| RETIRE RICH There is nothing more lucrative than royalty trusts or companies producing international royalty payments. These are the type of "buy it and forget it" stocks that any investor wants to pump up the compounded dividends in their portfolio. These fossil fuel picks will definitely supplement your retirement income. |

By Matt Badiali

It's public knowledge that U.S. President Barack Obama collects nearly $33,000 per month through his presidential salary...

But what most Americans don't realize is that the president is also tapping into an extraordinary income stream which has enabled him to collect an average of more than $72,780 every single month since taking office as "Commander in Chief."

That's more than double his government pay. NPR correspondent Frank James calls it, "One of the best financial moves President Obama ever made." And Reuters reports the president is now worth millions, thanks to this move. Just look at the Obama's tax returns over the past few years and you'll see why...

In each of the last four years he's served as president, Obama has made many times his government salary – in some years multiplying it by 300% or more – using this income strategy. But what's perhaps most surprising is that just about anyone can use this idea to generate a lot of wealth. In other words, it is not reserved solely for politicians, like Obama. For example, do you know the incredible story of Mildred and Patty Hill?

In the late 1890s, these two kindergarten teachers from Kentucky wrote a simple song they hoped with would be a useful teacher's aid. They originally called it "Good Morning to All." They intended it as a morning song to welcome students. The children liked the song. They even started to sing it at birthday parties. So, Patty adapted the lyrics. Today, the little song is known as "Happy Birthday to You." It has been sung hundreds of millions of times.

To this day, the Hill sisters still get paid royalties whenever this song is sung commercially. Producers have to pay money to the royalty holder – in this case, The Hill Foundation – if they want to use the song in a movie or on the radio. (It's also why most restaurant chains use their own versions of the song.) Nearly 120 years later, "Happy Birthday to You" brings in about $2 million in royalties every year.

The story of the Hill sisters highlights one of the greatest ways to become wealthy in America: By collecting money from patent rights and royalties. You make just one investment... or control one valuable asset... and then get paid over and over again, while somebody else takes the risk of marketing, development, and distribution.

That's how President Obama has made on average more than $72,000 per month since taking office from sales of his best seller, The Audacity of Hope. We call it the "Mainz" income secret. The Guttenberg Press, which was invented in Mainz, Germany, is generally considered the invention that first made collecting regular royalties possible... by allowing book publishers and authors to make a fortune after creating a valuable piece of work. And to this day, the "Mainz" secret remains one of the great low-risk ways to get rich in America.

In this report, I'll show you how to take advantage of this extraordinary income model... and how you can immediately take advantage of it in the natural resources markets. A modest investment here could make you tens of thousands of dollars in the coming years.

Get Paid Over and Over Again, For Life

In every industry, there's usually a low-risk way to get paid over and over again for a single idea, property or patent. In the drug business, the big money is in patents. After all the work is done developing a new drug, for example, a scientist can partner up with a larger company to handle the expenses and risks of testing, marketing, and distribution. Then the patent holder gets paid for every prescription that gets filled.

The guy who developed the popular pain medication Lyrica, for instance, shares in more than $2 million per month... because he owns the patents. The women who owned the patents on the antifungal medicine Nystatin shared more than $50,000 per month for 20 years.

In the publishing business the big money is in book royalties. Once you do all the work writing a book – like Obama did – you just sit back and collect your share of the profits. Ex-President Bill Clinton also benefits from this idea. He makes more than $84,000 per month from sales of his best seller, My Life.

Don't get me wrong. You don't have to develop a new drug or write a book. I've found an incredible (low-risk) way you can use the "Mainz" secret as an investor.

In short, you avoid all the normal risks of doing business... and simply collect incredible royalty streams for owning a very valuable asset.

As resource investors, we want to collect royalties on one of the world's most vital energy commodities. As you'll soon learn, you can regularly collect 8%-10% annual payments on some of the richest land in America. And your long-term gains could reach hundreds of percent. Let's get started...

Get Tax-Free Money From Royalty Trusts

Owning royalty companies is one of the easiest and safest ways to turn a small investment into incredible wealth. Royalty trusts generate cash by selling the production of natural resources – such as oil, natural gas, and coal. In this report, we are focusing on two companies created around oil and gas royalties.

Through these companies, you avoid all the normal risks of exploring for oil and gas... and simply own the companies that collect incredible streams of income from wells in two of the world's best oil and gas fields.

These companies don't spend capital on exploration. They don't spend it on developing projects or on maintaining them. The royalty trusts are built solely around income from existing projects.

Think of it this way... One company finds raw land, builds a new housing development, and then draws in people to rent. It manages the development and chases down dead-beats.

This company takes enormous risks. It lays out huge investments and hopes that it will eventually get its money back. That's like a typical oil and gas company. But we aren't buying that kind of company. We are essentially investing after the houses are full of renters... and we just show up on rent day and get a check for our share.

The trusts we're investing in have no physical operations and no management or employees. They are basically just a lawyer and an accountant. A "parent company" operates the wells and pays the overhead and costs for new production. The royalty trusts just get paid.

Royalties on some assets – such as oil and gas wells, mines, patents, or trademarks – are put into a trust. The bank manages the income from the royalties and distributes the income to the shareholders, or "unit-holders" as they are sometimes called. Companies like to put producing assets into trusts because trusts are "pass-through" investment vehicles. In other words, the IRS doesn't tax the revenue of the trust. Only shareholders – not the trust itself – are taxed on these dividends (or "distributions"). That means there is no double taxation of dividends, so more goes to the shareholders.

T. Boone Pickens – the king of natural gas – set up the first royalty trust back in 1979, the Mesa Royalty Trust. He packaged up producing wells as a kind of oil annuity. Investors bought shares in the trust and simply collected income over the life of the wells. Since then, the industry has spun out more than a dozen of these companies... including the three we're investing in this month.

These three oil and gas trusts were spun off from what was once one of the most popular natural gas companies in the industry, SandRidge Energy. But as we'll show you... these days, the former Wall Street darlings have been left for dead. Their share prices have plummeted... but they are still paying double-digit yields.

That sets us up for the perfect buying opportunity... and a great way to profit off royalties.

To understand why these companies are so hated – and thus, why they present such a good deal right now – we must understand where they came from...

Wall Street's Love/Hate Relationship with SandRidge Energy

In 2009, SandRidge Energy was one of the best-loved natural gas explorers on Wall Street.

Its CEO, Tom Ward, had years of experience in the field as the founder and former president of major natural gas company Chesapeake Energy. He was dedicated to expanding SandRidge Energy. And analysts claimed the company would outperform its peers.

However, Ward didn't want to wait for his company to grow using its own cash flows. That would take too long. He wanted to build the company quickly. And to do that, he needed cash now. He borrowed billions of dollars to spend on leasing acreage, hiring drill rigs, and putting fields into production.

Under Ward's "borrow and spend" leadership, SandRidge Energy's debt levels soared from roughly zero in 2006 to $4.3 billion today. As you can see in the chart below, the debt grew quickly. However, the market value didn't keep pace.

It's public knowledge that U.S. President Barack Obama collects nearly $33,000 per month through his presidential salary...

But what most Americans don't realize is that the president is also tapping into an extraordinary income stream which has enabled him to collect an average of more than $72,780 every single month since taking office as "Commander in Chief."

That's more than double his government pay. NPR correspondent Frank James calls it, "One of the best financial moves President Obama ever made." And Reuters reports the president is now worth millions, thanks to this move. Just look at the Obama's tax returns over the past few years and you'll see why...

In each of the last four years he's served as president, Obama has made many times his government salary – in some years multiplying it by 300% or more – using this income strategy. But what's perhaps most surprising is that just about anyone can use this idea to generate a lot of wealth. In other words, it is not reserved solely for politicians, like Obama. For example, do you know the incredible story of Mildred and Patty Hill?

In the late 1890s, these two kindergarten teachers from Kentucky wrote a simple song they hoped with would be a useful teacher's aid. They originally called it "Good Morning to All." They intended it as a morning song to welcome students. The children liked the song. They even started to sing it at birthday parties. So, Patty adapted the lyrics. Today, the little song is known as "Happy Birthday to You." It has been sung hundreds of millions of times.

To this day, the Hill sisters still get paid royalties whenever this song is sung commercially. Producers have to pay money to the royalty holder – in this case, The Hill Foundation – if they want to use the song in a movie or on the radio. (It's also why most restaurant chains use their own versions of the song.) Nearly 120 years later, "Happy Birthday to You" brings in about $2 million in royalties every year.

The story of the Hill sisters highlights one of the greatest ways to become wealthy in America: By collecting money from patent rights and royalties. You make just one investment... or control one valuable asset... and then get paid over and over again, while somebody else takes the risk of marketing, development, and distribution.

That's how President Obama has made on average more than $72,000 per month since taking office from sales of his best seller, The Audacity of Hope. We call it the "Mainz" income secret. The Guttenberg Press, which was invented in Mainz, Germany, is generally considered the invention that first made collecting regular royalties possible... by allowing book publishers and authors to make a fortune after creating a valuable piece of work. And to this day, the "Mainz" secret remains one of the great low-risk ways to get rich in America.

In this report, I'll show you how to take advantage of this extraordinary income model... and how you can immediately take advantage of it in the natural resources markets. A modest investment here could make you tens of thousands of dollars in the coming years.

Get Paid Over and Over Again, For Life

In every industry, there's usually a low-risk way to get paid over and over again for a single idea, property or patent. In the drug business, the big money is in patents. After all the work is done developing a new drug, for example, a scientist can partner up with a larger company to handle the expenses and risks of testing, marketing, and distribution. Then the patent holder gets paid for every prescription that gets filled.

The guy who developed the popular pain medication Lyrica, for instance, shares in more than $2 million per month... because he owns the patents. The women who owned the patents on the antifungal medicine Nystatin shared more than $50,000 per month for 20 years.

In the publishing business the big money is in book royalties. Once you do all the work writing a book – like Obama did – you just sit back and collect your share of the profits. Ex-President Bill Clinton also benefits from this idea. He makes more than $84,000 per month from sales of his best seller, My Life.

Don't get me wrong. You don't have to develop a new drug or write a book. I've found an incredible (low-risk) way you can use the "Mainz" secret as an investor.

In short, you avoid all the normal risks of doing business... and simply collect incredible royalty streams for owning a very valuable asset.

As resource investors, we want to collect royalties on one of the world's most vital energy commodities. As you'll soon learn, you can regularly collect 8%-10% annual payments on some of the richest land in America. And your long-term gains could reach hundreds of percent. Let's get started...

Get Tax-Free Money From Royalty Trusts

Owning royalty companies is one of the easiest and safest ways to turn a small investment into incredible wealth. Royalty trusts generate cash by selling the production of natural resources – such as oil, natural gas, and coal. In this report, we are focusing on two companies created around oil and gas royalties.

Through these companies, you avoid all the normal risks of exploring for oil and gas... and simply own the companies that collect incredible streams of income from wells in two of the world's best oil and gas fields.

These companies don't spend capital on exploration. They don't spend it on developing projects or on maintaining them. The royalty trusts are built solely around income from existing projects.

Think of it this way... One company finds raw land, builds a new housing development, and then draws in people to rent. It manages the development and chases down dead-beats.

This company takes enormous risks. It lays out huge investments and hopes that it will eventually get its money back. That's like a typical oil and gas company. But we aren't buying that kind of company. We are essentially investing after the houses are full of renters... and we just show up on rent day and get a check for our share.

The trusts we're investing in have no physical operations and no management or employees. They are basically just a lawyer and an accountant. A "parent company" operates the wells and pays the overhead and costs for new production. The royalty trusts just get paid.

Royalties on some assets – such as oil and gas wells, mines, patents, or trademarks – are put into a trust. The bank manages the income from the royalties and distributes the income to the shareholders, or "unit-holders" as they are sometimes called. Companies like to put producing assets into trusts because trusts are "pass-through" investment vehicles. In other words, the IRS doesn't tax the revenue of the trust. Only shareholders – not the trust itself – are taxed on these dividends (or "distributions"). That means there is no double taxation of dividends, so more goes to the shareholders.

T. Boone Pickens – the king of natural gas – set up the first royalty trust back in 1979, the Mesa Royalty Trust. He packaged up producing wells as a kind of oil annuity. Investors bought shares in the trust and simply collected income over the life of the wells. Since then, the industry has spun out more than a dozen of these companies... including the three we're investing in this month.

These three oil and gas trusts were spun off from what was once one of the most popular natural gas companies in the industry, SandRidge Energy. But as we'll show you... these days, the former Wall Street darlings have been left for dead. Their share prices have plummeted... but they are still paying double-digit yields.

That sets us up for the perfect buying opportunity... and a great way to profit off royalties.

To understand why these companies are so hated – and thus, why they present such a good deal right now – we must understand where they came from...

Wall Street's Love/Hate Relationship with SandRidge Energy

In 2009, SandRidge Energy was one of the best-loved natural gas explorers on Wall Street.

Its CEO, Tom Ward, had years of experience in the field as the founder and former president of major natural gas company Chesapeake Energy. He was dedicated to expanding SandRidge Energy. And analysts claimed the company would outperform its peers.

However, Ward didn't want to wait for his company to grow using its own cash flows. That would take too long. He wanted to build the company quickly. And to do that, he needed cash now. He borrowed billions of dollars to spend on leasing acreage, hiring drill rigs, and putting fields into production.

Under Ward's "borrow and spend" leadership, SandRidge Energy's debt levels soared from roughly zero in 2006 to $4.3 billion today. As you can see in the chart below, the debt grew quickly. However, the market value didn't keep pace.

In his first year, Ward borrowed and spent $1.1 billion. Within two years, he'd racked up $2.4 billion in total debt. In 2009, Ward began to shift the company away from natural gas and into oil. In its first strategic move in that direction, SandRidge bought assets in the Permian Basin of Texas. It paid $800 million for 80 million barrels of proven reserves that were 65% oil and "liquids"... like butane (lighter fluid), ethane (key component in plastics), and propane (barbeque fuel).

That worked out to just $10 per barrel of oil equivalent (BOE). With oil trading over $70 per barrel by June 2009, that was a great deal. Analysts loved it. (Reporting reserves in barrels of oil equivalent – even when they're mostly natural gas – is a standard industry practice. It's just a way of reporting all the company's reserves with one number.)

Four months later, SandRidge Energy bought oil company ARD. It paid $1.6 billion for 69.3 million barrels of proven reserves that were 87% oil and liquids. That worked out to $23 per BOE. Debt continued to rise. SandRidge's debt levels soared from $2.4 billion at the end of 2008 to $2.9 billion in 2010.

But Ward's vision for the company wasn't complete. That year, SandRidge Energy branched out to the Mississippian oil play in Kansas and Oklahoma. And again... Wall Street cheered and piled into the stock. The company's market value climbed from $1 billion in December 2008 to $3 billion by December 2010.

The oil industry drilled at the Mississippian play for the last 50 years, but didn't make a lot of money with traditional vertical wells. That's because the rocks that hold the oil don't like to give it up. And they are full of water, so for every barrel of oil, you get water as well.

Pumping water instead of oil makes the oil much more expensive. The industry had all but abandoned the field by 2000. However, updated, horizontal drilling methods changed the economics of this field... and maximized the amount of oil pumped from the wells.

Using this new drilling technology... SandRidge engineers predicted wells in the field would each produce around 422,000 barrels of oil equivalent. The cost to drill one of the wells was about $3 million. That works out to $7.11 per BOE. And with oil prices up near $100 per barrel at the time, the economics looked fantastic.

So SandRidge Energy spent another $400 million acquiring acreage in the old Mississippian oil fields. To finance the project, it needed to generate cash quickly. That's when it began packaging and selling off production into trusts.

The company spun off three royalty trusts – two of which will be the focus of this report: the Mississippian Trust I (NYSE: SDT) and the Mississippian Trust II (NYSE: SDR). (The third trust is located in the Permian Basin, a different oil and gas producing region of the country). SandRidge's "borrowing and spending" attitude, exaggerated promises, and poor price projections finally caught up with it... There was no way the trusts could meet expectations, and Wall Street quickly withdrew its support.

Wall Street Abandons SandRidge Energy and Creates a Buying Opportunity for Us

SandRidge Energy marketed its royalty trusts as safe, profitable, high-yield vehicles for investors. Engineers projected the Permian wells were high-value oil producers. And they projected that the Mississippian wells would provide a 36% return to investors. So investors piled into all three of the trusts as soon as they went public.

In all... the IPOs raised $1.6 billion for SandRidge Energy's projects. The company began drilling. And as long as SandRidge Energy continued to drill in the regions... the trusts should have remained profitable.

But the company's glowing expectations didn't pan out. You see, in order to gin up excitement for these trusts, SandRidge Energy set the bar far too high.

SandRidge Energy's profit model used the best possible case for Mississippian and Permian production. It assumed $100 per barrel of oil and $4.25 per thousand cubic feet (MCF) for natural gas. But as we know, commodity prices plummeted over the next year. And there was no way the royalty trusts could have lived up to the hype of their IPOs. By April 2012, the well-head price of natural gas – the price the producers are paid – had fallen to its lowest point in over a decade... $1.89 per mcf. By June, oil prices had collapsed to $77 per barrel.

And instead of engineering projections of 422,000 BOE per Mississippian well, SandRidge was only getting 369,000 BOE. That reduced the reserves by 13%. And the trusts failed to meet expectations. Analysts and investors were furious. In July 2012, brokerage firm Wunderlich Securities issued a "sell" recommendation for Mississippian Trust I. JPMorgan immediately told investors to be "underweight" SandRidge Energy stock, essentially issuing a sell order.

Most damning of all... SandRidge's largest shareholder – the $4 billion TPG-Axon Fund, which owned 10.8% of the company's shares – called for Ward's replacement. In a letter to the Board on November 8, 2012... the fund's CEO, Dinakar Singh, described Ward's tenure as "disastrous." According to Singh, Wall Street didn't trust SandRidge Energy's management anymore.

The market agreed. Shares of SandRidge Energy fell 60% over the past two years. And the three trusts – Mississippian I, Mississippian II, and the third trust – got dragged along with it... down 63%, 48%, and 43%, respectively.

So How Can We Profit Off Beaten-Down SandRidge Energy?

We can't. SandRidge Energy is debt-laden. It is run by an over-aggressive CEO who overlooks simple financials in order to grow the company. I wouldn't touch SandRidge with a 10-foot pole.

But we're not interested in SandRidge. We're interested in its royalty trusts.

It's important to note that SandRidge's mismanagement has nothing to do with the royalty trusts or their business model. Tom Ward beefed up expectations of the size and values of the Mississippian properties. Essentially, he promised two gallons of milk from a one-gallon jug. And when investors didn't get two gallons, they sent the trusts' share prices on a rip lower.

But none of that had anything to do with the trusts themselves. They are doing what they're supposed to be doing – driving to the bank and cashing checks.

Each trust has a 20-year life-span. That means each will receive royalty checks from SandRidge's wells in the Mississippian and Permian Basins – and pass that money along to shareholders – for the next two decades. Each trust is built upon both existing wells and proved, undeveloped reserves (PUDs). In other words, shareholders get paid for both current production and future production from new wells yet to be drilled in the areas.

Based on the current share prices – and using ultra-conservative commodities price estimates – we believe these trusts are a bargain today. They have the potential for capital gains. And they could each pay out at least 10% per year for the next three years. Even better, we could keep up to 39.6% of that cash tax-free...

Our Royalty Trust Model

We developed a model to figure out a realistic estimate of the value of these trusts... and how much they would pay us. The operator of the trusts, SandRidge Energy, secured prices for – or "hedged" – 60% of the production from the trusts. That means we know the price of a set amount of the oil and gas that will be produced in a year. And we'll get that money even if the prices of oil or natural gas collapse.

That reduces the range of possible outcomes... and makes our model results that much more reliable.

The volume of oil and natural gas produced from the wells is harder to gauge. Production in every oil well begins to decline as soon as it's put into production. That's why oil companies must constantly drill new wells to replace production. And our trusts are no different.

Each trust was created around existing production and a number of new wells drilled over the first three to four years of the trust's life. That means those first three to four years of the trust will capture the most production. (These trusts are between one and two years old.)

One risk with these companies is that the cash flow in the trusts is subject to commodity price and production swings. That means there can be changes from quarter-to-quarter in the amounts of money paid out by these trusts.

Also, we can't know the exact volume of oil and natural gas produced in a period. But we can make an accurate estimate. And in our model, we are conservative. Our estimates were less than the production estimates produced by the trusts' engineers. That way, if something goes wrong, we are covered.

One thing that could go wrong is SandRidge. You see, we aren't completely insulated from that company... SandRidge operates the trusts. That means it drills and maintains the wells. So if it can't drill new wells, we won't get the new production.

However, I see that as a minor risk to us. SandRidge owns 11 drill rigs. It plans to spend $1.75 billion drilling new wells in 2013. And many of those will be for the trusts. The company plans to drill 580 wells in the Mississippian this year alone. So I don't see a lack of new wells as a potential problem.

And the last major risk to this investment is that the trusts are "finite." In other words, they exist for 20 years and then end. By the end of 2031, all the trusts will close. That means the companies will sell off the remaining assets and pay out one last distribution to both SandRidge Energy and the shareholders of the trusts.

However, as the trust ages, the distributions become smaller. And more of it is simply our original investment coming back to us, instead of dividends – our "return of capital." Let me explain...

Oil and gas wells are finite resources. That means they run out. So if we spend $1 million to drill a well and we get $1.1 million back from selling the oil and gas, we didn't make $1.1 million in profit. We made $100,000 in profit. The rest of that money was a return of our original capital. The same thing is going on here. Our initial investment in the trust can be thought of as our share of the drilling costs.

As SandRidge drills off the wells, it will keep the production stable. However, when the wells are done, the production will begin to decline. We want to be out before that happens. That's why we will only hold these trusts for up to three years. We'll skim the cream and get out before the wells begin to decline. By the end of 2015, we will cash out. We should be able to take a small capital gain on the sale, depending on the prices of oil and natural gas. At the same time, we'll cash out those double-digit gains from the past three years. Now let's take a look at each Mississippian trust.

SandRidge Mississippian Trust I (NYSE: SDT)

In April 2011, SandRidge spun out the Mississippian Trust I. The trust owns royalty interests in oil and natural gas properties in Oklahoma.

The terms of the trust say that it will terminate on December 31, 2030. At that time, the remaining assets will be sold. Half of the proceeds will go to the trust's unit holders, and the other half will go to SandRidge.

Its initial public offering (IPO) price was $21 per share. Its initial market value was $588 million. Today, it trades around $13.79 per share and its market value is $386 million. The Mississippian Trust I suffered as SandRidge imploded, as you can see from the chart below. It sank 62% from its February 2012 high.

That worked out to just $10 per barrel of oil equivalent (BOE). With oil trading over $70 per barrel by June 2009, that was a great deal. Analysts loved it. (Reporting reserves in barrels of oil equivalent – even when they're mostly natural gas – is a standard industry practice. It's just a way of reporting all the company's reserves with one number.)

Four months later, SandRidge Energy bought oil company ARD. It paid $1.6 billion for 69.3 million barrels of proven reserves that were 87% oil and liquids. That worked out to $23 per BOE. Debt continued to rise. SandRidge's debt levels soared from $2.4 billion at the end of 2008 to $2.9 billion in 2010.

But Ward's vision for the company wasn't complete. That year, SandRidge Energy branched out to the Mississippian oil play in Kansas and Oklahoma. And again... Wall Street cheered and piled into the stock. The company's market value climbed from $1 billion in December 2008 to $3 billion by December 2010.

The oil industry drilled at the Mississippian play for the last 50 years, but didn't make a lot of money with traditional vertical wells. That's because the rocks that hold the oil don't like to give it up. And they are full of water, so for every barrel of oil, you get water as well.

Pumping water instead of oil makes the oil much more expensive. The industry had all but abandoned the field by 2000. However, updated, horizontal drilling methods changed the economics of this field... and maximized the amount of oil pumped from the wells.

Using this new drilling technology... SandRidge engineers predicted wells in the field would each produce around 422,000 barrels of oil equivalent. The cost to drill one of the wells was about $3 million. That works out to $7.11 per BOE. And with oil prices up near $100 per barrel at the time, the economics looked fantastic.

So SandRidge Energy spent another $400 million acquiring acreage in the old Mississippian oil fields. To finance the project, it needed to generate cash quickly. That's when it began packaging and selling off production into trusts.

The company spun off three royalty trusts – two of which will be the focus of this report: the Mississippian Trust I (NYSE: SDT) and the Mississippian Trust II (NYSE: SDR). (The third trust is located in the Permian Basin, a different oil and gas producing region of the country). SandRidge's "borrowing and spending" attitude, exaggerated promises, and poor price projections finally caught up with it... There was no way the trusts could meet expectations, and Wall Street quickly withdrew its support.

Wall Street Abandons SandRidge Energy and Creates a Buying Opportunity for Us

SandRidge Energy marketed its royalty trusts as safe, profitable, high-yield vehicles for investors. Engineers projected the Permian wells were high-value oil producers. And they projected that the Mississippian wells would provide a 36% return to investors. So investors piled into all three of the trusts as soon as they went public.

In all... the IPOs raised $1.6 billion for SandRidge Energy's projects. The company began drilling. And as long as SandRidge Energy continued to drill in the regions... the trusts should have remained profitable.

But the company's glowing expectations didn't pan out. You see, in order to gin up excitement for these trusts, SandRidge Energy set the bar far too high.

SandRidge Energy's profit model used the best possible case for Mississippian and Permian production. It assumed $100 per barrel of oil and $4.25 per thousand cubic feet (MCF) for natural gas. But as we know, commodity prices plummeted over the next year. And there was no way the royalty trusts could have lived up to the hype of their IPOs. By April 2012, the well-head price of natural gas – the price the producers are paid – had fallen to its lowest point in over a decade... $1.89 per mcf. By June, oil prices had collapsed to $77 per barrel.

And instead of engineering projections of 422,000 BOE per Mississippian well, SandRidge was only getting 369,000 BOE. That reduced the reserves by 13%. And the trusts failed to meet expectations. Analysts and investors were furious. In July 2012, brokerage firm Wunderlich Securities issued a "sell" recommendation for Mississippian Trust I. JPMorgan immediately told investors to be "underweight" SandRidge Energy stock, essentially issuing a sell order.

Most damning of all... SandRidge's largest shareholder – the $4 billion TPG-Axon Fund, which owned 10.8% of the company's shares – called for Ward's replacement. In a letter to the Board on November 8, 2012... the fund's CEO, Dinakar Singh, described Ward's tenure as "disastrous." According to Singh, Wall Street didn't trust SandRidge Energy's management anymore.

The market agreed. Shares of SandRidge Energy fell 60% over the past two years. And the three trusts – Mississippian I, Mississippian II, and the third trust – got dragged along with it... down 63%, 48%, and 43%, respectively.

So How Can We Profit Off Beaten-Down SandRidge Energy?

We can't. SandRidge Energy is debt-laden. It is run by an over-aggressive CEO who overlooks simple financials in order to grow the company. I wouldn't touch SandRidge with a 10-foot pole.

But we're not interested in SandRidge. We're interested in its royalty trusts.

It's important to note that SandRidge's mismanagement has nothing to do with the royalty trusts or their business model. Tom Ward beefed up expectations of the size and values of the Mississippian properties. Essentially, he promised two gallons of milk from a one-gallon jug. And when investors didn't get two gallons, they sent the trusts' share prices on a rip lower.

But none of that had anything to do with the trusts themselves. They are doing what they're supposed to be doing – driving to the bank and cashing checks.

Each trust has a 20-year life-span. That means each will receive royalty checks from SandRidge's wells in the Mississippian and Permian Basins – and pass that money along to shareholders – for the next two decades. Each trust is built upon both existing wells and proved, undeveloped reserves (PUDs). In other words, shareholders get paid for both current production and future production from new wells yet to be drilled in the areas.

Based on the current share prices – and using ultra-conservative commodities price estimates – we believe these trusts are a bargain today. They have the potential for capital gains. And they could each pay out at least 10% per year for the next three years. Even better, we could keep up to 39.6% of that cash tax-free...

Our Royalty Trust Model

We developed a model to figure out a realistic estimate of the value of these trusts... and how much they would pay us. The operator of the trusts, SandRidge Energy, secured prices for – or "hedged" – 60% of the production from the trusts. That means we know the price of a set amount of the oil and gas that will be produced in a year. And we'll get that money even if the prices of oil or natural gas collapse.

That reduces the range of possible outcomes... and makes our model results that much more reliable.

The volume of oil and natural gas produced from the wells is harder to gauge. Production in every oil well begins to decline as soon as it's put into production. That's why oil companies must constantly drill new wells to replace production. And our trusts are no different.

Each trust was created around existing production and a number of new wells drilled over the first three to four years of the trust's life. That means those first three to four years of the trust will capture the most production. (These trusts are between one and two years old.)

One risk with these companies is that the cash flow in the trusts is subject to commodity price and production swings. That means there can be changes from quarter-to-quarter in the amounts of money paid out by these trusts.

Also, we can't know the exact volume of oil and natural gas produced in a period. But we can make an accurate estimate. And in our model, we are conservative. Our estimates were less than the production estimates produced by the trusts' engineers. That way, if something goes wrong, we are covered.

One thing that could go wrong is SandRidge. You see, we aren't completely insulated from that company... SandRidge operates the trusts. That means it drills and maintains the wells. So if it can't drill new wells, we won't get the new production.

However, I see that as a minor risk to us. SandRidge owns 11 drill rigs. It plans to spend $1.75 billion drilling new wells in 2013. And many of those will be for the trusts. The company plans to drill 580 wells in the Mississippian this year alone. So I don't see a lack of new wells as a potential problem.

And the last major risk to this investment is that the trusts are "finite." In other words, they exist for 20 years and then end. By the end of 2031, all the trusts will close. That means the companies will sell off the remaining assets and pay out one last distribution to both SandRidge Energy and the shareholders of the trusts.

However, as the trust ages, the distributions become smaller. And more of it is simply our original investment coming back to us, instead of dividends – our "return of capital." Let me explain...

Oil and gas wells are finite resources. That means they run out. So if we spend $1 million to drill a well and we get $1.1 million back from selling the oil and gas, we didn't make $1.1 million in profit. We made $100,000 in profit. The rest of that money was a return of our original capital. The same thing is going on here. Our initial investment in the trust can be thought of as our share of the drilling costs.

As SandRidge drills off the wells, it will keep the production stable. However, when the wells are done, the production will begin to decline. We want to be out before that happens. That's why we will only hold these trusts for up to three years. We'll skim the cream and get out before the wells begin to decline. By the end of 2015, we will cash out. We should be able to take a small capital gain on the sale, depending on the prices of oil and natural gas. At the same time, we'll cash out those double-digit gains from the past three years. Now let's take a look at each Mississippian trust.

SandRidge Mississippian Trust I (NYSE: SDT)

In April 2011, SandRidge spun out the Mississippian Trust I. The trust owns royalty interests in oil and natural gas properties in Oklahoma.

The terms of the trust say that it will terminate on December 31, 2030. At that time, the remaining assets will be sold. Half of the proceeds will go to the trust's unit holders, and the other half will go to SandRidge.

Its initial public offering (IPO) price was $21 per share. Its initial market value was $588 million. Today, it trades around $13.79 per share and its market value is $386 million. The Mississippian Trust I suffered as SandRidge imploded, as you can see from the chart below. It sank 62% from its February 2012 high.

SandRidge built the trust around 37 existing horizontal wells and 123 wells to be drilled over the next three to four years. Today, SandRidge has drilled 117 of the 123 wells.

The trust owns a net royalty interest on 90% of the production from those first 37 wells and a 50% net royalty interest on the production from the 123 new wells. In other words, the trust gets nearly all the revenues from the existing wells. But it only gets half the production from the new wells.

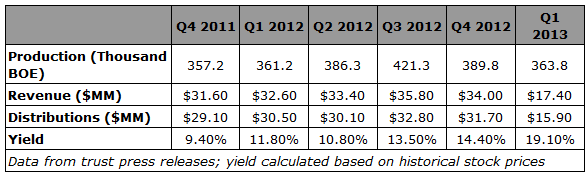

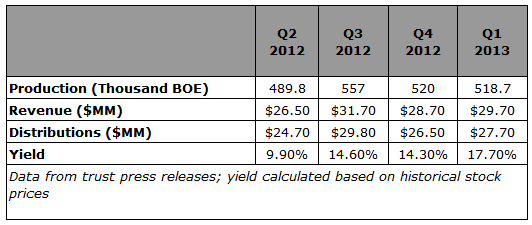

The wells produce a mix of 55% natural gas and 45% oil and natural gas liquids. Here's what the Mississippian Trust I's production and distribution history looks like...

The trust owns a net royalty interest on 90% of the production from those first 37 wells and a 50% net royalty interest on the production from the 123 new wells. In other words, the trust gets nearly all the revenues from the existing wells. But it only gets half the production from the new wells.

The wells produce a mix of 55% natural gas and 45% oil and natural gas liquids. Here's what the Mississippian Trust I's production and distribution history looks like...

Today, Mississippian Trust I trades around $13.79 per share with a 19.5% yield, using the last 12 months of distributions. However, if the market actually believed that the trust would maintain those payouts, the share price would be higher and the yield would be much lower. At today's prices, the market is anticipating a huge fall in distributions.

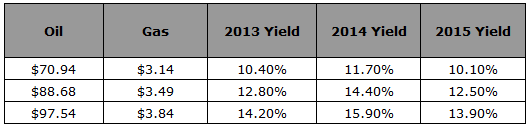

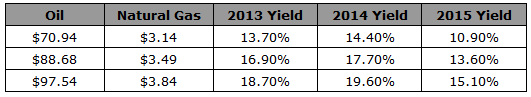

To test that, we built a conservative model to predict the future distributions, based on the company's oil and gas production. From the creation of the Mississippian Trust I, SandRidge Energy hedged 60% of the expected revenues that will be used to pay distributions through December 31, 2015. In other words, the oil price is already locked in on some of the production, at around $100 per barrel. Taking that into account, here are our expected yields on today's share price, based on three different price assumptions...

To test that, we built a conservative model to predict the future distributions, based on the company's oil and gas production. From the creation of the Mississippian Trust I, SandRidge Energy hedged 60% of the expected revenues that will be used to pay distributions through December 31, 2015. In other words, the oil price is already locked in on some of the production, at around $100 per barrel. Taking that into account, here are our expected yields on today's share price, based on three different price assumptions...

Today, the price of oil is $93 per barrel and the price of natural gas is $4.30 per mcf. And as you can see, those prices are above our mid-case estimate. That's because we want to go in with conservative expectations.

You can also see that even if oil prices collapse 15% to $70.94 a barrel... and natural gas prices collapse 30% to $3.14 per mcf... the trust will still provide an excellent yield. And as I said, the current price builds in a lot of risk here. Barring some major catastrophe, this trust will provide double-digit income on today's share price for the next three years. And the fat yield will provide support for the share price.

The trust pays dividends quarterly, with the most recent distribution coming on May 30, 2013 to shareholders who bought before May 15, 2013. The company will pay $0.59 per share for the first quarter.

If the company’s distributions are consistent this year, that would amount to $2.36 for the year, well above our expected return.

Based on the most conservative case of $70.94 per barrel oil and $3.14 per mcf gas, we expect the Mississippian Trust I to pay out $1.43 per share in 2013. That means we can lock in a 10% yield this year if we buy shares below $14.30. At its current price of $13.79, we get an almost 11% yield. However, if the company comes through with $2.36 for the year, we’ll earn 17%, based on a share price of $13.79. That’s exceptional.

Action to take: Buy SandRidge Mississippian Trust I (NYSE: SDT) up to $14.30 per share. Use a 25% trailing stop.

SandRidge Mississippian Trust II (NYSE: SDR)

In January 2012, SandRidge spun out its Mississippian Trust II. Like Mississippian Trust I, the wells are in Oklahoma. The terms of the trust say that it will terminate on December 31, 2031. But as with our other trusts, we plan to sell in three years.

Its initial public offering price was $21 per share and its initial market value was $1 billion. Today, it trades around $12.33 per share, and its market value is $613 million. Like its siblings, the Mississippian Trust II suffered as SandRidge imploded, as you can see from the chart below. It sank 48% from its April 2012 high.

You can also see that even if oil prices collapse 15% to $70.94 a barrel... and natural gas prices collapse 30% to $3.14 per mcf... the trust will still provide an excellent yield. And as I said, the current price builds in a lot of risk here. Barring some major catastrophe, this trust will provide double-digit income on today's share price for the next three years. And the fat yield will provide support for the share price.

The trust pays dividends quarterly, with the most recent distribution coming on May 30, 2013 to shareholders who bought before May 15, 2013. The company will pay $0.59 per share for the first quarter.

If the company’s distributions are consistent this year, that would amount to $2.36 for the year, well above our expected return.

Based on the most conservative case of $70.94 per barrel oil and $3.14 per mcf gas, we expect the Mississippian Trust I to pay out $1.43 per share in 2013. That means we can lock in a 10% yield this year if we buy shares below $14.30. At its current price of $13.79, we get an almost 11% yield. However, if the company comes through with $2.36 for the year, we’ll earn 17%, based on a share price of $13.79. That’s exceptional.

Action to take: Buy SandRidge Mississippian Trust I (NYSE: SDT) up to $14.30 per share. Use a 25% trailing stop.

SandRidge Mississippian Trust II (NYSE: SDR)

In January 2012, SandRidge spun out its Mississippian Trust II. Like Mississippian Trust I, the wells are in Oklahoma. The terms of the trust say that it will terminate on December 31, 2031. But as with our other trusts, we plan to sell in three years.

Its initial public offering price was $21 per share and its initial market value was $1 billion. Today, it trades around $12.33 per share, and its market value is $613 million. Like its siblings, the Mississippian Trust II suffered as SandRidge imploded, as you can see from the chart below. It sank 48% from its April 2012 high.

SandRidge built this trust around 67 existing horizontal wells and 206 wells to be drilled over the next three to four years. At the end of 2012, SandRidge had drilled 99 of the 206 wells. That means this trust will have more new production coming online than Mississippian Trust I. The trust owns a net royalty interest on 80% of the production from those first 67 wells and a 70% net royalty interest on the production from the 206 new wells.

The wells produce a mix of 55% natural gas and 45% oil and natural gas liquids. Here's what the Mississippian Trust II's production and distribution history looks like.

The wells produce a mix of 55% natural gas and 45% oil and natural gas liquids. Here's what the Mississippian Trust II's production and distribution history looks like.

Today, the trust trades around $12.33 per share with a 17.7% yield, based on the last 12 months of distributions. Like the other trusts, it's priced for a big drop in distributions. From the creation of the Mississippian Trust II, SandRidge Energy hedged nearly 69% of the expected revenues (both oil and natural gas) that will be used to pay distributions through 2014. In other words, the price is already locked in on some of the production, at around $100 per barrel. Here are the results of the model showing the future dividends.

As you can see, even at our most conservative level, the trust pays excellent yields.

The Trust pays dividends quarterly, with the most recent distribution coming on May 30, 2013 to shareholders who bought before May 13, 2013. The company will pay $0.56 per share for the first quarter.

If the company’s distributions are consistent this year, that would amount to $2.24 for the year, well above our expected return.

Our projected distributions for 2013 are $1.69 per share. That means we can lock in at least a 12% yield this year, if we buy this stock below $14 per share. At its current price of $12.33, our yield is 13.7%. And we could do much better if natural gas prices remain high. However, if the company comes through with $2.24 for the year, we’ll earn 18%, based on a share price of $12.33. And just like its sister company, that’s an exceptional yield.

Action to take: Buy SandRidge Mississippian Trust II (NYSE: SDR) up to $14 per share. Use a 25% trailing stop.

The two SandRidge Mississippian trusts fit our "royalty" model well. They are relatively safe, high-yield investments. I believe that they are great places to park some savings and collect double-digit yields over the next three years. And with most of the traditional safe-yield investments paying less than 3%, this is a fantastic opportunity to take advantage of dirt-cheap prices and high-income yields from two beaten-down stocks.

While I’m not counting on capital gains, these stocks could certainly see some in the future. You see, as they continue to pay out big dividends, the rest of the market will recognize that they are mispriced. And that will attract investors.

Right now, other royalty companies trade at much lower yields. For example, Dorchester Minerals (NASDAQ: DMLP), another royalty trust that I like, yields 7%. Another of my favorite royalty trusts, Permian Basin Royalty Trust (NYSE: PBT) yields just 6%.

In order to get the SandRidge Mississippian Trust I and II to yield 7%, the share prices would have to rise 144% and 160%, respectively. And even if that happened, we’d still collect our huge yields. That makes these companies elite investments. Safe, double-digit yields are nearly guaranteed AND we have the potential to more than double our money with capital gains. As you can see, even at our most conservative level, the trust pays excellent yields.

The Trust pays dividends quarterly, with the most recent distribution coming on May 30, 2013 to shareholders who bought before May 13, 2013. The company will pay $0.56 per share for the first quarter.

If the company's distributions are consistent this year, that would amount to $2.24 for the year, well above our expected return.

Our projected distributions for 2013 are $1.69 per share. That means we can lock in at least a 12% yield this year, if we buy this stock below $14 per share. At its current price of $12.33, our yield is 13.7%. And we could do much better if natural gas prices remain high. However, if the company comes through with $2.24 for the year, we'll earn 18%, based on a share price of $12.33. And just like its sister company, that's an exceptional yield.

Action to take: Buy SandRidge Mississippian Trust II (NYSE: SDR) up to $14 per share. Use a 25% trailing stop.

The two SandRidge Mississippian trusts fit our "royalty" model well. They are relatively safe, high-yield investments. I believe that they are great places to park some savings and collect double-digit yields over the next three years. And with most of the traditional safe-yield investments paying less than 3%, this is a fantastic opportunity to take advantage of dirt-cheap prices and high-income yields from two beaten-down stocks.

While I'm not counting on capital gains, these stocks could certainly see some in the future. You see, as they continue to pay out big dividends, the rest of the market will recognize that they are mispriced. And that will attract investors.

Right now, other royalty companies trade at much lower yields. For example, Dorchester Minerals (NASDAQ: DMLP), another royalty trust that I like, yields 7%. Another of my favorite royalty trusts, Permian Basin Royalty Trust (NYSE: PBT) yields just 6%.

In order to get the SandRidge Mississippian Trust I and II to yield 7%, the share prices would have to rise 144% and 160%, respectively. And even if that happened, we'd still collect our huge yields. That makes these companies elite investments. Safe, double-digit yields are nearly guaranteed AND we have the potential to more than double our money with capital gains.

The Trust pays dividends quarterly, with the most recent distribution coming on May 30, 2013 to shareholders who bought before May 13, 2013. The company will pay $0.56 per share for the first quarter.

If the company’s distributions are consistent this year, that would amount to $2.24 for the year, well above our expected return.

Our projected distributions for 2013 are $1.69 per share. That means we can lock in at least a 12% yield this year, if we buy this stock below $14 per share. At its current price of $12.33, our yield is 13.7%. And we could do much better if natural gas prices remain high. However, if the company comes through with $2.24 for the year, we’ll earn 18%, based on a share price of $12.33. And just like its sister company, that’s an exceptional yield.

Action to take: Buy SandRidge Mississippian Trust II (NYSE: SDR) up to $14 per share. Use a 25% trailing stop.

The two SandRidge Mississippian trusts fit our "royalty" model well. They are relatively safe, high-yield investments. I believe that they are great places to park some savings and collect double-digit yields over the next three years. And with most of the traditional safe-yield investments paying less than 3%, this is a fantastic opportunity to take advantage of dirt-cheap prices and high-income yields from two beaten-down stocks.

While I’m not counting on capital gains, these stocks could certainly see some in the future. You see, as they continue to pay out big dividends, the rest of the market will recognize that they are mispriced. And that will attract investors.

Right now, other royalty companies trade at much lower yields. For example, Dorchester Minerals (NASDAQ: DMLP), another royalty trust that I like, yields 7%. Another of my favorite royalty trusts, Permian Basin Royalty Trust (NYSE: PBT) yields just 6%.

In order to get the SandRidge Mississippian Trust I and II to yield 7%, the share prices would have to rise 144% and 160%, respectively. And even if that happened, we’d still collect our huge yields. That makes these companies elite investments. Safe, double-digit yields are nearly guaranteed AND we have the potential to more than double our money with capital gains. As you can see, even at our most conservative level, the trust pays excellent yields.

The Trust pays dividends quarterly, with the most recent distribution coming on May 30, 2013 to shareholders who bought before May 13, 2013. The company will pay $0.56 per share for the first quarter.

If the company's distributions are consistent this year, that would amount to $2.24 for the year, well above our expected return.

Our projected distributions for 2013 are $1.69 per share. That means we can lock in at least a 12% yield this year, if we buy this stock below $14 per share. At its current price of $12.33, our yield is 13.7%. And we could do much better if natural gas prices remain high. However, if the company comes through with $2.24 for the year, we'll earn 18%, based on a share price of $12.33. And just like its sister company, that's an exceptional yield.

Action to take: Buy SandRidge Mississippian Trust II (NYSE: SDR) up to $14 per share. Use a 25% trailing stop.

The two SandRidge Mississippian trusts fit our "royalty" model well. They are relatively safe, high-yield investments. I believe that they are great places to park some savings and collect double-digit yields over the next three years. And with most of the traditional safe-yield investments paying less than 3%, this is a fantastic opportunity to take advantage of dirt-cheap prices and high-income yields from two beaten-down stocks.

While I'm not counting on capital gains, these stocks could certainly see some in the future. You see, as they continue to pay out big dividends, the rest of the market will recognize that they are mispriced. And that will attract investors.

Right now, other royalty companies trade at much lower yields. For example, Dorchester Minerals (NASDAQ: DMLP), another royalty trust that I like, yields 7%. Another of my favorite royalty trusts, Permian Basin Royalty Trust (NYSE: PBT) yields just 6%.

In order to get the SandRidge Mississippian Trust I and II to yield 7%, the share prices would have to rise 144% and 160%, respectively. And even if that happened, we'd still collect our huge yields. That makes these companies elite investments. Safe, double-digit yields are nearly guaranteed AND we have the potential to more than double our money with capital gains.

RSS Feed

RSS Feed