of course, they generate tons of cash, and they pay large dividends to their owners every year.

The World’s Safest Industry

The companies I’m describing are a special breed of life insurance company. Now, I know what you’re thinking. Most financial gurus say life insurance is a bad place for your money but please bear with me.

What we discovered are not your run-of-the-mill insurance companies. I’ll explain why they’re different from regular life insurance companies in a moment. In fact, these companies behave much more like savings or investment accounts than insurance companies. However, the government restricts the advertising these companies can use.

Okay, so first let me explain why life insurance is such a great industry for safety-conscious investors... Life insurance is one of the oldest financial products in existence. The sale of life insurance in the U.S. began in the late 1760s. Life insurance has proven itself through two world wars, a revolution, a civil war, the Great Depression, and numerous other recessions. There hasn’t been a single life insurance contract default in the last 300 years in America.

Can you think of any other product that has proved itself like this? Popular investment products today include mutual funds, ETFs, 401(k)s, and IRAs. None of these products have been around longer than a few decades. Life insurance is a recession-proof business. People need it regardless of what’s going on in the economy. It’s also a mathematical business, like running a casino, but with even better odds. As long as you price your risk correctly and you don’t do anything stupid with the premiums you collect, you won’t lose money over the long term.

Of all of the different types of insurance companies, life insurance companies are the safest. Consider common insurable events, such as fires, earthquakes, hurricanes. They’re rare, so scientists have fewer examples to study. The damage claims can be astronomical. And you can’t predict when these types of events will occur. Now consider life insurance. A person’s death is certain. Life expectancy is predictable for large groups. There’s plenty of data. And the insurance company knows what the payout for death claims will be.

Demand for life insurance never changes. Even in a Great Depression or an economic boom. This industry doesn’t have a business cycle. Statistics drive profits in this industry. As long as their equations are accurate—which they are, because they’ve been using them successfully for decades—they make predictable profits.

Insurance companies hire data-crunching experts called “actuaries.” Actuaries study this data. Then they create life insurance policies for the insurance company’s customers. As long as the actuaries do their jobs and the insurance company has enough customers, you can virtually guarantee it’ll be profitable. During the Great Depression, more than 9,000 banks went bankrupt. According to a hearing of the Temporary National Economic Committee in 1940, only 2% of the total assets of all life insurance companies in the U.S. became impaired during the Great Depression from 1929 to 1938.

Because the life insurance industry was so strong, it played a big part in keeping the country afloat and helping many troubled businesses get back on their feet. One example is department store mogul James Cash Penney. The great stock market crash of 1929 almost wiped out J.C. Penney. He was able to borrow funds from his life insurance company against his policy to keep his small department store chain in business through the Depression. Today, JCPenney has 1,000 stores and is worth $3.4 billion.

The same pattern appeared after the stock market crash of 2008-2009. We examined several of the safest insurance companies and found that less than 1% of their investments were listed as “nonperforming” during the financial crisis. Not only did the recent financial crisis not affect these insurance companies, but they also continued their century-long track records of paying dividends. If I had to bet on a group of companies being around 100 years from now, I’d choose these.

But, as anyone who invested in MetLife stock knows, not all insurance companies are equal. MetLife’s stock crashed 80% between 2008 and 2009. For our Income for Life strategy, we’re interested in only a tiny, much safer subset of the life insurance industry.

An Elite Subclass of Life Insurance Companies

There are two types of life insurance companies: stock life insurance companies and mutual life insurance companies.

Stock life insurance companies are life insurance companies that trade on the stock market. They issue stock, and they trade like any other public companies. Hartford, MetLife, and Prudential are all examples of stock life insurance companies. So are American National Insurance Company, Kansas City Life Insurance, and National Western Life Insurance.

Mutual life insurance companies do not trade on the stock market. They don’t have shares, and you can’t buy into them through the stock market. They’re like credit unions, except the policyholder is an owner in the insurance company. Mutual life insurance companies are much safer than their “stock-issuing” cousins. For one thing, because mutual companies have no shareholders, Wall Street analysts and money managers cannot pressure management to make short-term decisions. The companies are free to pursue long-term strategies. As a result, these corporations are known to be among the most conservatively managed companies in the world.

Stock life insurance companies have millions of shareholders. Many of these shareholders are powerful money managers. They want higher returns on their investments. It encourages the management of stock life insurance companies to take risks.

Mutual life insurance companies serve only one master... the policyholder. There are no outside shareholders to split profits with. No Wall Street. No quarterly earnings estimates. No conference calls. No insider trading. No takeovers. No message board gossip. No stock options. Think of mutual life insurance companies as cooperatives, or not-for-profit clubs.

A bunch of people have come together and pooled their money to provide life insurance for themselves. Safety, stability, and good service are the only goals of the insurance company. Mutual insurance companies still generate profits. But these get distributed back to all of the members each year as dividends. We’ll get to dividends in a minute.

You’re more likely to see stock insurance companies borrowing money, advertising, and using other aggressive growth strategies. They’ll invest in riskier assets to appease hedge funds or large shareholders with higher returns. They’re also more likely to fudge their quarterly earnings releases to make their results seem better. In sum, mutual insurance companies are one of the safest places on the planet to put your money and one of the highest-paying places too.

In the rest of this report, I’m going to explain how you can use mutuals as “secret savings accounts” that offer the guaranteed growth of our money for the REST OF OUR LIVES. Right now, they’re paying rates of up to 5% tax-free per year. (This would increase, should national interest rates rise.)

Most Life Insurance Is a Bet on Your Life

The life insurance business started as a wager. On June 18, 1583, a London man named Richard Martin placed a bet with a group of merchants. The bet was on the life of another man, named William Gybbon. Martin put up 30 pounds. If Gybbon died within one year, Richard Martin would make 400 pounds. But if Gybbon did not die, Martin would lose his 30-pound stake. Gybbon died just before the end of the year. But the merchants refused to pay Richard Martin his winnings. So Martin took them to court.

The court ruled in favor of Richard Martin. And the merchants’ payment to Richard Martin became the first official life insurance payout. The modern name for this type of life insurance agreement is a “term” policy. Putting the above example into contemporary terms, Richard Martin was the “policyholder” and “beneficiary” of the policy. The 30 pounds he paid was his “premium payment.” The merchants were the insurance company. And we’d call William Gybbon the “insured.”

Term insurance is just a simple bet. It’s the policyholder betting against the insurance company. The policyholder is betting on a death, usually his own. And the insurance company is betting on survival. If the insured person dies in the allotted time or “term,” the policyholder wins the bet (and the beneficiary gets the money). If the insured survives, the insurance company wins the bet and the policyholder loses his stream of payments.

Please note, buying term life insurance is a bet the policyholder expects to lose, but it’s still a bet. But he’s willing to take this bet. That’s because it’s cheap. And he can provide his family with financial protection if he dies. Today, term policies are the most popular type of insurance policy, representing just fewer than 40% of all life insurance premiums paid in America each year. (Today it’s most common to buy 10- or 20-year term policies). Here’s a fact that may shock you... Only 3% of the term insurance contracts conclude with a payout. What that means is the insurance company “wins” the bet 97% of the time!

A Quick Homework Assignment

I want you to figure out how much a $1 million life insurance policy would cost on your life, valid for the next 10 years. It’s important you do this exercise, because it’ll give you a much clearer understanding of how our Income for Life strategy works. To do this, click on this link, enter your state, birthday, coverage amount ($1 million), term amount (10 years), if you smoke, your health class, and gender. Then click on the “Get Instant Quote” button. It’ll take you about 30 seconds.

If you’re younger than 60 and in good health, a 10-year, $1 million life insurance policy will cost you $3,000 per year, or less than $30,000 for the 10 years. It’s cheap because it’s extremely unlikely you’ll die in the next 10 years (3% of the time) and highly likely the insurance company will win the bet (97% of the time).

The Savings Account No One Knows Exists

Early in the 19th century, insurance companies invented a new type of insurance policy. They called it permanent insurance. Permanent insurance is an insurance contract that remains in force until the insured dies. It has no term. It’s permanent. Because there is a 100% chance that the insured will die, permanent life insurance is NOT a gamble; it’s a certainty. You buy $1 million of permanent life insurance. As long as you don’t cancel the policy and you make your premium payments, the insurance company is going to pay out $1 million someday.

To pay out $1 million when you die, the insurance company must accumulate at least $1 million while you’re living in order to make the payout and not go out of business. It accumulates this money by collecting premiums from you each year. These premiums build up over time, and they generate interest—which builds up and compounds too. By the time of your death, you’ve built up plenty of money at the insurance company so it can pay your policy off.

To reinforce this point: In order for the insurance company to pay out your life insurance policy when you die, it must first accumulate this money while you’re alive. It does this by collecting premiums from you each year and investing them.

When you boil permanent life insurance down to its basic cash flows, first you make a series of payments to the insurance company while you’re alive. The insurance company collects these payments, grows them, and then gives them back to you at the end of your life. In other words, permanent life insurance has almost nothing to do with life insurance. It’s a way while you’re alive to save money that you get back when you die. Do you see that?

Permanent life insurance is a certain payment to you from the insurance company in the future. This money exists because you’ve saved it up—and the insurance company has grown it—over many years. In this way, permanent life insurance has nothing to do with life insurance. It’s about saving money. It’s a glorified bank savings account with a much higher interest rate. In contrast, term life insurance is a wager with the insurance company whether or not you’ll die in a given period. Term life insurance is not a vehicle for saving money. It’s a way to protect your family in case you die unexpectedly.

The Opportunity

As you can see, a permanent life insurance contract is really a strategy for saving up money over time so that the insurance company can pay out the full amount when you die. Here’s the beautiful part: While you’re accumulating money with the insurance company, your money earns interest.

Due to special tax provisions for insurance companies, this return is tax-free. When you buy your policy through a mutual life insurance company, you become an owner of the company. As an owner, you receive a share of the profits your company generates via a dividend.

In fact, we studied eight companies that provide these policies, and they have now paid out, on average, for 121 years in a row. When I add it up right now, the money I have in Income for Life is generating a return of 5% per year, tax-free, after dividends and interest. If long-term interest rates rise, my dividend will rise too.

Your Big Objection

I know you have one major objection to this plan. If you’re like me, you’re probably thinking: “Why would I put my money into an investment that pays only when I die?” This is a great question and the answer is very simple. The way permanent life insurance works is that you can use the money you’re accumulating at the life insurance company anytime you want. You can do this through something the experts call a “policy loan.” Not one in 100 people know this, but you can use your Income for Life policies to pay for just about anything.

I’m using these policy loans to pay for all of my vacations, cars, houses, and medical expenses. I’ll also use these loans to finance any future investments I make in stocks, real estate, or small businesses. By running these expenses through my Income for Life policy, I’ll generate an enormous positive cash flow, and no one in my family will ever have to borrow money from a bank or financing firm again. I won’t get into the details of this strategy here. For now, all you need to know is that you can use the money you’ve saved anytime you want. You can do this with no penalty, and no fees, as if it were sitting in a bank account. And even while you’re using it, it keeps growing up to 5% per year.

The Only Life Insurance That’s Worthy

I’m certain complexity is the biggest reason people hate permanent life insurance. Insurance companies have sold permanent life insurance for centuries. But over the last three decades, they’ve made “innovations” to the original model. This has hurt its reputation.

For example, today, insurance companies sell policies in which you can adjust how much money you get when you die. Or when you pay the premiums. You can buy policies that pay interest based on the stock market’s performance or the bond market’s performance. You may have heard of some of these innovations. They have names like universal life, variable life, equity indexed life, etc.

In short, these innovations have introduced hundreds of variables into permanent life insurance policies. The customer can’t understand them. Most agents don’t understand them and most importantly, they have shifted the risk away from the insurance company and back to the policyholder. Plus, the complexity makes it easy for the insurance company to hide the fees and commissions it’s charging.

This was a big reason my wife and I wouldn’t buy life insurance. I couldn’t understand the fees the company wanted to charge me. I’m not saying you couldn’t structure an Income for Life strategy with a universal, variable, or equity indexed life insurance policy. But I’d advise you not to. They’re too complicated. [If you want to learn about the different types of permanent life insurance in more detail, read this article. It’s one of the best we’ve found.]

Our Income for Life strategy uses the most ordinary type of permanent life insurance. It’s the Coca-Cola Classic of the insurance industry. Its design hasn’t changed in over 100 years.

Here’s how it works: First, you agree with the insurance company how much money you want to receive when you die. Then you pay a minimum amount every year into your policy. They call these payments “premiums.” You agree to these amounts upfront with the insurance company. They never change.

While you’re alive, these payments build up a cash value in your policy and you earn interest and dividends, tax-free, on this cash. Meanwhile, you can also use this money whenever you need it. That’s it. There are no fancy customizations and it has nothing to do with the stock market but it’s easy to understand. It’s tried and tested over two centuries and it comes with some of the lowest commissions of any permanent life insurance product on the market.

In the industry, they call it “whole life insurance.” Whole life insurance is a common insurance product. You can buy it from almost any insurance agent in the country or around the world. Our Income for Life strategy uses a “participating” or “dividend-paying” whole life insurance policy.

Becoming a Part Owner to Share in the Profits

When you own a participating whole life insurance policy, you become a part owner of the insurance company. That means you’re entitled to a share of the profits. Profits come from two places, underwriting and investments.

Now, most insurance companies have several lines of business. They’ll issue term policies. Or they’ll offer employee benefit programs that offer medical, dental, and disability insurance.

They might issue auto policies. And most have retirement divisions that offer things such as 401(k)s, annuities, or long-term care solutions.

If insurance companies underwrite and manage these programs the right way, they’ll pour money into the insurance companies’ coffers. And the only customers of the life insurance companies who share in the underwriting profits these multiple lines of businesses generate are the ones with “participating” whole life policies.

The second way insurance companies generate profits is from their investing activities. Think of the hundreds of thousands of customers an insurance company has. All of these customers make annual, quarterly, or monthly payments to the insurance company for all of the policies they have.

That means there’s a steady stream of cash pouring into the company each day. The insurance company won’t need to pay many of its claims immediately. It takes years, sometimes decades, for people to collect.

Instead of sitting on this cash, insurance companies conservatively invest and grow it. They know with exact precision when they’ll need the money to pay claims.

At the end of each year, the insurance company tallies the profits from its investing and underwriting activities. It pays expenses and claims, then sets aside a little into a reserve account for extra safety. What happens to the rest of the profits? They’re dispersed to “participating” policyholders as a dividend each year.

The top mutual insurance companies we recommend are so prudent at managing their investments and insurance businesses that they’ve managed to pay dividends to their participating policyholders for more than 100 years in a row.

There’s one final twist we’ll add to a dividend-paying whole life insurance policy. This twist makes it different from any other type of life insurance policy, including most of the whole life policies the industry sells today.

[When a mutual insurance company issues a whole life policy, it calls it “participating” or “dividend-paying” whole life insurance. It calls it “participating” because policyholders own the mutual company and participate in the profits by earning interest and dividends.]

The Secret Ingredient That Makes Income for Life

Call up your local life insurance agent. Ask him for a whole life insurance policy. He’ll sell you the life insurance coverage that comes with a savings component but we’ve established that Income for Life is NOT about the life insurance coverage. What do I mean by this? Most people think of life insurance as something you buy to protect your family in case you die. It’s a precaution.

But our Income for Life strategy has nothing to do with estate planning, protection, or life insurance. It’s a program to save money and build wealth while you’re still living. We structure our whole life policy to emphasize the savings aspect and minimize the life insurance aspect.

In the insurance industry, they’d say we were trying to “maximize the cash value of the policy and minimize the life insurance coverage.” We do this by stuffing as much money into our whole life policy as we can, as fast as possible, keeping our life insurance coverage as low as possible. For example, a typical term life insurance buyer might pay $1,000 per year for a $2 million policy. But we would prefer to pay $20,000 per year for a $500,000 whole life policy. This way, we get much more money earning interest and dividends in our policy, and we give much less money to the insurance company for life coverage. Do you see this?

Most people want as MUCH life insurance coverage as possible by spending as LITTLE money as possible. With our Income for Life strategy, we want to get as LITTLE life insurance coverage as possible, by putting as MUCH money as possible into our policy. Income for Life uses a special tool to make this happen. It’s called a paid-up additions (PUA) rider. Most life insurance companies offer this rider. But few insurance agents know it exists. A PUA rider is a way to stuff as much money into your policy as legally possible.

This way, you’re earning more interest and more dividends in your account, without increasing the amount you spend on life insurance protection. I’m not going to get into all of the details of the PUA rider just yet. For now, all you need to know is that the PUA rider changes an ordinary whole life insurance policy into a wealth-building machine.

What do I mean by stuffing as much money in your policy as “legally possible?” Insurance policies confer enormous tax benefits. In the ’70s and ’80s, investors and corporations plowed billions into permanent life insurance policies to take advantage of the tax benefits. In 1986, the IRS clamped down. It set a limit on how much cash you could put into permanent life insurance. If you exceed this limit, your life insurance policy turns into what the IRS calls a “modified endowment contract,” or “MEC,” for short and it won’t qualify for the tax benefits.

This illustration below shows the relationships of insurance types to this MEC line. At the bottom of the chart, you have term insurance. It offers just insurance, and it’s the cheapest. There is no savings component with term insurance.

At the top of the scale, you have insurance policies that offer 100% savings with the least amount of life insurance. These are modified endowment contracts, or MECs. In between, you have other types of permanent life insurance.

The thick dotted line shows where an insurance policy turns into an MEC and loses its tax benefits (tax-free growth). Income for Life uses a participating/dividend-paying whole life insurance policy from a mutual insurance company. We use a PUA rider to put as much money into our whole life policy as we can WITHOUT crossing the MEC line. The fact that the government limits how much money you can put into your insurance policy should show you how powerful this strategy is.

How to Open an Income for Life Policy

A year ago, we hired a life insurance investigator. We paid him to investigate the Income for Life industry and figure out which Income for Life experts we could recommend to you, if any. “Not only should they have the experience,” I said, “but they should also have perfect reputations, and, most importantly of all, they must use the Income for Life strategy with their own money.”

This investigator was a licensed life insurance agent, so he was already familiar with the industry. Plus, he’d read all of the books on Income for Life, he’d attended both major Income for Life conferences, he knew more than a dozen of the top Income for Life experts, and he’d spoken with dozens of Income for Life customers. He’d also taken out several Income for Life policies on himself and his family members.

Our investigator’s name is Tim Mittelstaedt. Tim and I chose three Income for Life experts. Among them, they have hundreds of clients. They’ve set up thousands of Income for Life policies. And they have more than 53 years of combined experience in this industry. Most importantly, all three experts put their own money... lots of it into Income for Life policies.

In our opinion, these are the three top Income for Life experts in the country. To open an Income for Life policy, the first thing you must do is contact one of our recommended Income for Life experts.

Introducing Our Income for Life Experts

As with any recommendation we make, we don’t receive any commission, fee, kickback, or compensation of any kind for recommending these experts.. We know them, we like them, and we trust them. And we recommend them to you, because they understand how to set up and use our Income for Life strategy better than anyone else. It’s as simple as that.

[We have not published our Income for Life experts’ telephone numbers. To provide the highest level of service possible, they would like you to contact them—initially—by email. You’ll find their email addresses below.]

Top Income for Life expert #1: Patrick Donohoe, Paradigm Life

Patrick is my personal life insurance expert. He’s set up six policies for me so far. Patrick is also our resident expert. He’s helped us understand Income for Life and contributed to this report. He formed his company, Paradigm Life, in 2007. His business is doing so well that his firm now employs seven life insurance agents. Patrick owns 11 policies of his own. You can contact him at [email protected].

Top Income for Life expert #2: Kim Butler, Partners 4 Prosperity

Kim Butler formed her company, Partners 4 Prosperity, in 1999. She employs four life insurance agents. Kim has worked with Robert Kiyosaki, author of the best-selling personal finance book of all time, Rich Dad, Poor Dad. You can also learn more about a book she wrote on life insurance at www.liveyourlifeinsurance.com. Kim has 29 of her own policies on herself and her family. You can contact her at [email protected].

Top Income for Life expert #3: Becky Rice, Rebecca Rice & Associates

Becky formed her company, Rebecca Rice & Associates, in 2001. She employs 10 life insurance agents. Becky has 29 of her own policies for herself and her family. You can contact her at [email protected].

10 Tips on Working With Our Income for Life Experts

Please keep these general tips in mind as you begin contacting our Income for Life experts.

1. Pick an expert you connect with.

The government regulates the fees life insurance agents can charge you. So from a cost perspective, it doesn’t matter whom you choose. You’ll pay the same. You’ll have your Income for Life policy for the rest of your life. And you’re going to work with your agent for many years. It’s important that you like working with your agent.

I advise you contact ALL three of our recommended experts and see whom you like the best. Spend as much time as you need to find out whom you want to pick as your expert. You are not under any obligation to do business with them. And they’ll be happy to answer all of your questions.

2. Contact these experts only if you’re interested in Income for Life.

While these experts can set up every type of life insurance product, they specialize in Income for Life. If you’re looking for a term life insurance policy or an annuity, please do not bother calling these experts.

3. Start small.

When I invest in a new investment class I’m not familiar with, I start small. Then, when I’m satisfied that my investment is acting the way I expected it to, I add to my position. With Income for Life, my wife and I started with one small policy each. A year later, we took out four more—much larger—policies. There’s no financial cost to adding policies in this way and there are no flat fees or minimum amounts.

4. Do not attempt to set up an Income for Life policy with a life insurance agent who’s not trained in

Income for Life.

Ninety-nine percent of life insurance agents in America have never heard of Income for Life. And they have no concept of using a dividend-paying whole life insurance policy as a vehicle for saving money. Please do not ask your local life insurance agent or a family friend to set up a whole life policy for you. Even if they have heard about Income for Life, they won’t set it up correctly.

You’ll pay more in fees and you won’t enjoy the full benefits of this powerful strategy. Most importantly, setting up the policy is only the first step. Using your policy to finance your investments and expenses is the real benefit of this strategy. Your local insurance agent won’t be able to help you with this but our recommended experts will. They may even offer online tools to help you make the most of your policies.

5. Beware of life insurance agents claiming to be Income for Life experts.

The Income for Life concept is exploding in popularity. In 2005, only five people attended the annual Income for Life industry conference. This year, there were more than 200 attendees. Over the last few years, all of our experts have reported at least a 10-fold increase in the number of phone calls they receive each week.

Some untrained life insurance agents are trying to grow their businesses by claiming to be Income for Life experts. But they’re not Income for Life experts. They don’t understand the strategy. They don’t know how to set up Income for Life policies. It’s important that you don’t do business with these unqualified agents.

The paid up additions (PUA) rider I told you about earlier is one way to tell if an agent is an expert in Income for Life. The PUA rider is an essential piece of the Income for Life strategy, but it reduces agent commissions by 60-70%. If an agent does NOT recommend a PUA rider, either he doesn’t know about Income for Life or he doesn’t want to cut his commissions by adding a PUA rider to your policy.

If you’re still not sure the life insurance agent you are already dealing with is an Income for Life expert, ask ours. They know most Income for Life experts in the industry. They’ll be happy to verify the agent for you.

6. Don’t let all of the different names for Income for Life confuse you.

We call this strategy “Income for Life.” But the most established name for this strategy is the “Infinite Banking Concept,” or “IBC,” for short. Income for Life and Infinite Banking are exactly the same. We had to come up with our own name because “Infinite Banking” is trademarked. There are other experts, authors, and newsletters recommending this strategy too.

Each expert has their own name for the strategy. Names include “Bank on Yourself,” “Cashflow Banking,” “Bank of You,” and “Privatized Banking.” There may be small differences in the ways these experts design their policies. And some of these differences may weaken the strategy.

We don’t endorse any of these other “experts.” If you’re already working with one of these experts—or considering it—and you want to make sure you’re doing the right thing, call our Income for Life experts.

7. How much money do you intend to put into Income for Life?

You don’t need to have an exact number at this point. You may not have even made up your mind to start an Income for Life policy. But before you call one of our experts, please have a rough number in mind that could make sense for you.

For example: “I could afford to save $100 per month.” Or “I’m considering starting with $10,000 per year.”

Why? Using this number, our experts will create an example policy for you. They call it a “policy illustration.” It’ll show you how your money will grow over time. And your expert can talk you through real-life examples of how you could use your Income for Life policy.

8. Raise your questions and concerns upfront.

Do you have concerns that you are too old? Are you considering getting rid of your term insurance policy and putting the money into a whole life insurance policy? Do you want to use Income for Life policies to save for retirement, pay for your kids' college expenses, or finance your vehicles?

Please raise these questions and concerns the first time you speak to our Income for Life experts. This way, they’ll be able to give you more focused advice and better service.

9. Be prepared for dozens of personal questions.

Our Income for Life experts are going to ask you dozens of personal questions about your income, your savings, your health, and your family situation. They need this information to make sure Income for Life is right for you, and to figure out the best way to structure your policy.

When you first contact our experts by email, you’ll be asked to fill out a financial questionnaire. I’m uncomfortable talking about these personal details, and you probably are too. But in order to set my policies up correctly, Patrick needed to understand my personal financial situation.

10. Be prepared to take a medical exam.

Unless you’re insuring a newborn baby, you will need to take a medical exam. Think of the medical exam like a pre-approval for a mortgage. It won’t cost you any money. And it’s easy. The insurance company will send a nurse to your house at a time that’s convenient for you. The nurse will take urine and blood samples, your blood pressure, and some basic measurements. Then she’ll ask you questions about your health and your family’s medical history.

My wife and I have had to do this each time we’ve set up a new policy. I had the nurse come at 6 a.m. so the exam wouldn’t interfere with my work schedule.

Important: Please Read This Before You Contact an Income for Life Expert

Our Income for Life experts will receive thousands of inquiries as a result of this report. Please contact our experts by email instead of by phone. And please give them at least a week to get back to you from the date you write to them.

Also, life insurance policies require lots of setup and customization and a fair bit of paperwork. Plus, there is a health exam and some other stuff you have to do. It can take up to a month to set up your policies. Sometimes longer.

Income for Life is a lifelong strategy you’ll have in place for decades. There’s no rush. A few days or weeks won’t matter, in the big picture. Please be patient.

The thick dotted line shows where an insurance policy turns into an MEC and loses its tax benefits (tax-free growth). Income for Life uses a participating/dividend-paying whole life insurance policy from a mutual insurance company. We use a PUA rider to put as much money into our whole life policy as we can WITHOUT crossing the MEC line. The fact that the government limits how much money you can put into your insurance policy should show you how powerful this strategy is.

How to Open an Income for Life Policy

A year ago, we hired a life insurance investigator. We paid him to investigate the Income for Life industry and figure out which Income for Life experts we could recommend to you, if any. “Not only should they have the experience,” I said, “but they should also have perfect reputations, and, most importantly of all, they must use the Income for Life strategy with their own money.”

This investigator was a licensed life insurance agent, so he was already familiar with the industry. Plus, he’d read all of the books on Income for Life, he’d attended both major Income for Life conferences, he knew more than a dozen of the top Income for Life experts, and he’d spoken with dozens of Income for Life customers. He’d also taken out several Income for Life policies on himself and his family members.

Our investigator’s name is Tim Mittelstaedt. Tim and I chose three Income for Life experts. Among them, they have hundreds of clients. They’ve set up thousands of Income for Life policies. And they have more than 53 years of combined experience in this industry. Most importantly, all three experts put their own money... lots of it into Income for Life policies.

In our opinion, these are the three top Income for Life experts in the country. To open an Income for Life policy, the first thing you must do is contact one of our recommended Income for Life experts.

Introducing Our Income for Life Experts

As with any recommendation we make, we don’t receive any commission, fee, kickback, or compensation of any kind for recommending these experts.. We know them, we like them, and we trust them. And we recommend them to you, because they understand how to set up and use our Income for Life strategy better than anyone else. It’s as simple as that.

[We have not published our Income for Life experts’ telephone numbers. To provide the highest level of service possible, they would like you to contact them—initially—by email. You’ll find their email addresses below.]

Top Income for Life expert #1: Patrick Donohoe, Paradigm Life

Patrick is my personal life insurance expert. He’s set up six policies for me so far. Patrick is also our resident expert. He’s helped us understand Income for Life and contributed to this report. He formed his company, Paradigm Life, in 2007. His business is doing so well that his firm now employs seven life insurance agents. Patrick owns 11 policies of his own. You can contact him at [email protected].

Top Income for Life expert #2: Kim Butler, Partners 4 Prosperity

Kim Butler formed her company, Partners 4 Prosperity, in 1999. She employs four life insurance agents. Kim has worked with Robert Kiyosaki, author of the best-selling personal finance book of all time, Rich Dad, Poor Dad. You can also learn more about a book she wrote on life insurance at www.liveyourlifeinsurance.com. Kim has 29 of her own policies on herself and her family. You can contact her at [email protected].

Top Income for Life expert #3: Becky Rice, Rebecca Rice & Associates

Becky formed her company, Rebecca Rice & Associates, in 2001. She employs 10 life insurance agents. Becky has 29 of her own policies for herself and her family. You can contact her at [email protected].

10 Tips on Working With Our Income for Life Experts

Please keep these general tips in mind as you begin contacting our Income for Life experts.

1. Pick an expert you connect with.

The government regulates the fees life insurance agents can charge you. So from a cost perspective, it doesn’t matter whom you choose. You’ll pay the same. You’ll have your Income for Life policy for the rest of your life. And you’re going to work with your agent for many years. It’s important that you like working with your agent.

I advise you contact ALL three of our recommended experts and see whom you like the best. Spend as much time as you need to find out whom you want to pick as your expert. You are not under any obligation to do business with them. And they’ll be happy to answer all of your questions.

2. Contact these experts only if you’re interested in Income for Life.

While these experts can set up every type of life insurance product, they specialize in Income for Life. If you’re looking for a term life insurance policy or an annuity, please do not bother calling these experts.

3. Start small.

When I invest in a new investment class I’m not familiar with, I start small. Then, when I’m satisfied that my investment is acting the way I expected it to, I add to my position. With Income for Life, my wife and I started with one small policy each. A year later, we took out four more—much larger—policies. There’s no financial cost to adding policies in this way and there are no flat fees or minimum amounts.

4. Do not attempt to set up an Income for Life policy with a life insurance agent who’s not trained in

Income for Life.

Ninety-nine percent of life insurance agents in America have never heard of Income for Life. And they have no concept of using a dividend-paying whole life insurance policy as a vehicle for saving money. Please do not ask your local life insurance agent or a family friend to set up a whole life policy for you. Even if they have heard about Income for Life, they won’t set it up correctly.

You’ll pay more in fees and you won’t enjoy the full benefits of this powerful strategy. Most importantly, setting up the policy is only the first step. Using your policy to finance your investments and expenses is the real benefit of this strategy. Your local insurance agent won’t be able to help you with this but our recommended experts will. They may even offer online tools to help you make the most of your policies.

5. Beware of life insurance agents claiming to be Income for Life experts.

The Income for Life concept is exploding in popularity. In 2005, only five people attended the annual Income for Life industry conference. This year, there were more than 200 attendees. Over the last few years, all of our experts have reported at least a 10-fold increase in the number of phone calls they receive each week.

Some untrained life insurance agents are trying to grow their businesses by claiming to be Income for Life experts. But they’re not Income for Life experts. They don’t understand the strategy. They don’t know how to set up Income for Life policies. It’s important that you don’t do business with these unqualified agents.

The paid up additions (PUA) rider I told you about earlier is one way to tell if an agent is an expert in Income for Life. The PUA rider is an essential piece of the Income for Life strategy, but it reduces agent commissions by 60-70%. If an agent does NOT recommend a PUA rider, either he doesn’t know about Income for Life or he doesn’t want to cut his commissions by adding a PUA rider to your policy.

If you’re still not sure the life insurance agent you are already dealing with is an Income for Life expert, ask ours. They know most Income for Life experts in the industry. They’ll be happy to verify the agent for you.

6. Don’t let all of the different names for Income for Life confuse you.

We call this strategy “Income for Life.” But the most established name for this strategy is the “Infinite Banking Concept,” or “IBC,” for short. Income for Life and Infinite Banking are exactly the same. We had to come up with our own name because “Infinite Banking” is trademarked. There are other experts, authors, and newsletters recommending this strategy too.

Each expert has their own name for the strategy. Names include “Bank on Yourself,” “Cashflow Banking,” “Bank of You,” and “Privatized Banking.” There may be small differences in the ways these experts design their policies. And some of these differences may weaken the strategy.

We don’t endorse any of these other “experts.” If you’re already working with one of these experts—or considering it—and you want to make sure you’re doing the right thing, call our Income for Life experts.

7. How much money do you intend to put into Income for Life?

You don’t need to have an exact number at this point. You may not have even made up your mind to start an Income for Life policy. But before you call one of our experts, please have a rough number in mind that could make sense for you.

For example: “I could afford to save $100 per month.” Or “I’m considering starting with $10,000 per year.”

Why? Using this number, our experts will create an example policy for you. They call it a “policy illustration.” It’ll show you how your money will grow over time. And your expert can talk you through real-life examples of how you could use your Income for Life policy.

8. Raise your questions and concerns upfront.

Do you have concerns that you are too old? Are you considering getting rid of your term insurance policy and putting the money into a whole life insurance policy? Do you want to use Income for Life policies to save for retirement, pay for your kids' college expenses, or finance your vehicles?

Please raise these questions and concerns the first time you speak to our Income for Life experts. This way, they’ll be able to give you more focused advice and better service.

9. Be prepared for dozens of personal questions.

Our Income for Life experts are going to ask you dozens of personal questions about your income, your savings, your health, and your family situation. They need this information to make sure Income for Life is right for you, and to figure out the best way to structure your policy.

When you first contact our experts by email, you’ll be asked to fill out a financial questionnaire. I’m uncomfortable talking about these personal details, and you probably are too. But in order to set my policies up correctly, Patrick needed to understand my personal financial situation.

10. Be prepared to take a medical exam.

Unless you’re insuring a newborn baby, you will need to take a medical exam. Think of the medical exam like a pre-approval for a mortgage. It won’t cost you any money. And it’s easy. The insurance company will send a nurse to your house at a time that’s convenient for you. The nurse will take urine and blood samples, your blood pressure, and some basic measurements. Then she’ll ask you questions about your health and your family’s medical history.

My wife and I have had to do this each time we’ve set up a new policy. I had the nurse come at 6 a.m. so the exam wouldn’t interfere with my work schedule.

Important: Please Read This Before You Contact an Income for Life Expert

Our Income for Life experts will receive thousands of inquiries as a result of this report. Please contact our experts by email instead of by phone. And please give them at least a week to get back to you from the date you write to them.

Also, life insurance policies require lots of setup and customization and a fair bit of paperwork. Plus, there is a health exam and some other stuff you have to do. It can take up to a month to set up your policies. Sometimes longer.

Income for Life is a lifelong strategy you’ll have in place for decades. There’s no rush. A few days or weeks won’t matter, in the big picture. Please be patient.

RSS Feed

RSS Feed