| RETIRE RICH It amazes me how many people DON'T take advantage of their employers retirement program. It is truly one of the largest mistakes in life a person could make. Even if your employer's retirement provider has lousy products, you should open your own self-directed IRA and still get that pre-tax cash and contributions. |

By Dr. David Eifrig,

It's one of the biggest financial opportunities in America. It's literally FREE MONEY and the numbers show that it's likely you're not taking advantage of it. I'm talking about the employer-offered retirement accounts known as 401(k)s. I know you hear lots of financial advisors talk about 401(k)s and how beneficial they are but even the best financial advisors often don't take the time to show you the hard numbers of how important this savings vehicle is.

Today, I'm going to walk you through the numbers and show you exactly how much free money you could unwittingly be giving up every single pay period. This is the story you're not hearing about anywhere else. One of the easiest decisions you can make in retirement investing is enrolling in your 401(k) plan. If your employer offers an "employee match," this is an investment that simply can't be beat. There is no better strategy out there than letting someone else enlarge your deposits and compounding it tax-free.

Where I work, employees earn an immediate 50% return on the first 6% they tuck away for retirement. Many companies across the country work the same way. Yet many Americans balk at the opportunity.

According to the nonprofit National Bureau of Economic Research, only about one-third of American workers enroll in 401(k) programs. I've seen other numbers that say a measly 23% participate.

When employers install automatic enrollment programs – which allow employees to opt out – enrollment jumps to more than 85%. So it's not usually a calculated, intentional decision that keeps employees from saving in their 401(k)s. It's just inertia that prevents people from making what's clearly the best financial decision for their future.

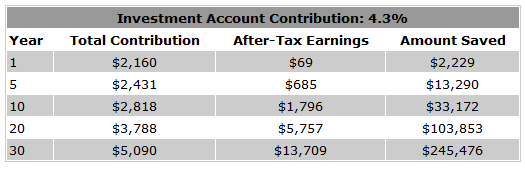

Let's walk through the numbers now and take a look at why enrolling in an employer-match program is a no-brainer decision... and why it's worth getting over your inertia. Say you make $50,000 a year and you get 3% annual raises. You set aside 6% of your salary every year. But after you pay 28% taxes on that money, you end up saving just 4.3% of your salary. Now let's say you put it in a regular, taxable investment account and you earn an average of 8% per year on your investment – the S&P 500's historic annual return. This is what your investment account would look like over 30 years...

It's one of the biggest financial opportunities in America. It's literally FREE MONEY and the numbers show that it's likely you're not taking advantage of it. I'm talking about the employer-offered retirement accounts known as 401(k)s. I know you hear lots of financial advisors talk about 401(k)s and how beneficial they are but even the best financial advisors often don't take the time to show you the hard numbers of how important this savings vehicle is.

Today, I'm going to walk you through the numbers and show you exactly how much free money you could unwittingly be giving up every single pay period. This is the story you're not hearing about anywhere else. One of the easiest decisions you can make in retirement investing is enrolling in your 401(k) plan. If your employer offers an "employee match," this is an investment that simply can't be beat. There is no better strategy out there than letting someone else enlarge your deposits and compounding it tax-free.

Where I work, employees earn an immediate 50% return on the first 6% they tuck away for retirement. Many companies across the country work the same way. Yet many Americans balk at the opportunity.

According to the nonprofit National Bureau of Economic Research, only about one-third of American workers enroll in 401(k) programs. I've seen other numbers that say a measly 23% participate.

When employers install automatic enrollment programs – which allow employees to opt out – enrollment jumps to more than 85%. So it's not usually a calculated, intentional decision that keeps employees from saving in their 401(k)s. It's just inertia that prevents people from making what's clearly the best financial decision for their future.

Let's walk through the numbers now and take a look at why enrolling in an employer-match program is a no-brainer decision... and why it's worth getting over your inertia. Say you make $50,000 a year and you get 3% annual raises. You set aside 6% of your salary every year. But after you pay 28% taxes on that money, you end up saving just 4.3% of your salary. Now let's say you put it in a regular, taxable investment account and you earn an average of 8% per year on your investment – the S&P 500's historic annual return. This is what your investment account would look like over 30 years...

After 10 years, your nest egg would be more than $33,000. And by year 30, you're going to have almost a quarter-million dollars. But you can more than DOUBLE that... without putting aside a single extra penny.

Let's say you use exactly the same rate of savings. But instead of putting it in a regular investment account, you put it in a 401(k) plan that has a 50% employer match. That way, you get to put the whole 6% toward savings, because 401(k) contributions are tax-free. And you get to keep all your earnings, because 401(k) investment gains can compound tax-free. Plus, you get an extra 3% from your employer. Here's what that looks like:

Let's say you use exactly the same rate of savings. But instead of putting it in a regular investment account, you put it in a 401(k) plan that has a 50% employer match. That way, you get to put the whole 6% toward savings, because 401(k) contributions are tax-free. And you get to keep all your earnings, because 401(k) investment gains can compound tax-free. Plus, you get an extra 3% from your employer. Here's what that looks like:

As you can see, you've saved about $750,000. Now, once you retire and start withdrawing that money, you have to pay taxes on it. That will drop your final sum down to a little under $540,000. Still, it comes out to more than double what you did in a regular investment account. It's 119.8% more to be exact.

It's a no-brainer. Putting your money in a 401(k) with employer match is one of the simplest ways to take your financial future into your own hands and ensure a richer future for yourself and your family. Unfortunately, many people don't understand how simple this saving plan can be. All it takes is the hard numbers to show it and overcoming your own inertia to put it to work.

It's a no-brainer. Putting your money in a 401(k) with employer match is one of the simplest ways to take your financial future into your own hands and ensure a richer future for yourself and your family. Unfortunately, many people don't understand how simple this saving plan can be. All it takes is the hard numbers to show it and overcoming your own inertia to put it to work.

RSS Feed

RSS Feed